We haven’t written about Silicon Valley Financial institution in nearly a yr, however the saga of the third-largest financial institution collapse continues.

SVB’s father or mother firm, SVB Monetary Group, had $2 billion on deposit at its financial institution subsidiary. When the FDIC made it clear that every one depositors could be made entire, one would assume that included the $2 billion of the father or mother firm’s cash.

However the FDIC has thus far refused to pay. Now, the lawsuits are flying.

For some time, it regarded just like the father or mother firm would get their cash as $2.12 billion was moved to the bridge financial institution, and the father or mother withdrew $177 million. However then the FDIC halted these payouts.

Legal professionals ?for SVB Monetary Group argue that ?”the FDIC’s act was tantamount ?to theft” given the general public assurances on the security of deposits.

The FDIC just isn’t commenting on the pending litigation. It is going to be left ?to a California courtroom to resolve.

Featured

> Traders Search Billions From SVB’s Husk. Why Regulators Refuse to Pay

The mud had barely settled after Silicon Valley Financial institution’s collapse final yr when savvy traders started lining up for a giant payout, primarily based on a swiftly written authorities press launch.

From Fintech Nexus

> The potential of digital wallets

By Peter Renton

It’s time for digital wallets to return into their very own. They will and must be greater than a cost methodology, they may develop into the monetary

Podcast

Mitch Jacobs, Founder & CEO of Plink on transaction personalization

The CEO and founding father of Plink explains why even at present banks are unable to totally make the most of the cardboard transaction knowledge that exists…

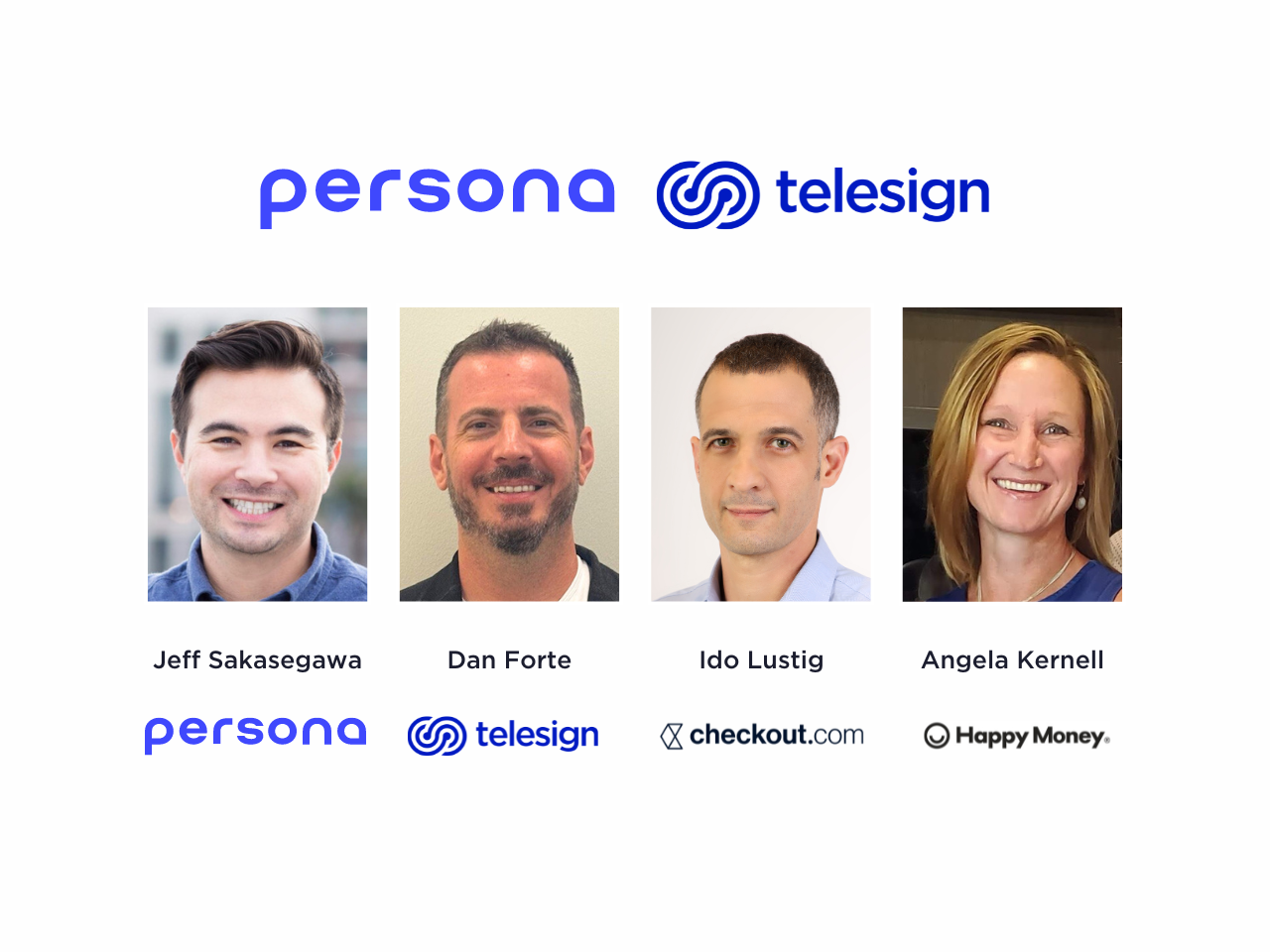

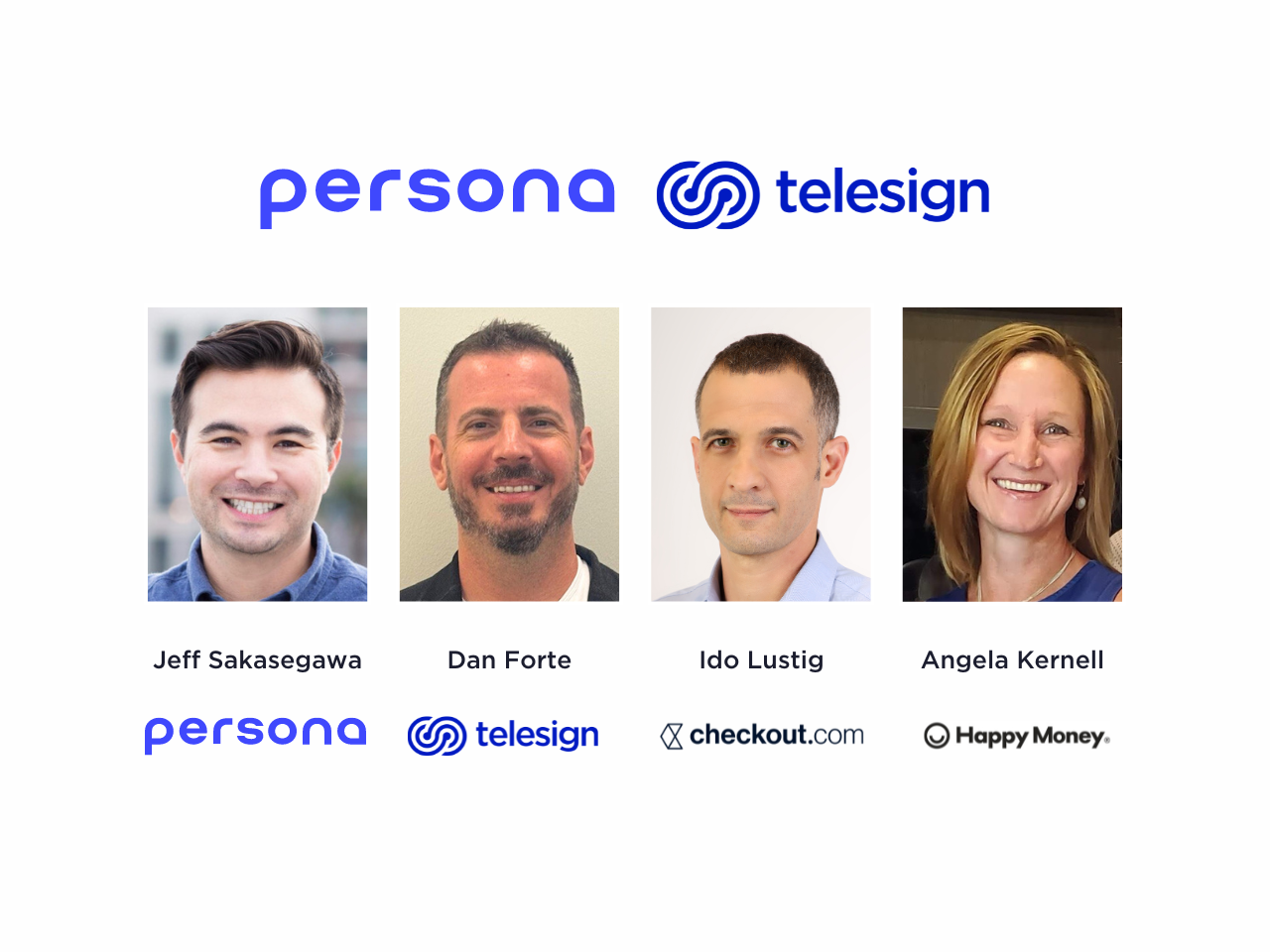

Webinar

How one can Maximize Conversions, Reduce Fraud at Account Opening

Might 2, 2pm EDT

Each banks and fintech need onboarding new prospects to be safe, easy and quick. However there’s a delicate stability. Make…

Additionally Making Information

To sponsor our newsletters and attain 180,000 fintech lovers along with your message, contact us right here.