KEY

TAKEAWAYS

- The Nasdaq Composite is buying and selling above its final swing excessive, which might a the primary signal of a reversal to the upside

- The S&P 500 is up towards resistance from its 50-day shifting common and a downward sloping trendline

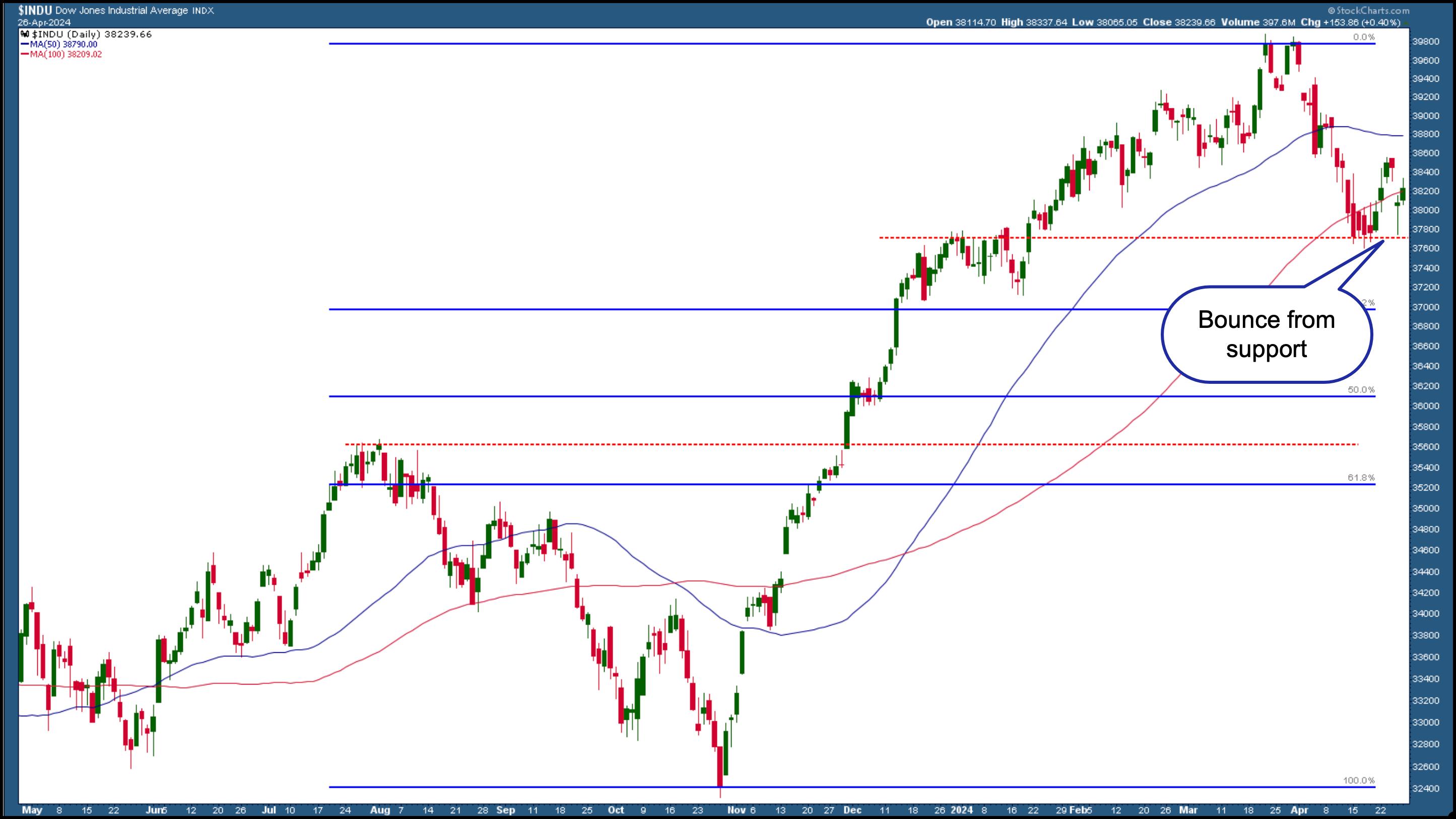

- The Dow Jones Industrial Common has reversed from a help degree and is above its 50-day shifting common

A tug-of-war with no clear winner—that is what the inventory market gave the impression to be enjoying this week. With a Fed assembly, key financial knowledge, and extra earnings on prime, will a winner emerge subsequent week?

It was an attention-grabbing week within the inventory market. Financial knowledge reveals that development is slowing, whereas inflation is not exhibiting indicators of slowing down. This potential “stagflation” situation paves a path in the direction of extra uncertainty, particularly in the case of rates of interest. And with subsequent week’s Fed assembly, traders have gotten much more cautious about making any buying and selling or investing selections.

Wanting again finally week, we will see how Tesla (TSLA) bounced greater after it missed earnings. Meta Platforms (META) beat earnings estimates, however its inventory worth gapped decrease on weak Q2 steering. That was a priority, since META has been having fun with a bullish rally for the reason that finish of 2022. It stays to be seen if the hole up in META’s inventory worth on February 2, 2024 will get crammed. The inventory is buying and selling at its 100-day easy shifting common (SMA), which could possibly be a help degree the inventory bounces from; nevertheless, META might additionally find yourself breaking beneath it and sliding additional.

Buyers had been involved by META’s weak steering, as they had been on the lookout for Tech earnings to be the catalyst that pushes the market greater. After META took a lot of the market decrease, the subsequent fear was whether or not the opposite Tech shares would observe the identical path. Luckily, that did not happen. Microsoft (MSFT), Alphabet (GOOGL), and Snap (SNAP) all beat earnings, and their inventory costs moved greater, reversing the downtrend.

Is that this Reversal Sustainable?

The constructive earnings excited the bulls, nevertheless it felt like they hit a wall. There wasn’t sufficient follow-through to push the inventory market indexes greater, and the bears did not appear to be fascinated with placing up a lot of a struggle.

Whereas the S&P 500 ($SPX), Dow Jones Industrial Common ($INDU), and Nasdaq Composite ($COMPQ) traded greater on Friday, the weekly chart reveals the S&P 500 and Nasdaq did not shut above final week’s excessive. The Dow did shut barely greater, although.

The day by day charts are extra engaging. Under is the day by day chart of the Nasdaq Composite, which reveals that, after final Friday’s low, the index moved greater, then fell on Thursday earlier than recovering these losses on the shut of the buying and selling day. At the moment (Friday, April 26), the Nasdaq gapped greater and closed above Wednesday’s swing excessive.

CHART 1. DAILY CHART OF NASDAQ COMPOSITE. After closing greater than the final swing excessive, there’s hope the Nasdaq might rally greater relying on what unfolds subsequent week. Chart supply: StockCharts.com. For academic functions.

The Nasdaq Composite is getting near its 50-day SMA, which might be a powerful resistance degree for the index.

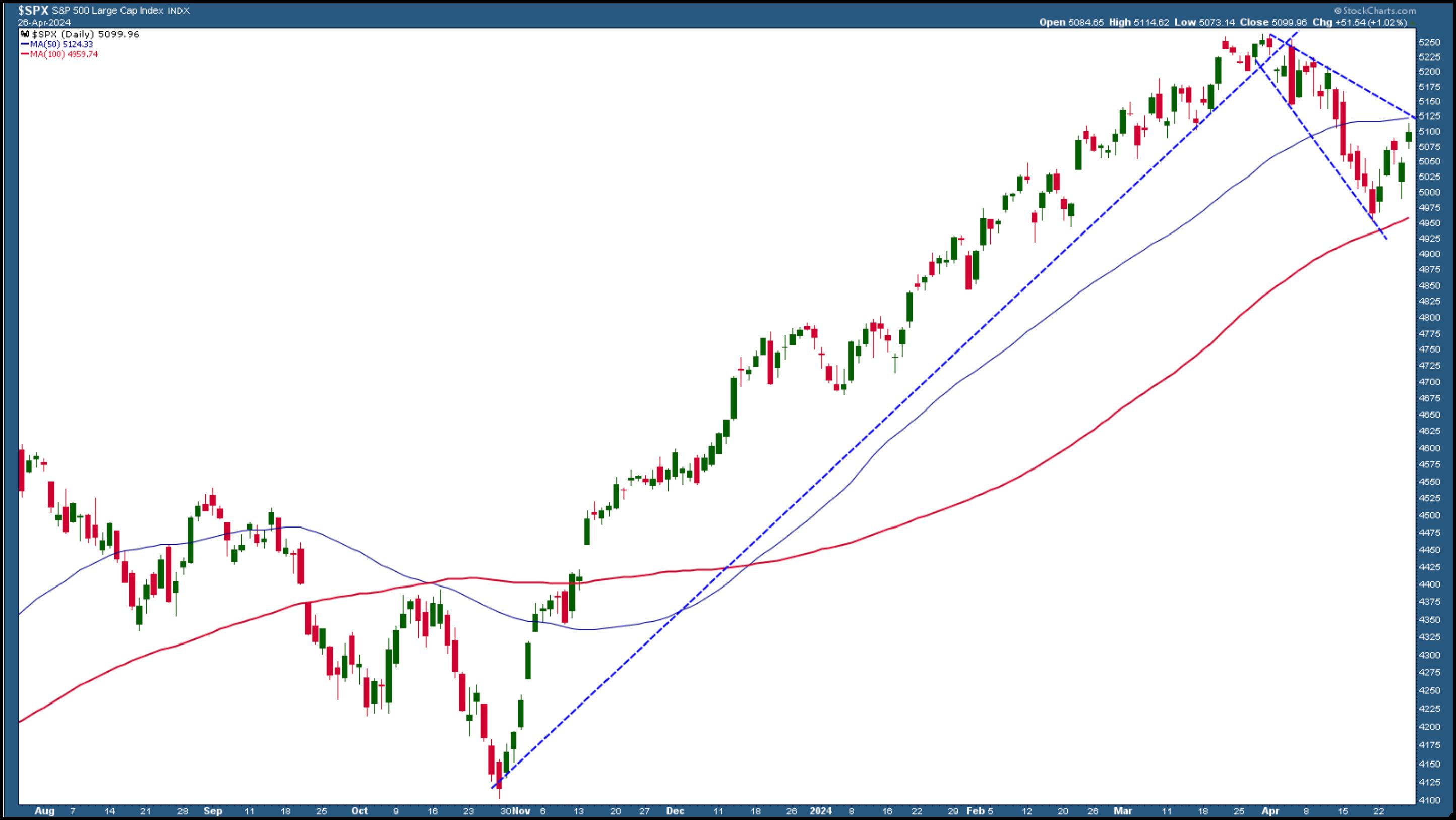

Transferring on to the S&P 500, the index is up towards resistance from its 50-day SMA, which coincides with a downward-sloping trendline.

CHART 2. DAILY CHART OF S&P 500 INDEX. If the S&P 500 breaks above the downward sloping trending on the highest of the channel and its 50-day shifting common, there could possibly be upside follow-through. Chart supply: StockCharts.com. For academic functions.

The Dow is essentially the most bullish of the three broad indexes. It has seen a transparent reversal from a help degree (crimson dashed line), and any bullish information subsequent week will doubtless transfer the index greater.

CHART 3. DAILY CHART OF THE DOW JONES INDUSTRIAL AVERAGE. A transparent bounce from a major help degree might imply the Dow has extra shopping for than promoting stress. Chart supply: StockCharts.com.

Which Approach Will the Inventory Market Transfer?

It seems just like the bulls are hungry to be the extra dominant participant. If any information blocks the bulls from taking this market any greater, the bears might be fast to take over. Bear in mind, the market takes the steps up and the elevator down. The market will in all probability proceed to see some choppiness till Wednesday afternoon, when the Fed makes its rate of interest choice. That may in all probability be what is going to take the inventory market down or up.

Finish-of-Week Wrap-Up

- S&P 500 closes up 1.02% at 5,099.96, Dow Jones Industrial Common closes up 0.4% at 38,239.66; Nasdaq Composite closes up 2.03% at 15,927.90

- $VIX down 2.28% at 15.02

- Finest performing sector for the week: Know-how

- Worst performing sector for the week: Supplies

- Prime 5 Massive Cap SCTR shares: Tremendous Micro Laptop, Inc. (SMCI); Coinbase International Inc. (COIN); Vertiv Holdings (VRT); MicroStrategy Inc. (MSTR); Vistra Vitality Corp. (VST)

On the Radar Subsequent Week

- April ISM Manufacturing PMI

- Fed rate of interest choice

- Fed Chairman Powell’s Press Convention

- March JOLTS Job Openings report

- April Non Farm Payrolls (Jobs) Report

- April ISM Providers

- Earnings season continues with Amazon (AMZN), Superior Micro Gadgets (AMD), Eli Lilly (LLY), Barrick Gold (GOLD) and Reserving Holdings (BKNG) reporting.

Disclaimer: This weblog is for academic functions solely and shouldn’t be construed as monetary recommendation. The concepts and methods ought to by no means be used with out first assessing your personal private and monetary scenario, or with out consulting a monetary skilled.

Jayanthi Gopalakrishnan is Director of Web site Content material at StockCharts.com. She spends her time developing with content material methods, delivering content material to coach merchants and traders, and discovering methods to make technical evaluation enjoyable. Jayanthi was Managing Editor at T3 Customized, a content material advertising and marketing company for monetary manufacturers. Previous to that, she was Managing Editor of Technical Evaluation of Shares & Commodities journal for 15+ years.

Be taught Extra