We have been overlaying the indicators of weak spot for shares, from the bearish divergences in March, to the mega-cap progress shares breaking by way of their 50-day transferring averages, to even the dramatic improve in volatility usually related to main market tops. Whereas Q1 was marked by broad market power and loads of new 52-week highs, Q2 has up to now offered a a lot totally different playbook for traders. Each bulls and bears have felt validated by the current choppiness for the most important market averages.

Over the past week, the S&P 500 managed to realize about 2.7%, regardless of some hotter-than-expected inflation knowledge and a combined bag of earnings for the Magnificent 7 shares. Does this set us up for a lot additional positive aspects, and a possible break to new all-time highs, as we proceed by way of the second quarter? Or are we at the moment experiencing the “useless cat bounce” section with a countertrend transfer to the upside earlier than the good bear market continues?

Psst! Take a look at the January 2024 version of this train, and guess which situation really performed out!

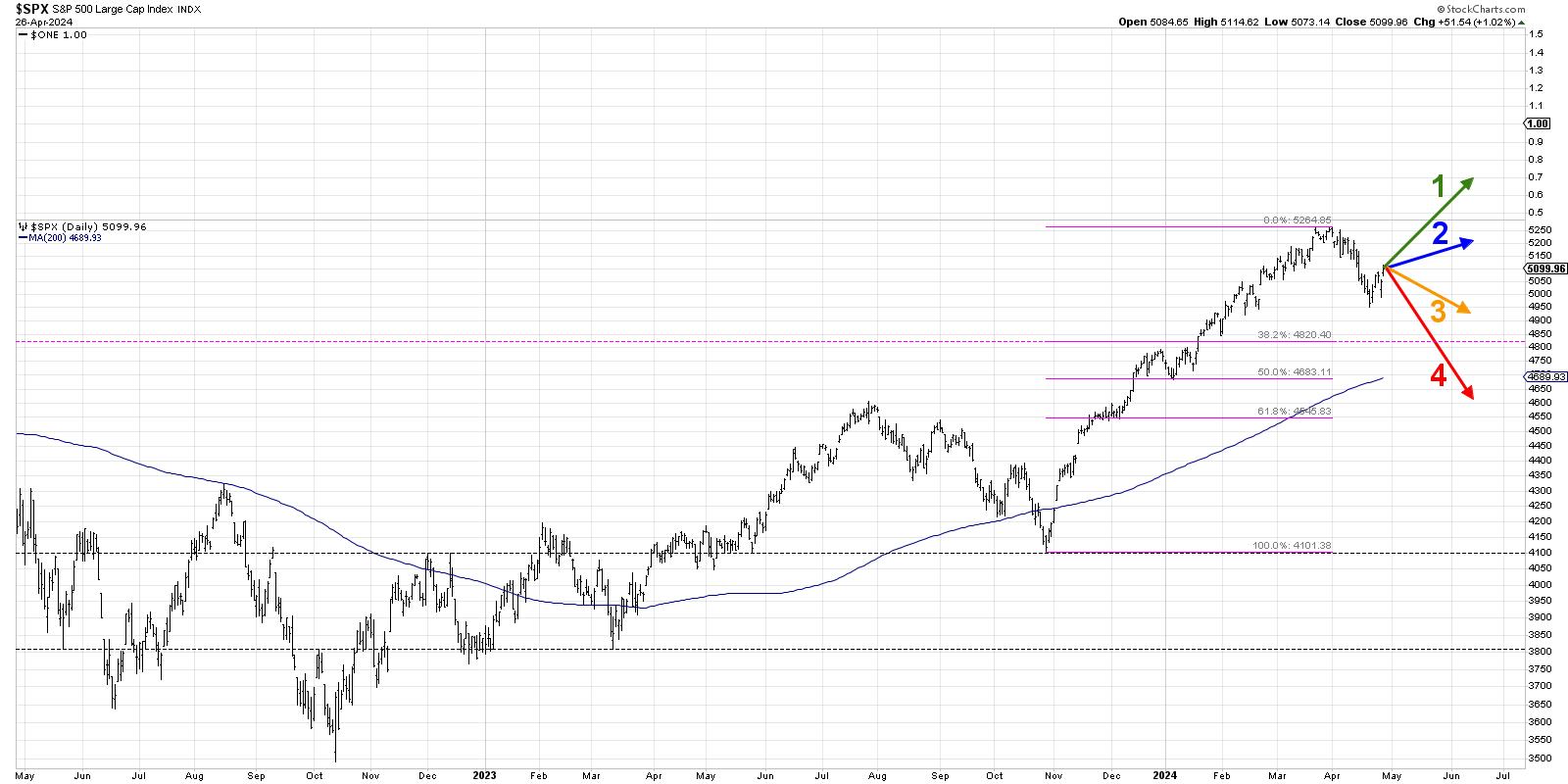

Immediately, we’ll lay out 4 potential outcomes for the S&P 500 index. As I share every of those 4 future paths, I will describe the market situations that will probably be concerned, and I will additionally share my estimated chance for every situation. And keep in mind, the purpose of this train is threefold:

- Contemplate all 4 potential future paths for the index, take into consideration what would trigger every situation to unfold when it comes to the macro drivers, and evaluate what alerts/patterns/indicators would affirm the situation.

- Resolve which situation you’re feeling is most certainly, and why you suppose that is the case. Remember to drop me a remark and let me know your vote!

- Take into consideration how every of the 4 situations would affect your present portfolio. How would you handle danger in every case? How and when would you’re taking motion to adapt to this new actuality?

Let’s begin with probably the most optimistic situation, involving a transfer to new all-time highs over the following six to eight weeks.

Possibility 1: The Very Bullish State of affairs

For those who suppose the April pullback was simply one other buyable dip inside a main bullish pattern, then the Very Bullish State of affairs is for you. This situation can be made potential provided that the Magnificent 7 shares returned to their former magnificent methods, with shares like AMZN and NVDA following GOOGL in making new all-time highs.

We might must see financial indicators, particularly inflation readings, are available a lot weaker, which might give the Fed confidence to start reducing charges on the June Fed assembly. By the tip of June, we would be speaking in regards to the S&P 500 breaking above 5500, and even 6000 may very well be on the desk.

Dave’s Vote: 10%

Possibility 2: The Mildly Bullish State of affairs

What if the S&P manages to carry the April low round 4950, however is unable to push to new all-time highs? State of affairs 2 may imply that value-oriented sectors like industrials and supplies expertise a resurgence, outpacing the expansion management shares from Q1. However since these sectors are a lot decrease weight within the S&P 500, it is simply not sufficient market cap to maneuver the needle on the most important benchmarks.

Maybe the remainder of earnings season yields combined outcomes, and by the tip of Q2 we’re left with extra questions than solutions because the Fed is unable to decide to aggressive charge cuts. Rates of interest stay elevated, which creates a significant headwind for progress shares.

Dave’s vote: 30%

Possibility 3: The Mildly Bearish State of affairs

Now we get to 2 situations that will imply a extra bearish image emerges within the coming weeks. State of affairs 3 would imply the S&P 500 is unable to carry the April low round 4950, however we stay above a 38.2% retracement degree round 4820. The Fed both delays its first charge reduce or makes use of language that exudes little confidence in a number of extra charge cuts in 2024.

The Magnificent 7 shares can be uneven at finest, and as they stall out making an attempt to return to new all-time highs, traders see that as a sign of restricted upside. Gold and gold shares change into the commerce of the day, as traders are searching for something aside from shares to attempt to generate constructive returns.

Dave’s vote: 45%

Possibility 4: The Tremendous Bearish State of affairs

You all the time have to incorporate a doomsday situation, and our remaining choice would imply the April selloff was certainly just the start. Might and June are marked with decrease lows and decrease highs, and Q2 feels similar to September and October of 2023. The S&P 500 breaks by way of Fibonacci help round 4820, and even pushes beneath the 200-day transferring common for the primary time for the reason that October 2023 low.

What may trigger this final situation? Financial knowledge may are available means increased than anticipated, and the Fed may then change into unwilling to chop charges whereas the financial system exhibits indicators of renewed power. The market braces for “increased for longer” rates of interest, growth-oriented sectors like know-how and communication providers start the paved the way decrease, and defensive sectors bump increased as traders ignite the “flight for security” commerce.

Dave’s vote: 15%

What chances would you assign to every of those 4 situations? Take a look at the video beneath, after which drop a remark with which situation you choose and why!

RR#6,

Dave

P.S. Able to improve your funding course of? Take a look at my free behavioral investing course!

David Keller, CMT

Chief Market Strategist

StockCharts.com

Disclaimer: This weblog is for academic functions solely and shouldn’t be construed as monetary recommendation. The concepts and methods ought to by no means be used with out first assessing your personal private and monetary scenario, or with out consulting a monetary skilled.

The creator doesn’t have a place in talked about securities on the time of publication. Any opinions expressed herein are solely these of the creator and don’t in any means signify the views or opinions of another individual or entity.

David Keller, CMT is Chief Market Strategist at StockCharts.com, the place he helps traders reduce behavioral biases by way of technical evaluation. He’s a frequent host on StockCharts TV, and he relates mindfulness strategies to investor choice making in his weblog, The Aware Investor.

David can be President and Chief Strategist at Sierra Alpha Analysis LLC, a boutique funding analysis agency targeted on managing danger by way of market consciousness. He combines the strengths of technical evaluation, behavioral finance, and knowledge visualization to determine funding alternatives and enrich relationships between advisors and shoppers.

Study Extra