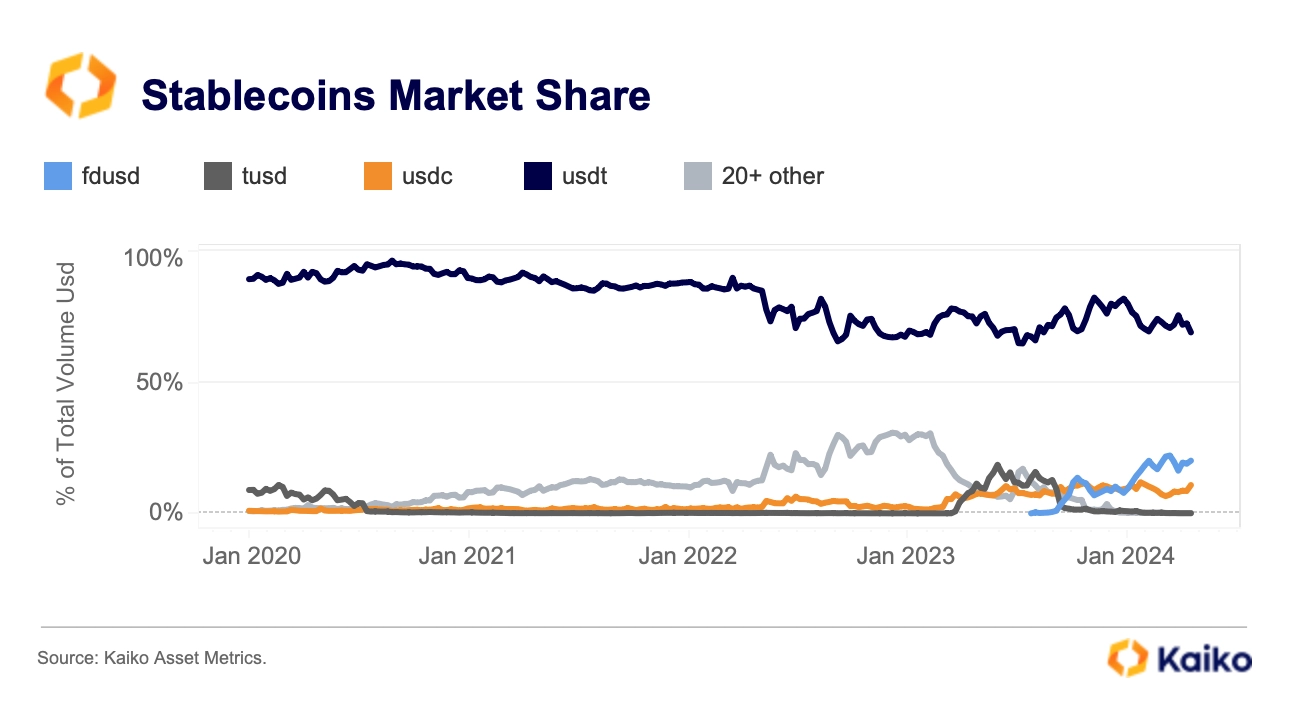

Market intelligence platform Kaiko Analytics stories that new opponents are chipping away at Tether’s (USDT) stablecoin dominance.

In a brand new report titled “Tether Loses Market Share,” Kaiko Analytics says that the stablecoin issuer’s market share over centralized change platforms (CEXs) has dipped 13% year-to-date (YTD) because of the development of rival dollar-pegged digital belongings, akin to FDUSD and USDC.

“Regardless of its dominant market place, USDT’s market share on CEXs has been trending downwards, declining from 82% to 69% YTD. This lower might be partly attributed to rising competitors from stablecoins like FDUSD which profit from Binance’s zero-fee promotions.

USDC has additionally skilled an increase in its market share, signaling a rising choice for regulated alternate options. At current, stablecoins issued within the US make up 10% of the general stablecoin commerce quantity.

Solely one of many high 5 stablecoins by market cap, Circle’s USDC, is regulated beneath state US cash transmitter frameworks. Nonetheless, its share has elevated from lower than 1% in 2020 to 11% at present.”  In accordance with Kaiko, different rivals akin to Ethena (USDe), which uniquely presents yield, is also slicing into Tether’s market dominance.

In accordance with Kaiko, different rivals akin to Ethena (USDe), which uniquely presents yield, is also slicing into Tether’s market dominance.

“One more reason for Tether’s declining market share could possibly be linked to the emergence of modern yield-bearing alternate options akin to Ethena’s USDe. Since its launch in February, USDe’s quantity has grown considerably, though it has retreated from April’s all-time excessive of greater than $800 million following Ethena’s ENA airdrop.”

In accordance with Tether’s 2024 Attestation Report, the agency posted a record-breaking $4.52 billion in earnings throughout the first quarter of the yr.

Do not Miss a Beat – Subscribe to get e-mail alerts delivered on to your inbox

Examine Worth Motion

Comply with us on X, Fb and Telegram

Surf The Every day Hodl Combine

Disclaimer: Opinions expressed at The Every day Hodl should not funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your individual threat, and any losses chances are you’ll incur are your accountability. The Every day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Every day Hodl an funding advisor. Please word that The Every day Hodl participates in affiliate internet marketing.

Featured Picture: Shutterstock/balabolka