Fast Take

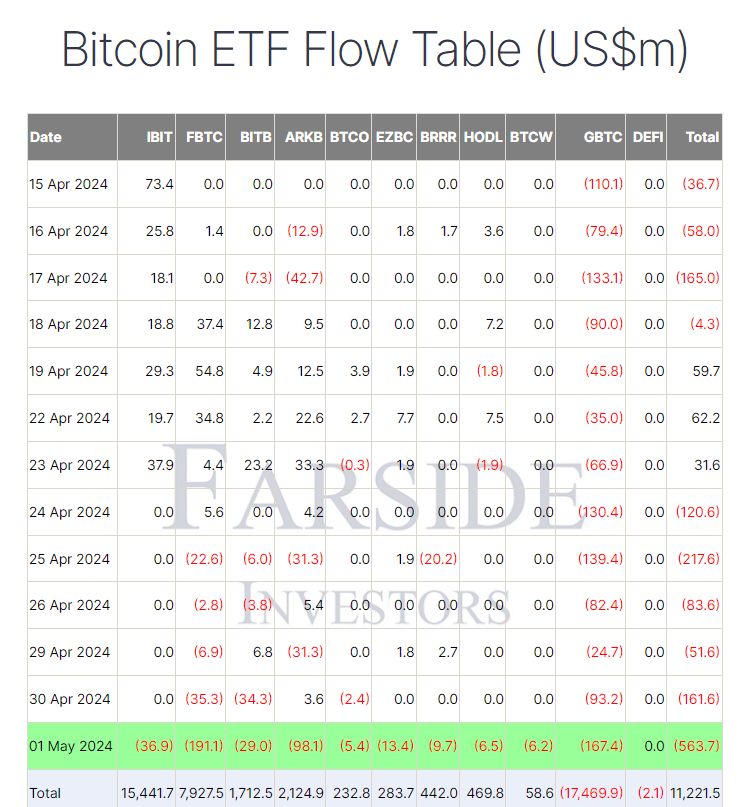

Farside information exhibits that on Could 1, Bitcoin exchange-traded funds (ETFs) suffered a file $563.7 million outflow – the worst single-day efficiency since their inception. This huge capital exodus marked the sixth consecutive buying and selling day of withdrawals, aligning with Bitcoin’s over 20% plunge from its all-time excessive.

BlackRock’s IBIT noticed its first redemption of $36.9 million since launch after 5 straight days of no flows. Regardless of this, IBIT maintains a powerful $15,441.7 billion in whole inflows. Constancy’s FBTC skilled its largest single-day outflow of $191.1 million, the fifth consecutive buying and selling day of withdrawals, but nonetheless boasts $7,927.5 billion in cumulative inflows, in line with Farside information.

Farside information exhibits that Ark’s ARKB endured its greatest outflow of $98.1 million, bringing whole inflows all the way down to $2,124.9 billion. Grayscale’s GBTC noticed $167.4 million redeemed, its largest single-day outflow since April 8, pushing whole internet outflows to a staggering $17,469.9 billion. Regardless of the current turmoil in Bitcoin worth, Bitcoin ETFs have collectively collected a considerable $11,221.5 billion in internet inflows.