Is the Gold Market Actually Falling:

Decline and Methods for Bearish Occasions

Gold, the historic haven for traders in occasions of uncertainty, has seen a latest worth decline. However is that this a full-fledged bear market, or a brief dip? Let’s dissect the explanations behind the decline and discover how merchants can navigate this potential bear market utilizing efficient alerts.

Understanding the Decline

A number of components are contributing to the present softness within the gold market:

- Rising Curiosity Charges: As central banks elevate charges to fight inflation, the chance price of holding non-yielding gold will increase. Buyers search belongings that supply returns, placing downward stress on gold.

- Stronger Greenback: A resurgent US greenback weakens the demand for gold, typically seen as a hedge towards a declining greenback.

- Shifting Investor Sentiment: With financial knowledge exhibiting indicators of enchancment, traders could also be rotating out of safe-haven belongings like gold and into riskier belongings like shares.

Buying and selling in a Bear Market: Indicators for Success

Whereas the decline is perhaps regarding, a bear market doesn’t should spell doom for merchants. Right here’s leverage alerts to navigate this potential shift:

- Technical Indicators: Technical indicators like Relative Power Index (RSI) and Transferring Common Convergence Divergence (MACD) can determine overbought and oversold circumstances. In a bear market, recognizing oversold alerts can point out potential shopping for alternatives for a short-term bounce.

- Assist and Resistance Ranges: Figuring out historic assist ranges the place earlier worth declines have been halted can point out areas the place the value might discover non permanent shopping for stress once more. Conversely, resistance ranges can warn of promoting stress and potential worth caps.

- Financial Information: Staying up to date on financial knowledge releases, significantly inflation figures and Federal Reserve pronouncements, will help anticipate future rate of interest actions and their impression on the gold market.

- Gold-to-equity Ratio: Monitoring the ratio between gold costs and inventory indices can provide insights into investor sentiment. A rising ratio may point out a flight to security, probably foreshadowing a reversal within the gold worth decline.

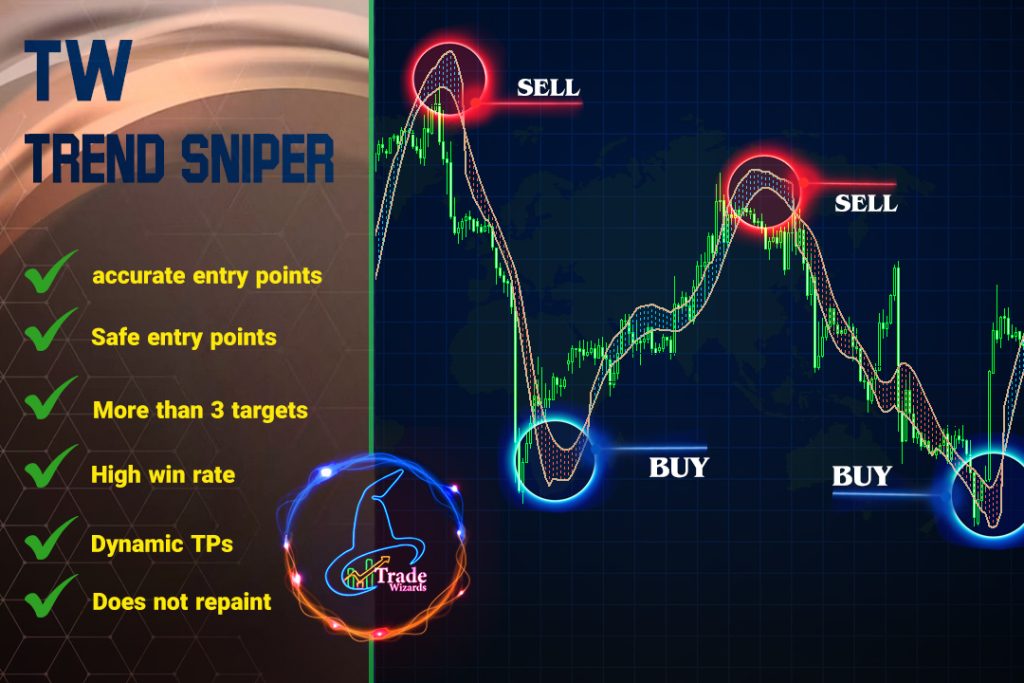

In fluctuations:

Even when the gold market declines additional, try the “TW pattern Sniper” product. This all-in-one instrument supplies precious alerts via technical indicators, assist/resistance ranges and financial knowledge, permitting you to probably commerce in bull markets by figuring out shopping for alternatives throughout gold worth declines and promoting alternatives throughout market rallies. And make a revenue.

Bear in mind:

- Keep Disciplined: Follow your buying and selling plan and keep away from emotional selections.

- Handle Danger: Make use of stop-loss orders to restrict potential losses.

- Diversification is Key: Don’t overcommit to a bearish gold market. Preserve a diversified portfolio to hedge towards threat.

Utilizing a mix of those alerts alongside sound threat administration practices is essential for profitable buying and selling in a bear market.

The gold market’s future trajectory stays unsure. Nonetheless, by understanding the causes of the decline and by strategically using varied alerts, merchants can place themselves to capitalize on potential alternatives on this evolving market panorama.

Disclaimer: This text is for informational functions solely and shouldn’t be thought of monetary recommendation. Please seek the advice of with a certified monetary advisor earlier than making any funding selections.

Joyful buying and selling

might the pips be ever in your favor!