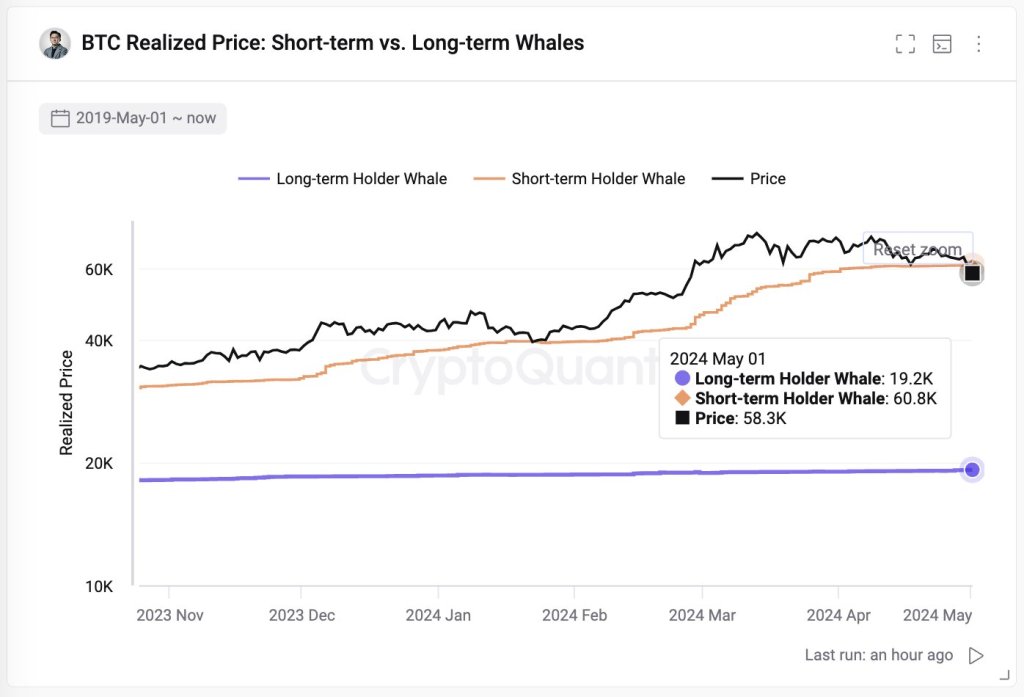

As Bitcoin slumps, on-chain information by Ki Younger Ju, the founding father of the blockchain analytics platform CryptoQuant, paints a stark image: all new whales, together with holders of spot exchange-traded funds (ETFs), at the moment are underwater.

New Whales And Spot ETF Buyers Are In Crimson

Taking to X, Ju mentioned that extra losses can be incoming, predicting that HODLers will discover “max ache” at round $51,000. The dip is lower than $10,000 from spot charges, suggesting that though there are cracks, the correction won’t be deep.

This overview is welcomed, contemplating the latest sell-off. Even so, predicting worth bottoms in a fast-moving market influenced by a number of forces is hard.

As worth motion stands, Ju says believers might take the chance to double down on the coin. The founder provides that the present worth low cost presents a possibility for savvy traders to outperform conventional finance whales, together with establishments with BTC publicity through spot ETFs in the US.

Bitcoin is beneath immense liquidation stress on the time of this writing. Although bulls soaked up the sell-off earlier at present, the coin stays inside a bearish breakout. Costs are buying and selling beneath the help zone of between $60,000 and $61,000 and beneath April 2024.

Influx To Spot Bitcoin ETFs Decline As Sentiment Deteriorate

This formation means that although bulls are optimistic, the trail of least resistance stays southwards for now. BTC dropped after posting spectacular returns from October 2023 to March 2024, when costs peaked. Some analysts assume the present cool-off is inevitable following sharp positive factors within the final six months.

The truth that whales are underwater was sudden, contemplating the state of affairs within the final week of April. Then, the influx from new whales practically doubled the cumulative holdings of older whales. Analysts mentioned this inflow of recent capital pointed to rising institutional curiosity.

Nonetheless, trying on the present worth motion, new whales at the moment are within the crimson territory, and their pleasure appears to wane.

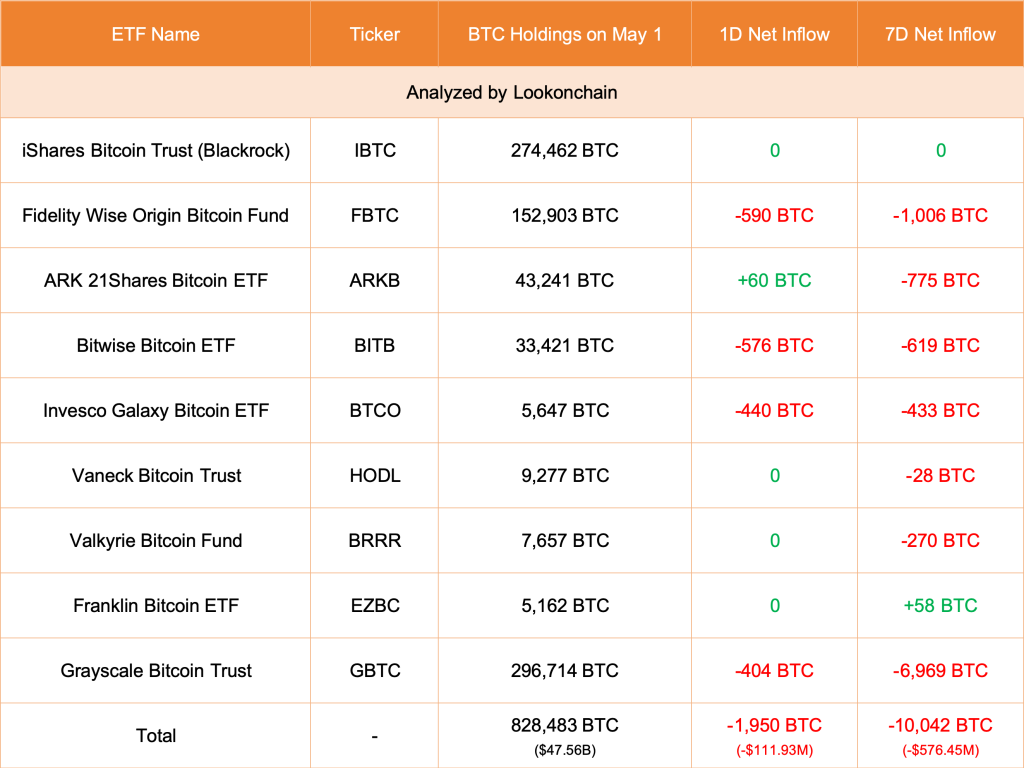

In line with Lookonchain information, influx into the eight-spot Bitcoin ETFs, together with BlackRock, has stalled. On Might 1, all issuers, together with Grayscale through GBTC, decreased by 1,950 BTC. Of be aware is that BlackRock’s IBIT has not seen inflows for 5 straight days.

Nonetheless, confidence abounds. Inflows into spot Bitcoin ETFs are extremely influenced by sentiment, which rests on how costs carry out. If BTC shakes off the present weak point and tears larger within the anticipated post-Halving rally, spot ETF issuers will start receiving new inflows.

Characteristic picture from DALLE, chart from TradingView

Disclaimer: The article is supplied for academic functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your individual analysis earlier than making any funding selections. Use data supplied on this web site solely at your individual danger.