Word to the reader: That is the nineteenth in a collection of articles I am publishing right here taken from my e book, “Investing with the Pattern.” Hopefully, you’ll discover this content material helpful. Market myths are usually perpetuated by repetition, deceptive symbolic connections, and the whole ignorance of details. The world of finance is filled with such tendencies, and right here, you will see some examples. Please remember the fact that not all of those examples are completely deceptive — they’re typically legitimate — however have too many holes in them to be worthwhile as funding ideas. And never all are instantly associated to investing and finance. Get pleasure from! – Greg

Relative Power

Again within the Seventies, we used to have an indicator that regarded on the quantity on the American Inventory Change (AMEX), also called the curb, and the amount on the New York Inventory Change (NYSE), often called the large board. It was referred to as The Hypothesis Index. The AMEX consisted of small, comparatively illiquid points, usually all that might not make the itemizing necessities of the NYSE. The ratio of AMEX quantity to NYSE quantity was thought to characterize extreme optimism when it reached a sure stage.

In excellent hindsight, I feel if we had used it as a pattern indicator, it will have been extra helpful. Determine the rising path of hypothesis and because the quantity of the AMEX elevated relative to that of the NYSE, you’d be in a superb uptrend.

Word: In 2008, the AMEX was acquired by the NYSE Euronext, which introduced that the change can be renamed the NYSE Alternext US. The latter was renamed NYSE Amex Equities in March 2009. These adjustments have made stand-alone AMEX buying and selling volumes troublesome to supply and monitor, because of which, the hypothesis index has misplaced a lot of its relevance as a measure of speculative exercise.

Small-Cap vs. Giant-Cap Element

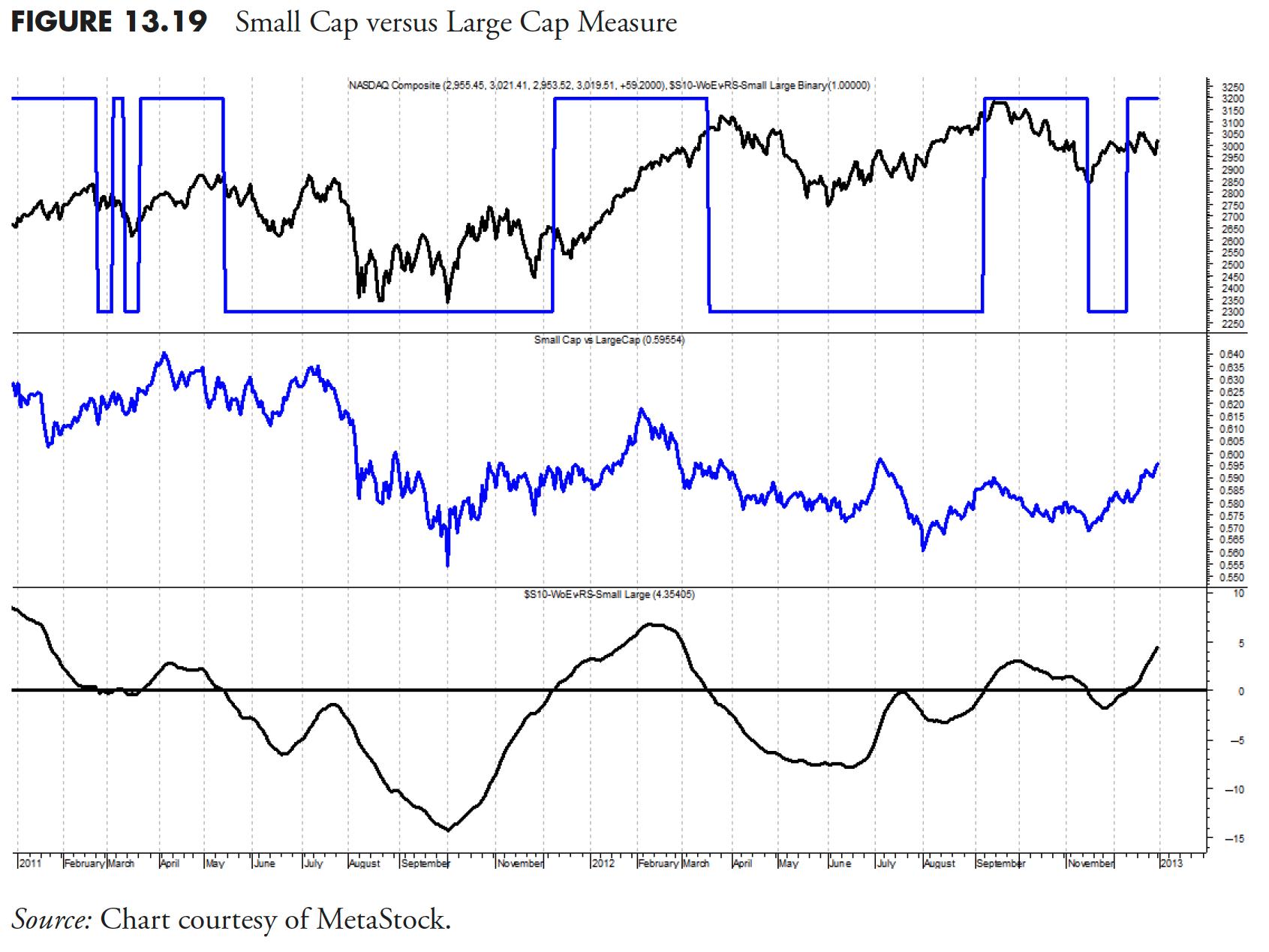

Small-cap participation is vital for sustained uptrends out there as a result of small-caps replicate hypothesis and hypothesis is a requirement for uptrends. For small capitalization points, the Russell 2000 Index is used, and for giant capitalization points, the venerable S&P 500 Index is used. The mathematics is just to create the ratio of the small to giant, then use technical evaluation to offer a normalized pattern measure.

In Determine 13.19 the standard Nasdaq Composite is within the prime plot, together with the small-cap large-cap binary. The center plot is simply the ratio of the small to giant points, and the decrease plot is the small-cap large-cap weight of the proof measure. On this instance, you may see that small caps dominated the up transfer close to the middle of the chart, however have been comparatively weak since. If you concentrate on it, small caps additionally extra carefully relate to breadth.

Progress vs. Worth Element

This element of relative power measures the distinction between progress shares and worth shares. Now it will shock most people who’ve studied the markets, however I take advantage of small-cap points for each the expansion and worth elements. I used to be initially involved that small cap worth was nearly an oxymoron, however the knowledge has proved time and time once more that it’s completely legitimate. Determine 13.20 exhibits the expansion worth ratio within the center, with the expansion worth weight of the proof measure within the backside plot and its binary overlaid within the prime plot.

Breadth vs. Worth Element

There is just one extra relative power measure to view, the connection between breadth and value. For breadth, a relationship between the advancing points and the declining points is used, whereas the Nasdaq Composite is used for value. The center plot in Determine 13.21 exhibits the uncooked ratio of these two, with the worth to breadth weight of the proof measure within the decrease plot and its binary within the prime plot. This is a superb instance of how technical manipulation of the info can flip that noisy center plot into one thing like the underside plot, and a superb pattern measure.

Relative Power Compound Measure

This compound measure (see the earlier article) is designed to measure market sentiment. Are buyers actively taking funding threat? Or are they behaving far more bearishly? Once more, there are three indicators that drive this element and are proven above. These indicators take a look at the connection between small-cap points vs. large-cap points, growth-oriented points vs. worth points, and breadth measurements vs. value measurements.

For instance, when small-caps are dominant (small-caps outperforming large-caps) it’s usually an indication of extra hypothesis happening within the markets, as buyers are prepared to simply accept extra threat. That is usually a superb signal, and it’s throughout these environments that the markets usually carry out effectively traditionally. When large-caps are dominant, it’s often the results of a flight to high quality, as buyers are taking threat off the desk. The sort of investor sentiment often ends in much less favorable market situations.

The same relationship exists between progress and worth. When progress points are outperforming, it’s usually as a result of the market is pricing in favorable progress estimates, and conversely, when worth points are dominating, it’s as a result of the market is not pricing in such optimistic constructive progress estimates. The breadth vs. value measurement is much like an equal-weighted measurement versus a capitalization-weighted measurement. Once more, we’re utilizing three indicators on this element for affirmation functions. When this relative power element is on, it’s including worth to the load of the proof of the mannequin by letting me know that the sentiment within the markets is favorable and is considered extra as a pattern affirmation measure versus a pattern identification measure.

Determine 13.22 is a chart displaying a lot of knowledge however contains all three elements of the relative power measure. The highest plot is the Nasdaq Composite with the compound binary measure overlaid. The binary measure for every of the elements can also be exhibits overlaid on their respective plots.

Determine 13.23 is identical because the previous determine, however with much less knowledge displayed.

Dominant Index

An idea often called the Dominant Index measures the relative power between the Nasdaq Composite and the New York Inventory Change (NYSE) Composite. The Nasdaq is mostly dominated by small capitalization points and the NYSE is dominated by giant capitalization points. Subsequently, a measure that exhibits which is outperforming can also be displaying whether or not small cap points are outperforming large-cap points or vice versa.

Determine 13.24 exhibits the Nasdaq Composite and the NYSE Composite within the prime plot, with the connection between the 2 displayed within the backside plot. Each time the road is above the horizontal line, it means the Nasdaq is performing higher than the NYSE. Within the final decade, the Nasdaq has grown significantly with many extra large-cap points, which considerably hampers this measure.

Pattern Capturing Measure

It is a really vital compound measure, which might drive the load of the proof or maintain it again. The pattern capturing measure, like many compound measures, consists of three impartial indicators of pattern, and on this case two are based mostly on breadth and one on value. Any two measures saying there’s an uptrend will work.

Advance Decline Element

The advance decline element of the pattern capturing measure makes use of the advances and declines distinction after which mathematically places that distinction right into a relationship much like MACD (see Determine 13.25). The indicators are given by the crossing of that system with its shorter-term (10–18 durations) exponential shifting common.

Up Quantity/Down Quantity Element

The up quantity/down quantity element of the pattern capturing measure (see Determine 13.26) makes use of the up quantity and the down quantity in the same method because the advance and decline measure in Determine 13.25. One may assume that these can be very related as they’re tied to the identical value motion, one by day by day adjustments, and one by the quantity of quantity behind these adjustments. Nonetheless, within the up quantity/down quantity, the parameters used are considerably longer than within the advance decline element.

Worth Element

The worth element of the pattern capturing measure (Determine 13.27), like the opposite two elements, makes use of the same relationship, however this one makes use of parameters which can be longer than the opposite two.

Pattern Capturing Compound Measure

It is a main element of my mannequin, as a result of it ties instantly with the funding philosophy of figuring out constructive market traits which have a excessive chance of constant into the long run. I by no means predict; I solely have an expectation that the recognized pattern will proceed.

This element is a composite of three technical measurements. One is a value measure, and the opposite two are breadth measures, considered one of which makes use of up and down quantity, and the opposite makes use of advancing and declining points (see Figures 13.26 and 13.27). I take advantage of a number of indicators for affirmation functions. For example, when the primary of those three indicators turns constructive, it’s telling us there’s a constructive value pattern growing. When the second of those indicators turns constructive, it offers affirmation of the pattern, and if the third turns constructive as effectively, I do know I’ve a really stable pattern in place. See Determine 13.28.

LTM—Lengthy-Time period Measure

Typically a great way to dampen issues is to make the most of a longer-term overlay measure, resembling this Lengthy-Time period Measure (LTM). There are a number of methods to clean out the noise in knowledge, we have mentioned one, the shifting common, at size. The opposite, utilizing weekly knowledge, typically does the identical factor, typically even higher.

The long-term measure makes use of solely weekly knowledge. It has many elements, resembling weekly advances and declines, weekly new excessive/new low knowledge, weekly up quantity and down quantity knowledge, plus a value element that measures the connection amongst many market indices and tracks their place relative to their long-term shifting common. All of that knowledge is calculated after which put collectively in a reasonably complicated method to present the binary indicator proven within the prime plot of Determine 13.29. It has an intermediate stage, form of a transition zone in order that, because the long-term elements go from being on to off, they pause within the transition zone to make sure there’s comply with via. It is a pretty sluggish shifting measure and is finest used to establish cyclical strikes out there. The perfect place to seek out weekly breadth knowledge is from Dow Jones and Firm, in both Barron’s or The Wall Road Journal.

Determine 13.30 exhibits the long-term measure over a shorter time-frame so you may higher see the motion of every measure.

Bull Market Confirmation Measure

The Bull Market Affirmation Measure is about so simple as it could get. (See Determine 13.31.) It simply makes use of a 50 shifting common and a filter to establish bull strikes. It’s calculated on the typical value of the excessive, low, and shut ((H+L+C)/3). The distinction between the common value and its 50 interval easy shifting common is then adjusted to figuring out solely occasions when it’s outdoors of the -5% and -10% vary. As the typical value drops beneath the -5% worth it’s a promote sign and when it rises above the -10% it’s the purchase sign. These crossover percentages are decided based mostly on the worth collection you’re utilizing. They’ll most likely be completely different for each.

Figures 13.31 and 13.32 is the Bull Market Affirmation measure with much less knowledge, so as to see the turning factors simpler.

Preliminary Pattern Measures (ITM)

A major enhancement to a pattern following mannequin is an early warning set of indicators. I name them Preliminary Pattern Measures, or Early Pattern Measures. They’re designed to measure traits similar to the load of the proof measure does, however use shorter time period parameters in an try to choose up or establish the pattern at an earlier stage in its improvement. You need to use as many short-term pattern measures as you want, however often 3 is greater than sufficient when you have them in several classes of pattern measurement, resembling value, breadth, and relative power.

Determine 13.33 is without doubt one of the Preliminary Pattern Measures that makes use of up quantity in comparison with down quantity. It may be both the Nasdaq knowledge or the NYSE knowledge. The highest plot is the Nasdaq bar chart, with the indicator’s binary wave overlaid on the worth bars. Recall that the binary is on the prime when the indicator is above its shifting common and on the backside when it’s beneath its shifting common.

Determine 13.34 exhibits the Preliminary Pattern Measure, which makes use of the advance decline knowledge. Similar to the opposite weight of the proof measures, this makes use of an MACD method.

Determine 13.35 is one other ITM, this one utilizing value, and on this case it’s the Nasdaq Composite Index that’s used. This measure is much like the pattern measure talked about earlier, however utilizing short-term parameters.

Determine 13.36 is the same preliminary pattern measure, however this one makes use of the NYSE Composite Index for value.

The Preliminary Pattern Measures present an alert mechanism for the load of the proof. Additionally, you will see their use within the subsequent chapter when used together with the commerce up guidelines.

Pattern Gauge

It is a idea that was launched to me by my good friend Ted Wong (TTSWong Advisory), referring to using a number of market indices and measuring their relationship to their shifting common.

Pattern Gauge is comprised of Mega Pattern Plus and Pattern Power. An idea that makes an attempt to establish general trendiness out there is at all times going to be a helpful instrument for a pattern follower. For functions of this instance, I chosen the ever present 200-day exponential common, then smoothed the outcomes with a three-day arithmetic common. There are a variety of modifications one may do with this idea, together with optimizing the shifting common lengths for every of the market indices. I say that with this warning, optimization have to be carried out correctly to keep away from curve becoming, and was mentioned earlier on this chapter. I’d begin with shifting common lengths which can be carefully tied to the pattern lengths I wish to give attention to, after which use a short-term noise discount smoothing like I did on this instance.

Mega Pattern Plus

Mega Pattern Plus is constructed by choosing 11 main indexes with the longest historic database. One may simply make the case for kind of indices and which indices are to be included. I’d recommend utilizing sufficient indices to present you broad protection over how you intend to make investments. The Mega Pattern Plus can also be used within the Lengthy-Time period Measure (LTM), however in that case it makes use of weekly knowledge. Clearly if you will have a give attention to worldwide securities, you’d wish to embrace worldwide indices. The checklist of indices used on this instance is:

- Nasdaq Composite

- S&P 500

- S&P 100

- Russell 2000

- Russell 2000 Progress

- Russell 2000 Worth

- New York Composite

- Dow Jones Industrials

- Dow Jones Transports

- Dow Jones Utilities

- Worth Line Geometric

When the index is larger than its exponential shifting common (EMA), it receives a +1; beneath its EMA, it receives a -1. Then the scores from all 11 indexes are summed after which normalized so the composite may have a variety between 0% and 100%. An uptrending market is known as when the composite is larger than or equal to 85%. A downtrending market is when the composite is lower than or equal to fifteen%. As soon as a threshold is crossed, the market stance stays till the other threshold is penetrated. Therefore Mega Pattern Plus is a digital meter: both bull or bear.

Determine 13.37 exhibits the S&P 500 within the prime plot, Mega Pattern Plus within the decrease plot, and the Mega Pattern Plus binary overlaid on the S&P 500. The binary is at +1 when.ever Mega Pattern Plus is larger than or equal to 85, at -1 every time Mega Pattern Plus is lower than or equal to fifteen, and at zero when it’s between 15 and 85. You may see that it does an inexpensive job of pattern identification. It is a weight of the proof method that’s completely associated to the ideas on this e book.

Pattern Power

Pattern Power is a special composite, which is the sum of 11 ratios. For every market index, a ratio is calculated with this system: (value/EMA–1) x one hundred pc. The EMA lengths are equivalent to these utilized in Mega Pattern Plus. The ratio depicts how distant (up or down) the index is positioned relative to its EMA. Therefore, Pattern Power is an oscillating analog meter that measures the momentum of every of the 11 market indexes (see Determine 13.38).

Pattern Gauge combines the readings from each the digital and analog meters (Mega Pattern Plus and Pattern Power). It represents a weight of proof method in figuring out each the path (digital) and the power (analog) of the general market pattern. Determine 13.39 exhibits the S&P 500 within the prime plot and Pattern Gauge within the decrease plot. Each time the Pattern Gauge is at +1, it has recognized an uptrend; when at -1, it has recognized a downtrend; and when at 0, there’s neither an up- or downtrend (impartial).

Determine 13.40 is identical knowledge as in Determine 13.39 , simply over a for much longer time-frame. The start date in Determine 13.40 is 1992.

Measuring the market is a significant factor to a superb pattern following, rules-based mannequin. This text and the earlier one have launched many measures that can be utilized individually or in teams to help in pattern identification. Clearly, there have been many measures launched, and hopefully you could find a couple of that may suit your wants. Additionally, hopefully you’ll not use all of them, as many are related with minor deviations of their idea.

Thanks for studying this far. I intend to publish one article on this collection each week. Cannot wait? The e book is on the market right here.