KEY

TAKEAWAYS

- Evaluating equal weighted and cap weighted sectors on a Relative Rotation Graph can provide attention-grabbing insights

- When the trajectory of the tails and their place on the chart differ considerably it warrants an additional investigation

- For the time being two sectors are displaying such divergences

All On The Identical Monitor …. or?

The distinction between equal-weighted sectors and cap-weighted sectors is apparent. The cap-weighted variant is far heavier and is impacted by the modifications in some heavy-weight, typically mega-cap, shares.

However, once you plot these sectors on Relative Rotation Graphs, you’ll typically discover that their tails typically transfer in the identical route and/or observe the identical path.

When that doesn’t occur, when the tails of the 2 variations of the identical sector are on totally different paths or in utterly totally different positions on the RRG, it is time to examine.

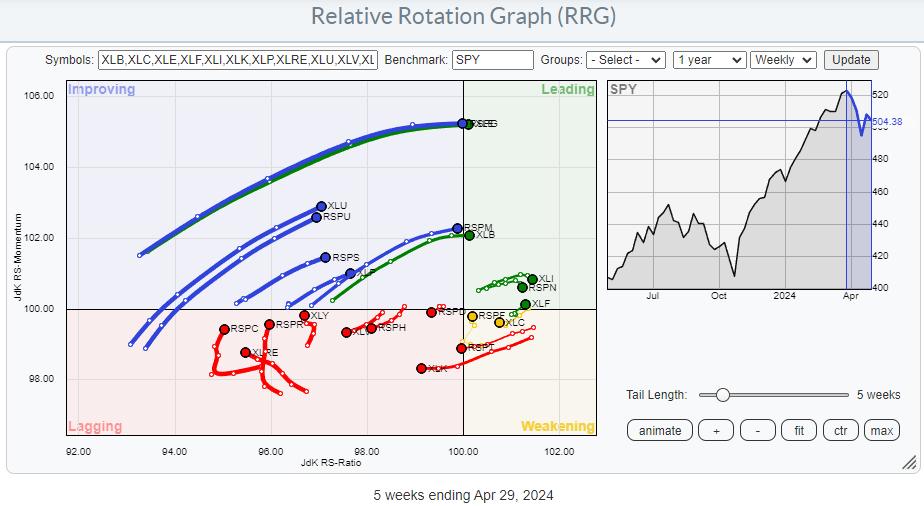

The RRG above reveals the 2 universes, cap-weighted and equal-weighted, plotted on the identical RRG and in opposition to SPY because the benchmark. Trying carefully, you will discover most sector pairs on the identical trajectory. In case you have a SC account, you may click on on the graph, open the RRG in your personal account, and do a more in-depth inspection.

*It can save you RRGs as bookmarks in your browser. By doing that, you may create your personal customized RRGs and save them for later retrieval. Scroll to the underside of the web page, click on “permalink,”

Zooming in

then save this hyperlink as a bookmark in your browser.

then save this hyperlink as a bookmark in your browser.

To get a greater deal with and a clearer image, I’ve eliminated the sectors the place bot tails are on comparable trajectories and positions and solely left the tails on the graph the place they differ.

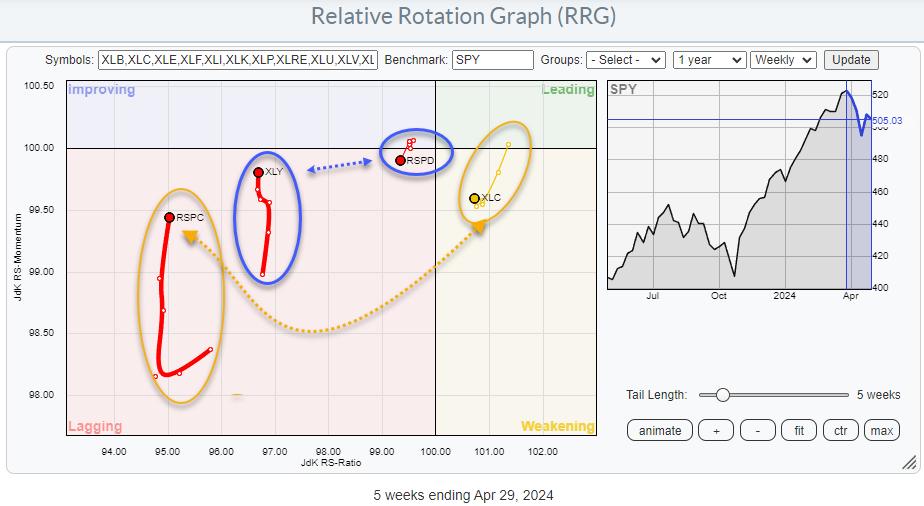

Two sectors stay. Client Discretionary and Communication Companies.

Client Discretionary

Each tails are contained in the lagging quadrant. Nevertheless, that’s so far as the comparability goes. XLY is shifting increased on the RS-Momentum scale, indicating an enchancment in relative momentum, whereas RSPD is shifting decrease and is on a adverse RRG-Heading. Additionally, the tail on XLY is considerably longer than on RSPD, indicating the facility behind the transfer.

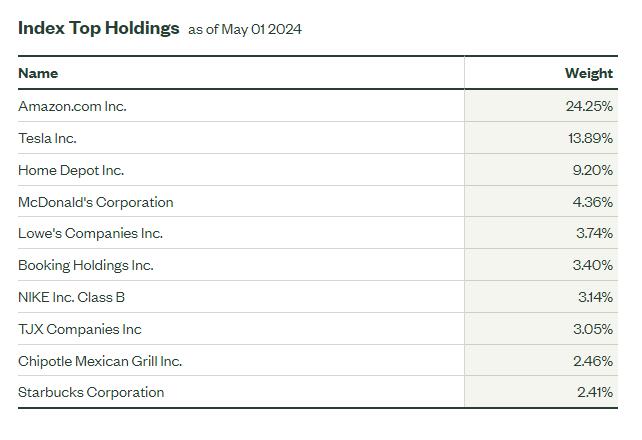

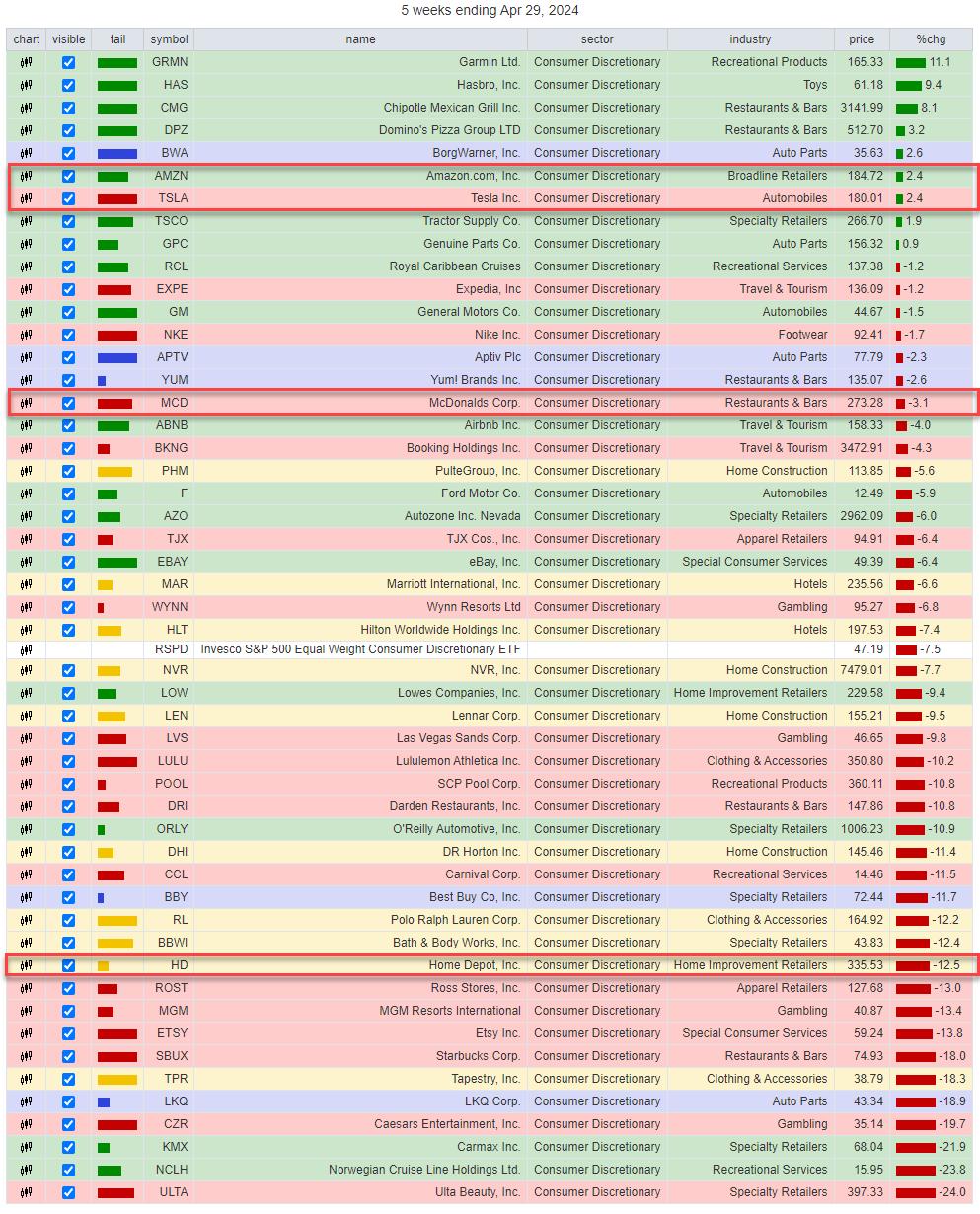

Trying on the composition of the sector, it is apparent which shares inside Client Discretionary are inflicting the distinction.

AMZN, TSLA, HD, and MCD comprise 50% of the index, whereas AMZN and TSLA are already 38%.

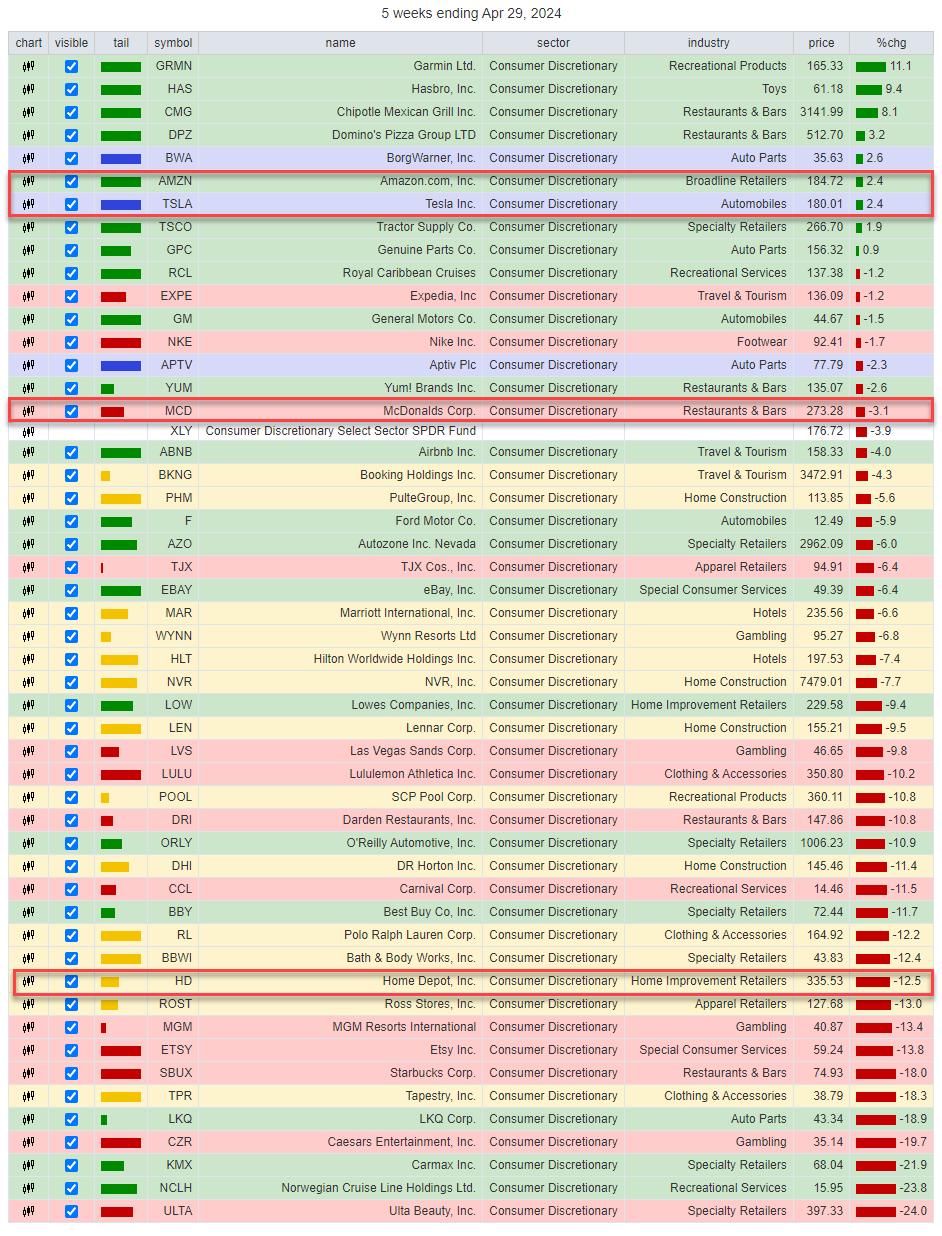

Trying on the efficiency over the past 5 weeks (tail size on the RRG), we will see how the sector’s efficiency has shifted to the big names. The desk above reveals the highest 50 shares within the discretionary sector. AMZN and TSLA are within the higher finish of the vary, and MCD is simply above XLY, which is at place 17 out of fifty…

This means that almost all shares are performing worse than that sector index. Roughly the underside half is at double-digit declines. And nonetheless, whereas AMZN and TSLA are “solely” up 2.4%, they drag the sector index as much as round 1/3 of the whole universe, even with HD displaying a 12.5% decline over that interval.

Now, take a look at the identical desk. As an alternative of utilizing XLY because the benchmark, we at the moment are utilizing RSPD because the benchmark.

RSPD is displaying up at place 27 / 50. Proper, the place you’d count on an equal weight benchmark. In the course of the universe, balancing out all of the performances.

The underside line is that XLY has been selecting up lately solely due to TSLA, AMZN, and MCD. However underneath the hood, most discretionary shares are going via a horrible correction.

From a buying and selling perspective, such observations can provide nice pair buying and selling concepts, XLY:RSPD

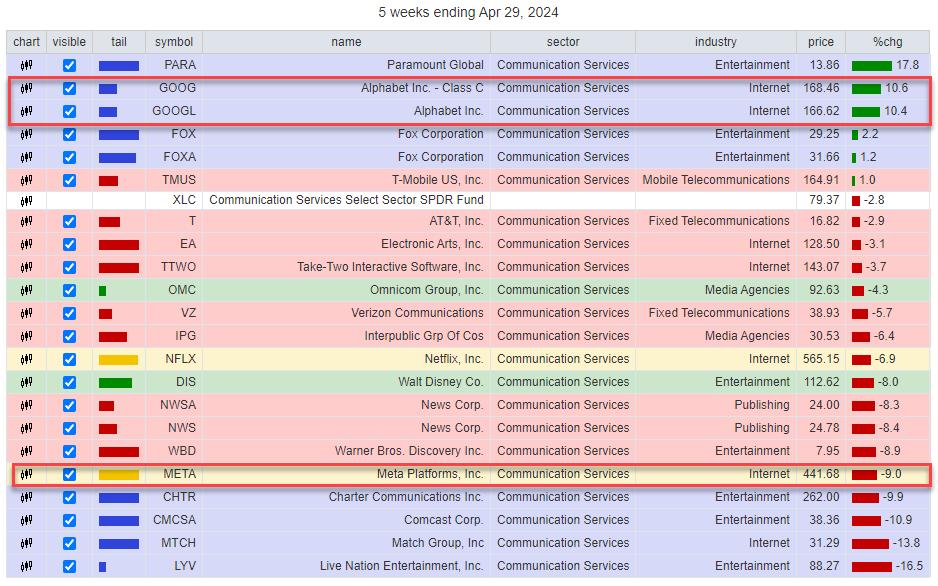

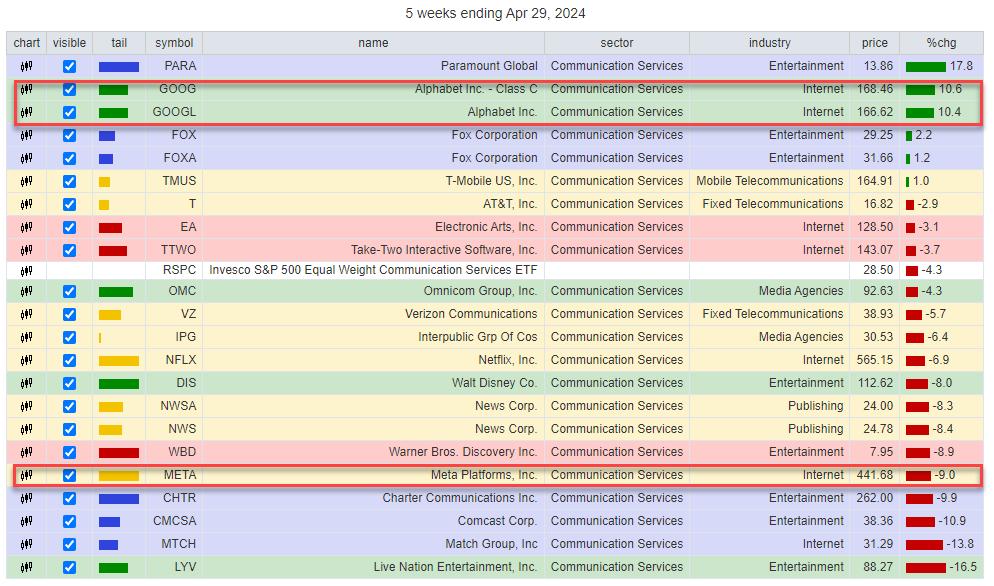

Communication Companies

The tails for XLC and RSPC are additionally far aside on the RRG. XLC remains to be contained in the weakening quadrant and has simply began to point out the primary indicators of curling again up. RSPC is deep contained in the lagging quadrant at a extremely low studying on the RS-Ratio scale general and is selecting up relative momentum however no relative development (RS-Ratio) but.

Over the five-week interval, XLC misplaced 2.8%, whereas RSPC misplaced 4.3%

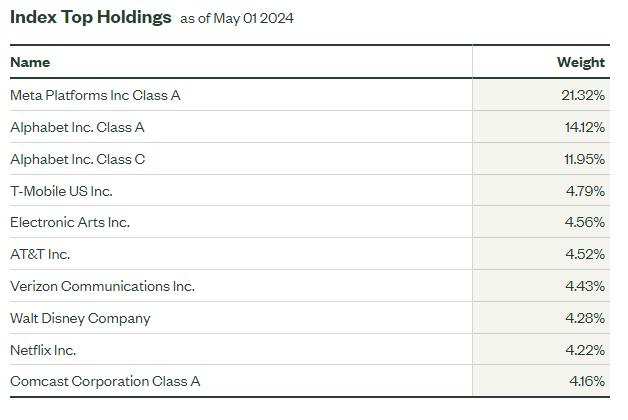

The composition for this sector is much more top-heavy than Client Discretionary

META is listed as the highest holding in XLC at 21%. However once we add up the weights for Alphabet A and B it comes out at 26%. So collectively the highest two shares in XLC are a whopping 47% of the sector.

Trying on the similar desk for XLC we discover Alphabet on the prime of the record over the past 5 weeks. Meta is within the decrease half at -9%. The sector (XLC) is available in at -2.8% which implies that META is UNDERperforming (-9% + 2.8% =) -6.2%.

However Alphabet Class A is OUTperforming (10.4% + 2.8% = ) 13.2% and Alphabet Class C is OUTperforming (10.6% + 2.8% = ) 13.4%. It is a approach stronger upward pull for the index than the drag attributable to META.

Altering the benchmark to the EW model of Communication Companies reveals this desk

Once more we see the equal weight benchmark (RSPC) dropping to close the center of the record, balancing out the return extra evenly.

All in all, this supplies the same pair buying and selling alternative. XLC:RSPC

This relative development is far more mature than the XLY:RSPD pair, however so long as the rhythm of upper highs and better lows continues, shopping for the dips on this relative line gives alternatives.

More often than not the cap-weighted and equal-weighted variations of a sector will transfer kind of in tandem. However after they do not they’re price investigating as they could provide attention-grabbing buying and selling alternatives.

#StayAlert and have a fantastic weekend, –Julius

Julius de Kempenaer

Senior Technical Analyst, StockCharts.com

Creator, Relative Rotation Graphs

Founder, RRG Analysis

Host of: Sector Highlight

Please discover my handles for social media channels underneath the Bio beneath.

Suggestions, feedback or questions are welcome at Juliusdk@stockcharts.com. I can’t promise to answer every message, however I’ll actually learn them and, the place fairly potential, use the suggestions and feedback or reply questions.

To debate RRG with me on S.C.A.N., tag me utilizing the deal with Julius_RRG.

RRG, Relative Rotation Graphs, JdK RS-Ratio, and JdK RS-Momentum are registered emblems of RRG Analysis.