Anyway you slice it, Q1 2024 was a incredible quarter for MoneyLion. They’d report income, report adjusted EBITDA and report GAAP internet earnings. Listed below are the pivotal takeaways from the earnings presentation that you need to be conscious of.

Strong Monetary Development

The corporate reported a record-breaking income of $121 million, marking a big milestone in its monetary journey. This top-line progress is complemented by a powerful adjusted EBITDA of $23 million and a GAAP internet earnings of $7 million, with diluted earnings per share (EPS) hitting $0.60. These figures not solely spotlight the corporate’s profitability but additionally its effectivity in capital administration and price management.

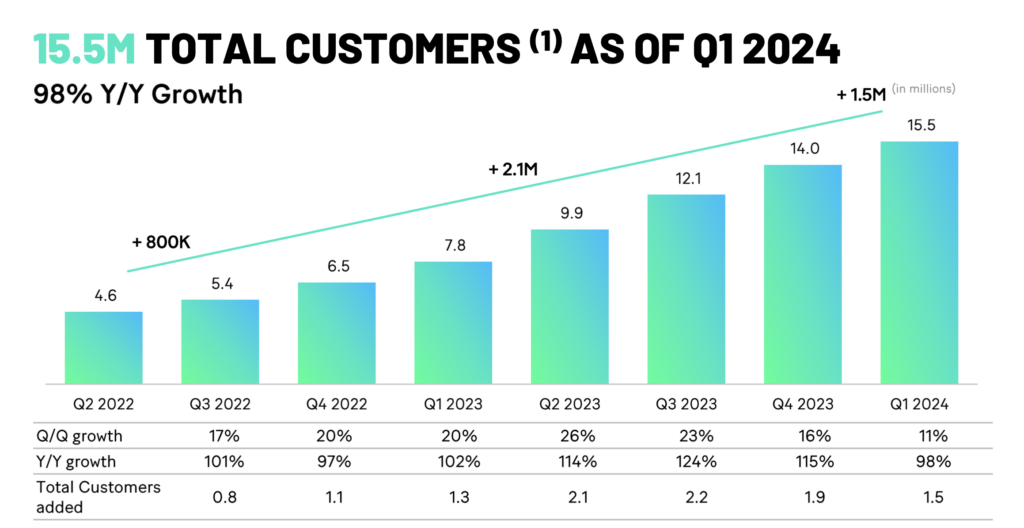

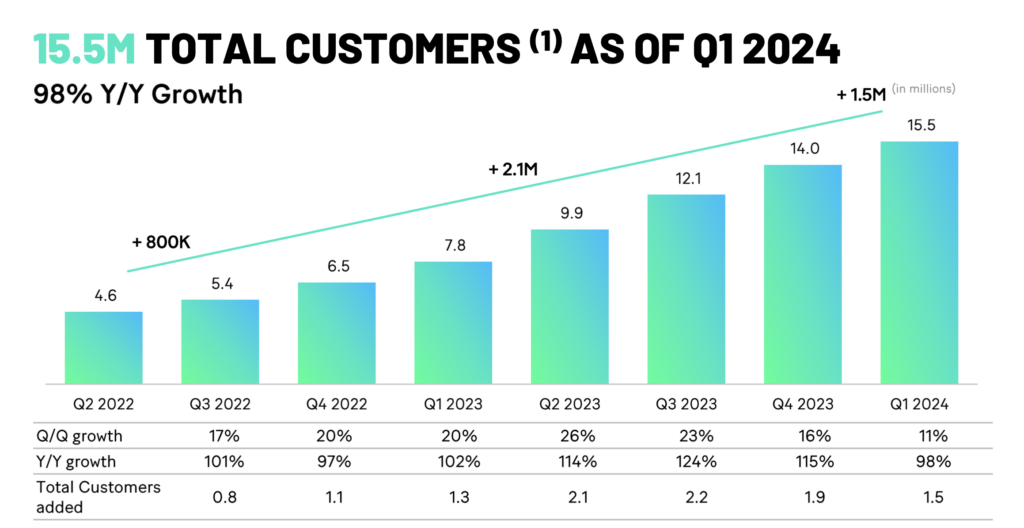

Increasing Buyer Base and Market Affect

A standout statistic from the earnings report is the expansion in buyer base, now standing at 15.5 million folks. This represents not simply an enlargement of the corporate’s direct client impression, but additionally a rise within the potential information and analytics that may drive personalised monetary options. The corporate’s ‘marketplace-first’ technique has propelled a exceptional year-over-year progress of 73%, showcasing its profitable alignment with client wants and trade calls for.

Progressive Platform and Partnership Synergy

The corporate continues to steer with probably the most full-featured Private Monetary Administration (PFM) instrument within the trade, a declare that’s substantiated by its sturdy progress metrics. Furthermore, externalizing its expertise to over 1,100 enterprise companions has been a game-changer, leading to roughly 80 million buyer inquiries within the first quarter alone. This strategy not solely amplifies the corporate’s attain but additionally enhances its scalability and integration capabilities inside the fintech ecosystem.

Lifecycle Technique and Recurring Income Streams

The presentation detailed a strategic concentrate on each client and enterprise cohort lifetime efficiency, which has been instrumental in driving vital recurring income. This ongoing income stream is important because it offers monetary stability and the flexibility to reinvest in innovation and buyer acquisition, making certain sustained progress.

Steering and Future Outlook

Trying ahead, the corporate is well-positioned for progress acceleration in 2024. This optimistic outlook is supported by its sturdy enterprise fundamentals, progressive product choices, and a scalable platform that meets various buyer wants. The steering supplied suggests a trajectory that would redefine trade requirements and benchmarks.

Key Strategic Initiatives

Listed below are key takeaways from the MoneyLion earnings presentation that underscore a number of strategic imperatives:

- Innovation as a Development Lever: Steady funding in expertise and platform capabilities is essential for sustaining aggressive benefit.

- Information-Pushed Methods: Leveraging buyer information to reinforce consumer expertise and product choices can result in larger retention and acquisition charges.

- Partnership and Ecosystem Improvement: Constructing and nurturing a accomplice ecosystem can prolong market attain and enrich service choices.

- Monetary Well being Monitoring: Strong monetary monitoring and adaptive methods are important for navigating the risky fintech setting.

MoneyLion has each a direct to client enterprise in addition to a thriving enterprise enterprise which makes them considerably distinctive within the fintech area. The market is beginning to acknowledge this potential as their inventory is up 263% over the previous yr.