Fast Take

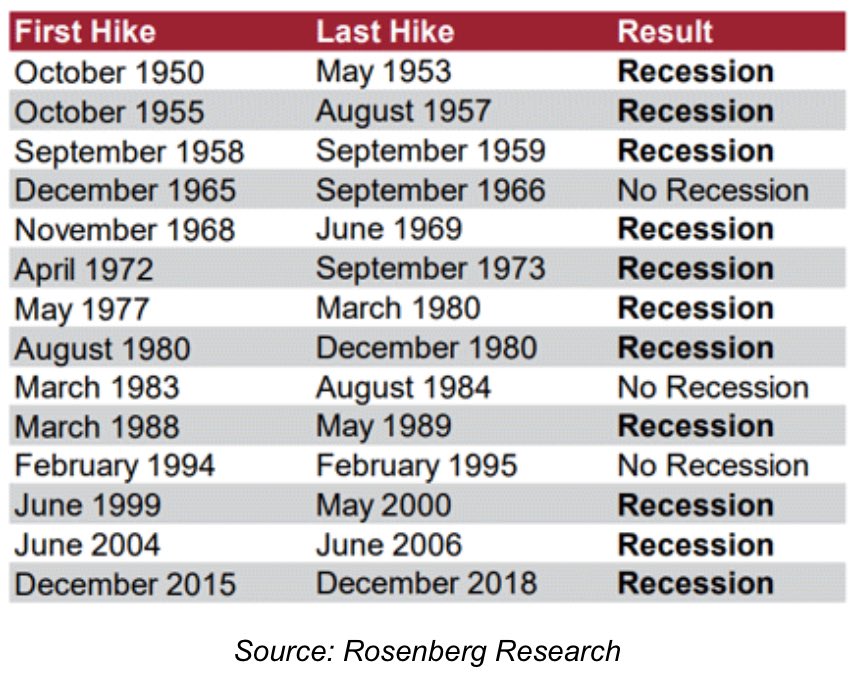

The Federal Reserve and different central banks worldwide are approaching the top of a rate-hiking cycle, elevating considerations a few potential recession. Historic knowledge from Rosenberg Analysis, shared by QE infinity, reveals a regarding development: out of the previous 14 rate-hiking cycles since 1950, the USA has skilled a recession 11 instances. Recessions have been efficiently averted in 1966, 1984, and 1995.

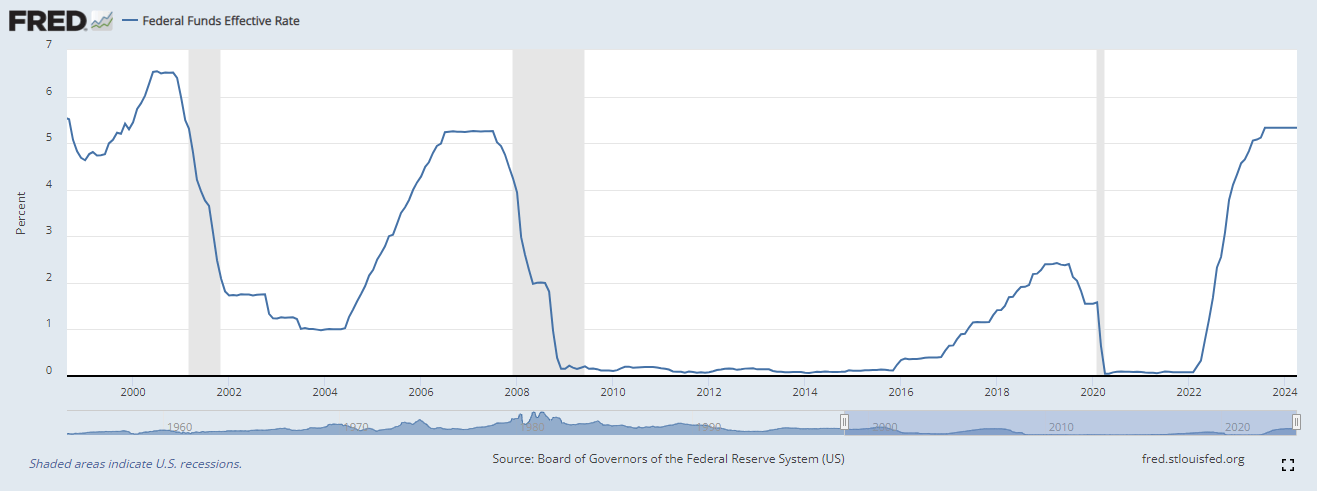

The present rate-hiking cycle has seen the Federal Reserve increase the federal funds charge to five.33% in August 2023, and it has maintained this charge since then, pausing for 9 consecutive conferences. Evaluating this to the 2008 recession, the Fed final hiked charges in June 2006 to five.25% and held for 12 months earlier than the recession hit.

Because the Fed and different central banks proceed to navigate the fragile steadiness between controlling inflation, unemployment, and sustaining financial development, the CME FedWatch device is at the moment pricing in two charge cuts in 2024, doubtlessly reducing the federal funds charge to the vary of 4.75% – 5.00% by the top of 2024.

Whereas charge hikes are a regular device central banks use to fight inflation, the info means that such measures usually come at the price of financial contraction.