Observe to the reader: That is the 20th in a sequence of articles I am publishing right here taken from my ebook, “Investing with the Pattern.” Hopefully, you will discover this content material helpful. Market myths are usually perpetuated by repetition, deceptive symbolic connections, and the whole ignorance of details. The world of finance is filled with such tendencies, and right here, you may see some examples. Please remember the fact that not all of those examples are completely deceptive — they’re typically legitimate — however have too many holes in them to be worthwhile as funding ideas. And never all are instantly associated to investing and finance. Take pleasure in! – Greg

It isn’t unusual for traders to consider that the extra info they’ve, the higher their probability at selecting good investments. Monetary web sites provide alerts on shares, the financial system, and absolutely anything you suppose you would possibly want. The unhappy half is that the investor thinks each iota of data is essential and tries to attract a conclusion from it. The conclusion could transform appropriate, however it’s often not.

The difficulty is that investor is making an attempt to tie every merchandise of reports to the motion of a inventory, which usually by no means appears to work; just some minutes watching the monetary media ought to let you know that it does not work. Human feelings make the investor be ok with having information that helps their beliefs, however not often do these feelings contribute to funding success. I discover it wonderful what number of instances I’m going into an workplace and discover the monetary tv taking part in, typically muted, however most likely solely after they see me coming. An excessive amount of info can result in a complete disarray of funding concepts and choices. Maintain it easy, flip off the skin noise, and use a technical method to find out which points to purchase and promote. You may be more healthy.

Rating Measures

Rating measures are the technical indicators used to find out which points to purchase based mostly on their trendiness. They are often assigned as obligatory or tie-breaker rating measures. The obligatory ones are the rating measures which have to fulfill sure necessities earlier than a problem may be purchased. The tie-breaker rating measures are there to help in situation choice, however should not obligatory.

Rating measures can be utilized with particular person shares, Alternate Traded Funds (ETFs), mutual funds, and bonds; nevertheless, there should be a course of for choosing them, if for no different cause than to cut back the quantity right down to a usable quantity. For instance, in an exchange-traded fund (ETF)-only technique, think about that there are almost 1,400 ETFs, and a totally invested portfolio would possibly solely have positions in 20 ETFs. Rating measures are indicators, primarily of worth or worth relationships that help within the dedication of whether or not a problem is in an uptrend.

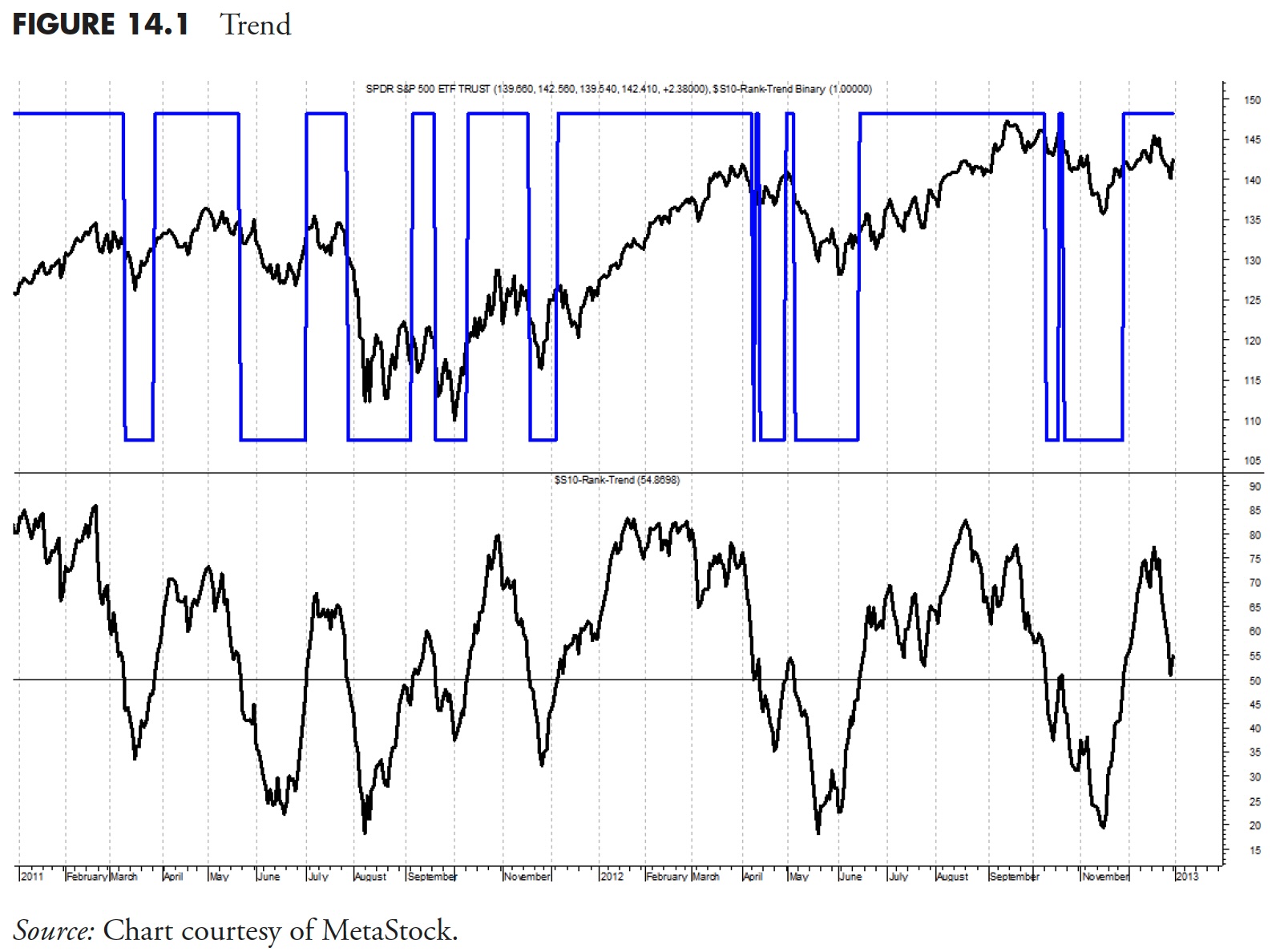

All through this part, the charts present the exchange-traded fund SPY within the high plot at any time when doable, the rating measure within the backside plot, and the rating measure’s binary overlaid on the SPY within the high plot. Some exceptions to utilizing SPY are when quantity is required for the rating measure, wherein case one other broad-based ETF will likely be used. A dialogue of the parameters that can be utilized for every rating measure can also be included. I don’t go into excruciating evaluation on every chart, because the idea is de facto easy. The binary is the sign line, and it solely represents the rating measure’s indicators precisely. Not all rating measures have a binary sign, as they’re used for affirmation of a pattern path.

The dialogue for every rating measure is diverse as some are pretty easy to know and will not contain an in depth dialogue. I actually am not the sort that discusses the wiggles and waggles of every indicator.

Pattern

Pattern is the title given to a by-product of an indicator initially created by Jim Ritter of Stratagem Software program. He wrote about it within the December 1992 (V. 12:12, 534–534) situation of Shares & Commodities journal, within the article “Create a Hybrid Indicator.” Pattern is an easy idea, but is a strong mixture of two overbought oversold indicators: Stochastics (%Okay) and Relative Energy Index (RSI). The indicator makes use of 50% of every one together, and whereas each are range-bound between zero and 100, the mixture can also be range-bound between zero and 100. Stochastics, usually a lot faster to react to cost modifications, is dampened by the often slower-to-react RSI. Together, you will have an indicator that exhibits sturdy pattern measurements at any time when it’s above a predetermined threshold.

Parameters

The Stochastic must be for much longer than when utilized by itself, whereas RSI can be utilized near its authentic worth. The Stochastic vary of 20 to 30 ought to work nicely, with the ultimate worth decided by the size pattern you wish to observe. The RSI vary can fluctuate, however you do not wish to make it too lengthy, as it’s already a slower-reacting measure. Lastly, the edge used for Pattern must be within the 50 to 60 vary, once more depending on how quickly you need the sign, remembering that early indicators may also give extra whipsaws.

The examples of Pattern in Determine 14.1 have the edge drawn at 50, which is an efficient all-around worth. The idea is just that at any time when Pattern is above 50, the ETF is in an uptrend, and at any time when Pattern is beneath 50, it’s not in an uptrend. The binary is overlaid on the worth plot (high) so to see the indicators higher. Discover that when costs are in an uptrend, the binary is often on the high, and when costs should not, it’s on the backside. Additionally be aware that, in the midst of the plot, there have been a lot of fast indicators in succession; that is why one shouldn’t depend on a single indicator for evaluation.

Pattern Fee of Change (ROC)

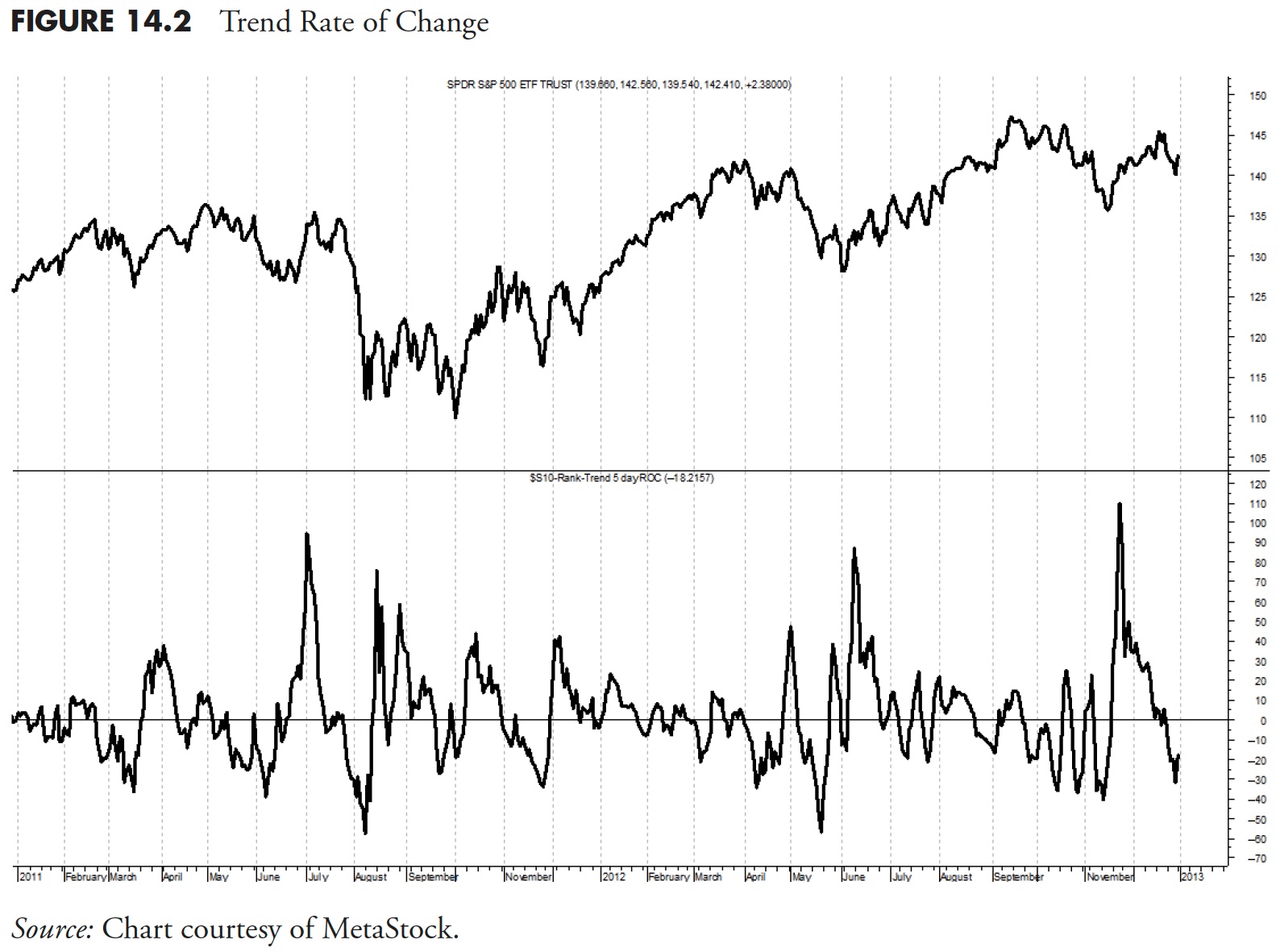

That is merely the five-day price of change of Pattern. Why would you utilize that? When viewing lots of knowledge on a spreadsheet that doesn’t include any charts, and also you see the worth for Pattern is 65, you additionally have to know whether it is rising by means of 65 or declining by means of it. A snapshot of the information may be harmful should you do not additionally take a look at the path the indicator is transferring.

Determine 14.2 is a chart of the five-day price of change of Pattern. You’ll be able to see that whereas Pattern continues to be barely constructive (above the 50 line), it’s declining (see Determine 14.1). Then, if you examine it with the Pattern ROC in Determine 14.2, it’s displaying important weak point. In fact, displaying the five-day price of change of an indicator with out displaying the indicator itself is silly; it was performed right here in order that you could possibly see the measure being mentioned.

Parameters

This may be nearly any worth you need based mostly on what you might be utilizing it for. I used it right here to see the short-term pattern of an indicator, so 5 days is nearly proper. In the event you have been utilizing price of change as an indicator for measuring the energy of an ETF or an index, then an extended interval would most likely be extra acceptable. I exploit 21 days after I use ROC by itself.

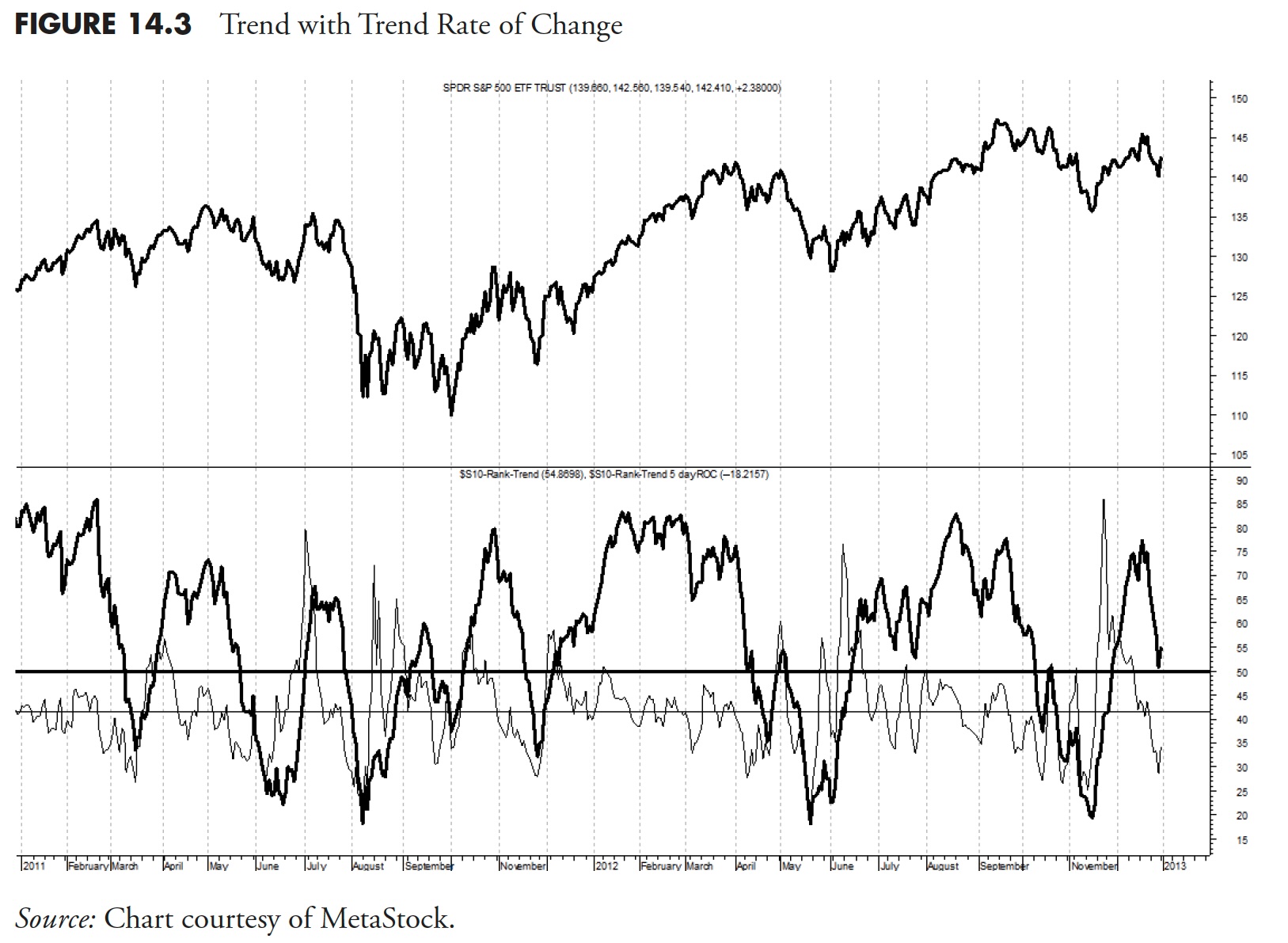

Determine 14.3 exhibits the Pattern with the five-day price of change of Pattern overlaid (lighter). That is the way in which that every one the obligatory rating measures and among the tiebreaker measures are proven. You’ll be able to see from this that the Pattern is above 50, however the five-day price of change is deteriorating and is nicely beneath zero (damaging).

Pattern Diffusion

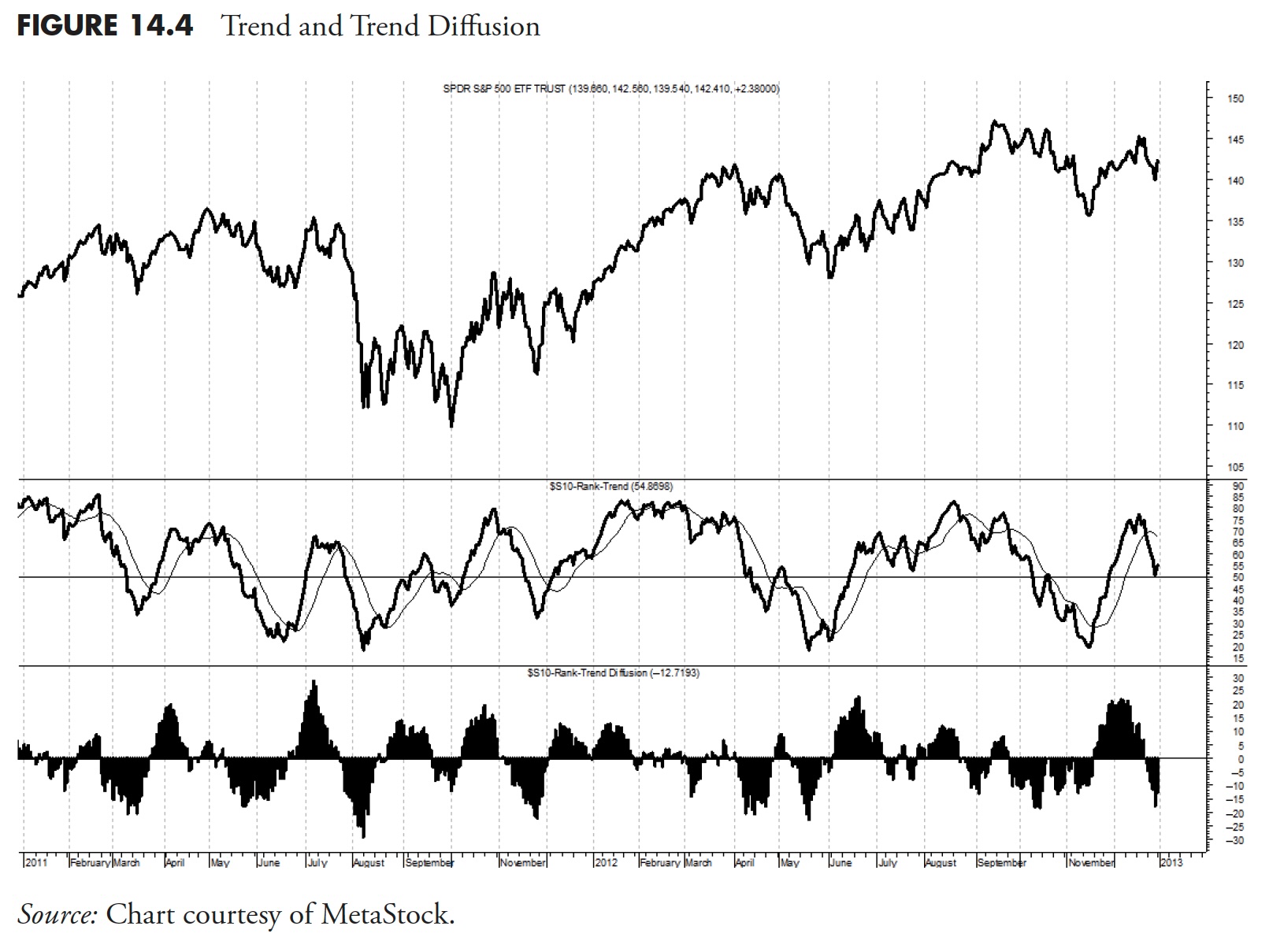

That is also referred to as Detrend, which is a method the place you subtract the worth of an indicator’s transferring common from the worth of the indicator. It’s a easy idea, really, and never not like the distinction between two transferring averages with one common being equal to 1, or MACD for that matter. Technical evaluation is ripe with easy diversions from ideas and sometimes with somebody’s title hooked up to the entrance if it— do not get me began on that one.

Determine 14.4 is similar Pattern as beforehand mentioned, besides that it’s the 15-day Detrend of Pattern, or Pattern Diffusion. The center plot is the Pattern, with the lighter line being a 15-day easy transferring common of the Pattern. The underside plot is the Pattern Diffusion, which is just the distinction between the Pattern and its personal 15-day transferring common. You’ll be able to see this when the Pattern strikes above its transferring common, the Pattern Diffusion strikes above the zero line. Equally, at any time when the Pattern strikes beneath its 15-day transferring common within the center plot, the Pattern Diffusion strikes beneath the zero line within the backside plot. The data from the 15-day Pattern Diffusion is totally no completely different that the data within the center plot displaying the Pattern and its 15-day transferring common, simply simpler to visualise.

Parameters

The instance in Determine 14.4 makes use of 15 days, which is three weeks. Parameters have to be chosen based mostly on the timeframe in your evaluation. A variety from 10 to 30 might be enough for Pattern Diffusion.

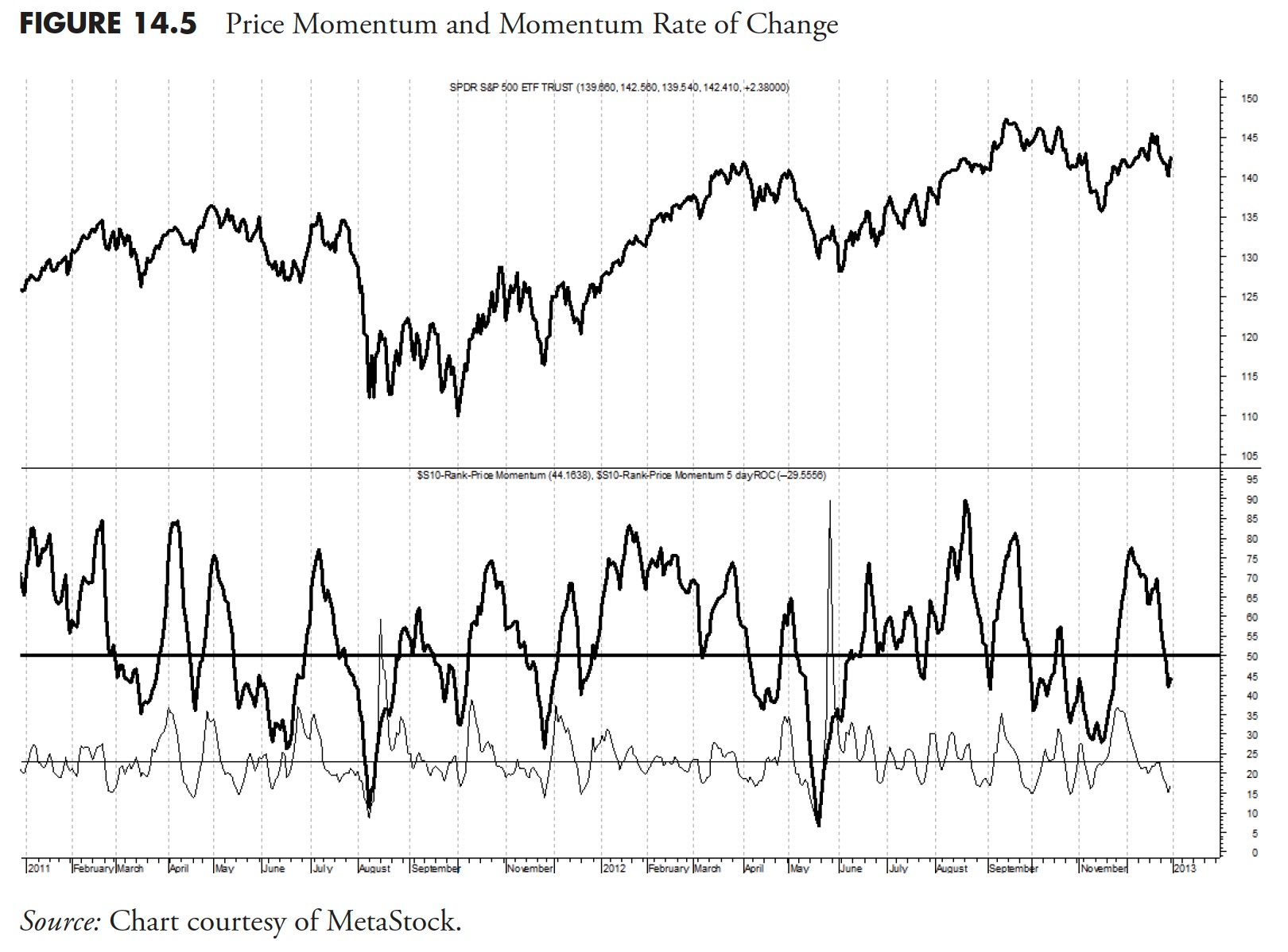

Worth Momentum

This indicator appears again on the worth right this moment in comparison with X days in the past. It’s created by calculating the distinction between the sum of all current good points and the sum of all current losses after which dividing the outcomes by the sum of all worth motion over the interval being analyzed. This oscillator is just like different momentum indicators, comparable to RSI and Stochastics, as a result of it’s rangebound, on this case from -100 to +100.

Parameters

Worth Momentum may be very near being the identical as price of change; usually the one distinction between the 2 is the scaling of the information. Momentum oscillates above and beneath zero and yields absolute values, whereas the Fee of Change strikes between zero and 100 and yields relative values. The form of the road, nevertheless, is analogous. With momentum, the edge is proven at 50, however could possibly be greater if requiring extra stringent rating necessities.

Determine 14.5 exhibits the Worth Momentum rating measure (darkish line) and its five-day price of change (lighter line). You’ll be able to see that the Worth Momentum is weak and the ROC is damaging and declining.

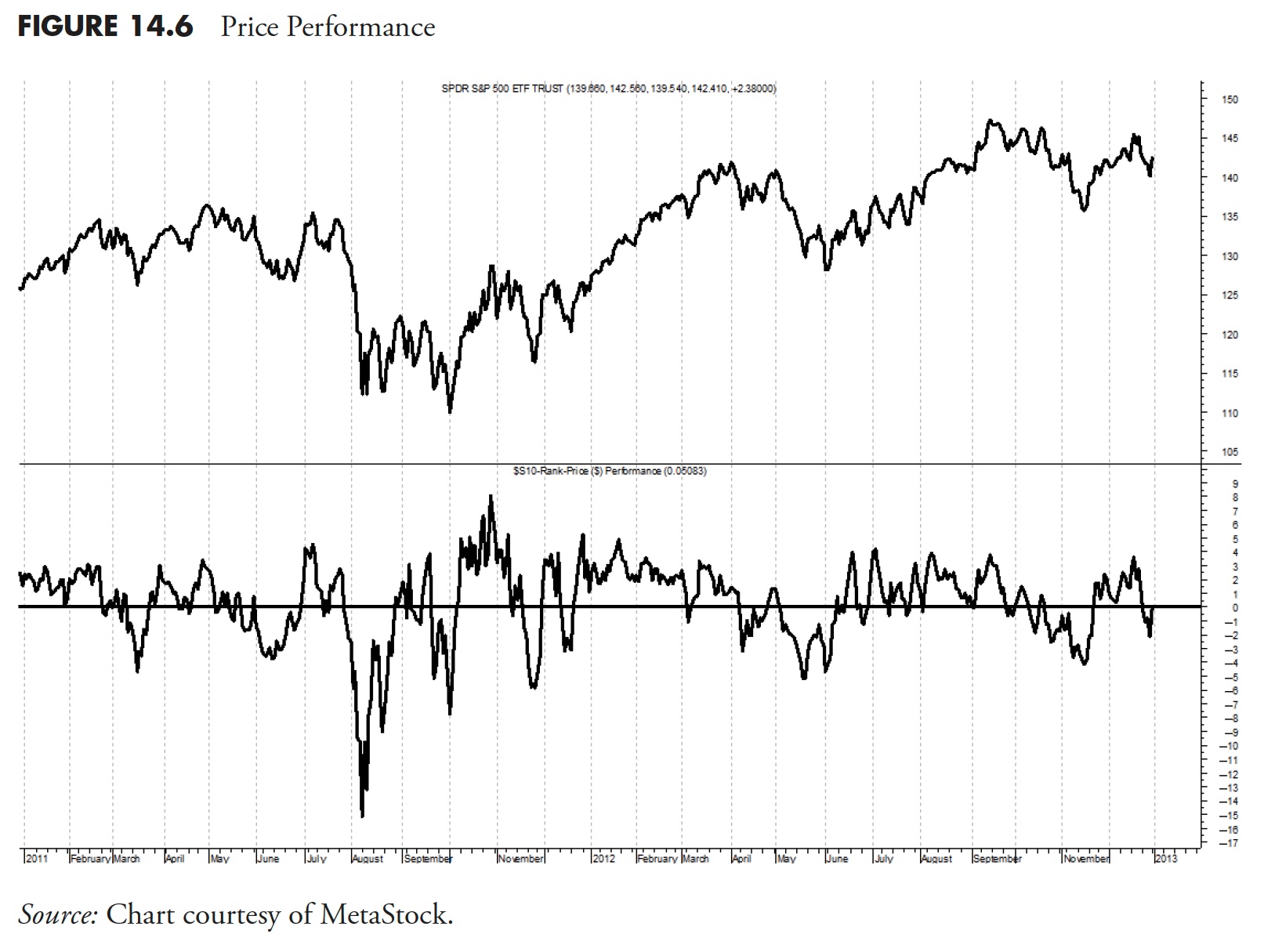

Worth Efficiency

This indicator exhibits the current efficiency based mostly on its precise price of change for a number of durations, added collectively, after which divided by the variety of charges of change used. On this instance, I used three charges of change of 5, 10, and 21 days, which equates to 1 week, 2 weeks, and 1 month. Merely calculate every price of change, add them collectively, after which divide by three. This provides an equal weighting to charges of change over varied days.

Parameters

Like many indicators, the parameters used are completely depending on what you are attempting to perform. Right here, I’m making an attempt solely to establish ETFs which are in an uptrend.

Determine 14.6 exhibits the Worth Efficiency measure utilizing the three charges of change talked about above. There isn’t a want to indicate the everyday five-day price of change of this indicator, since it’s in itself a price of change indicator.

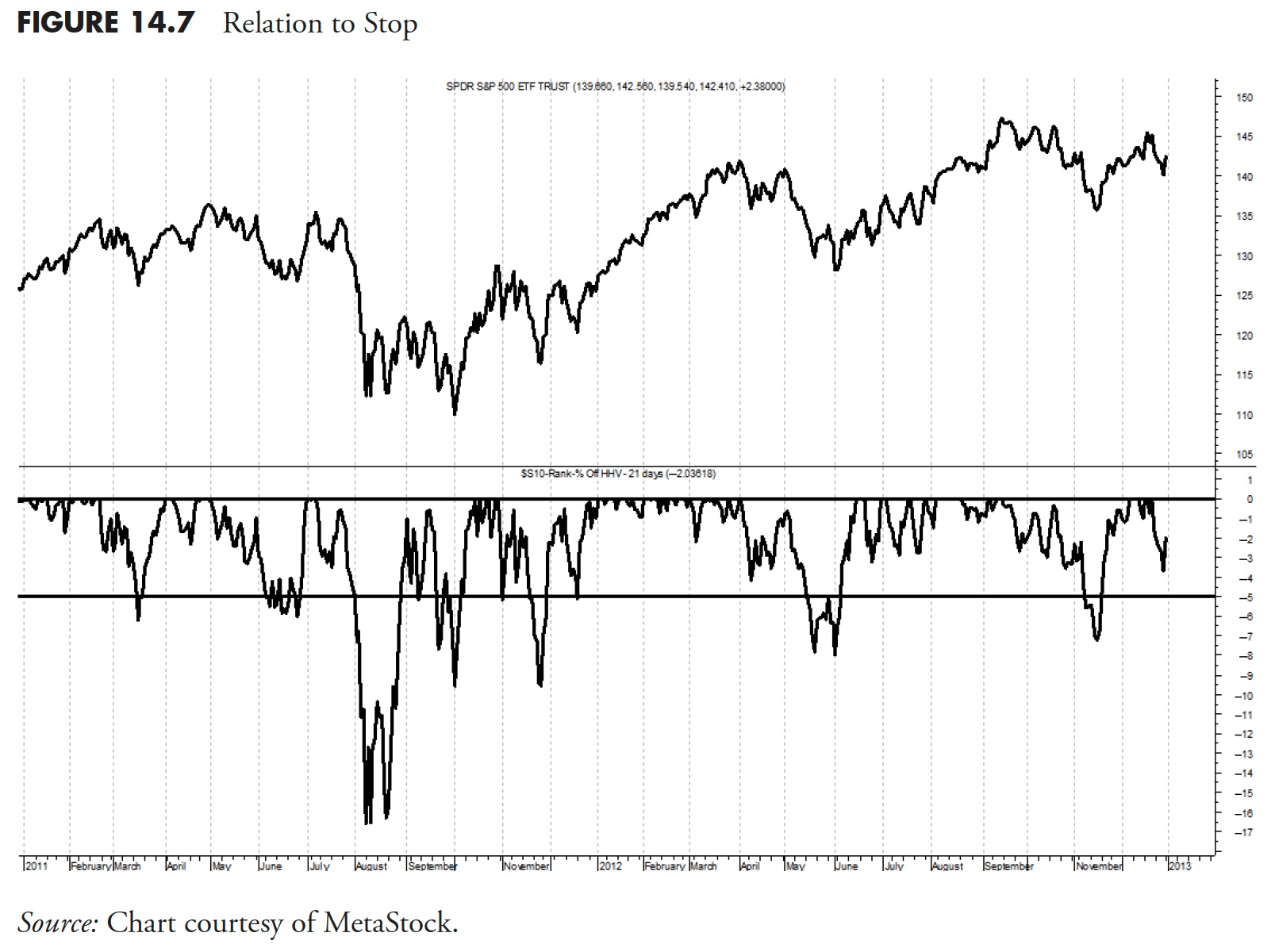

Relationship to Cease

That is the proportion that worth is beneath its earlier 21-day highest shut. That is a particularly essential rating measure, and this is why.

In case you are utilizing a system that all the time makes use of cease loss placement (hopefully you might be), then you definately actually wouldn’t wish to purchase an ETF that was already near its cease. That is the case when utilizing trailing stops; if utilizing portfolio stops, or stops based mostly on the acquisition worth, this measure doesn’t come into play. I like to make use of stops in periods of low danger of 5% beneath the place the closing worth had reached its highest worth over the previous 21 days. If you consider this, which means that, as costs decline from a brand new excessive, then the cease baseline is ready at that time and the proportion decline is measured from there.

Parameters

Most often, this can be a variable parameter decided by the danger that you’ve got assessed available in the market or within the holding. I desire very tight stops within the early phases of an uptrend, as a result of I do know there are going to be instances when it doesn’t work, and when these instances occur, I would like out. The setting of cease loss ranges is fully too subjective, however I’d say that as danger lessens, the stops ought to turn into looser, permitting for extra each day volatility within the worth motion.

Determine 14.7 exhibits the 5% trailing cease utilizing the very best closing worth over the previous 21 days. The 2 strains are drawn at zero and -5%. When this measure is at zero, it implies that the worth is at its highest stage prior to now 21 days. The road then constantly exhibits the place the worth is relative to the transferring 21-day highest closing worth. When it drops beneath the -5% line, then the cease has been hit and the holding must be bought.

Please discover that I didn’t beat across the bush on that final sentence. When a cease is hit, promote the holding. Like Forrest Gump, that’s all I ‘m going to say about that.

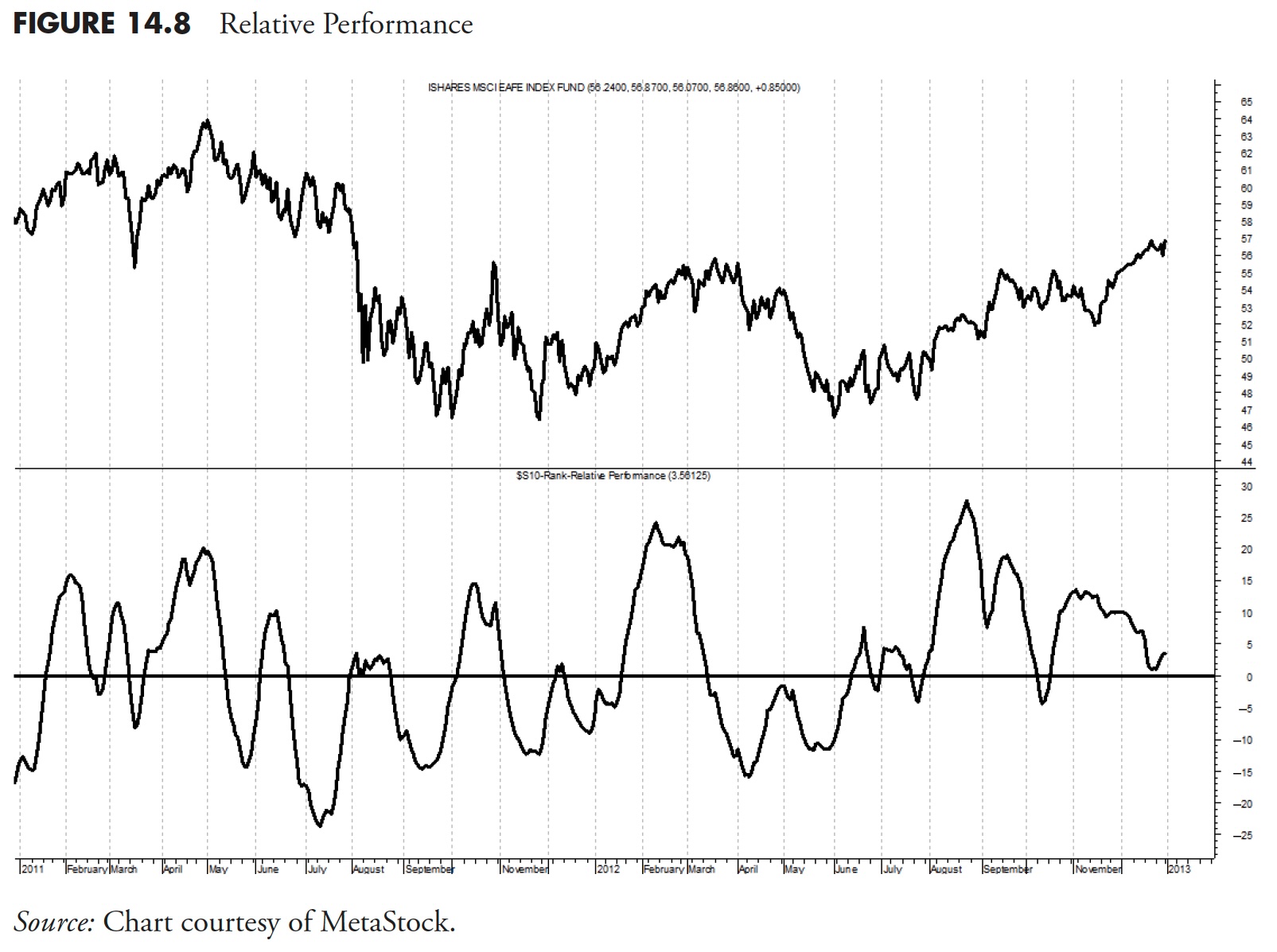

Relative Efficiency

This indicator exhibits the current efficiency of an ETF relative to that of the S&P 500. Typically, there’s a tendency to indicate the efficiency relative to the whole return model of the S&P 500. That is solely advisable in case you are really measuring and utilizing the whole return model of an ETF. As well as, most measurements are of a timeframe the place the whole return doesn’t come into play. Nonetheless, purists might want one over the opposite, and the outcomes will likely be passable if used constantly.

Normally the information analyzed is price-based; due to this fact, the relative efficiency must be utilizing the worth solely S&P 500 Index. Additionally, when evaluating an ETF to an index, one should be cautious when evaluating, say the SPY with the S&P 500 Index, two points that ought to monitor comparatively shut to one another. The arithmetic can blow up on you, so simply be cognizant of this example. Therefore, the instance within the chart beneath has switched from utilizing SPY to utilizing the EFA exchange-traded fund.

Lastly, you can not merely divide the ETF by the index and plot it, or you should have lots of noise with no clear indication as to the relative efficiency. I prefer to normalize the ratio of the 2 over a time interval that’s acceptable for my work; on this case, over 65 days. This will additional be expanded, just like the Worth Efficiency measure coated beforehand, and likewise use one other normalization interval, say 21 days, then common them. Moreover, you possibly can then easy the outcomes to assist take away some noise. Bear in mind, you might be solely making an attempt to evaluate relative efficiency right here.

Parameters

This, like many rating measures, relies completely on private choice, and likewise on the time-frame you might be utilizing for evaluation. On this instance, I normalized the ratio with 65 and 21 days, then smoothed the end result with the distinction between their 15- and 50-day exponential common.

Determine 14.8 exhibits EFA relative to the S&P 500 Index. At any time when it’s above the horizontal zero line, then EFA is outperforming the S&P 500. This may be thought-about an alpha-generating rating measure in case your benchmark is the S&P 500.

Energy Rating

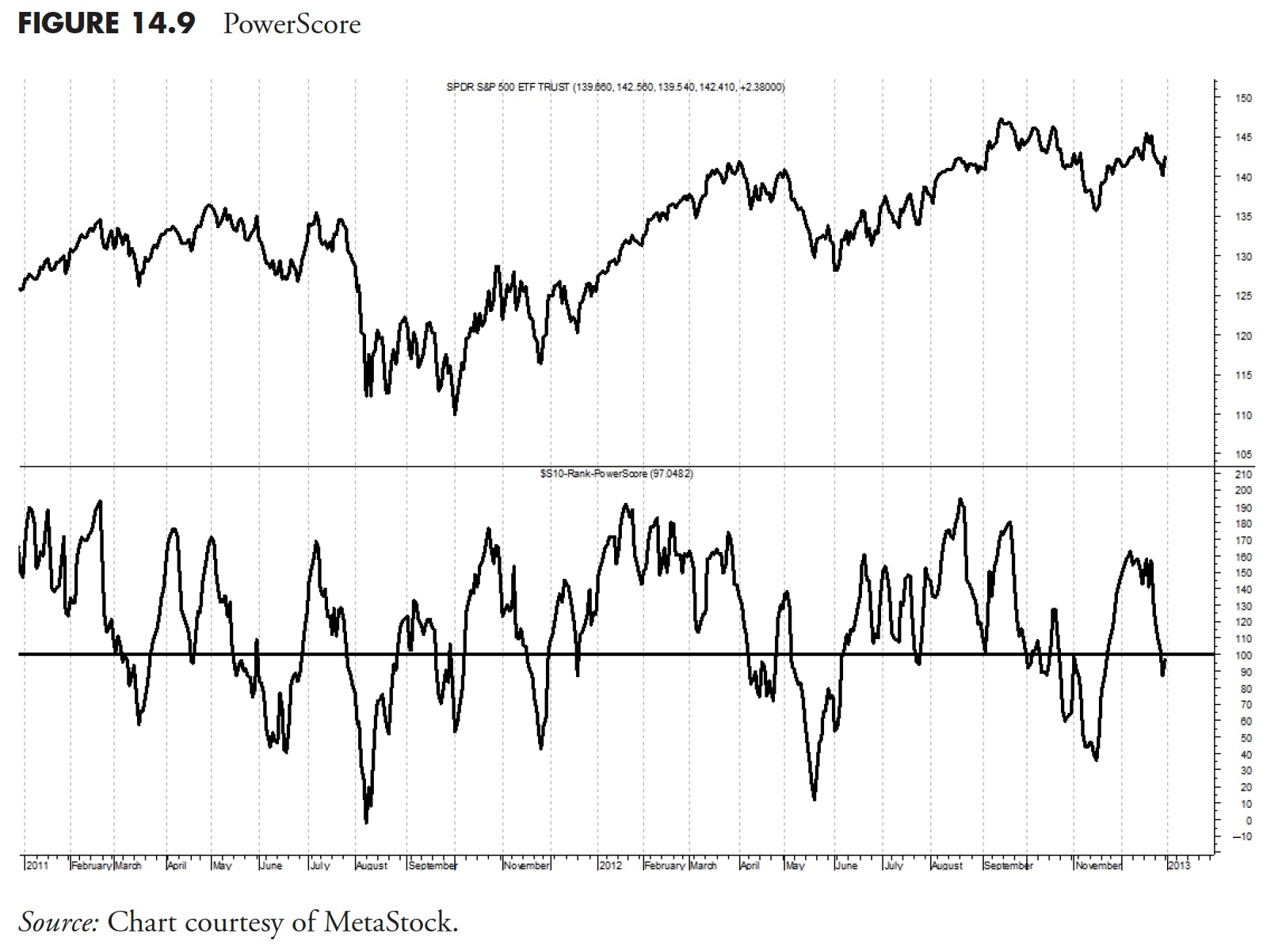

It is a mixture indicator that takes 4 indicators under consideration to get a composite rating. These indicators are Pattern, Worth Momentum, Worth Efficiency, and Relationship to Cease. Moreover, the PowerScore additionally components within the five-day charges of change of the Worth Momentum and Pattern measures.

Parameters

There should not actually any parameters to debate with PowerScore, as it’s created through the use of 4 of the obligatory rating measures. The idea right here may be as broad or as slim as wanted. Utilizing solely the obligatory rating measures appears cheap; nevertheless, the PowerScore is limitless in what elements can be utilized.

Determine 14.9 exhibits the PowerScore with a horizontal line on the worth of 100. Based mostly on the calculations of the elements for this indicator, at any time when PowerScore is above 100, then it’s saying that the elements are collectively saying the ETF is in an uptrend. This could possibly be thought-about a composite measure, however, not like those referred to within the weight of the proof elements, this one makes use of all elements.

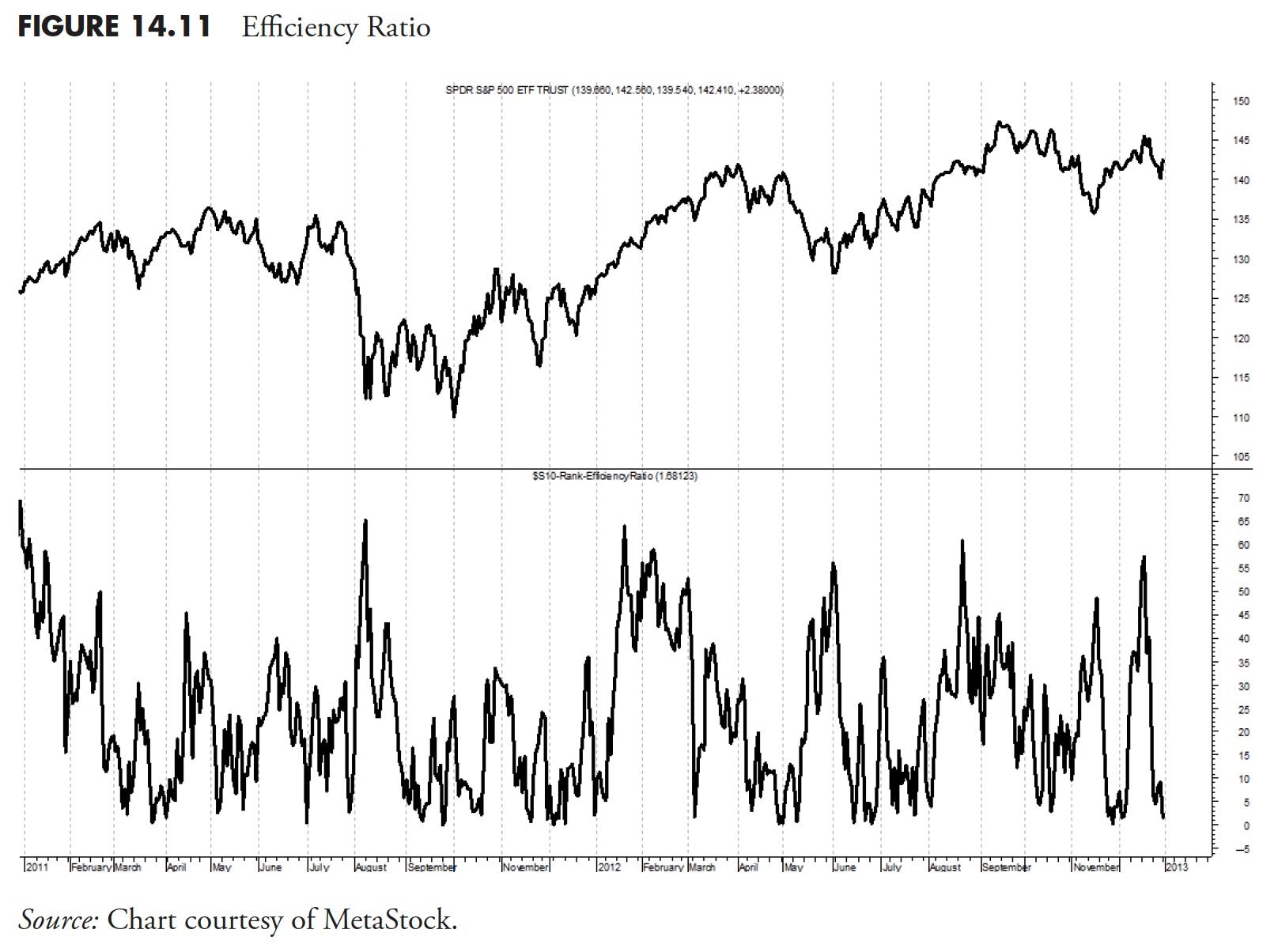

Efficiency Ratio

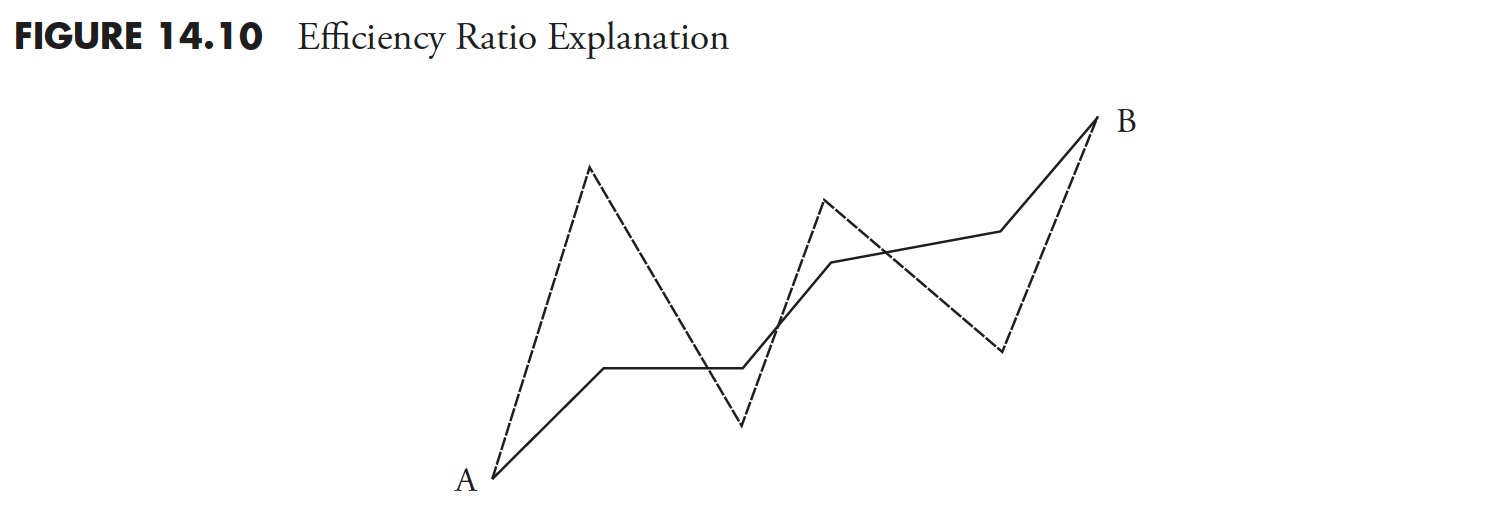

This ratio exhibits how a lot worth motion prior to now 21 days was basically noise. It’s a measure of the smoothness of the 21-day price of change, created years in the past by Perry Kaufman. It is a wonderful rating measure, however you might want to know that it’s an absolute measure of how an ETF will get from level A to level B; on this case, from 21 days in the past till right this moment.

Determine 14.10 is an instance of how to consider this. In the event you have been keen on two funds, fund 1 (stable line) and fund B (thicker dashed line), measuring their worth actions of the identical time period, then which of the 2 would you like? The one which easily rose from level A to level B, or the one which had erratic actions up and down however ended up on the similar place? I believe everybody agrees that the smoother journey, or the stable line, is preferable.

Parameters

I exploit 15 or 21 days, however as all the time, that is extra dependent in your buying and selling model and timeframe of reference. The worth ought to carefully mirror what the minimal size pattern you are attempting to establish, unbiased of path.

Determine 14.11 exhibits the 21-day effectivity ratio for SPY. You’ll be able to see that at any time when the ETF is trending, the Effectivity Ratio rises, and when the ETF is range-bound and transferring sideways, the Effectivity Ratio stays low. In different phrases, a excessive effectivity ratio means the journey is extra comfy. It’s transferring effectively.

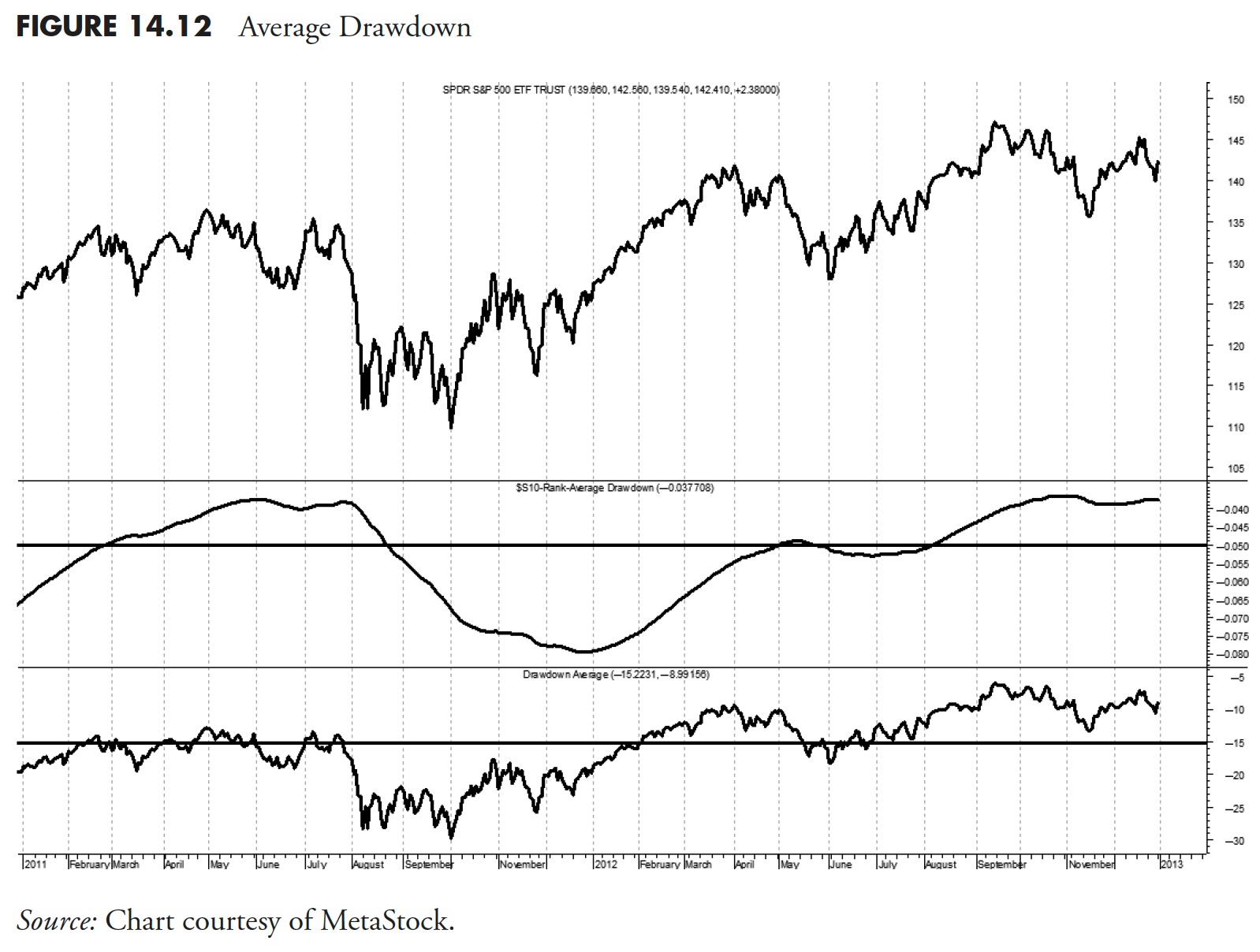

Common Drawdown

In the event you learn the part on this ebook on Drawdown Evaluation (Chapter 11), then you already know precisely what this rating measure accomplishes. The idea of common Drawdown for evaluation and utilizing it for a rating measure are significantly completely different. To make the most of common drawdown as a rating measure, you might want to use a transferring common drawdown, comparable to over the previous yr. It’s because a problem that has been in a state of drawdown for a lot of years is not going to provide the rating knowledge that’s wanted for a body of reference over the previous few months. A transferring common of drawdown will assist reset the drawdown as time strikes ahead.

Parameters

I prefer to see the typical drawdown over the previous yr, which is, on common 252 market days. That is sufficient time for a measurement, however brief sufficient to get a really feel for the way lengthy it stays in a state of drawdown.

Determine 14.12 exhibits the typical drawdown over the previous 252 days. The horizontal line is drawn at -5% as a reference. The decrease plot is the cumulative drawdown, with the horizontal line being the long-term common.

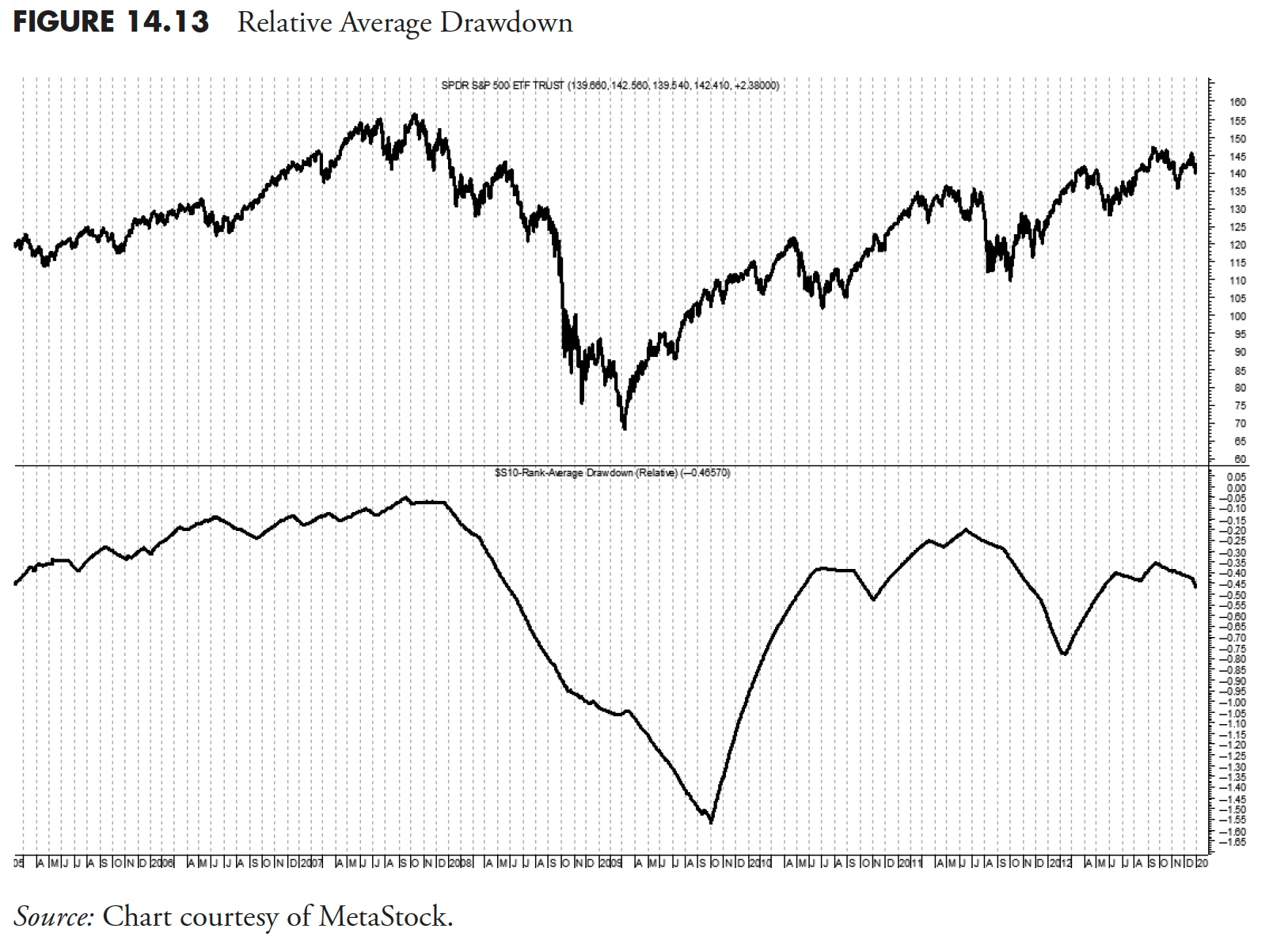

Relative Common Drawdown

Determine 14.13 exhibits the distinction between the typical drawdown of the difficulty in comparison with that of the S&P 500 Index. That is proven right here solely for example of one other sort of rating measure, and positively would by no means qualify as a compulsory rating measure.

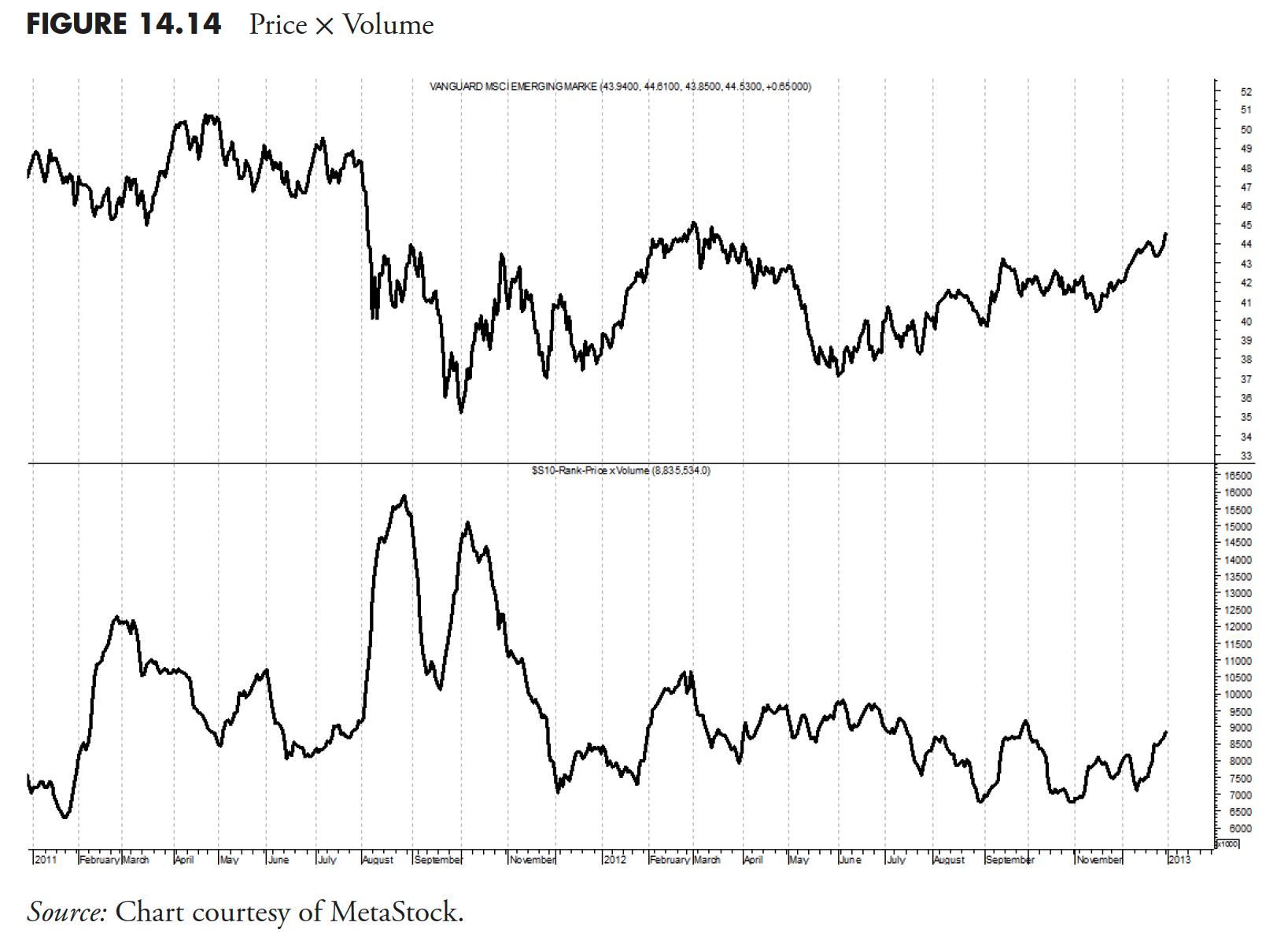

Worth x Quantity

Determine 14.14 exhibits the 21-day easy common of the amount instances the shut worth. The aim right here is to indicate if the difficulty has sufficient liquidity to be traded. The rating measures ought to all the time give a fast view on quite a lot of indicators, and this one would possibly present you instantly if there may be sufficient buying and selling quantity to provide the liquidity you would wish to commerce it. In fact, the best resolution is to have a superb relationship with the buying and selling desk that you’ll be utilizing, as they can provide you recent info on what quantity you possibly can commerce.

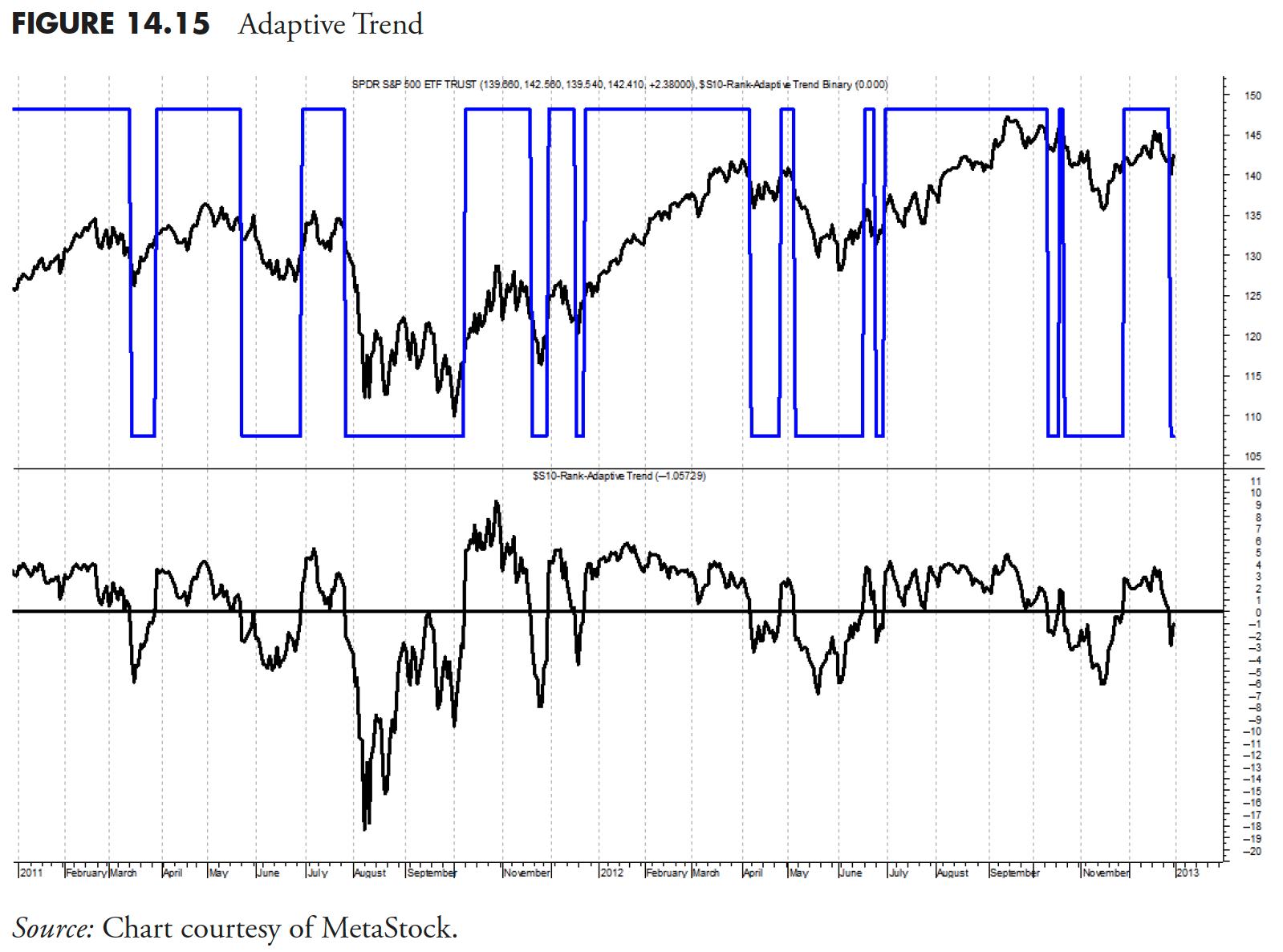

Adaptive Pattern

Adaptive Pattern is an intermediate pattern measure that modifications based mostly on the volatility of the worth actions. The Adaptive Pattern measure incorporates the newest 21 days of market knowledge to compute volatility based mostly on a real vary methodology. This course of all the time considers yesterday’s shut worth within the present day’s excessive–low vary to make sure we’re utilizing days that hole both up or right down to their fullest profit. When the worth is buying and selling above the Adaptive Pattern, a constructive sign is generated, and when beneath, a damaging sign is in place.

The chart in Determine 14.15 exhibits the Adaptive Pattern as an oscillator above and beneath zero, in order that when it’s above zero, it means the worth is above the Adaptive Pattern, and when beneath zero, worth is beneath the Adaptive Pattern. The highest plot exhibits the Adaptive Pattern binary. In the event you desire, the horizontal line at zero is the adaptive pattern, just like the Pattern Diffusion mentioned earlier.

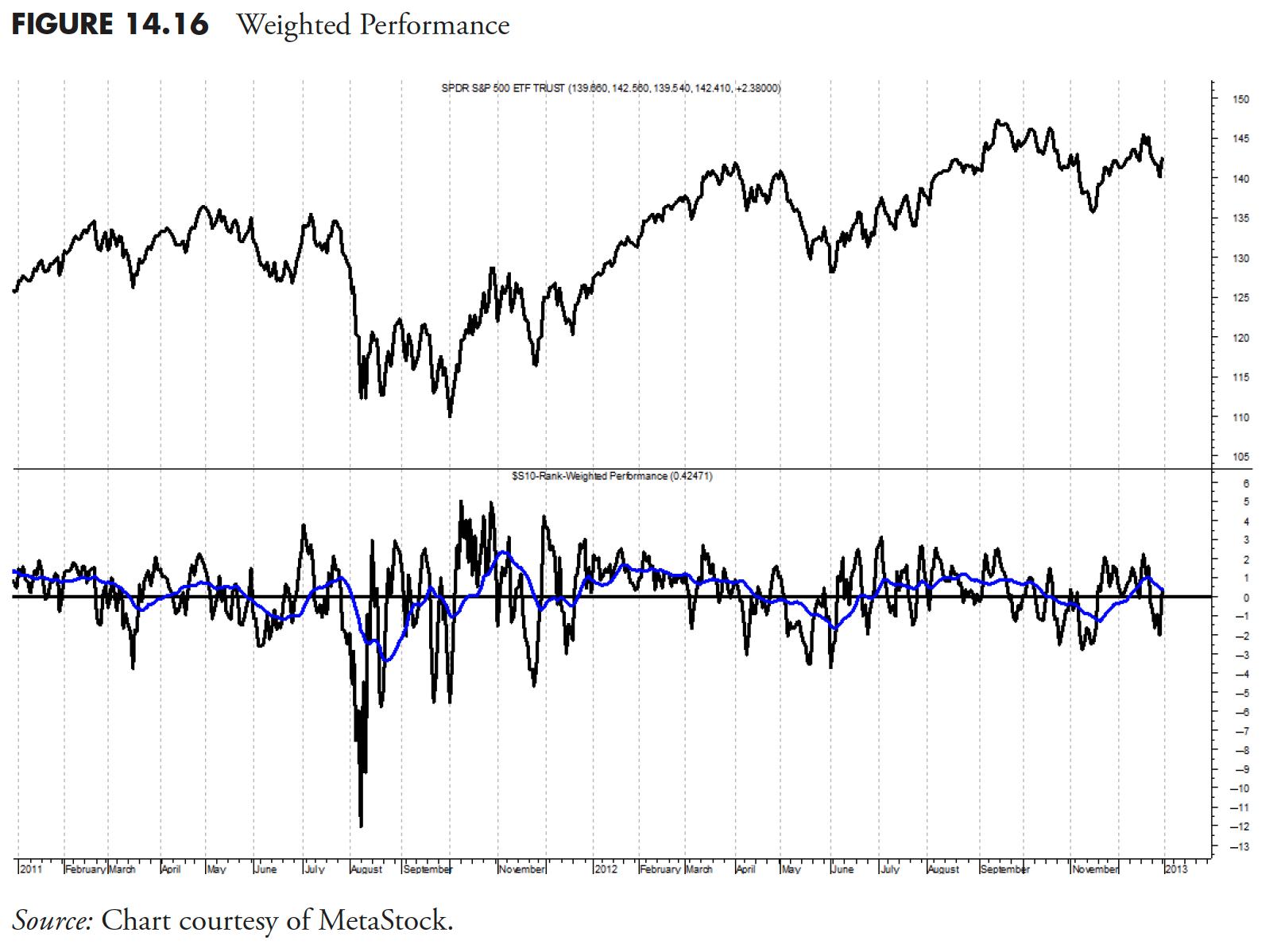

Weighted Efficiency

Determine 14.16 is a weighted common of the 1-, 3-, 5-, 10-, and 21-day charges of change. One can argue that it’s tough to resolve which precise interval to measure for efficiency, and I’d not disagree. The tactic takes a lot of durations into consideration and averages them for a single end result. One might carry this idea additional and weight every of the measurements and have a double-weighted efficiency measure.

You must, nevertheless, attempt to preserve issues easy, as complexity has a larger tendency to fail.

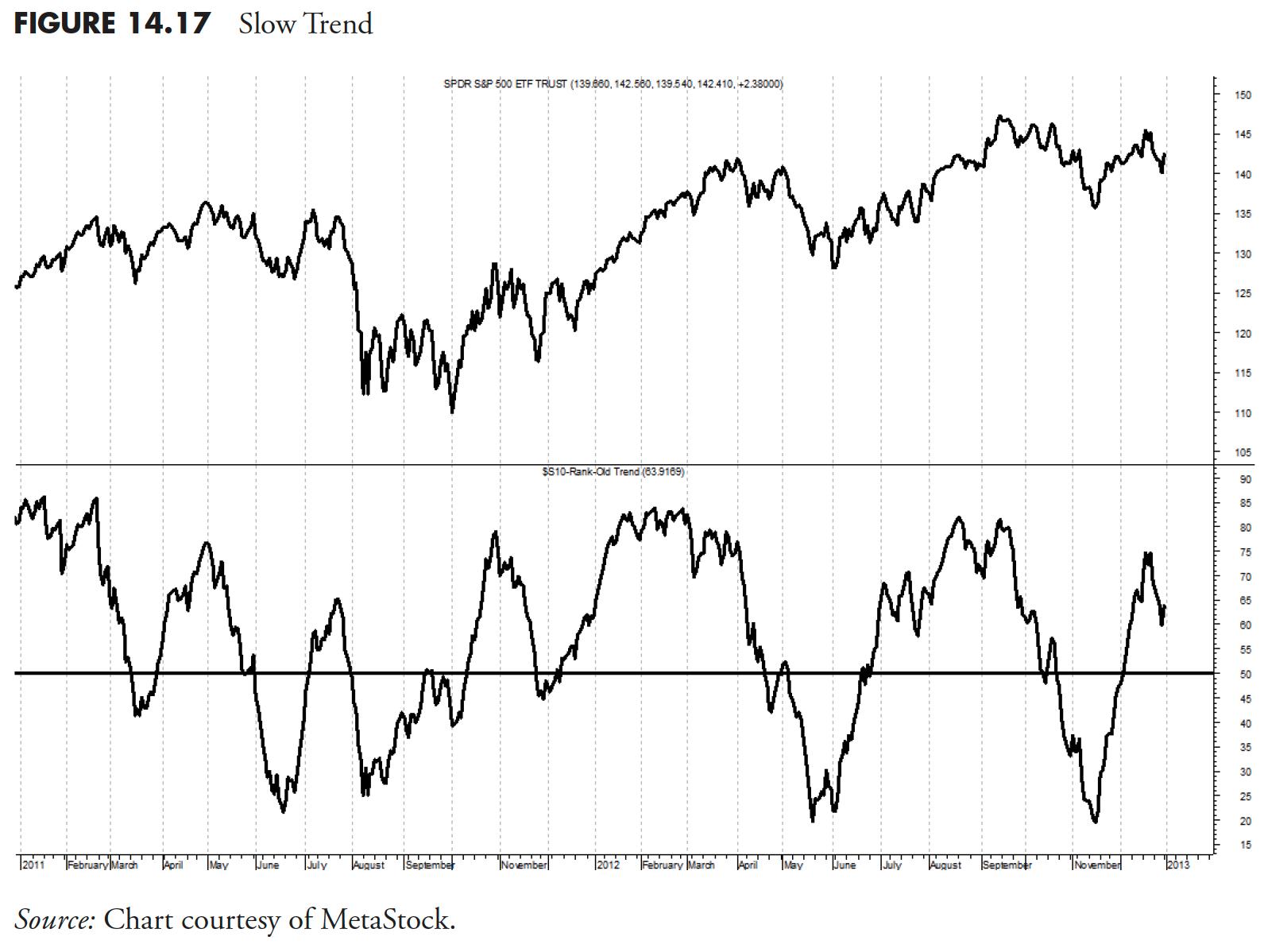

Sluggish Pattern

This measure, proven in Determine 14.17 , is just like Pattern, however makes use of an extended interval for its calculation. This idea can be utilized on most of the rating measures as a second line of protection or affirmation. The quicker model is sweet for preliminary choice, and the slower model is sweet for including to positions (buying and selling up).

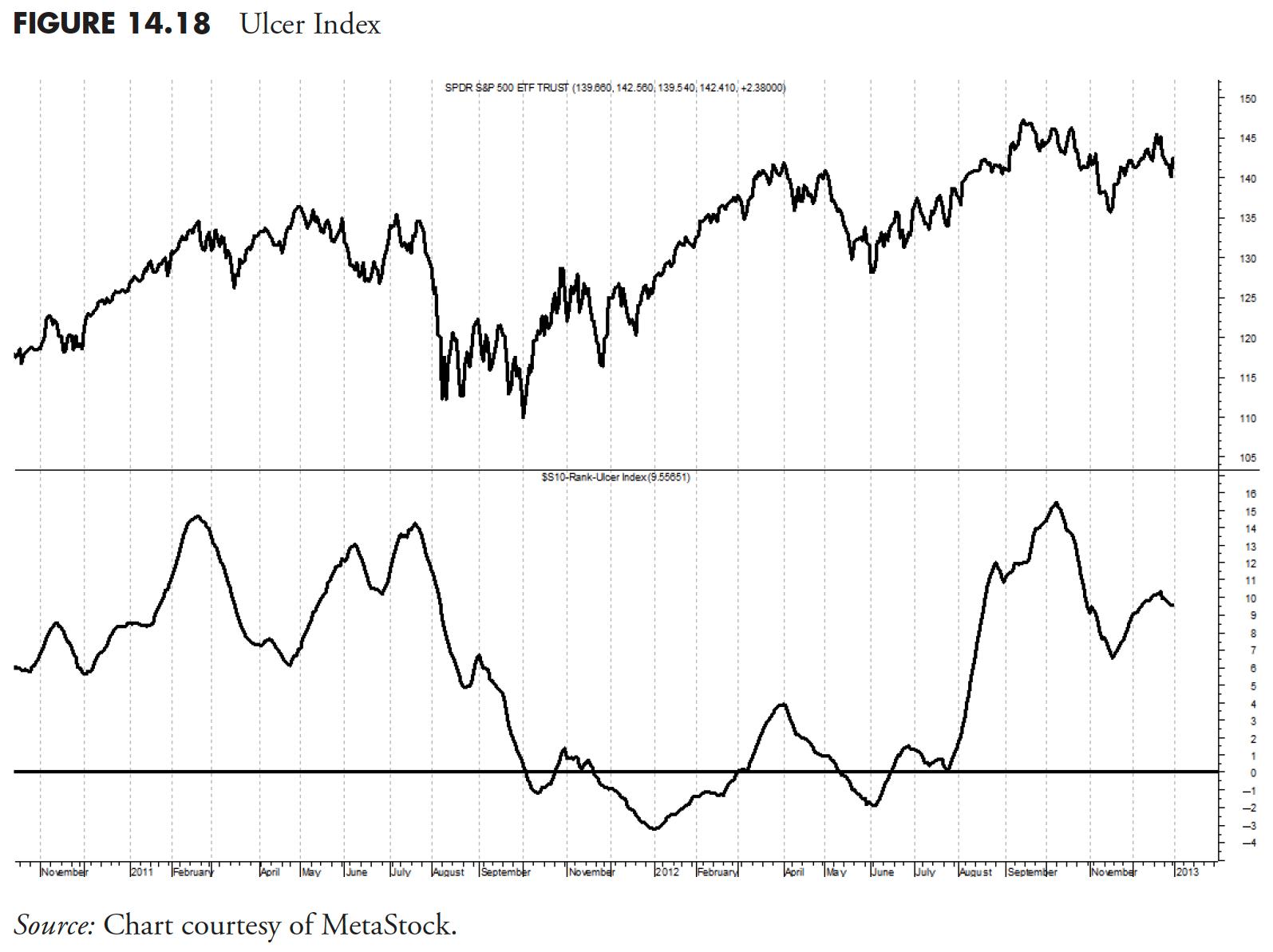

Ulcer Index

The Ulcer Index (Determine 14.18) takes under consideration solely the downward volatility for a problem, plus makes use of worth crossover approach with a 21-period common. This idea was first written about by Peter Martin in The Investor’s Information to Constancy Funds, in 1989.

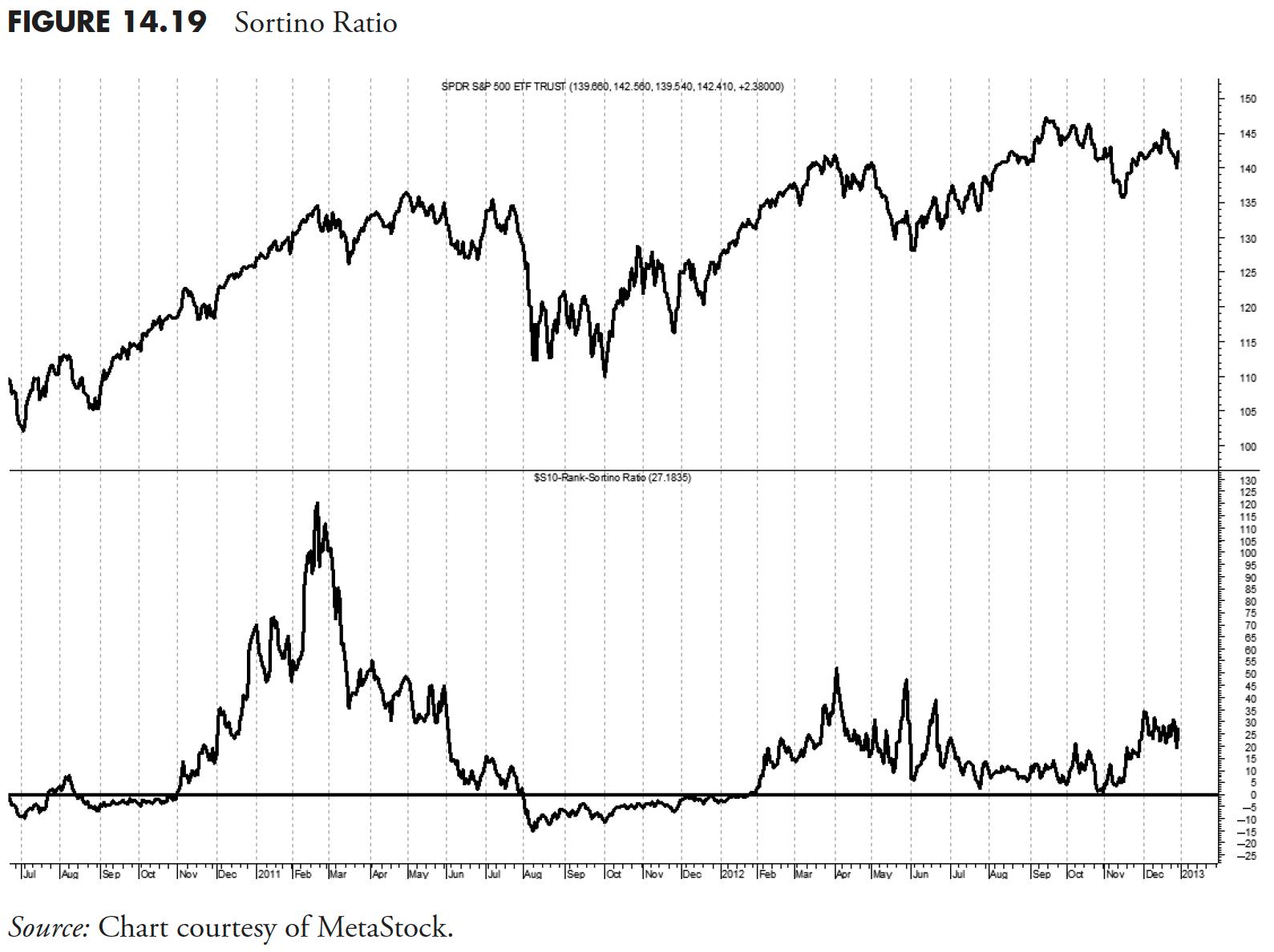

Sortino Ratio

Determine 14.19 exhibits the draw back danger after the return of the difficulty falls beneath that of the 13-week T-bill yield. It’s a risk-adjusted return just like the Sharpe Ratio, however solely penalizes downward volatility, whereas the Sharpe Ratio makes use of sigma (normal deviation). That is additionally just like the Treynor ratio, which makes use of beta because the denominator and anticipated return for the numerator.

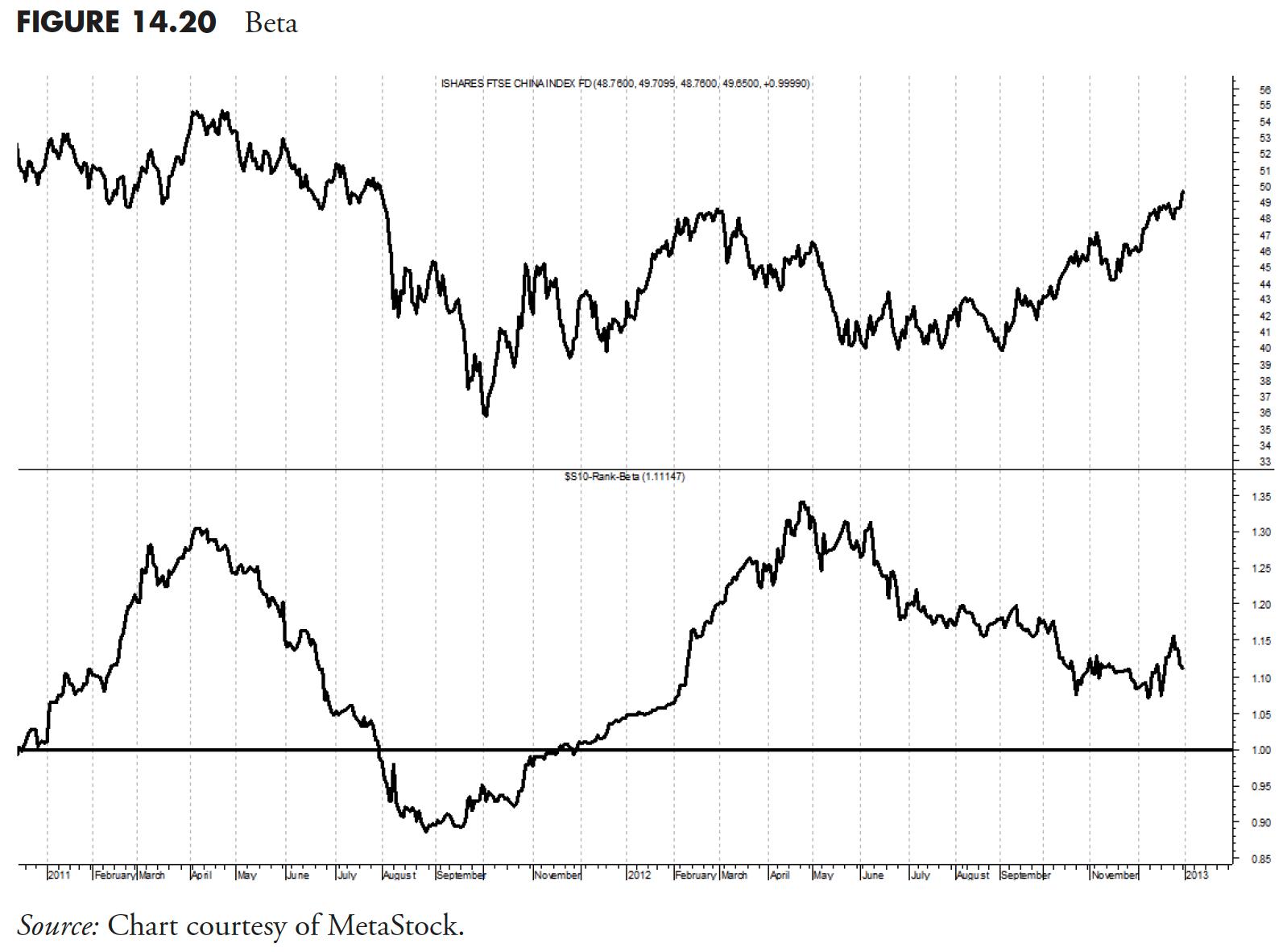

Beta

Determine 14.20 is the difficulty’s beta based mostly on the previous 126 days (6 months). The identical situation exists right here as with the Relative Efficiency earlier. You can’t measure beta until it’s measured in opposition to one thing, on this case the S&P 500. Subsequently, watch out when evaluating a large-cap ETF to a large-cap benchmark, small-cap ETF to a small-cap benchmark, and so forth.

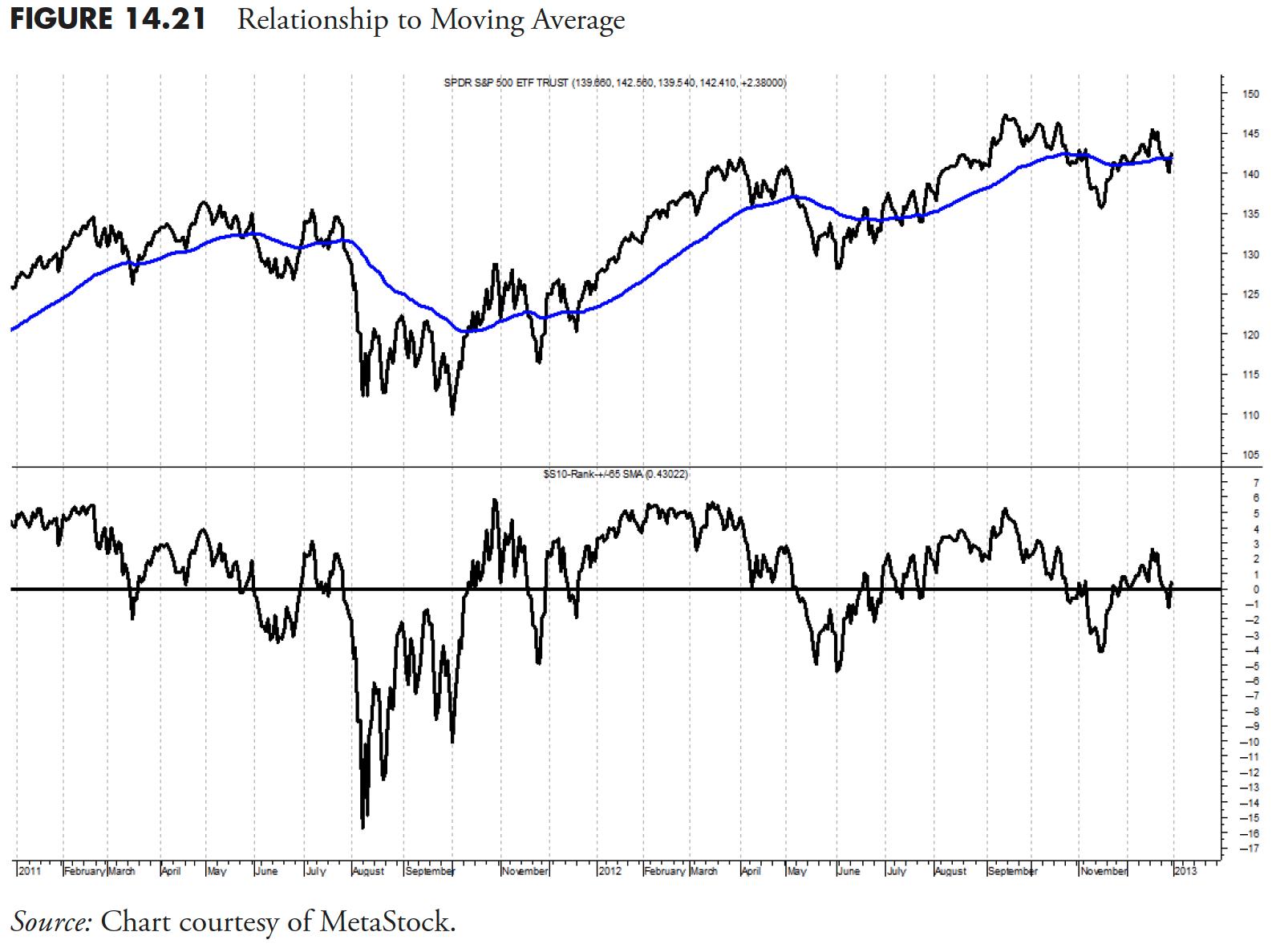

Relationship to Shifting Common

Determine 14.21 exhibits the % above or beneath the straightforward 65-day exponential transferring common. That is just like detrend or diffusion. I believe right here the worth is that one ought to all the time decide a transferring common interval to make use of and keep it up, so that you simply get a really feel for its motion throughout sure market actions. In different phrases, you turn into accustomed to how this transferring common works over time. I equate this to utilizing just one wedge in golf as a substitute of a number of ones. Most of us can not dedicate the time to observe with a number of wedges, so be taught one and keep it up.

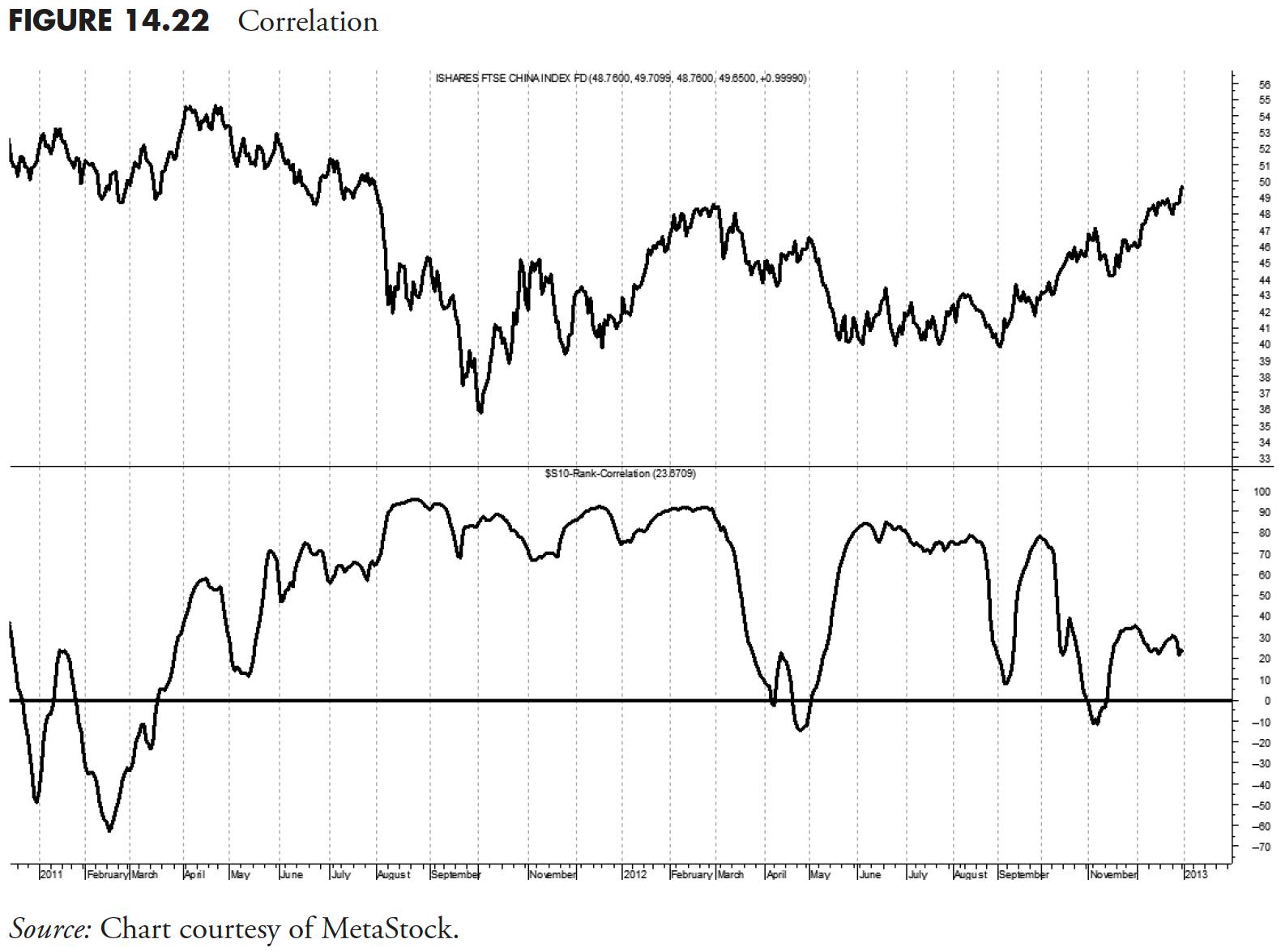

Correlation

Correlation is an try and discover a shut relationship with an index such because the S&P 500. That is one other a type of rating measures you might want to watch out to not examine a like ETF to the same index. For instance, the arithmetic of correlation would blow up should you tried to match the ETF SPY with the S&P 500 Index.

In Determine 14.22, at any time when the road is close to the highest of the plot, then it’s saying the correlation of the highest plot is correlated to the benchmark getting used. When the market is advancing, you need extremely correlated holdings. When the market is declining, otherwise you see it start to roll over in a topping method, you wish to transfer into much less correlated holdings. You should remember the fact that you might be nonetheless a momentum participant and, despite the fact that you need much less correlation to the market, they nonetheless should be advancing on a person foundation.

Correlation just isn’t all the time causation, however do not strive explaining that to your canine when he hears the can opener. — Tom McClellan

Thanks for studying this far. I intend to publish one article on this sequence each week. Cannot wait? The ebook is on the market right here.