There is no denying the energy the key averages have displayed off their April lows. The S&P 500 completed the week inside a rounding error of the earlier all-time excessive round 5250. What wouldn’t it take for the SPX and NDX to energy to new all-time highs in Could?

As we speak, we’ll break down three market breadth indicators that we’re watching to verify the chance of an additional rise for the fairness indexes. We’re additionally watching those self same three charts for warning indicators of a development exhaustion! First, let’s measure what number of shares are above key shifting averages.

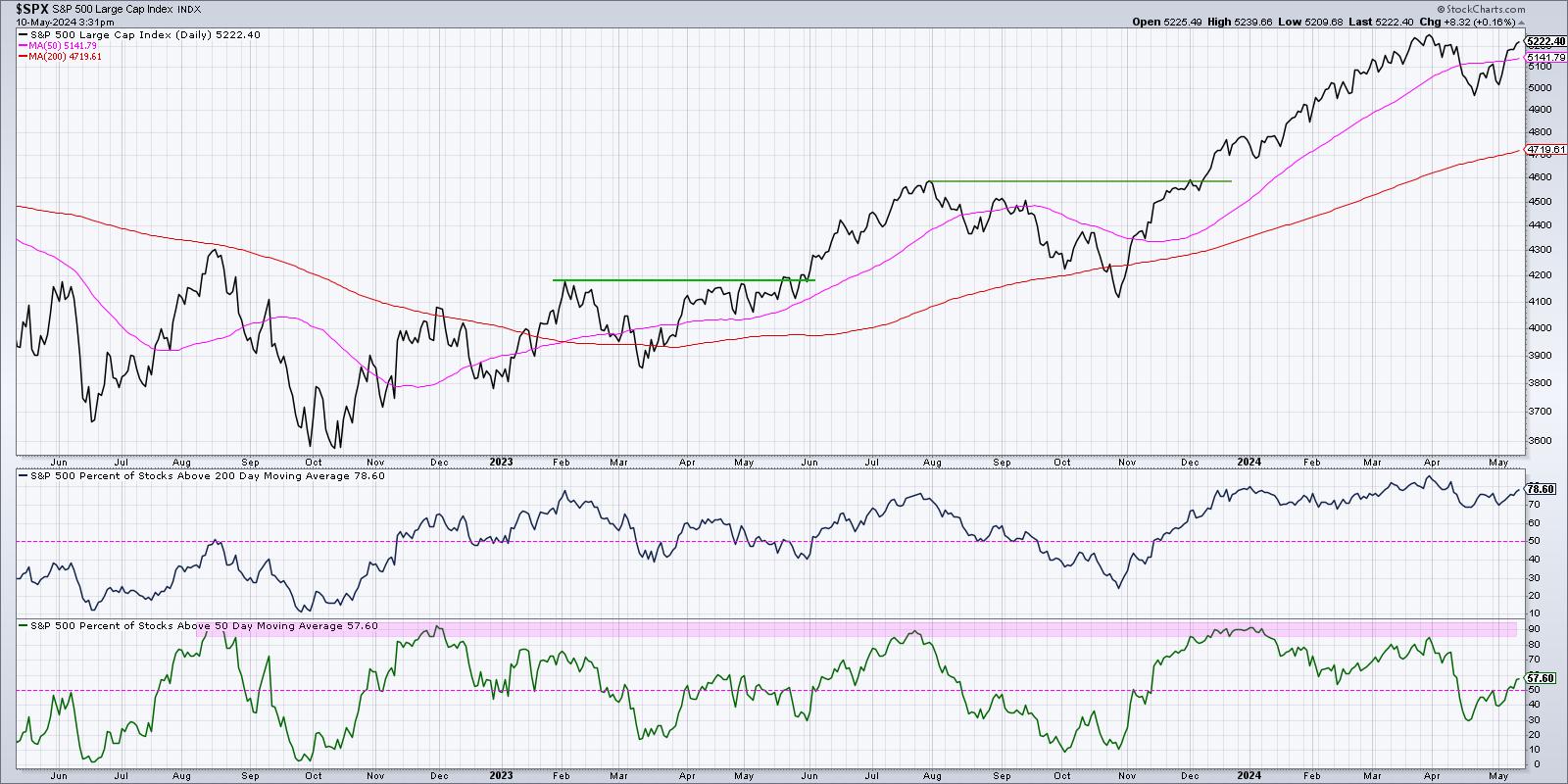

P.c of Shares Above the 50- and 200-Day Shifting Averages

One in all my favourite breadth indicators appears to be like at how the members of a specific index are buying and selling relative to their 50-day and 200-day shifting averages. Throughout an uptrend section, a inventory tends to be shifting increased above two upward-sloping shifting averages. By making this straightforward comparability throughout a lot of names, we are able to decide whether or not a market transfer is extra of a slim or a broad advance.

The underside panel exhibits that on the finish of 2023, about 90% of the S&P 500 members have been buying and selling above their 200-day shifting common. By the mid-April market low, that quantity had gone all the way down to round 30%. That means that about 60% of the S&P 500 members had damaged down by way of their 50-day shifting common in early 2024. Discuss a broad market decline!

Because the April low, this indicator has popped again over 50% to achieve nearly 60% this week. I’ve typically noticed values over 50% are bullish, which means that almost all SPX members are in a short-term uptrend. Thus, so long as this indicator stays above 50%, circumstances are pretty constructive. By way of hazard indicators on this chart, I’ve seen that when the indicator will get as much as round 85-90%, that is normally proper round a market prime. So, for now, this indicator suggests market energy.

New 52-Week Highs and Lows

Now that we have decided a broad advance off the April lows, what in regards to the management names? Are there shares already reaching a brand new 52-week excessive?

You’ll be able to see within the backside panel that, when the S&P 500 had pulled again to round 4950 in mid-April, there have been only a few 52-week highs (inexperienced) or 52-week lows (crimson) for the S&P 500 members. Most shares had made a brand new 52-week excessive in Q1, and most are nonetheless nicely above their October 2023 lows. However, within the subsequent three weeks, you may see a rising variety of new 52-week highs.

So though the S&P 500 itself has nonetheless not achieved a brand new 52-week excessive, there are some early management names which can be already pushing to their very own 52-week excessive. A wholesome uptrend is normally marked by an growth in new 52-week highs. Therefore, the extra inexperienced on this chart going ahead, the higher.

What would elevate a crimson flag on this second chart? Principally, an evaporation of recent 52-week highs would inform you these early management shares are not making upward progress, and that, more than likely, we’re in a brand new pullback section.

Nasdaq 100 Bullish P.c Index

The Bullish P.c Index is a market breadth indicator constructed by analyzing level & determine charts for a specific universe — on this case, the Nasdaq 100 members. What p.c of these shares have most not too long ago given a purchase sign on their very own level & determine charts?

The highest panel exhibits the Nasdaq 100 Bullish P.c Index, which is getting very close to to the 50% degree. I’ve discovered that when the indicator dips under 30%, however then pushes again above 50%, this usually serves as a robust purchase sign and suggests additional upside. You’ll be able to see the newest indicators in January 2023 and November 2023 show this phenomenon.

So if this indicator pushes above 50% within the month of Could, that may counsel that the present uptrend section may be getting began. If the indicator fails to push above 50%, that would point out that this group of main development shares, together with just about the entire Magnificent 7 shares, aren’t displaying sufficient upside momentum to verify the uptrend.

Do you suppose the S&P 500 will obtain a brand new all-time excessive above 5250 in Could 2024? Watch the video under, then drop a remark and let me know!

RR#6,

Dave

P.S. Able to improve your funding course of? Take a look at my free behavioral investing course!

David Keller, CMT

Chief Market Strategist

StockCharts.com

Disclaimer: This weblog is for instructional functions solely and shouldn’t be construed as monetary recommendation. The concepts and techniques ought to by no means be used with out first assessing your individual private and monetary state of affairs, or with out consulting a monetary skilled.

The creator doesn’t have a place in talked about securities on the time of publication. Any opinions expressed herein are solely these of the creator and don’t in any approach symbolize the views or opinions of some other individual or entity.

David Keller, CMT is Chief Market Strategist at StockCharts.com, the place he helps traders decrease behavioral biases by way of technical evaluation. He’s a frequent host on StockCharts TV, and he relates mindfulness methods to investor resolution making in his weblog, The Aware Investor.

David can be President and Chief Strategist at Sierra Alpha Analysis LLC, a boutique funding analysis agency targeted on managing danger by way of market consciousness. He combines the strengths of technical evaluation, behavioral finance, and information visualization to determine funding alternatives and enrich relationships between advisors and shoppers.

Study Extra