EUR/USD: Medium-Time period Outlook Favours the Greenback

● All through the previous week, EUR/USD exhibited combined dynamics, primarily pushed by expectations regarding potential rate of interest cuts by the US Federal Reserve (Fed) and the European Central Financial institution (ECB). Statements by officers from each central banks, in addition to financial macro-statistics, both heightened or lowered these expectations.

● The EUR/USD bullish rally commenced on 16 April from the 1.0600 mark, reaching a peak of 1.0811 on 3 Might, after which development stalled, beginning the previous week at 1.0762. On Monday, 6 Might, statistics from the Eurozone offered some help to the widespread European forex. In April, the Companies Buying Managers’ Index (PMI) rose from 52.9 to 53.3, exceeding the forecast of 52.9. The Composite PMI, which incorporates the manufacturing sector and companies, elevated from 51.4 to 51.7. Germany’s Composite PMI additionally confirmed optimistic dynamics, rising from 50.5 to 50.6. Consequently, enterprise exercise within the Eurozone reached its highest stage in virtually a yr. Furthermore, retail gross sales within the area confirmed important development, rising from -0.5% to +0.7% year-on-year.

● This information backdrop suggests potential inflation development, which in idea might deter the ECB from initiating a financial coverage easing. Nevertheless, ECB Chief Economist Philip Lane acknowledged that the Govt Board of the financial institution has compelling arguments for a fee reduce on the 6 June assembly. One other ECB consultant, Lithuanian Central Financial institution head Gediminas Simkus, indicated that fee cuts shouldn’t be restricted to June, suggesting it might occur thrice by the tip of the yr. Nevertheless, whereas the chance of easing (QE) in June is close to 100%, there may be some uncertainty relating to additional steps. ECB Vice President Luis de Guindos admitted that the regulator is cautiously forecasting any tendencies past June.

Along with ECB officers’ statements supporting easing, statistics launched on Tuesday, 7 Might, additionally contributed. They confirmed that manufacturing orders in Germany, the locomotive of the European economic system, decreased by 0.4% in March after a 0.8% decline in February. In consequence, the EUR/USD pair’s development halted, pulling again to 1.0723.

● The pair made one other try to interrupt by the sturdy resistance zone of 1.0790-1.0800 on Thursday, 9 Might, when US preliminary jobless claims knowledge was unexpectedly reported at 231K, a lot worse than the anticipated 210K. This coincided with a widespread detrimental session for US yields alongside the curve. The scenario worsened because the unemployment knowledge confirmed regarding statistics launched on 3 Might. In line with the US Bureau of Labor Statistics (BLS), non-farm payrolls (NFP) rose by simply 175K in April, considerably under the March determine of 315K and market expectations of 238K. The employment report additionally confirmed a rise in unemployment from 3.8% to three.9%.

Apart from combating inflation, the Fed’s different declared fundamental purpose is most employment. “If inflation stays secure and the labor market sturdy, it might be applicable to delay fee cuts,” acknowledged Fed Chair Jerome Powell. Now, the power of the labour market is in query. Nevertheless, the Fed is prone to give attention to combating inflation, which continues to be removed from the two.0% goal.

A key inflation indicator tracked by the Fed, the Private Consumption Expenditures (PCE) Value Index, rose from 2.5% to 2.7% in March. Nevertheless, the ISM Manufacturing PMI fell under the important thing 50.0 mark, dropping from 50.3 to 49.2 factors. Keep in mind, a stage of fifty.0 separates financial development from contraction. In such a scenario, elevating the rate of interest is inadvisable, however decreasing it is usually not an choice. That is precisely what the FOMC (Federal Open Market Committee) of the Fed did. At its assembly on Wednesday, 1 Might, its members unanimously left the speed unchanged at 5.50%. That is the best fee in 23 years, and the US central financial institution has stored it unchanged for six consecutive conferences.

● The primary situation foresees the Fed starting to assessment the speed in direction of a lower no sooner than autumn, doubtless in September, with one other reduce by year-end. Nevertheless, if US inflation doesn’t decline or, worse, continues to rise, the regulator might abandon financial coverage easing till early 2025. Thus, contemplating the above, many analysts imagine the medium-term benefit stays with the greenback, and EUR/USD continues to be engaging for gross sales with a horizon of a number of months.

● The ultimate level of the week for EUR/USD was at 1.0770, making the weekly end result virtually zero. Relating to the forecast for the close to time period, as of the night of 10 Might, it’s maximally impartial: 50% count on greenback strengthening, and 50% count on its weakening. Pattern indicators on D1 are equally divided: half are on the aspect of the reds, and half are on the aspect of the greens. Amongst oscillators, solely 10% voted for the reds, one other 10% remained impartial, and 80% voted for the greens (though 1 / 4 of them are already signalling overbought circumstances). The closest help for the pair is situated within the 1.0710-1.0725 zone, adopted by 1.0650, 1.0600-1.0620, 1.0560, 1.0495-1.0515, 1.0450, 1.0375, 1.0255, 1.0130, and 1.0000. Resistance zones are within the areas of 1.0795-1.0810, 1.0865, 1.0895-1.0925, 1.0965-1.0980, 1.1015, 1.1050, and 1.1100-1.1140.

● Within the coming week, on Tuesday, 14 Might, shopper inflation knowledge (CPI) in Germany and the Producer Value Index (PPI) within the US will probably be launched. Additionally scheduled for this present day is a speech by Fed Chair Jerome Powell. The subsequent day, Wednesday, 15 Might, essential indicators resembling Client Value Index (CPI) and retail gross sales volumes in the USA will probably be revealed. On Thursday, 16 Might, the standard variety of preliminary jobless claims within the US will probably be introduced. And on the very finish of the working week, on Friday, 17 Might, we are going to study the Eurozone CPI as a complete, which can affect the ECB’s resolution relating to the euro rate of interest.

GBP/USD: Pound Stays Underneath Stress however Holds On

● At its assembly on Thursday, 9 Might, the Financial institution of England’s (BoE) Financial Coverage Committee maintained the rate of interest at 5.25%, the best in 16 years. Economists polled by Reuters largely anticipated borrowing prices to stay unchanged, with a committee vote ratio of 8 to 1. Nevertheless, the vote was 7 to 2. Throughout discussions, two committee members supported a fee reduce to five.0%, which market members interpreted as a step in direction of the start of a coverage easing cycle.

On the post-meeting press convention, BoE Governor Andrew Bailey expressed optimism, stating that the UK economic system is transferring in the proper route. Bailey additionally famous that “a fee reduce subsequent month is kind of potential,” however he intends to attend for knowledge on inflation, exercise, and the labour market earlier than making a call. Chief Economist Huw Capsule, though he joined the bulk in voting to maintain the speed unchanged, additionally expressed rising confidence that the time for a discount is approaching. He added that “focusing solely on the subsequent Financial institution of England assembly [20 June] is considerably unreasonable” and that “medium-term inflation forecasts don’t essentially sign fee actions on the subsequent or subsequent conferences.”

● Total, the motion of the GBP/USD pair final week resembled that of the EUR/USD pair. The chart reveals a definite surge on Thursday, 9 Might, triggered by knowledge indicating a cooling US labour market. The pound was additionally supported by optimistic GDP knowledge for the UK for Q1 2024 and manufacturing sector knowledge for March.

GDP (quarter-on-quarter) rose by +0.6% after a decline of -0.3% within the earlier quarter (forecast +0.4%). Moreover, the GDP grew by +0.2% year-on-year, recovering from a fall of -0.2%.

● As with the euro, the pound is below stress from the prospect of earlier financial coverage easing by the BoE in comparison with the Fed. Nevertheless, the British forex ended the previous week above the important thing 1.2500 stage, at 1.2523. Furthermore, 65% of analysts count on the pair not solely to carry above this horizon but additionally to proceed its development. The remaining 35% voted for the pair’s motion south. As for technical evaluation, development indicators on D1 are break up 50-50. Amongst oscillators, solely 10% suggest promoting, 40% took a impartial place, and 50% suggest shopping for (10% of them sign overbought circumstances). If the pair rises, it’ll encounter resistance at ranges 1.2575-1.2610, 1.2695-1.2710, 1.2755-1.2775, 1.2800-1.2820, and 1.2885-1.2900. In case of a fall, it’ll face help ranges and zones at 1.2490-1.2500, 1.2450, 1.2400-1.2410, 1.2300-1.2330, 1.2185-1.2210, and 1.2070-1.2110, 1.2035.

● The upcoming week’s calendar highlights Tuesday, 14 Might, when knowledge from the UK labour market will probably be launched. Additionally of curiosity is the Inflation Report listening to scheduled for Wednesday, 15 Might.

USD/JPY: $50 Billion Interventions Wasted?

● Evidently till the Financial institution of Japan (BoJ) takes assured and clear steps to tighten its financial coverage, nothing will assist the yen. At its assembly on 26 April, the board members of this regulator unanimously determined to depart the important thing fee and QE program parameters unchanged. Expectedly robust feedback on the outlook had been additionally absent. This inaction elevated stress on the nationwide forex, sending the USD/JPY pair to new heights. It continued its cosmic saga, reaching a brand new 34-year excessive of 160.22. Following this, Japan’s monetary authorities lastly selected a double forex intervention. Though there was no official affirmation, specialists estimate its whole quantity at $50 billion.

Did it assist? Judging by the USD/JPY chart, probably not. The pair headed north once more final week. In contrast to the euro and the British pound, the yen barely reacted even to weak US labour market knowledge on Thursday, 9 Might, solely slowing its decline.

● All this happens amid limitless statements from the Japanese Central Financial institution and Ministry of Finance about their readiness to take essential measures to cut back speculative stress on the nationwide forex. The revealed minutes of the BoJ assembly present that the majority board members took a “hawkish” stance, calling for a fee hike. Nevertheless, many analysts imagine that the Financial institution of Japan will take just one such step within the second half of the yr.

● The final chord of the previous 5 days sounded at 155.75. Economists at Singapore’s United Abroad Financial institution Restricted (UOB) count on the USD/JPY pair to commerce within the 154.00-157.20 vary within the subsequent 1-3 weeks. UOB additionally believes that the probabilities of it falling to 151.55 have considerably diminished. Total, most specialists (70%) merely shrug their shoulders in uncertainty. The remaining 30% persistently count on the yen to strengthen. As for technical evaluation, 100% of development indicators on D1 look north. Amongst oscillators, 50% are such, 15% level south, and 35% level east. Relating to help/resistance ranges, merchants ought to word that with such volatility, the slippage can attain many tens of factors. The closest help stage is round 155.25, adopted by 154.70, 153.90, 153.10, 151.85-152.25, 151.00, 150.00, after which come 146.50-146.90, 143.30-143.75, and 140.25-141.00. Resistance ranges are 156.25, 157.00, 157.80-158.00, 158.60, 159.40, and 160.00-160.25.

● Occasions of the upcoming week embrace the discharge on Thursday, 16 Might, of preliminary GDP knowledge for Japan for Q1 2024. No different important publications relating to the Japanese economic system are anticipated within the coming week.

CRYPTOCURRENCIES: A Week of Reflection and Uncertainty

● What’s going to occur to bitcoin within the foreseeable future? It appears there is no such thing as a clear reply to this query. Specialists and influencers usually level in reverse instructions: some shoot for the celebrities, whereas others maintain their eyes on the bottom.

● As an example, in accordance with the founding father of Pomp Investments, Anthony Pompliano, bitcoin is “stronger than ever.” He concluded this primarily based on the 200-day transferring common (200 DMA) reaching its ATH (All-Time Excessive) of $57,000. Michael Saylor, CEO of MicroStrategy, can be optimistic. In his newest message, he urged traders to “run with the bulls.” (It must be famous right here that MicroStrategy holds 205,000 BTC on its stability sheet, so Saylor’s bullish calls are fairly comprehensible. He merely has to do that for his firm to revenue moderately than incur losses).

● Nevertheless, analysts word that bitcoin’s destiny relies upon not solely on the rosy calls of the MicroStrategy CEO. And if purchaser help weakens, BTC might break by the important thing help stage of $61,000, falling to the $56,000 zone, the place important liquidity is concentrated. MN Buying and selling founder Michael Van De Poppe doesn’t rule out one other correction to round $55,000. Nevertheless, the specialist shortly reassures traders, stating that that is fairly acceptable so long as bitcoin holds above $60,000. Anthony Pompliano believes that the worth won’t fall under $50,000, and one other professional, Alan Santana, doesn’t rule out a drop to $30,000.

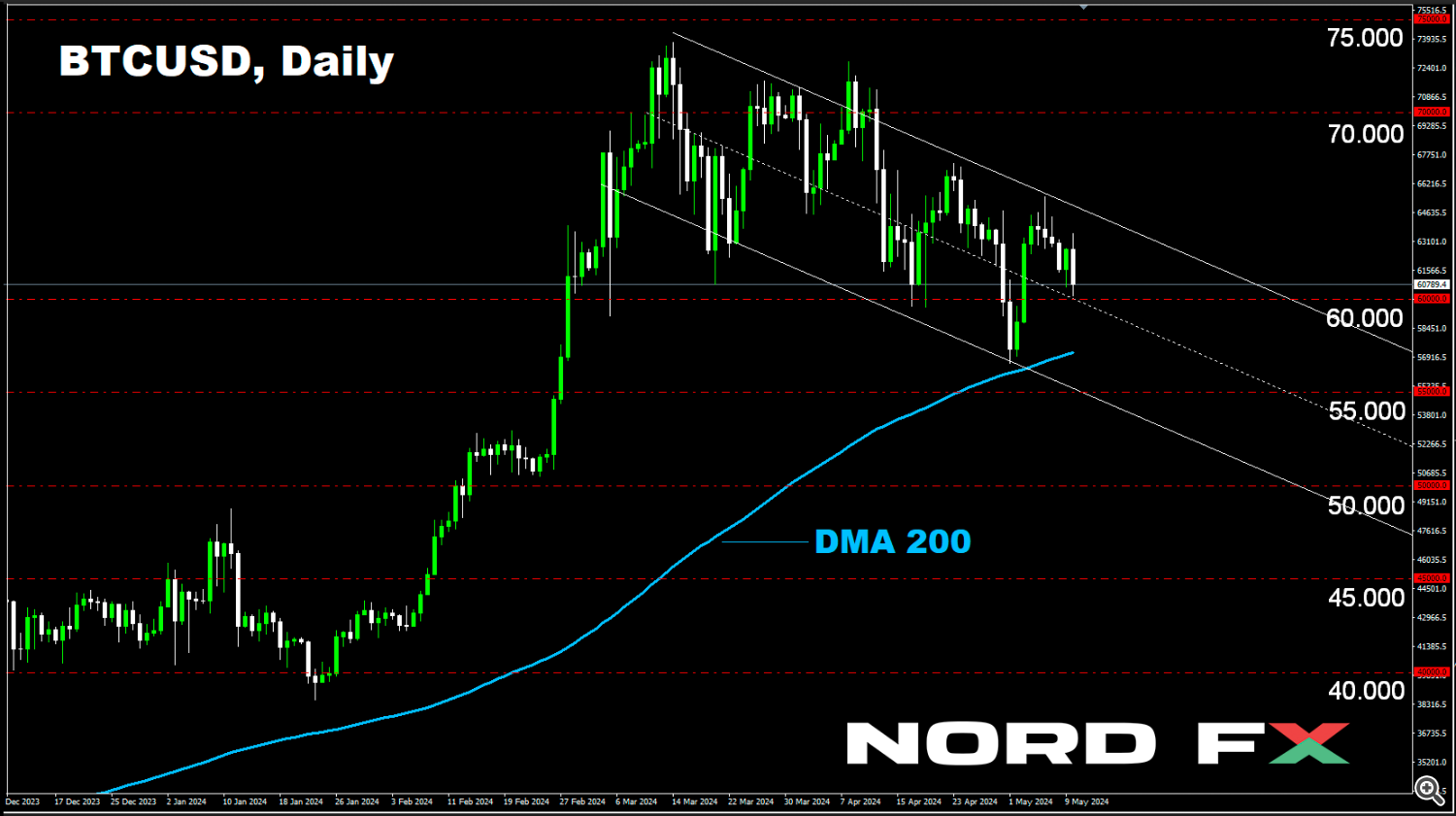

Dealer and analyst Rekt Capital believes that the primary cryptocurrency has exited the post-halving “hazard zone” and entered the preliminary section of re-accumulation. In line with this professional, in 2016, BTC demonstrated an extended crimson candle after the halving, falling by 17%. This time, the sample repeated, with the distinction between the post-halving most and minimal being 16%. The value reached an area backside at round $56,566 however then rose to $65,508, on which Rekt Capital concluded that it re-entered the “re-accumulation vary.” Nevertheless, there may be one “however” – after this, we once more noticed a drop to $60,175. Total, plainly BTC/USD is in a descending channel, which will increase investor concern.

● Generally, the forecasts are fairly various. Info on the exercise of assorted classes of merchants and traders additionally varies. Analyst and CMCC Crest co-founder Willy Woo famous the exercise of so-called crypto dolphins and sharks. “There has by no means been such a fast buy of cash by rich holders as within the final two months when the worth fluctuated between $60,000-70,000. We’re speaking about those that maintain from 100 BTC to 1000 BTC or roughly $6.5-65 million,” he defined. However, in accordance with CryptoQuant analysts, whales holding from 1000 to 10000 BTC, in contrast to dolphins and sharks, have behaved fairly passively. Michael Van De Poppe, for his half, notes the absence of retail traders.

● All this means that we might not see new all-time highs for BTC within the coming months. We wrote about this within the earlier assessment, citing, amongst different issues, the opinion of such a Wall Road legend as Issue LLC head Peter Brandt. With a 25% likelihood, he assumed that bitcoin had already shaped one other ATH inside the present cycle.

As for long-term forecasts, nothing has modified right here – most of them predict a strong bull rally for bitcoin. Anthony Pompliano writes about this. Willy Woo expects bitcoin to proceed rising its penetration into numerous spheres of on a regular basis life, that means the variety of customers will develop. “By 2035, we count on bitcoin’s truthful worth to succeed in $1 million. This forecast is predicated on the person development curve. And I am speaking about truthful worth, not a peak throughout a bull market frenzy,” the analyst notes.

● The creator of the bestseller “Wealthy Dad Poor Dad,” entrepreneur Robert Kiyosaki, as soon as once more included bitcoin within the TOP-3 methods to save lots of and enhance capital. “Dangerous information: the [currency market] crash has already begun. Will probably be extreme. Excellent news: a crash is the very best time to get wealthy,” he wrote, providing a number of suggestions on the way to act in a disaster. Let’s word two of them. The primary reads: “Discover an extra supply of revenue. Synthetic Intelligence will destroy thousands and thousands of jobs. Begin a small enterprise and change into an entrepreneur, not an worker afraid of shedding a job.” “Do not hoard faux cash (US greenback, euro, yen, peso) that’s shedding worth. Hoard gold, silver, and bitcoin – actual cash whose worth will increase, particularly in a market crash,” is Kiyosaki’s second suggestion.

● Relating to bitcoin’s development, Kiyosaki is completely proper; it is even pointless to argue. In line with a research by Colin Wu, higher often called WuBlockchain, over the previous decade, the worth of the main cryptocurrency has grown by an astonishing 12,464%, outpacing giants like Amazon, Apple, Google, Meta, Tesla, and Netflix. BTC was second solely to Nvidia (+17,797%). However the truth that bitcoin took second place, being a consultant of a comparatively new and unstable market, is an actual achievement. BTC’s spectacular development trajectory over the previous decade demonstrates its resilience and potential as a vital part in traders’ portfolios.

● On the time of penning this assessment, on the night of Friday, 10 Might, the BTC/USD pair is buying and selling at $60,470. The overall market capitalization of the crypto market is $2.24 trillion ($2.33 trillion per week in the past). The Crypto Concern & Greed Index has risen from the Impartial zone (48 factors per week in the past) to the Greed zone, now standing at 66 factors.

NordFX Analytical Group

Discover: These supplies should not funding suggestions or tips for working in monetary markets and are supposed for informational functions solely. Buying and selling in monetary markets is dangerous and can lead to an entire lack of deposited funds.

#eurusd #gbpusd #usdjpy #Foreign exchange #forex_forecast #signals_forex #cryptocurrency #bitcoin #nordfx