In his newest technical evaluation, veteran crypto analyst Christopher Inks gives an in depth have a look at the present Bitcoin market construction by a complete chart evaluation. The chart, not too long ago shared on X, reveals Bitcoin’s worth actions alongside a number of key technical indicators and ranges that would sign a possible reversal from its bearish pattern.

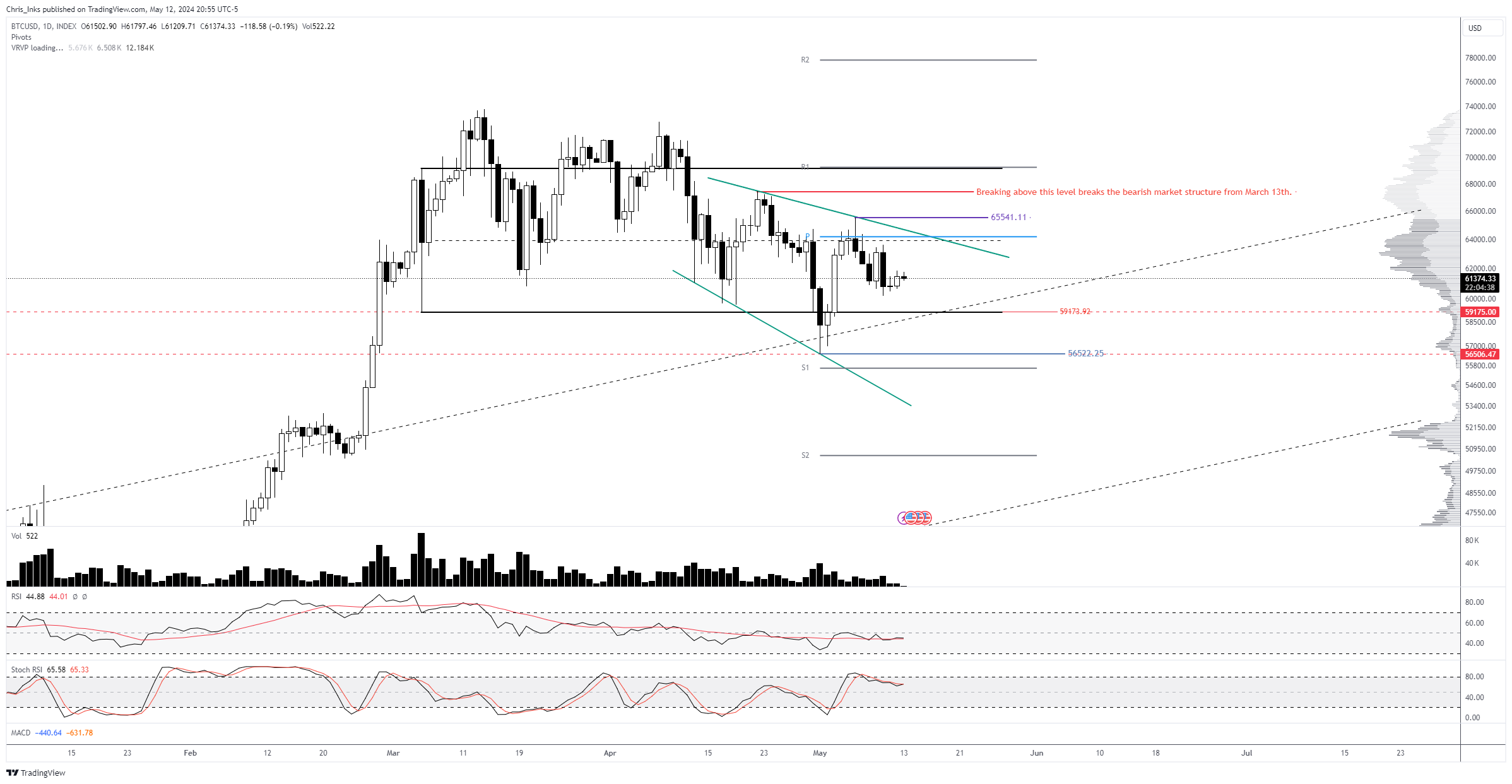

The analyst illustrates Bitcoin’s worth motion with every day candlesticks over the previous few months, pinpointing important help (S1, S2) and resistance (R1, R2) ranges. As of press time, Bitcoin traded at across the $63,000 mark, encapsulated by two descending pattern traces which symbolize a bearish market construction.

The Backside Sign For Bitcoin

“We nonetheless need to see a breakout above the famous stage to sign a break within the bearish market construction that started on the ATH,” Inks said. This stage is of paramount significance as a result of it serves as a junction of a number of technical parts: the every day pivot level, the higher descending inexperienced resistance line, and the two-month vary equilibrium.

Associated Studying

In accordance with Inks, “an impulsive breakout and shut above the every day pivot/descending inexperienced resistance/2-month vary EQ confluence space will sign that the low is probably going in.” This implies that overcoming this barrier may herald the top of the bearish market construction that commenced from the all-time excessive.

If this resistance breaks, the subsequent main resistance is situated at $65,541. Afterwards, $68,000 may very well be on the playing cards. “Breaking above this stage breaks the bearish market construction from March thirteenth,” in line with Inks. Then, R1 at $69,000 and R2 at round $78,000 may very well be the subsequent targets.

On the draw back, essentially the most essential help is at $56,522. It represents the decrease boundary that Bitcoin wants to keep up to stop a brand new low, which might exacerbate the bearish sentiment.

Associated Studying

Inks articulates the significance of this help, noting, “If we will print a better low now, which might require a breakout above the $65.541 stage with out printing a brand new low under $56,522, then that may actually add help for the concept the underside is in and a new ATH is incoming.”

This assertion underlines the need for Bitcoin to carry above this help to keep away from additional declines and stabilize inside its present vary. If BTC breaks under the pivotal help, the worth may very well be headed under $56,000 (S1) and $50,90 (S2).

Notably, the evaluation is supported by quite a lot of technical indicators. The Relative Power Index (RSI), hovering across the impartial 50 mark, suggests a balancing act between bullish and bearish forces. The RSI’s place signifies that the market is neither overbought nor oversold, leaving room for potential upward motion if bullish indicators strengthen.

The Shifting Common Convergence Divergence (MACD) at present reveals that the MACD line is under the sign line, a conventional bearish signal. Nevertheless, the proximity of those traces additionally hints at a attainable upcoming bullish crossover, ought to the momentum shift.

The Stochastic RSI additionally signifies potential for motion in both course however is especially helpful for figuring out when Bitcoin could be getting into overbought or oversold territories, that are vital for predicting short-term worth reversals.

Inks additionally commented on the market’s dynamics, stating, “The positives of the vary are that provide has continued to lower all through the bearish market construction.” This commentary means that diminishing provide, paired with sustaining key help ranges, may assist stabilize and doubtlessly improve Bitcoin’s worth.

At press time, BTC traded at $62,902.

Featured picture created with DALL·E, chart from TradingView.com