In line with a report by Messari, Layer 1 (L1) blockchain Aptos skilled substantial positive aspects in key metrics in the course of the first quarter (Q1) of the yr. The expansion was pushed by the surge in Bitcoin costs to new document highs and elevated capital influx out there.

Nonetheless, Aptos’ native token, APT, has struggled with value efficiency, recording modest positive aspects in comparison with different high cryptocurrencies.

Aptos Community Exercise Surges

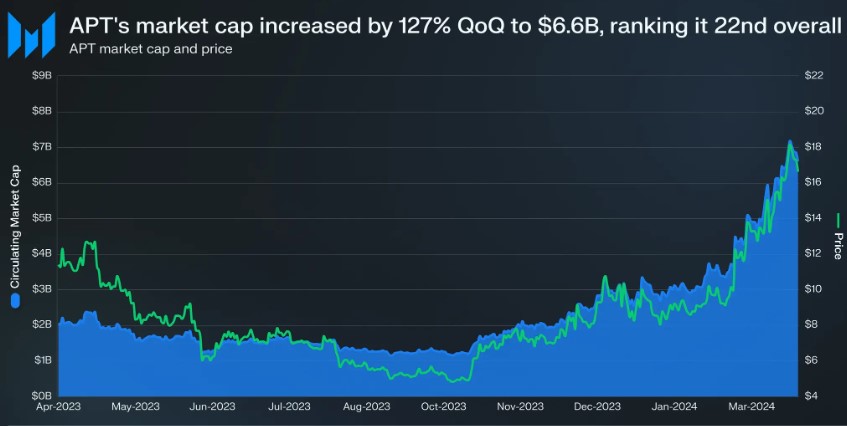

The report highlighted that Aptos’ circulating market cap elevated 127% quarter-on-quarter (QoQ) to $6.6 billion.

This development outpaced different tasks with related market caps, bettering market cap rank from 33 to 22. Regardless of this development, APT’s value skilled a extra modest improve of 76% QoQ.

Aptos income, which encompasses all charges collected by the protocol, grew by 37% to $475,000. Nonetheless, when denominated in APT, the income decreased by 10%. All income generated by Aptos is burned, however these burned tokens haven’t considerably lowered inflation.

Associated Studying

APT inflation began at a 7% annualized fee and is about to lower by 1.5% every year till it reaches 3.5%. By mid-October, the inflation fee had lowered to only below 6.9%. Moreover, there was inflationary strain from the genesis provide unlocks, with virtually 31% of the genesis provide distributed by the top of Q1.

community exercise, Aptos witnessed a big improve in transactions and energetic addresses in Q1. Common each day transactions and addresses noticed 66% and 97% QoQ development charges, respectively.

Regardless of the elevated transaction exercise, the typical transaction price decreased by 45% QoQ to 0.0006 APT ($0.007). Moreover, common each day new addresses grew by 91% QoQ to 44,000, and the weighted common one-month retention fee elevated by 82% QoQ to 14%.

APT Staked Tokens Lower 5%

Concerning staking, APT staked decreased by 5% to 861 million tokens. Nonetheless, when denominated in USD, the staked market cap grew by 68% QoQ, surpassing $14 billion.

As seen within the chart above, Aptos additionally skilled development in its decentralized finance (DeFi) whole worth locked (TVL), which elevated by 376% QoQ to $573 million.

In line with Messari, this improve was not solely because of APT value appreciation; TVL additionally grew by 170% QoQ in APT phrases. Moreover, Aptos’s stablecoin market cap practically doubled QoQ, reaching $97 million.

APT Struggles To Break $8.80 Resistance

Regardless of these constructive developments, APT’s value efficiency has confronted challenges. The native token has declined over 16% prior to now month, leading to a modest 2.7% surge year-to-date. This contrasts with the double or triple-digit positive aspects seen by different high cryptocurrencies.

Associated Studying

At the moment buying and selling at $8.46, APT has struggled to surpass its nearest resistance wall at $8.80, resulting in a consolidation part between $8.20 and $8.70 over the previous month.

Featured picture from Shutterstock, chart from TradingView.com