AVAX, the native foreign money of Avalanche, a excessive throughput blockchain, is rising, including a formidable 9% from Might 15 lows. Consumers are taking up after weeks of decrease lows. Whereas the growth of Bitcoin costs might clarify these beneficial properties, there may very well be extra.

Superb Wine Funding Fund Tokenized On Avalanche

Avalanche has introduced tokenizing a high quality wine funding fund, a transfer that may see the platform experience on the wave of tokenization. In a press release, Avalanche mentioned the Wine Capital Fund has been tokenized by Oasis Professional and listed on ATS through the Avalanche C-Chain, the place sensible contracts are deployed.

Associated Studying

The ATS is Oasis Professional’s buying and selling platform registered by america Securities and Alternate Fee (SEC). In the meantime, the capital fund is a “closed-end funding automobile.” Particularly, it focuses on high quality wines and is overseen by WIVX Asset Administration.

The choice to tokenize on Avalanche is a step ahead in making a tokenized asset ecosystem, mirroring progress made in Ethereum, amongst different chains.

By making inroads into the high quality wines market, estimated to be price over $400 billion, the platform goals to democratize entry, making it obtainable to extra buyers. Analysts declare tokenization removes limitations widespread in conventional finance. Notably, Avalanche will play an enormous position because the community is scalable, boosting a excessive throughput with sub-second finality.

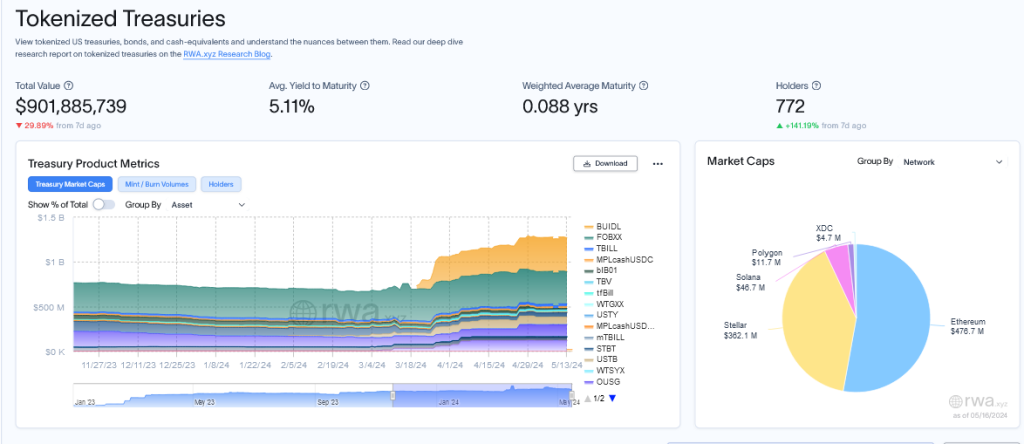

The variety of real-world property (RWA) being onboarded is rising. When writing, information from RWA.xyz reveals that over $7.6 billion price of personal credit score has been tokenized. On the identical time, months after saying the deployment of the BUIDL fund on Ethereum, it manages over $381 million of tokenized United States treasuries.

Efforts On Meme Cash, DeFi: Will AVAX Break $40?

Avalanche isn’t solely making progress in tokenization; earlier, they introduced efforts to encourage meme coin exercise on-chain. To do that, the Avalanche Basis launched Memecoin Rush, a $1 million liquidity mining incentive program.

Associated Studying

The mannequin follows the Avalanche Rush program. The variety of decentralized finance (DeFi) options deploying on the excessive throughput chain quickly grew by this program.

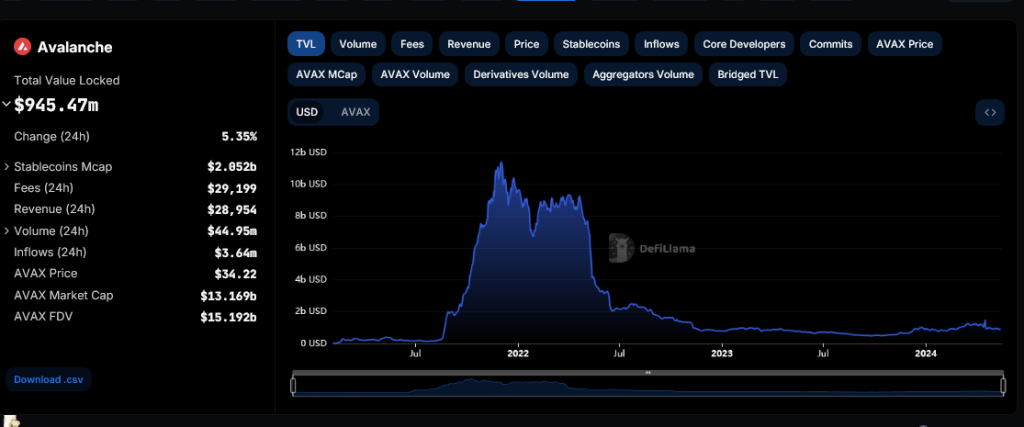

As of mid-Might 2024, DeFiLlama information exhibits that Avalanche DeFi protocols handle over $945 million. The quantity has shrunk by over 90% since November 2021, at over $10.9 billion.

AVAX costs are steady at spot charges. Nonetheless, with the coin discovering help at $30 and printing a triple backside, the trail of least resistance seems northward towards $40 or larger.

Characteristic picture from UnSplash, chart from TradingView