Introduction

Scalper Deriv is an skilled advisor (EA) designed to capitalize on worth fluctuations by analyzing a number of timeframes concurrently, with M1 (1 minute) being the first one. It may be used on any image, with any leverage, and preliminary capital. Its technique is predicated on Value Motion and a mathematical mannequin that decomposes the market into waves. Primarily based on the conduct of those waves, market entry is set.

Uncover extra about Scalper Deriv EA and enhance your buying and selling methods right this moment!

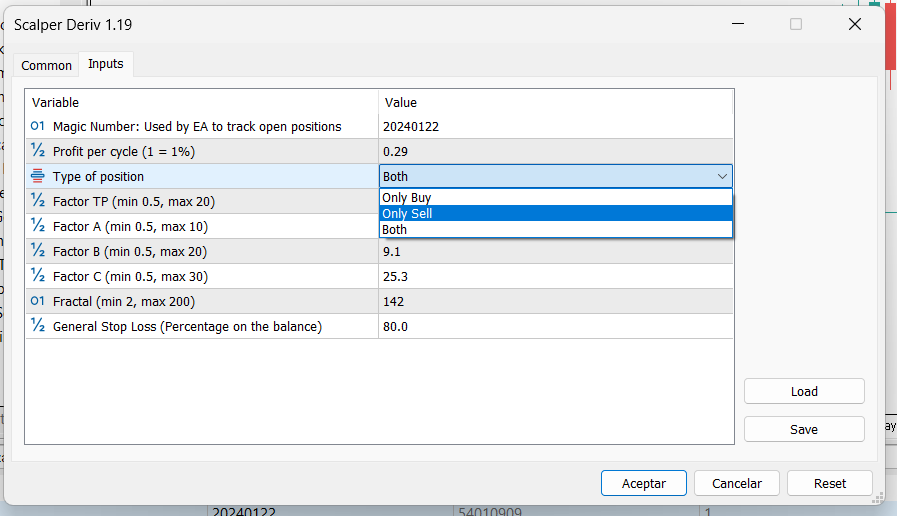

Enter Parameters

- Revenue per cycle (1 = 1%): Defines the share of revenue sought when reaching the take revenue (TP). For instance, with a steadiness of 1000 and a “revenue per cycle” of 1, the revenue can be 10 (1% of 1000) upon reaching the TP.

- Sort of place: Defines whether or not the trades can be purchase, promote, or each.

- Issue TP (min 0.5, max 20): This summary parameter of the mathematical mannequin defines the space of the TP. The smaller the quantity, the nearer the TP can be.

- Issue A, B, C (min 0.5, max 30): Outline the frequency of trades. The smaller the values, the upper the frequency of trades.

- Fractal (min 2, max 200): Variety of candles within the M1 timeframe thought-about to determine the final related excessive and low.

- Basic Cease Loss: Most share of loss to shut all positions with a loss. For instance, if it is set to 50 and the steadiness is 1000, when the overall revenue reaches -500, all positions with a loss can be closed.

Optimization Course of

Introduction to the Quick Genetic Primarily based Optimization Algorithm

Optimization is a vital course of for bettering the efficiency of any Knowledgeable Advisor (EA). The Quick Genetic Primarily based Algorithm is a complicated method that makes use of ideas of genetics and evolution to seek for the very best parameter combos. This algorithm considerably hurries up the optimization course of, permitting for the environment friendly and efficient exploration of a variety of configurations.

This technique mimics pure choice, combining and mutating enter parameters to search out optimum settings that maximize the EA’s efficiency. It’s particularly helpful when coping with a lot of variables and potential combos, as is the case with the Scalper Deriv EA.

Modeling Choice

For variations above 1.02, it is suggested to make use of “1 minute OHLC” for a quicker optimization course of.

Optimization Interval

Apply the 10 to 1 precept:

- For acquiring a setfile for a day, optimize with knowledge from the final 10 days.

- For a weekly setfile, optimize with knowledge from the final 10 weeks.

- For a month-to-month setfile, optimize with knowledge from the final 10 months.

Optimization: Standards Choice

Funded Accounts or Prop Companies

For customers working with funded accounts or prop corporations, it is essential to keep up strict management over threat and drawdown. Due to this fact, it is suggested to pick one of many following optimization standards:

- Drawdown min: Minimizes drawdown to keep up account stability.

- Complicated Criterion max: Balances profit-seeking with drawdown management.

Moreover, set the “Basic Cease Loss” parameter beneath 5. This ensures that the EA will robotically shut all positions if the drawdown approaches 5%, thus defending the account from extreme losses.

Common Accounts

For customers with common accounts who wish to maximize income, even when it means taking up larger threat, they could take into account the next optimization standards:

- Steadiness Max: This criterion maximizes the account steadiness, searching for excessive returns in a brief interval, with related dangers.

- Revenue Issue Max: This criterion maximizes the revenue issue, which is the ratio between gross revenue and gross loss. A excessive revenue issue signifies a extra worthwhile and secure technique over time.

On this case, customers could go for a extra versatile “Basic Cease Loss” worth, relying on their threat tolerance and efficiency targets.

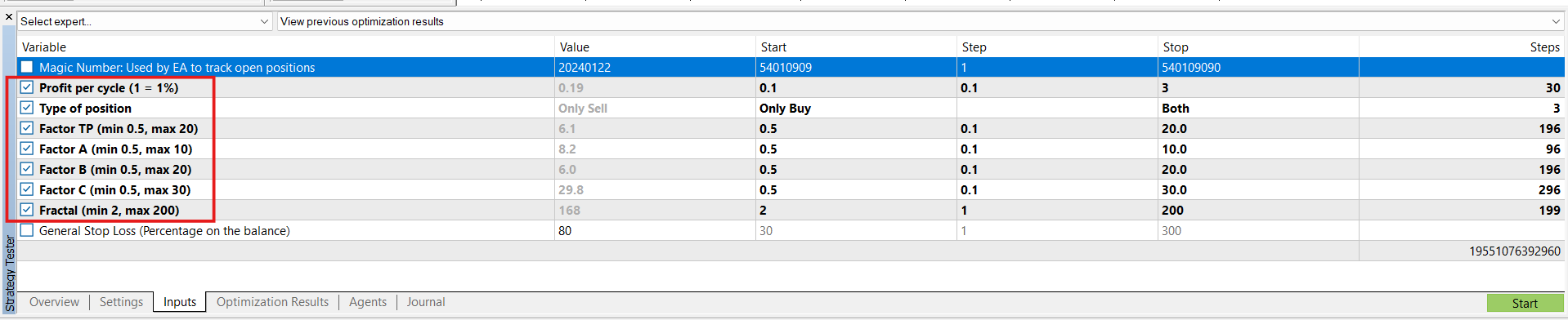

Clarification of the Inputs Tab

The Inputs tab in MetaTrader 5’s Technique Tester permits you to configure and optimize the parameters of the Knowledgeable Advisor (EA). On this instance, solely the parameters inside the crimson field ought to be chosen and optimized. Under is an outline of every of those parameters, explaining their objective and the vary of values used for optimization.

Enter Parameters

1. Revenue per cycle (1 = 1%)

– Description: Defines the share of revenue sought when reaching the take revenue (TP). For instance, if the steadiness is 1000 and the “revenue per cycle” is 1, the revenue can be 10 (1% of 1000) when the TP is reached.

– Present Worth: 0.19

– Optimization Vary:

– Begin: 0.1

– Step: 0.1

– Cease: 3

2. Sort of place

– Description: Defines the kind of trades the EA will execute (purchase, promote, or each).

– Present Worth: Solely Promote

– Optimization Vary:

– Choices: Solely Purchase, Solely Promote, Each

3. Issue TP (min 0.5, max 20)

– Description: This summary parameter from the mathematical mannequin defines the space of the TP. The decrease the quantity, the nearer the TP can be.

– Present Worth: 6.1

– Optimization Vary:

– Begin: 0.5

– Step: 0.1

– Cease: 20

4. Issue A (min 0.5, max 10)

– Description: Defines the frequency of trades. The decrease the worth, the upper the frequency of trades.

– Present Worth: 8.2

– Optimization Vary:

– Begin: 0.5

– Step: 0.1

– Cease: 10

5. Issue B (min 0.5, max 20)

– Description: Defines the frequency of trades. The decrease the worth, the upper the frequency of trades.

– Present Worth: 6.0

– Optimization Vary:

– Begin: 0.5

– Step: 0.1

– Cease: 20

6. Issue C (min 0.5, max 30)

– Description: Defines the frequency of trades. The decrease the worth, the upper the frequency of trades.

– Present Worth: 29.8

– Optimization Vary:

– Begin: 0.5

– Step: 0.1

– Cease: 30

7. Fractal (min 2, max 200)

– Description: Variety of candles within the M1 timeframe thought-about to determine the final related excessive and low.

– Present Worth: 168

– Optimization Vary:

– Begin: 2

– Step: 1

– Cease: 200

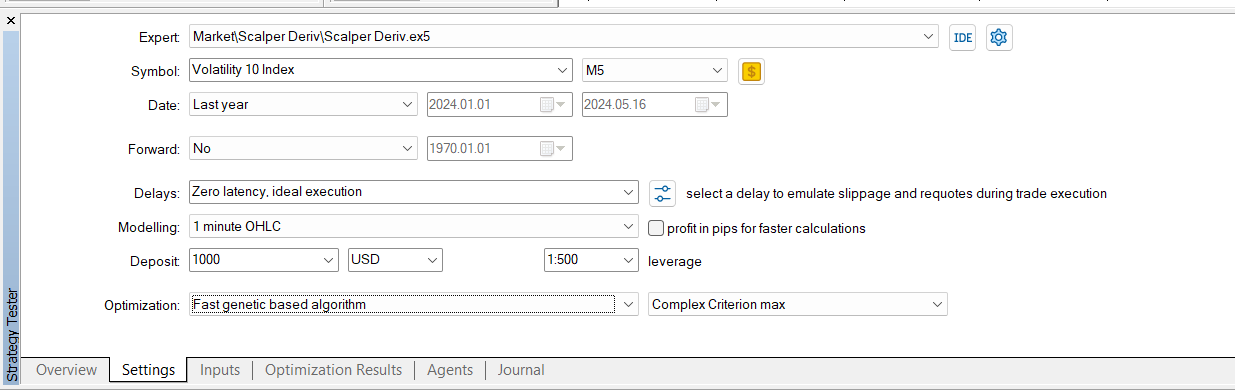

Steps for Optimization

1. Preliminary Setup:

– Choose the Knowledgeable Advisor (Scalper DerivScalper Deriv.ex5) and the image (Volatility 10 Index). That is simply an instance; you may choose any image.

– Configure the timeframe (M5) and the date vary (Final 12 months, 2024.01.01 – 2024.05.16). You’ll be able to choose any timeframe; M5 is simply a part of the instance. The date vary ought to take into account the ten to 1 precept.

– Choose the modeling sort (“1 minute OHLC”) for a quicker optimization.

– Set the preliminary deposit (1000 USD) and leverage (1:500). You’ll be able to choose any preliminary deposit and leverage values.

2. Optimization Algorithm Setup:

– Select the optimization algorithm (“Quick genetic primarily based algorithm”).

– Choose the suitable optimization standards:

– For funded accounts: It isn’t beneficial to pick Steadiness Max. Use standards like Drawdown min or Complicated Criterion max.

– For normal accounts: Any optimization criterion may be chosen, however Complicated Criterion max is beneficial.

3. Enter Parameters Setup:

– Modify the enter parameters utilizing the beginning, step, and cease values indicated above.

4. Begin the Optimization:

– Click on the “Begin” button to start the optimization.

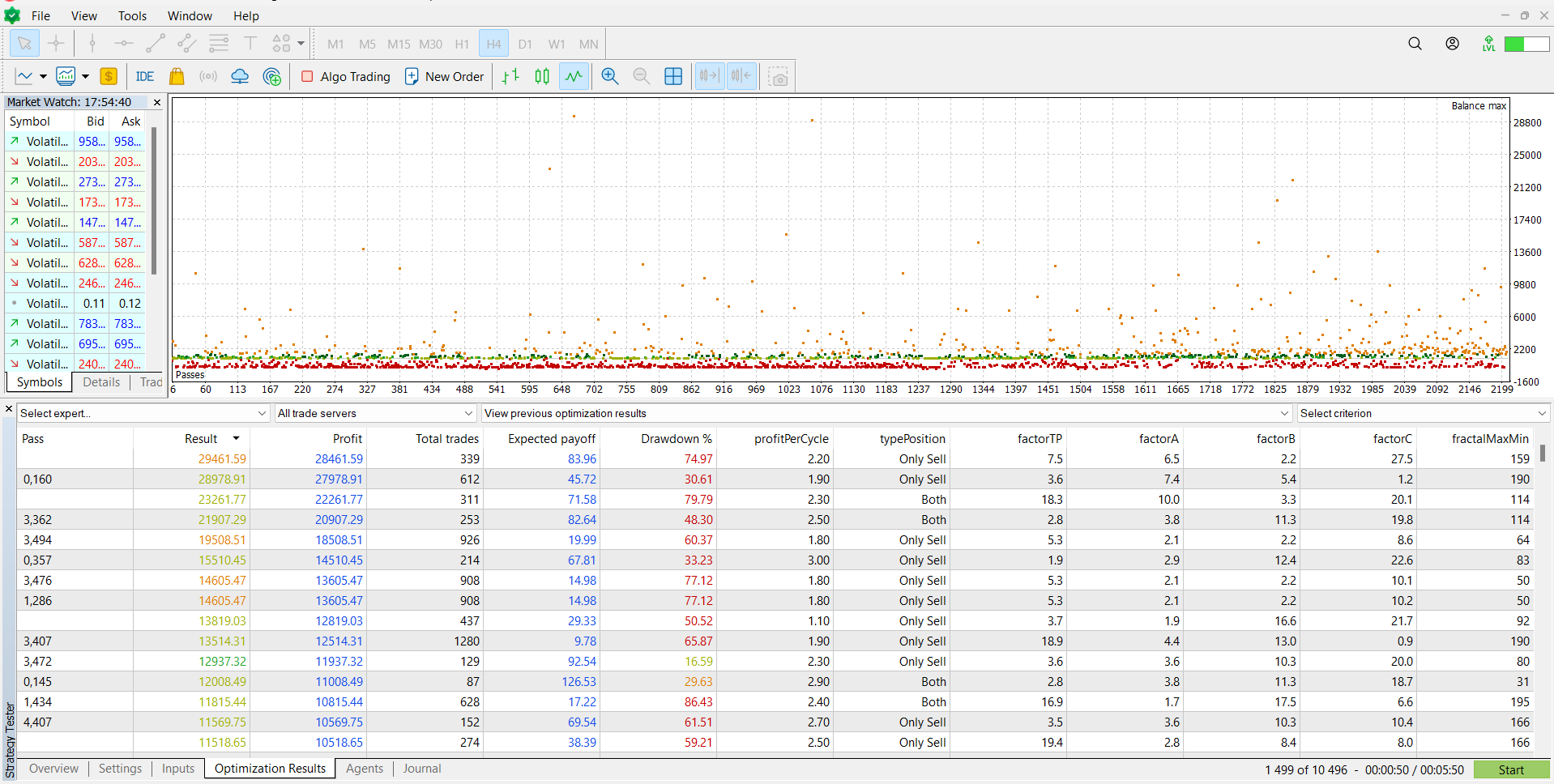

Interpretation of Optimization Outcomes

On the finish of the optimization course of, you will note a outcomes window much like the one proven beneath. Understanding this output is essential for choosing the right setfile on your buying and selling technique.

Key Metrics

1. Move: The variety of optimization iterations accomplished. Every cross represents a novel mixture of enter parameters examined in the course of the optimization course of.

2. End result: The general efficiency rating for every cross. That is usually primarily based on the chosen optimization standards, similar to steadiness or drawdown.

3. Revenue: The overall revenue generated by the EA in the course of the optimization interval.

4. Whole trades: The overall variety of trades executed by the EA in every cross.

5. Anticipated payoff: The common revenue per commerce, calculated as complete revenue divided by the variety of trades.

6. Drawdown %: The utmost drawdown share skilled in the course of the optimization interval. This means the biggest peak-to-trough decline within the account steadiness.

7. ProfitPerCycle: The revenue per cycle setting used within the cross.

8. TypePosition: The kind of trades executed (Solely Purchase, Solely Promote, or Each).

9. Issue TP, Issue A, Issue B, Issue C: The values of those parameters utilized in every cross.

10. FractalMaxMin: The fractal parameter setting used within the cross.

Steps to Choose the Greatest Setfile

1. Consider the Standards: Deal with passes with the very best steadiness between excessive revenue and low drawdown. The chosen standards (e.g., steadiness, drawdown) ought to information this analysis.

2. Verify Stability: Guarantee the chosen cross reveals constant efficiency throughout completely different metrics. Excessive revenue with extraordinarily excessive drawdown is probably not fascinating.

3. Overview Commerce Frequency: Guarantee the overall variety of trades is affordable. Too few trades would possibly point out inadequate knowledge, whereas too many trades might sign over-optimization.

4. Analyze Anticipated Payoff: Greater anticipated payoff signifies extra environment friendly buying and selling. Choose passes with an excellent steadiness between anticipated payoff and drawdown.

5. Consistency of Parameters: Guarantee the chosen setfile has constant and logical parameter values. Excessive values could counsel overfitting.

6. Export Setfile: When you determine the very best cross, export the setfile to be used in dwell buying and selling or additional testing. In MetaTrader 5, right-click on the specified cross and choose “Save as Setfile”.

Instance

Within the supplied picture, the cross with the very best result’s “Move 0,160” with a revenue of 29,879.91 and a drawdown of 30.61%. Regardless of the excessive revenue, the drawdown is comparatively excessive, suggesting a better threat technique. Evaluate it with different passes to discover a steadiness that matches your threat tolerance.

By fastidiously analyzing the optimization outcomes, you may determine essentially the most strong and worthwhile setfiles on your Scalper Deriv EA. This course of helps guarantee your buying and selling technique is each efficient and sustainable.

Conclusion

Understanding and analyzing the optimization outcomes is essential for maximizing the efficiency of your Scalper Deriv EA. By following this information and choosing the right setfile, you may improve your buying and selling technique and obtain extra constant outcomes. Bear in mind, the secret’s to steadiness profitability and threat administration.

Further Sources

For a complete tutorial on the way to optimize your Scalper Deriv EA, watch our YouTube tutorial

Discover all of our Knowledgeable Advisors and improve your buying and selling expertise by visiting our MQL5 profile.

For buying and selling, we suggest utilizing this dealer.