In an evaluation shared by way of X, famend crypto analyst Ted (@tedtalksmacro) has offered compelling proof to help his assertion that the present Bitcoin bull run is much from over. Ted’s insights are based mostly on 4 important indicators associated to conventional finance and crypto liquidity, every pointing to sustained progress within the close to future. Right here’s a breakdown of his evaluation:

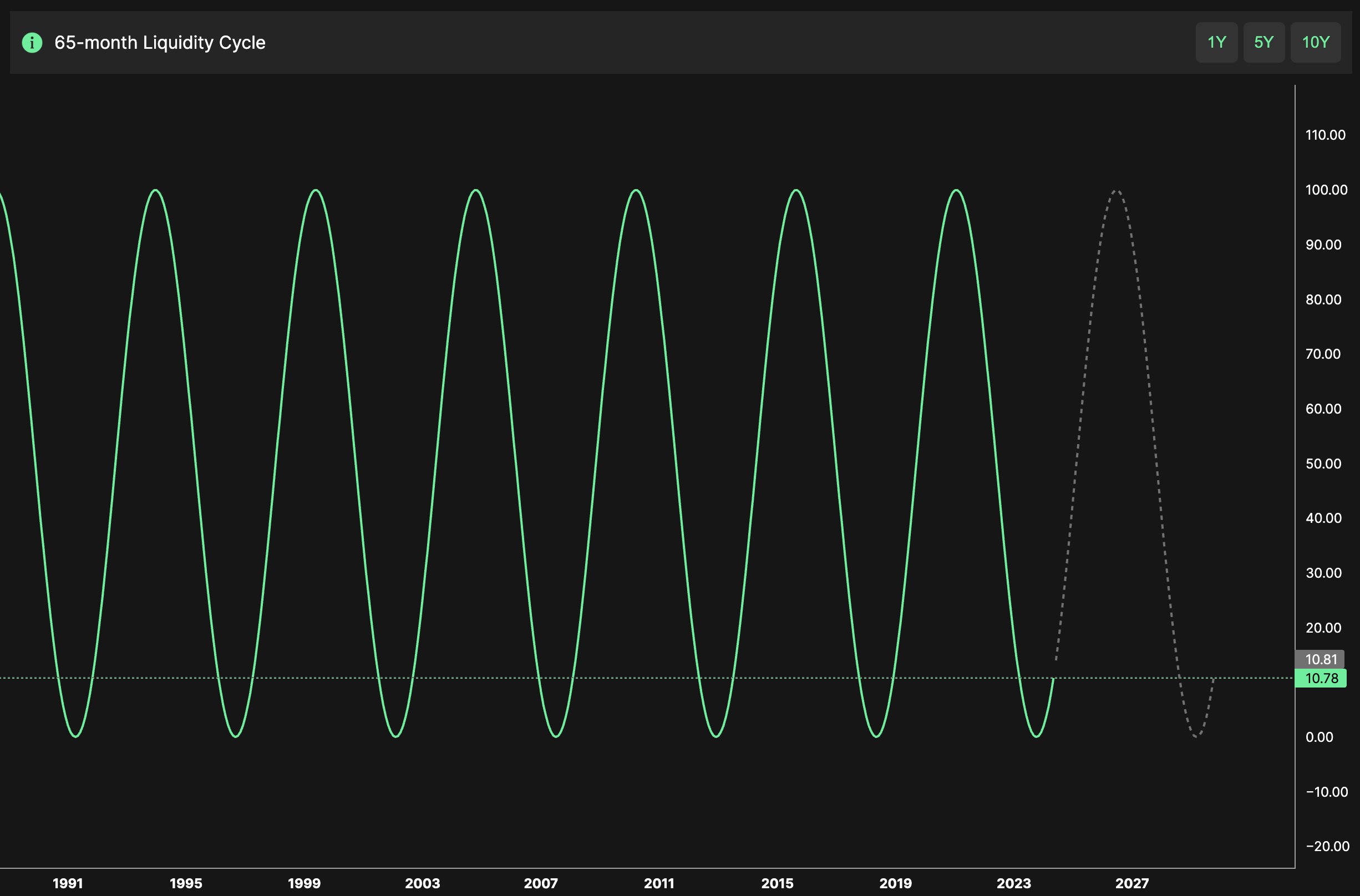

#1 65-Month Liquidity Cycle

Ted highlights the 65-month liquidity cycle, a historic sample that marks the ebb and movement of liquidity in monetary markets. Based on his evaluation, this cycle bottomed out in October 2023, signaling the start of a brand new growth section.

“We are actually within the growth section, which is predicted to peak in 2026,” Ted said. This projection aligns with the anticipated easing by central banks in response to slowing financial knowledge over the subsequent 18 to 24 months. Traditionally, elevated liquidity has been a precursor to bull markets in numerous asset lessons, together with Bitcoin and the broader crypto ecosystem.

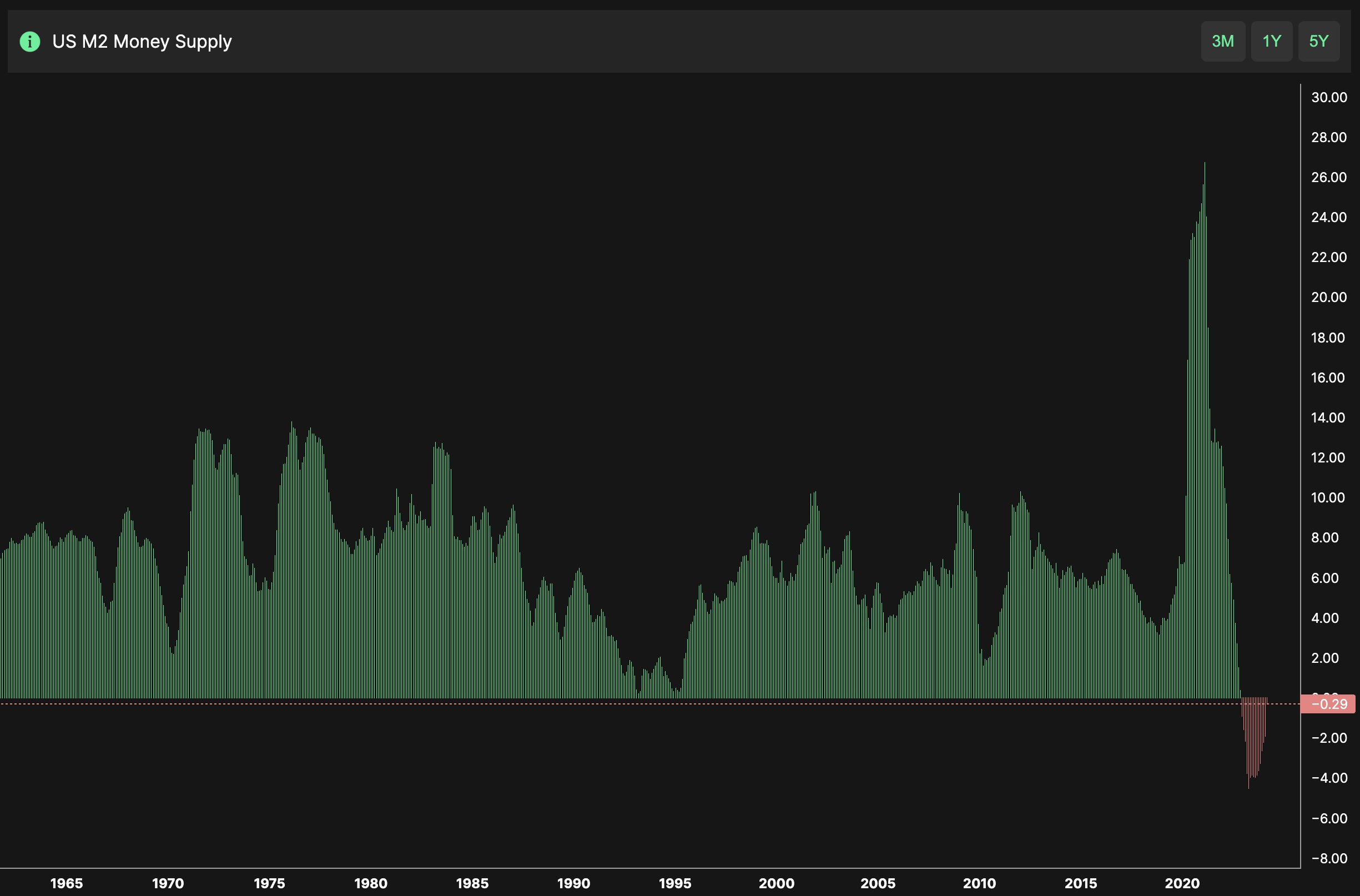

#2 M2 Cash Provide

The M2 cash provide, which incorporates money, checking deposits, and simply convertible close to cash, is one other essential indicator, if not the most necessary indicator of worldwide liquidity. Ted notes that the speed of growth within the M2 cash provide is at its lowest because the Nineties.

“There’s loads of room to the upside for relieving liquidity circumstances,” he defined. As central banks probably ease financial insurance policies to stimulate economies, elevated M2 progress may result in extra capital flowing into threat belongings like Bitcoin.

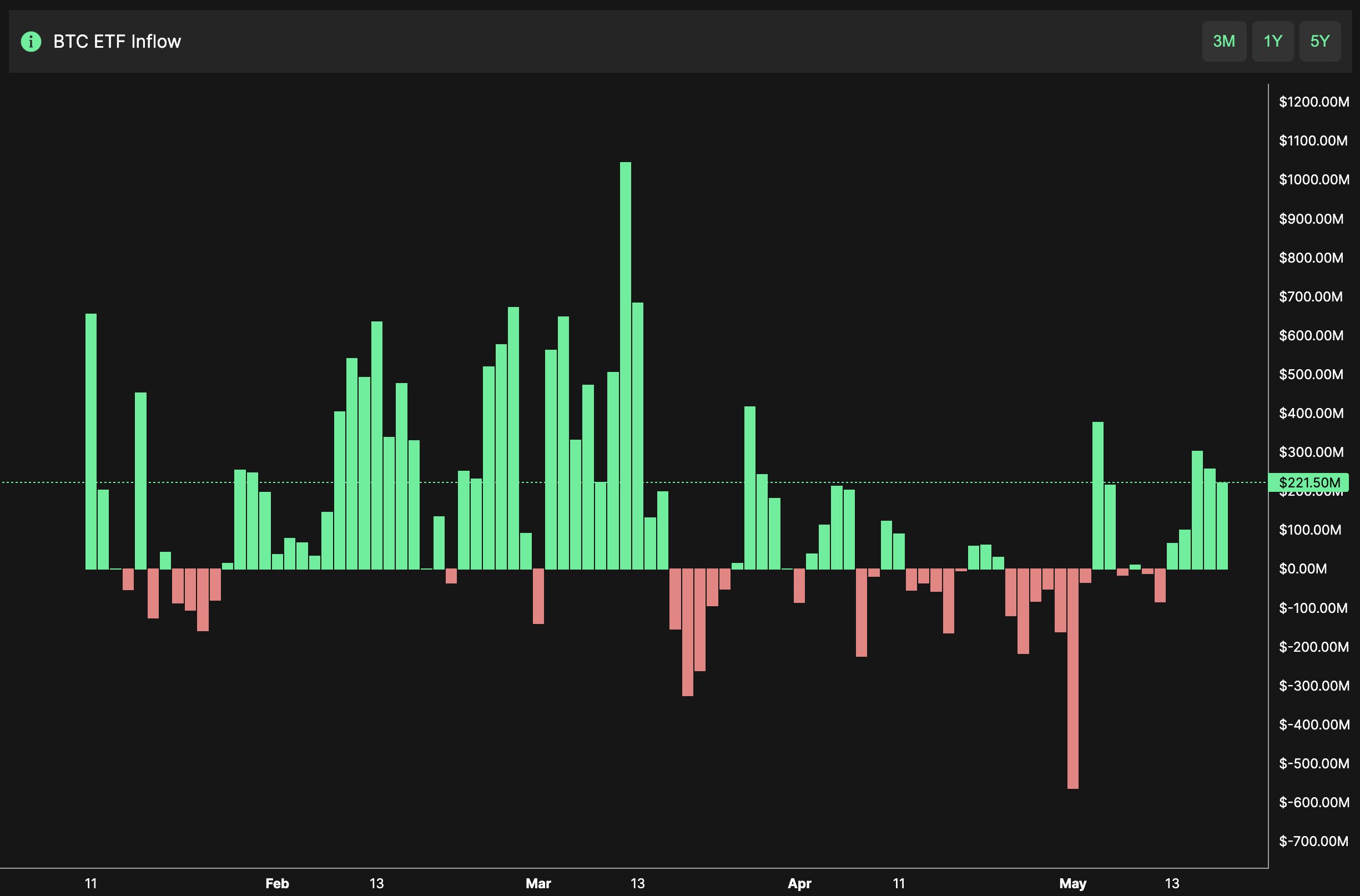

#3 Crypto Liquidity

Whereas liquidity has returned to the crypto markets, notably with the introduction of spot Bitcoin ETFs, Ted factors out that the rate of inflows has not but reached the degrees seen at cycle tops. “The speed of influx has not but seen a manic section in step with cycle tops,” he famous.

Associated Studying

This means that whereas curiosity and funding in Bitcoin are rising, the market has not but reached the speculative frenzy that usually precedes a serious correction. This section of measured influx can present a extra secure basis for continued value will increase.

#4 Spot Bitcoin ETF Flows

The US based mostly spot Bitcoin ETFs have seen important inflows, with final week alone witnessing $950 million flowing into spot Bitcoin ETFs within the US, the most important internet influx since March. Ted expects these inflows to extend as Bitcoin’s value rises and conventional finance buyers regain confidence within the asset.

“Count on these to solely enhance as value drifts larger and tradFi as soon as once more renew religion within the asset,” he said. The rising acceptance and funding from institutional buyers by way of ETFs are a powerful bullish indicator for Bitcoin’s continued ascent.

Every of those elements factors to a sustained and strong bull marketplace for Bitcoin. Ted’s evaluation, grounded in conventional monetary indicators and crypto-specific knowledge, gives a complete outlook on the present and future state of the Bitcoin market. As central banks probably ease financial insurance policies and institutional curiosity continues to develop, the circumstances seem ripe for Bitcoin’s bull run to increase properly into the approaching years.

At press time, BTC traded at $66,602.

Featured picture created with DALL·E, chart from TradingView.com