Fast Take

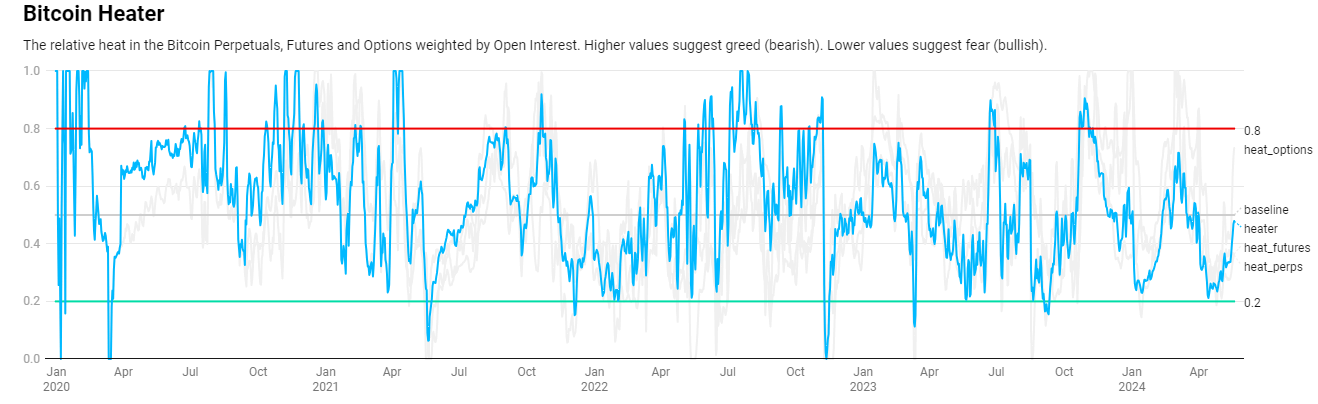

Capriole Investments’ derivatives information presents a singular lens into Bitcoin’s market well being. By analyzing Bitcoin perpetual, futures, and choices weighted by open curiosity, Capriole defines a metric that gives worthwhile insights.

Larger values on this metric point out bearishness, signaling extreme leverage and hypothesis out there. Conversely, decrease values recommend bullishness, reflecting worry amongst market contributors.

Capriole information exhibits that values above 0.8 have coincided with Bitcoin worth tops, pushed by greed and euphoria. Equally, bottoming out close to 0.2 or going under has been noticed during times of maximum worry, such because the COVID-19 crash in March 2020, the China mining ban in Might 2021, and the FTX collapse in November 2022.

Capriole information exhibits that the metric hovers across the center vary, suggesting a wholesome stability out there. This follows a current bounce off the 0.2 low in April, doubtlessly indicating some hypothesis reentering the market throughout Bitcoin’s rally to $67,000. Nevertheless, there aren’t any speedy considerations, as the present ranges don’t sign extreme greed or worry.

The submit Derivatives information monitoring Bitcoin’s response to international crises exhibits market cycle removed from over appeared first on CryptoSlate.