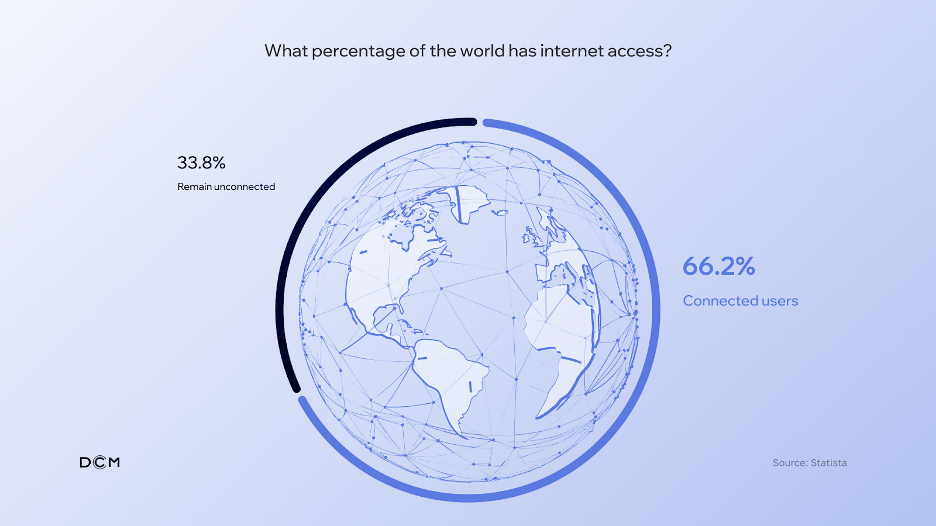

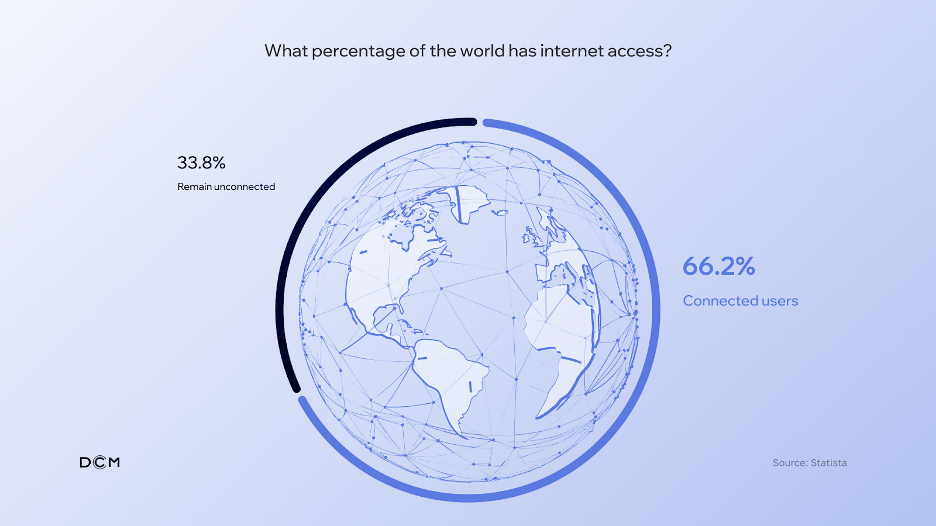

Entry to the web already appears one thing broadly accessible and unusual. Most of our each day actions, together with distant work, communication with pals and kin, funds, and extra, rely upon this facility. However is it as accessible as we predict? Chances are you’ll be shocked, however solely 66.2% of the inhabitants globally has entry to the web. Consequently, round 2.65 billion folks don’t have entry to on-line providers and, most significantly, to digital banking and related providers.

The issue could seem distant; nevertheless, I’m not speaking about some rising economies right here. Nearly six million People are unbanked. In the meantime, 1.4 billion folks outdoors of the US don’t have or can’t have a checking account. So, within the occasions once we faucet or scan to pay, and companies refuse to take money, these folks discover themselves reduce off from the civilized world.

The dependency of digital funds on the web or telecoms connectivity is an enormous drawback. Whereas we hear plenty of talks about racial wealth gaps and gender-based earnings inequality, monetary exclusion is saved low on the agenda. Nevertheless, the latter is among the contributors to world poverty, the place folks can’t entry digital monetary establishments to avoid wasting, make investments, or borrow. They aren’t welcome within the digital-first world and are pressured to use to various monetary organizations, pay excessive charges, get buried on this vicious poverty cycle, and use money. Worldpay’s International Funds Report 2024 discovered that money transaction worth totaled $6.1 trillion in 2023, in comparison with $6.7 in 2022. Let’s admit it: the YoY distinction of 8% is minimal.

Tapping into offline digital funds, nonetheless not

Growing offline digital cost options may considerably handle the problem of monetary inclusion. Nevertheless, that’s simpler stated than accomplished. The idea in a nutshell seems to be promising, but it surely faces operational, safety, and technological hurdles. These options signify an untapped market with substantial potential, highlighting the necessity for additional analysis and improvement to quantify this chance precisely.

Furthermore, we shouldn’t neglect the complexity and expense of present banking strategies. Present transaction charges are nonetheless so excessive that they’ll simply eat up a big proportion of a small switch or cost of a low-income particular person. I hear you saying that it’s one other vicious cycle, however it isn’t the case. The issue is that we’re trapped in a slender mindset concerning the kinds and methods of funds.

Taking part in trump playing cards: trendy applied sciences as offline cost enablers

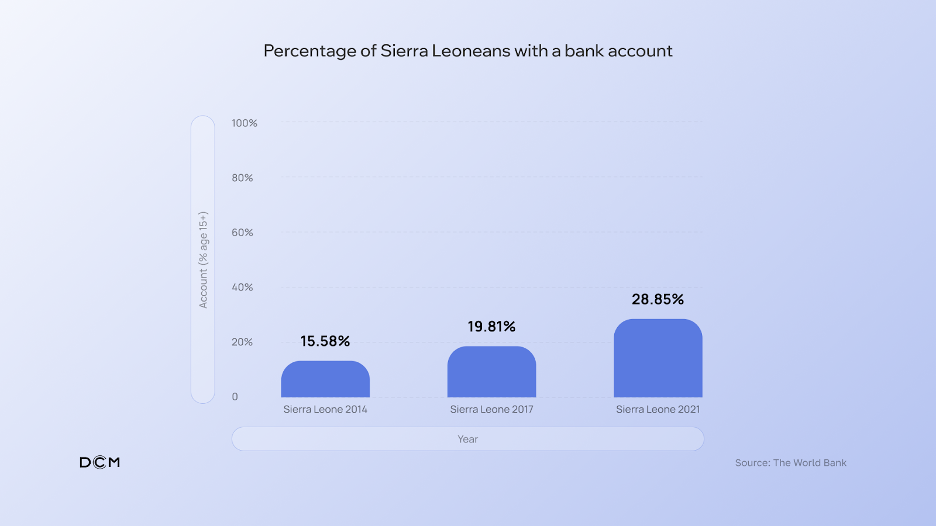

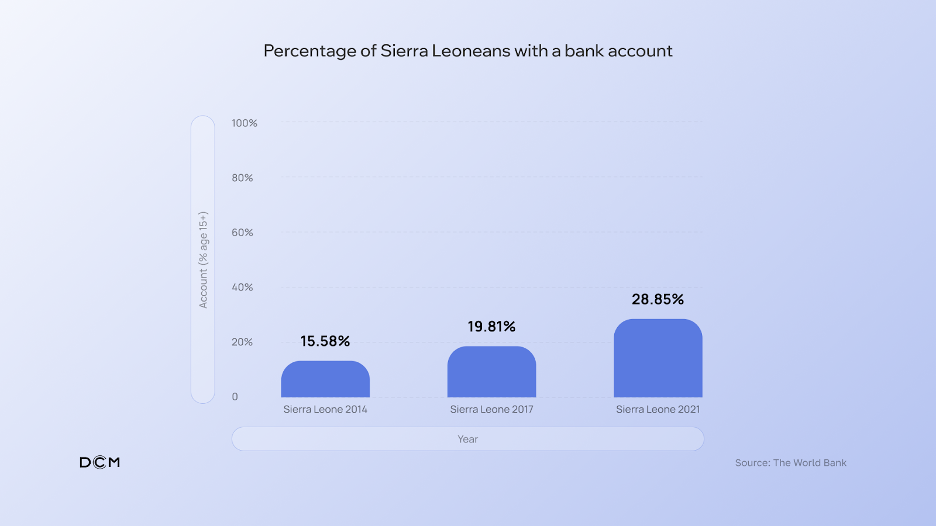

The case of Sierra Leone’s journey in direction of monetary inclusion has emphasised the function of digital monetary providers in overcoming obstacles to banking. In 2014, when the nation began receiving tech help and grants for digital monetary providers, solely 15.58% of adults had a checking account, regardless of dozens of business/neighborhood banks and a number of monetary establishments current within the nation??. In 2021, after the primary section of the Nationwide Technique for Monetary Inclusion challenge, these numbers reached 28.85%. In 2023, the federal government launched the Nationwide Fee Change—a monetary infrastructure enabling cost interoperability amongst banks, fintechs, and different establishments.

Admittedly, a lot work is forward, however Sierra Leone’s case is one other proof that trendy applied sciences are the accelerants of inclusive monetary providers. Using blockchain expertise, Central Financial institution Digital Currencies (CBDCs), and stablecoins might be pivotal in implementing offline cost infrastructures. These applied sciences provide a basis for reasonably priced, safe, and accessible monetary providers for unbanked populations. How can they make it potential?

Enabling offline transactions for the ‘not-so-digital’ world

There are numerous methods for offline digital funds, together with close to area communication (NFC) wallets, QR codes, and token-loaded notes. Every method has its personal set of challenges and concerns, together with machine dependency, infrastructure wants, and the necessity to combine these applied sciences into present monetary methods. So, let’s look nearer at every of them.

- Close to area communication (NFC) wallets, playing cards, and units that comprise stability knowledge and are in a position to wirelessly share it with different units in shut proximity. Offline NFC funds are supported by some apps and playing cards; nevertheless, they primarily provide restricted performance or permit transfers inside a sure restrict. Problem: The necessity for a tool that prompts and helps NFC expertise.

- QR code as a cost service is a extra handy and inclusive method to allow offline funds. Usually, shoppers might face particular limits associated to the quantity or variety of offline transactions launched for safety causes. Plus, QR-code cost nonetheless requires a pockets to retailer stability knowledge and infrastructure to lock the transaction quantity. However regardless of that, it’s one of the best ways to course of offline funds to this point. Problem: The necessity for expertise to learn or course of QR codes.

- Token-loaded notes—a blockchain offline pockets to retailer belongings, aka Ledger pockets, within the type of a banknote or some other handy service that may be loaded with forex to spend offline by dealing with the be aware to a different individual offline, like conventional money. Although it’s the most futuristic however but dependable method to allow offline cost utilizing digital cash as they’ll simply be transferred from such note-based wallets to digital wallets and vice versa. Problem: The necessity for NFC or particular minting units.

The highest-priority job for expertise firms will not be about giving the unbanked entry to conventional banks. Usually, low-income folks gained’t meet their standards, reminiscent of charges, minimal balances, credit score scoring, or others, and thus stay unbanked. The purpose right here is to supply an alternate means for them to entry the benefits of the digital financial system. Blockchain expertise not solely helps the event of digital cost options but in addition performs a vital function in enhancing financial circumstances for unbanked populations. Digital banking, credit score, and retirement financial savings might turn out to be accessible to much more folks globally, making certain stability and monetary safety.

Blockchain-enabled options can facilitate safe and environment friendly transactions, thus eradicating obstacles to monetary inclusion. By doing so, firms can foster and help extra sustainable and equitable financial improvement.