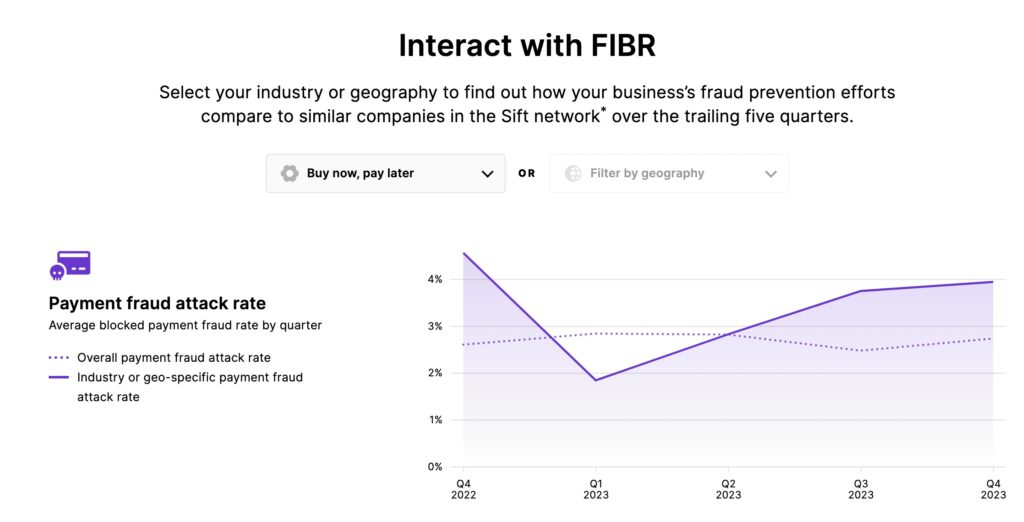

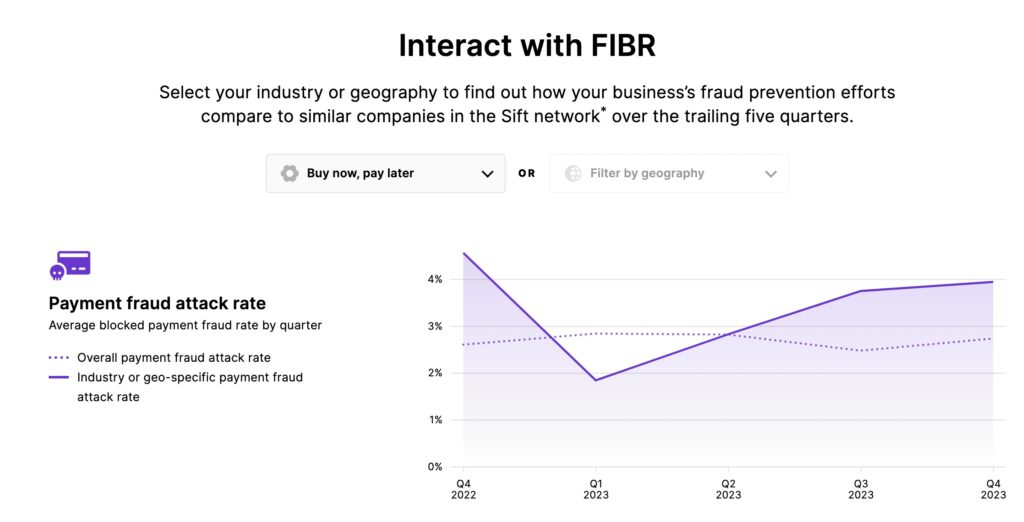

Sift’s new Fraud Business Benchmarking Useful resource (FIBR) lets fraud and threat professionals see how their enterprise’ safety instruments stack up towards the competitors. FIBR posts fee fraud assault charges, fraudulent chargeback charges, and handbook evaluation charges towards aggregated business averages over time, utilizing Sift’s one trillion-plus processed transactions. Charges are damaged down by business and geography.

CMO Armen Najarian stated he usually hears from executives questioning how their fraud charges examine to their opponents. Throughout industries and geographies, Sift clients see a median fee fraud assault (block) fee of two.5%. That’s tried fee fraud charges that Sift detects and prevents in real-time. The Service provider Danger Council (MRC) stories a median 4% order rejection fee globally.

Sift clients common a 0.08% fraudulent chargeback fee, 97% decrease than the two.6% fee reported by the MRC. The MRC discovered international retailers manually display screen a median of 19% of all e-commerce orders. Sift slices that right down to 2.1%.

Najarian stated Sift started utilizing the information a yr in the past throughout totally different evaluations they held with purchasers. Then in early summer season, they determined to make the information out there to anybody through FIBR. With so many individuals seeking to examine themselves to the Joneses, why not let everybody do it?

At present, knowledge seekers can test both by business or geography. Quickly, they will do each and get insights on account creation, log-ins and different KPIs. With multiple yr of information, FIBR permits annual comparisons, too.

What FIBR exhibits within the Americas

A fast take a look at Central and South America fraud assault charges exhibits they’re constantly increased every quarter. Najarian means that it’s because prime fraud management use is inconsistent throughout the area. With decrease ranges of management, Latin America might invite extra fraud makes an attempt.

“This area is beginning to make investments not simply within the instruments however the folks,” Najarian stated. “We’re seeing, particularly within the final a number of quarters, extra expertise being employed, put into place and promoted. Which may clarify why we’re seeing that area overachieve within the handbook versus the remainder of the inhabitants.”

In North America, FIBR exhibits charges usually observe to international averages. There’s room for first-party (aka pleasant) fraud to work as science struggles to determine aberrant conduct from in any other case regular clients.

Crypto volumes returning

FIBR tracks many key fintech sub-sectors and in addition cryptocurrency. Najarian sees crypto transaction volumes returning. Fee fraud assault charges are increased in crypto.

“That’s simply according to not seeing full regulation in all markets with all crypto transactions,” Najarian stated. “And there’s a nuance right here the place utilizing crypto as a fee automobile is one factor we’re taking a look at. We’re additionally taking a look at shifting crypto by way of open banking. Between these two, I feel that helps the fact that with lighter regulation, particularly in some markets, with this being a more moderen area nonetheless, there’s completely some room for exploitation, and we’re seeing the assault quantity this yr was increased.”

However post-chargeback fraud charges in crypto are decrease. Najarian credit folks.

“The quantity of expertise flowing into the area is fairly robust. We’re additionally seeing, maybe, some impact on handbook evaluations. It’s more practical handbook evaluations. So regardless that the handbook evaluation fee is decrease, on the whole, versus the final inhabitants, we’re seeing some actually good skills and good management and fraud administration which are perhaps serving to to drive higher decisioning sooner.”

Additionally learn: