It has been a busy previous couple of days for the CFPB and their fintech work. For the third consecutive day this week our lead story issues actions taken by the CFPB.

This time it’s round BNPL. The CFPB is proposing new guidelines that will primarily lump BNPL in with bank cards on the subject of shopper protections.

Director Chopra has taken a eager curiosity in BNPL since turning into the CFPB’s chief. So, we knew one thing like this was coming, we simply didn’t know what type it will take.

Principally, the CFPB is saying that BNPL suppliers want to stick to the 1968 Reality in Lending Act in the identical approach that bank card corporations do. This implies price disclosures and normal practices for dealing with disputes and issuing refunds.

A lot of the main BNPL suppliers have already got procedures in place for these sorts of issues however the CFPB is arguing that it must be uniform throughout the trade.

That is an “interpretive rule,” so no new regulatory necessities are being proposed. The company will probably be looking for feedback by August 1.

Featured

> CFPB says purchase now, pay later companies should adjust to U.S. bank card legal guidelines

The purchase now, pay later market is dominated by fintech companies like Affirm, Klarna and PayPal.

From Fintech Nexus

> Rising digital spending amongst findings of Alkami, Cornerstone Advisors report

By Tony Zerucha

Cellular cost charges, energetic digital financial institution customers, and chatbot deployment are numbers on the rise in a report from Alkami and Cornerstone Advisors.

> Offline Digital Funds to Deal With Monetary Exclusion of the Non-Digital World

By Ross Kolodiazhnyi

Within the west we take it with no consideration that the overwhelming majority of individuals have web entry. However that isn’t true within the creating world. For digital funds to take off there we have to develop sturdy offline funds infrastructure.

Podcast

Brendan Carroll, Co-Founder & Senior Associate of Victory Park Capital, on the expansion of personal credit score

The Co-Founding father of Victory Park takes us by the historical past of asset backed lending, how the trade has grown, and what…

Webinar

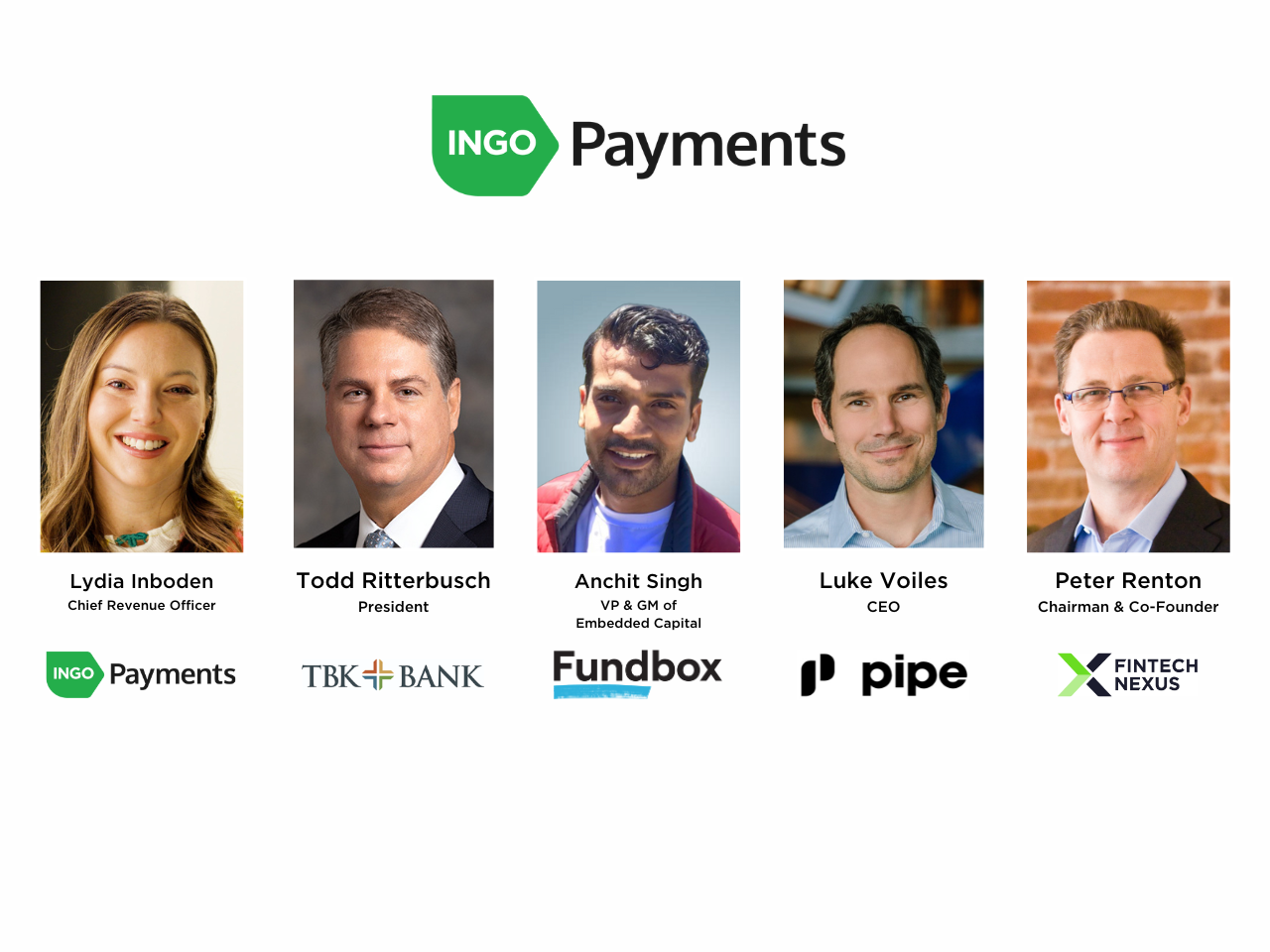

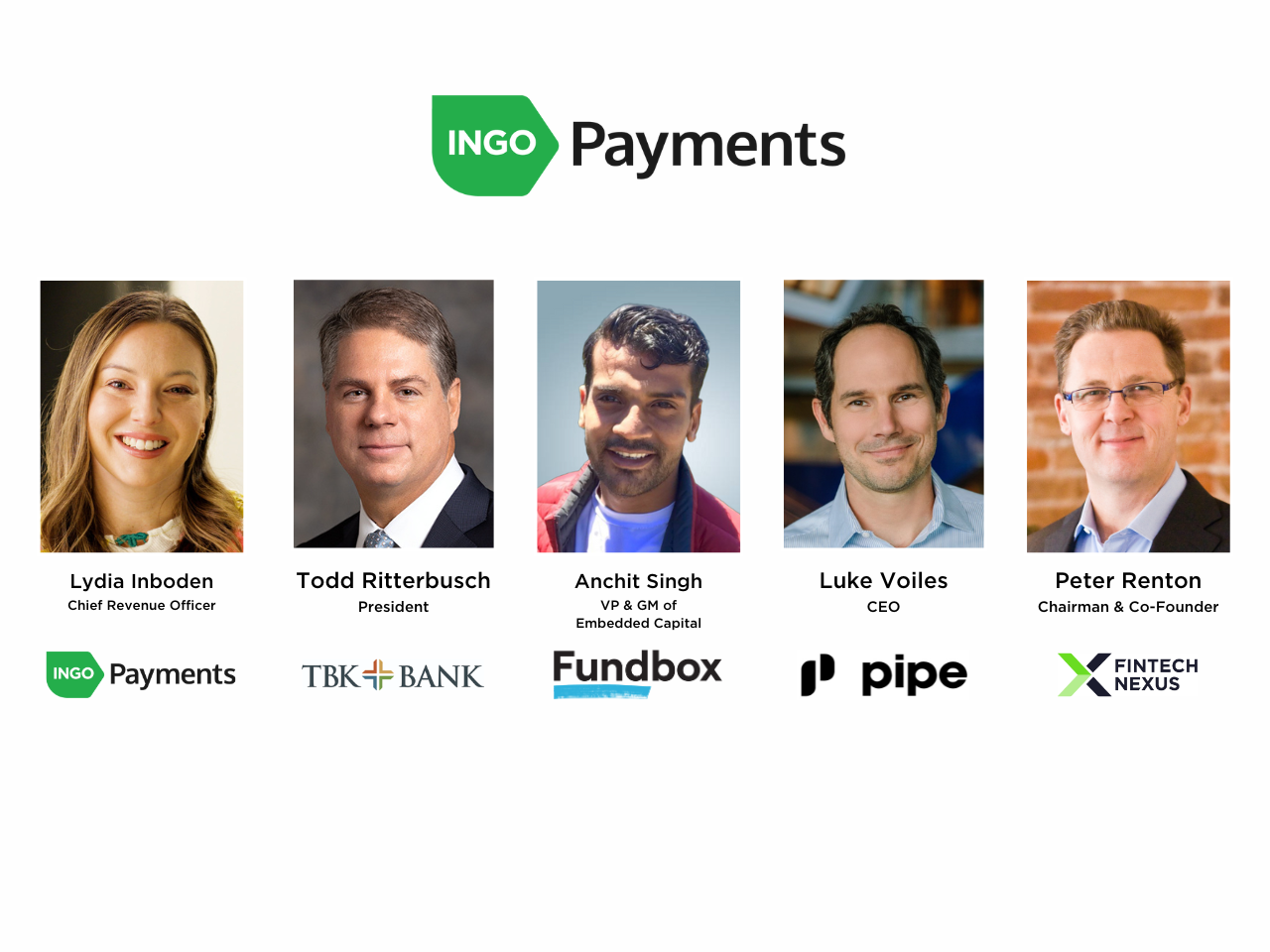

Prompt funds orchestration: a necessary instrument now for lending and factoring

Jun 5, 2pm EDT

In in the present day’s on-demand economic system, immediate funds are transferring from a nice-to-have to a must have. Within the small enterprise house,…

Additionally Making Information

- USA: Teen fintech Copper needed to abruptly discontinue its banking, debit merchandise

One other fintech startup, and its prospects, has been gravely impacted by the implosion of banking-as-a-service startup Synapse. Copper Banking, a digital banking service aimed toward teenagers, notified its prospects on Might 12 that it will be discontinuing financial institution deposit accounts and debit playing cards on Might 13.

- USA: SoLo Funds vows to struggle CFPB lawsuit

The corporate modified a number of of the practices the company complained about a number of years in the past, equivalent to threatening to report nonpaying debtors to credit score bureaus, co-founder Rodney Williams says.

- USA: SEC Chair: Home Crypto Invoice Creates ‘Immeasurable Threat’

The top of the SEC says new cryptocurrency laws will undermine his company’s work. Hours earlier than a scheduled vote Wednesday (Might 22), SEC Chair Gary Gensler issued a press release decrying The Monetary Innovation and Know-how for the twenty first Century Act (FIT 21).

- USA: Unpacking Brigit’s journey to $100 million in income

Brigit, the non-public finance administration [PFM] app, revealed final month that it achieved a major milestone, surpassing $100 million in income final 12 months. The fintech is backed by NBA [The National Basketball Association] star Kevin Durant’s Thirty 5 Ventures and Lightspeed Enterprise Companions, amongst different traders.

To sponsor our newsletters and attain 180,000 fintech fanatics together with your message, contact us right here.