Fast Take

On Might 28, the London Inventory Change opened buying and selling for crypto exchange-traded notes (ETNs), however entry was restricted to regulated monetary traders, excluding retail merchants. This growth raises questions in regards to the demand for these ETNs, particularly since European traders have already had entry to digital asset ETFs for a while now.

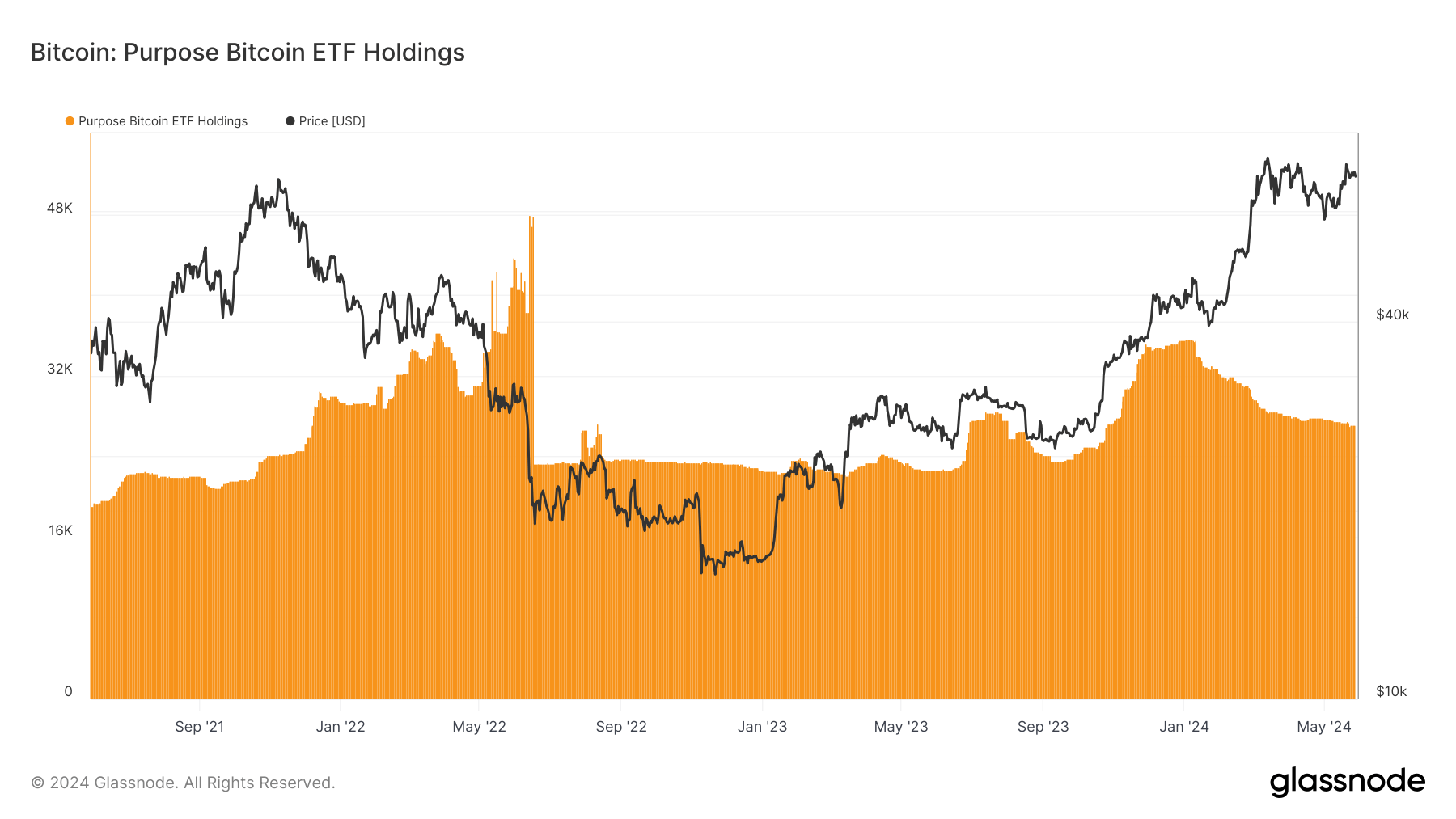

The poor begin of the UK ETNs displays broader traits, as evidenced by the restricted success of the Canadian Function spot bitcoin ETF, which presently holds round 27,000 BTC, down from its peak of practically 50,000 BTC, and the minimal traction seen with Hong Kong ETFs. Nevertheless, the US has seen great success, most notably BlackRock IBIT.

Charlie Morris, who heads up ByteTree, highlighted a poor begin for these Bitcoin ETNs, with simply 200 shares traded from 21Shares. Morris mentioned:

“In the direction of the shut, 21Shares had the tickets,”

Morris hopes this step will ultimately result in retail approval, though he finds the state of affairs peculiar as a result of lack of prior announcement or public relations efforts.

“This can be a very odd state of affairs. No warning or PR. No level besides that’s it’s hopefully a starter earlier than retail approval. However these aren’t funds, they’re simply new share lessons of current German and Swiss Bitcoin ETFs which were round for fairly a very long time”.