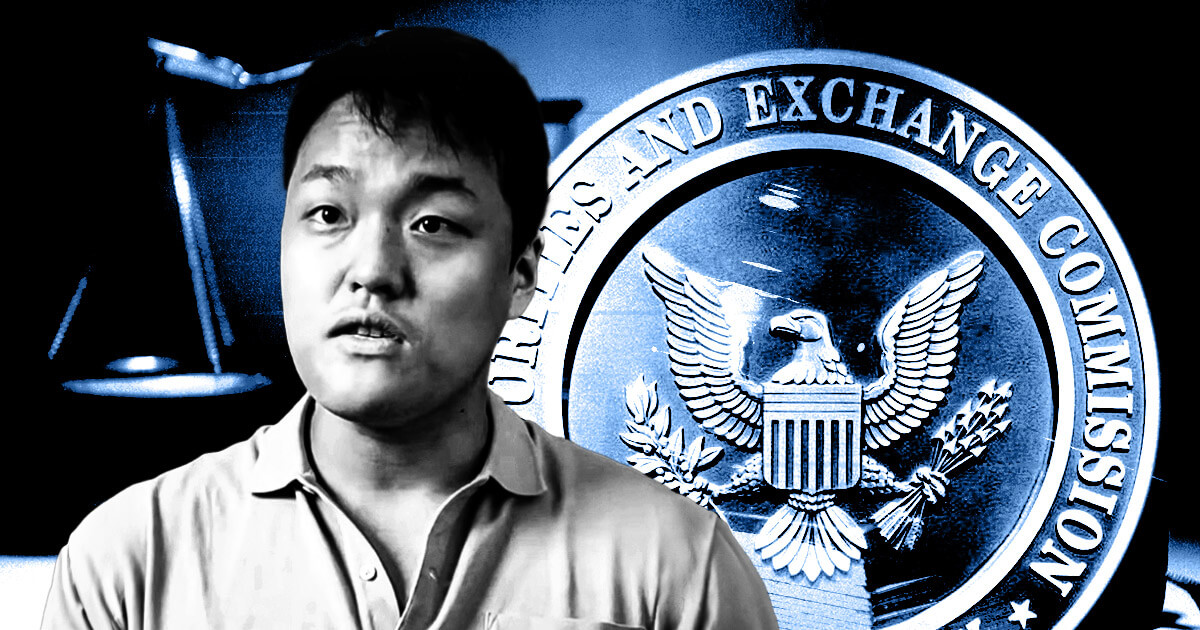

Singapore-based Terraform Labs and its founder, Do Kwon, have reached a settlement settlement with the SEC to finish the civil lawsuit filed within the US over allegations of defrauding crypto buyers.

The event comes after a jury within the US District Court docket for the Southern District of New York discovered the corporate and Kwon chargeable for civil fraud in April.

The main points of the settlement haven’t been made public as of press time. The tentative settlement was disclosed on a court docket web site. US District Choose Jed Rakoff has requested each the SEC and the defendants to submit supporting paperwork by June 12.

Civil lawsuit

The SEC accused Kwon and Terraform Labs of deceptive buyers in regards to the stability of their stablecoin, TerraUSD, and falsely claiming that their blockchain know-how was utilized in a distinguished Korean cell fee app.

The alleged fraud led to the collapse of TerraUSD and the community’s native token LUNA in Could 2022, which resulted in estimated investor losses exceeding $40 billion. The SEC described the incident as an enormous deception that worn out tens of billions in market worth nearly in a single day.

The SEC had sought vital monetary penalties, together with the relinquishment of $5.3 billion in earnings deemed ill-gotten and fines totaling $520 million for Terraform Labs and Kwon.

Nevertheless, Kwon and his firm argued that the utmost fines allowable had been considerably decrease, at $3.5 million for Terraform Labs and fewer than $1 million for Kwon.

Kwon’s imprisonment

Kwon, who faces associated felony prices in each the US and South Korea, has denied any wrongdoing. He was arrested in Montenegro in March 2023 after he tried to fly overseas utilizing pretend paperwork.

Since his arrest, Kwon has been awaiting extradition after serving a sentence in Montenegro. Montenegrin authorities have but to find out whether or not he shall be despatched to the US or South Korea.

The settlement represents a major step in addressing the fallout from one of the vital notable collapses within the crypto market and highlights the SEC’s dedication to holding events accountable for fraudulent actions within the crypto house.