EUR/USD: Awaiting a Turbulent Week

● Recall that Monday, 27 Might was a vacation within the US. Nonetheless, on Tuesday, greenback bulls took management, and the DXY Index began to rise, bolstered by a major enhance within the US Shopper Confidence Index (from 97.5 to 102.0 in opposition to a forecast of 96.0). Consequently, EUR/USD moved southward.

Strain on the euro was additionally as a consequence of expectations that the European Central Financial institution (ECB) is more likely to reduce the important thing rate of interest by 25 foundation factors (bps) from 4.50% to 4.25% at its assembly on 06 June. This intention was confirmed by the top of the Financial institution of Finland, Olli Rehn, who said on Monday that he thought of it well timed to transition to dovish rhetoric in June. Related opinions had been expressed by his colleague François Villeroy de Galhau, head of the Financial institution of France, and on Tuesday, 28 Might, by Robert Holzmann, head of the Financial institution of Austria.

● Not like the dovish stance of European officers, representatives of the Federal Reserve (Fed) take a extra stringent place and need to make sure that US inflation is steadily shifting in direction of the two.0% goal.

Recall that the report launched on 15 Might by the US Bureau of Labour Statistics (BLS) confirmed that the Shopper Worth Index (CPI) decreased from 0.4% to 0.3% month-on-month (m/m) in opposition to a forecast of 0.4%. Yr-on-year, inflation additionally fell from 3.5% to three.4%. Retail gross sales demonstrated a fair stronger decline, dropping from 0.6% to 0.0% m/m (forecast was 0.4%). These information indicated that though inflation is resisting in some areas, it’s usually declining. If beforehand market contributors anticipated the primary price reduce on the finish of 2024 and even early 2025, after the publication of this information, talks a couple of doable Fed price reduce already this autumn resumed. Earlier than the discharge of the preliminary US GDP information, the likelihood of a price reduce in September was 41%.

● The report printed on Thursday, 30 Might by the Bureau of Financial Evaluation confirmed that, in response to preliminary information, US financial development in Q1 slowed considerably to an annualized price of 1.3%, under the forecast of 1.6% and This autumn 2023’s determine of three.4%.

Specialists attribute the weak GDP development at first of this 12 months primarily to the dynamics of client spending. In Q1, client spending elevated by 2.0%, not the beforehand anticipated 2.5%. The US Division of Commerce’s revised information additionally modified the evaluation of the Core Private Consumption Expenditures (PCE) index, which excludes vitality and meals costs. On the finish of Q1, the determine was 3.6%, not 3.7%. Analysts imagine that this decline in all indicators was attributable to a mix of things: the depletion of funds accrued by the inhabitants through the COVID-19 pandemic, the Fed’s cycle of financial tightening, and restrained earnings development.

● In opposition to this backdrop, the greenback weakened barely, and EUR/USD moved north. It obtained one other bullish impulse after Eurostat introduced on Friday, 31 Might, a preliminary estimate of inflation within the Eurozone, which accelerated for the primary time this 12 months. Thus, the annual development price of client costs (CPI) in Might was 2.6% in comparison with 2.4% in April, the bottom since November final 12 months. The consensus forecast anticipated inflation to speed up solely to 2.5%. Core inflation (CPI Core), which excludes vitality and meals costs, additionally elevated from 2.7% in April to 2.9% in Might (forecast was 2.8%). This was a wake-up name for traders who had hoped that the ECB wouldn’t solely reduce charges as soon as this 12 months however proceed to take action.

● In direction of the top of the working week, market consideration centered on US client market information. In line with the Bureau of Financial Evaluation, inflation within the nation, measured by the Private Consumption Expenditures (PCE) Worth Index, remained steady in April at 2.7% y/y. The Core PCE, which excludes risky meals and vitality costs, rose by 2.8% y/y, matching the forecast. Different report particulars confirmed that private incomes rose by 0.3% m/m in April, whereas private spending elevated by 0.2%.

● After these information, the DXY Greenback Index was beneath slight stress, and EUR/USD obtained a 3rd bullish impulse. Nonetheless, it didn’t final lengthy, and finally, in any case these fluctuations, EUR/USD returned to the Pivot Level of the final two and a half weeks, ending at 1.0848. Concerning the analysts’ forecast for the close to future, as of the night of 31 Might, all of them (100%) voted for the greenback to strengthen. This forecast is comprehensible given the anticipated ECB resolution on a price reduce on 06 June. However what if it would not occur? Or maybe this forecast has already been priced into the market? In that case, as an alternative of the greenback strengthening, we might see the other response.

All pattern indicators on D1 are 100% inexperienced, whereas solely 50% of oscillators are inexperienced, with 15% purple and 35% neutral-grey.

The closest assist for the pair lies within the 1.0830-1.0840 zone, adopted by 1.0800-1.0810, 1.0725-1.0740, 1.0665-1.0680, 1.0600-1.0620. Resistance zones are within the areas of 1.0880-1.0895, 1.0925-1.0940, 1.0980-1.1010, 1.1050, 1.1100-1.1140.

● The upcoming week appears to be very eventful and risky. On Monday, 03 June, and Wednesday, 05 June, the US Manufacturing and Providers PMI information will probably be launched. On 04, 06, and 07 June, there will probably be a slew of statistics from the US labour market, together with Friday’s essential information on the unemployment price and the variety of new non-farm jobs (NFP). Probably the most turbulent day of the week, nevertheless, is more likely to be Thursday, 06 June. On today, retail gross sales information for the Eurozone will probably be launched first, adopted by the ECB assembly. The market will probably be centered not solely on the ECB’s price resolution but additionally on the next press convention and feedback on future financial coverage.

GBP/USD: Foggy Occasions, Foggy Forecasts

● We have beforehand written that the prospects for the British forex, in addition to the nationwide financial system, look reasonably foggy. The Enterprise Exercise Index (PMI) confirmed a decline, and never simply it. A lot of the pessimism is said to the sharp drop in retail gross sales in April, which fell by 2.7% y/y in comparison with the earlier development price of 0.4%. Extra uncertainty comes from the truth that snap parliamentary elections are scheduled for 04 July. Prime Minister Rishi Sunak said that “financial instability is just the start.” This sounds horrifying, would not it? If that is just the start, what lies forward? Surprisingly, regardless of this case, the pound has been strengthening since 22 April. Throughout this era, GBP/USD rose by 500 factors and on 28 Might recorded a neighborhood most on the spherical determine of 1.2800.

● Concerning the timing of the Financial institution of England’s (BoE) rate of interest reduce, the whole lot additionally appears as foggy because the Thames mist. JP Morgan (JPM) analysts, whereas adhering to their forecast for a price reduce in August, warn that “the dangers have clearly shifted in direction of a later discount. The query now could be whether or not the Financial institution of England will be capable of ease its coverage in any respect this 12 months.” Goldman Sachs, Deutsche Financial institution, and HSBC strategists have additionally adjusted their price reduce forecasts, shifting the date from June to August.

● GBP/USD ended the week at 1.2741. Economists at Singapore’s United Abroad Financial institution (UOB) imagine that the present strengthening of the British forex has ended. UOB considers that over the subsequent 1-3 weeks, “the pound is more likely to commerce with a downward bias, however a extra important pullback would require breaking under 1.2670. Then again, if the pound breaks above 1.2770 (the ‘robust resistance’ degree), it will point out that it’ll possible commerce inside a spread reasonably than pulling again decrease.”

The median forecast of analysts for the close to time period is as follows: 75% voted for the pair to maneuver south, whereas the remaining 25% voted for a northward motion.

As for technical evaluation, not like the consultants, all 100% of pattern indicators and oscillators on D1 level north, though 15% of the latter sign overbought circumstances. If the pair continues to fall, assist ranges and zones are at 1.2670-1.2700, 1.2575-1.2600, 1.2540, 1.2445-1.2465, 1.2405, 1.2300-1.2330. If the pair rises, it would encounter resistance at ranges 1.2760, 1.2800-1.2820, 1.2885-1.2900.

● No important financial statistics are scheduled to be launched within the UK subsequent week.

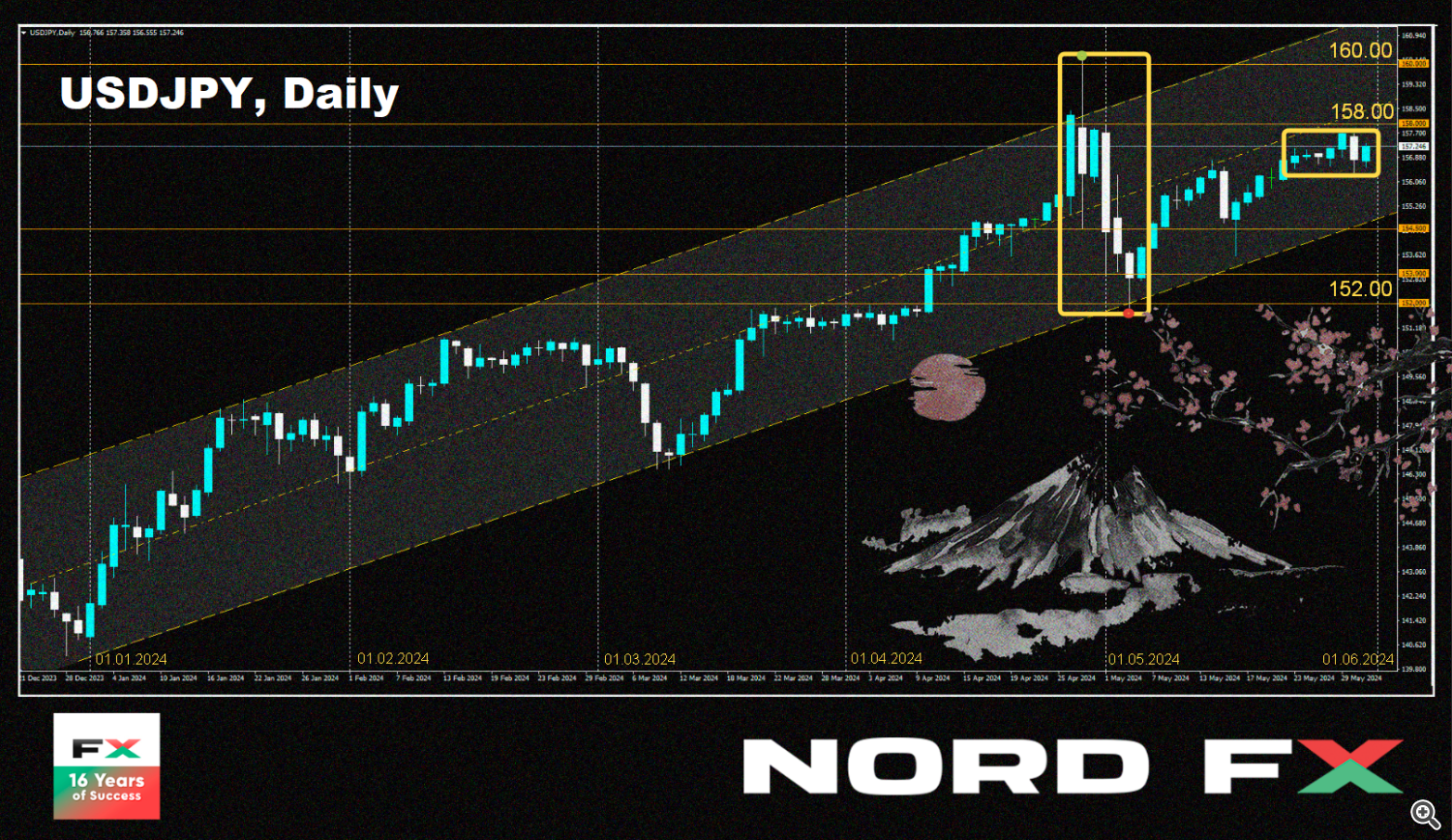

USD/JPY: A Very Calm Week

● The previous week was surprisingly calm for the yen. USD/JPY moved inside a super-narrow sideways channel of 156.60-157.00 for the primary half of the week, however then, amid US information and Japanese macro statistics, the buying and selling vary expanded barely to 156.36-157.70. In comparison with the value swings on the finish of April and early Might, it is exhausting to imagine this is identical forex pair. Apparently, Japanese monetary authorities haven’t formally confirmed whether or not they carried out intensive yen purchases on 29 April and 1 Might to assist its alternate price. Nonetheless, Bloomberg studies that evaluating deposits on the Financial institution of Japan means that round ¥9.4 trillion ($60 billion) may need been spent on these forex interventions, a brand new month-to-month report for such monetary operations.

● Nonetheless, if this $60 billion helped, it was solely barely – the greenback has already recovered half of its losses. Since rates of interest within the US and Europe haven’t but decreased, and the yen price stays extraordinarily low at 0.1%, officers from the Ministry of Finance and the Financial institution of Japan (BoJ) are attempting to purchase time till this hole begins to slim. Feedback from BoJ board member Seiji Adachi, who said on 30 Might that the Japanese central financial institution leaders might elevate the rate of interest, offered some assist for the yen. Nonetheless, the query of when this may occur stays open, and officers are reluctant to reply. In his conventional speech on Friday, 31 Might, Japan’s Minister of Finance, Shunichi Suzuki, reiterated that alternate charges ought to mirror basic indicators and that he would reply appropriately to extreme actions.

● On Friday, 31 Might, a block of necessary macroeconomic statistics on the state of the Japanese financial system was launched. The Shopper Worth Index (CPI) in Tokyo confirmed that inflation rose to 2.2% y/y in Might. In April, this determine was at 1.8%, matching a 26-month low. Core inflation in Tokyo additionally rose to 1.9% from 1.6% y/y, and the CPI excluding risky meals and vitality costs elevated from 1.8% to 2.2% y/y. (It ought to be famous that inflation in Tokyo is normally larger than the nationwide figures, that are printed three weeks later. Subsequently, the Tokyo CPI is a preliminary however not ultimate indicator of inflation dynamics on the nationwide degree.)

The present rise in inflation might enhance confidence in future BoJ financial coverage tightening. Nonetheless, the concern of low inflation and a pointy yen appreciation deters the BoJ from elevating the rate of interest and narrowing the hole with different main world currencies’ charges. A robust yen would hurt nationwide exporters. The decline in industrial manufacturing, which fell by -0.1% in April each month-on-month and year-on-year, doesn’t encourage borrowing prices to rise.

● The final word of the week for USD/JPY was struck at 157.25. United Abroad Financial institution (UOB) analysts imagine that within the subsequent 1-3 weeks, “the greenback has the potential for development, however given the weak upward momentum, any development is more likely to be sluggish. The 157.50 degree could be troublesome to beat, and resistance at 158.00 is unlikely to be reached within the close to future.”

Talking of the common forecast of consultants, solely 20% point out a southward path, whereas the remaining 80% undertake a impartial place and look east. Technical evaluation instruments present no such doubts or disagreements. Thus, 100% of pattern indicators and oscillators on D1 level north, with 15% already within the overbought zone. It ought to be famous that if the inexperienced/north coloration of the symptoms for the euro and the British pound signifies their strengthening, within the case of the yen, it conversely signifies its weakening. Subsequently, merchants could discover it fascinating to concentrate to the EUR/JPY and GBP/JPY pairs, whose dynamics have been spectacular recently.

The closest assist degree is within the space of 156.25-156.60, adopted by zones and ranges at 155.50-155.90, 153.10-153.60, 151.85-152.35, 150.80-151.00, 149.70-150.00, 148.40, 147.30-147.60, 146.50. The closest resistance is within the 157.40 zone, adopted by 157.70-158.00, 158.60, and 160.00-160.20.

● No important occasions or publications concerning the state of the Japanese financial system are anticipated subsequent week.

CRYPTOCURRENCIES: Bullish and Bearish Ethereum Prospects

● For the second week, market contributors’ consideration has been centered on the primary altcoin. On 23 Might, the US Securities and Change Fee (SEC) authorized 19b-4 purposes from eight issuers of spot exchange-traded funds based mostly on Ethereum. (In line with JP Morgan consultants, this was dictated not by a want to assist digital belongings however by a political resolution geared toward supporting Joe Biden forward of the US presidential elections.) Regardless of the true motive for this regulatory transfer, everyone seems to be now eager about the place Ethereum costs will go.

● The new child ETH-ETFs can solely begin buying and selling after the SEC approves the S-1 purposes. In line with Bloomberg analyst James Seyffart, this might take “weeks or months,” though it is rather more likely to occur in mid-June. In line with DeFiance Capital CEO Arthur Cheong, Ethereum’s value might rise to $4,500 even earlier than buying and selling begins. CCData analysts imagine that inside 100 days of the launch of ETH-ETFs, the value might attain $5,000 per coin. This forecast is predicated on linear regression and the value statistics of bitcoin after the launch of spot BTC-ETFs. CCData’s evaluation assumes that inflows into comparable Ethereum funds will probably be not less than 50% of inflows into Bitcoin-ETFs, which suggests about $3.9 billion over a 100-day interval.

● Fashionable analyst Lark Davis has forecasted future development for bitcoin to $150,000 and Ethereum to $15,000, explaining such a pointy value enhance by the rising market dynamics. The principle motive for development, Davis additionally cites spot BTC-ETFs, to which ETH-ETFs will now be a part of. This may additional gasoline the cryptocurrency market’s enthusiasm. At present, spot BTC-ETFs maintain 1,002,343 cash (≈ $68 billion), which is about 5% of the circulating provide of the flagship asset. Davis believes this spectacular determine clearly signifies rising recognition of cryptocurrency and curiosity from institutional traders, particularly from the US.

● Strike CEO Jack Mallers predicts that through the ongoing bull rally, bitcoin might attain $250,000 and presumably rise in value to $1 million. On a podcast with Pomp Investments founder Anthony Pompliano, Mallers defined his daring forecast by stating that bitcoin remains to be at an early stage of improvement. In line with him, the bond market is presently going through issues, so central banks could inject a major quantity of liquidity into the monetary system to stabilize it. This liquidity inflow will set off a rise within the worth of dangerous belongings, together with the main cryptocurrency.

Jack Mallers disagrees with the notion that bitcoin is a bubble or a instrument for hypothesis. The asset is changing into more and more standard amongst monetary giants on Wall Road, and its restricted provide of 21 million cash makes BTC extremely immune to inflation, not like fiat currencies and gold. “Bitcoin will be referred to as the toughest type of cash – because of the fastened issuance schedule and halvings each 4 years. The discharge price of recent cash progressively decreases, thereby growing bitcoin’s long-term worth,” argued the Strike CEO.

● Analysts from monetary funding firm Motley Idiot additionally goal a six-figure quantity. They urged that bitcoin’s price might rise to $400,000 and presumably even attain $1 million. The rationale, which has been talked about many occasions, is the inflow of cash from institutional traders by spot ETFs. Motley Idiot analysts famous that increasingly more pension funds and hedge funds, managing multi-billion greenback sums, are coming into the bitcoin market. Due to cryptocurrency ETFs, they will simply embody bitcoin (and shortly Ethereum) of their funding portfolios.

In line with analysts, round 700 funding corporations have already invested in such funds. Nonetheless, the share of institutional traders in bitcoin-ETFs is presently solely about 10% of the overall. Motley Idiot estimates that if monetary establishments make investments about 5% of their belongings in bitcoin, the market capitalization of the primary cryptocurrency might exceed $7 trillion, which explains its forecasted price of $400,000.

● Significantly much less optimism was heard within the forecast of Bloomberg senior analyst Mike McGlone. In line with him, bitcoin’s volatility leaves it trailing gold and the US greenback in funding enchantment. Moreover, he believes that shares will quickly crash amid the anticipated recession, however BTC will endure much more than the inventory market. McGlone emphasised that the Tether (USDT) stablecoin, pegged to the US greenback, sometimes trades twice as a lot per day as bitcoin. “I can entry the US greenback wherever on this planet from my telephone utilizing Tether. Tether is the primary buying and selling token. It is the primary cryptocurrency for buying and selling. It is the greenback. The entire world has moved to the greenback. Why? As a result of it is the least dangerous of all fiat currencies,” the Bloomberg knowledgeable said.

● Whereas Mike McGlone merely downgraded bitcoin’s attractiveness, Cardano founder Charles Hoskinson merely buried it. He equated bitcoin to a faith and said that the trade has outgrown its dependence on it. In line with Hoskinson, “the trade now not wants bitcoin to outlive.” He identified crucial threats to the main cryptocurrency, together with inadequate adaptability and dependence on the Proof-of-Work algorithm.

Franklin Templeton analysts, quite the opposite, contemplate L2 protocols, together with Ordinals, Runes, and DeFi primitives, as one of many principal drivers of bitcoin’s innovation revival. Strike CEO Jack Mallers defended the primary cryptocurrency. In line with him, the Lightning Community, created for fast and low-cost transactions, a second-layer resolution based mostly on the BTC blockchain, can additional enhance the demand for the primary cryptocurrency. Mallers believes that because of this, bitcoin can be utilized for on a regular basis purchases, akin to paying for a cup of espresso. Former BitMEX CEO Arthur Hayes referred to as the native token of the Cardano blockchain (ADA) “canine shit” as a consequence of its low use in protocols.

● As of the time of scripting this assessment on the night of Friday, 31 Might, ADA is buying and selling at 0.45 USD per coin, whereas bitcoin and Ethereum are faring considerably higher: BTC/USD is buying and selling at $67,600, and ETH/USD at $3,790. The full cryptocurrency market capitalization is $2.53 trillion ($2.55 trillion per week in the past). The Bitcoin Concern & Greed Index remained virtually unchanged over 7 days, staying within the Greed zone at 73 factors (74 per week in the past).

● It ought to be famous that ETH/USD failed to interrupt by the $4,000 resistance this previous week. The native most was recorded on Monday, 27 Might, at $3,974. The dearth of a direct pump is defined by the truth that everybody who wished to purchase Ethereum in anticipation of the SEC’s historic resolution already did so. In the meantime, in response to some analysts, there’s a excessive likelihood that instantly after the launch of the long-awaited spot alternate funds, Ethereum will enter a deep drawdown, much like what occurred in January with bitcoin. Then, over 12 days, it fell by 21%.

One of many key causes for BTC’s drawdown at the moment was the unlocking of GBTC fund belongings from Grayscale, which was transformed right into a spot fund from a belief. It started dropping investments each day at a price of $500 million. It’s doable that one thing comparable might occur with Ethereum, the place Grayscale’s ETHE fund holds $11 billion value of ETH. As quickly as this fund is transformed right into a spot fund and its belongings are unlocked, short-term traders may begin taking income, doubtlessly inflicting ETH/USD to fall to the robust assist zone of $2,900-3,200.

● Pessimists amongst bearish components additionally cite the unsure authorized standing of the altcoin, because the SEC has not but clearly outlined whether or not ETH is a commodity or a safety. Moreover, the regulator has many complaints concerning the staking program.

Staking is a option to earn cryptocurrency by “locking” a specific amount of cash in a pockets on the Proof of Stake (PoS) algorithm to assist the community. In return, the consumer receives rewards within the type of further cash. In line with Wall Road legend Peter Brandt, “the largest disasters within the cryptocurrency sphere which might be but to occur will probably be associated to staking.” The knowledgeable famous that such belongings as Ethereum are sometimes rented out to earn such earnings, typically within the type of curiosity, which strongly reminds him of collapsed monetary pyramids. As staking turns into extra widespread, Brandt warned, it might entice elevated consideration from central banks, treasuries, and different authorities. This might result in tighter regulation, considerably altering the crypto area and doubtlessly ensuing within the cessation of staking and bankruptcies for these concerned.

NordFX Analytical Group

Discover: These supplies aren’t funding suggestions or tips for working in monetary markets and are supposed for informational functions solely. Buying and selling in monetary markets is dangerous and can lead to an entire lack of deposited funds.

#eurusd #gbpusd #usdjpy #Foreign exchange #forex_forecast #signals_forex #cryptocurrency #bitcoin #nordfx