Money stream underwriting has been “the following large factor” in lending for a number of years now. And whereas a number of lenders are utilizing it as a part of their underwriting, it has not develop into a mainstream instrument. That would change with the announcement immediately from Plaid.

Whereas Plaid first introduced a money stream underwriting initiative a yr in the past, immediately, they’re taking it to the following stage with the launch of Client Report,

Let’s step again for a minute. Plaid turned a shopper reporting company (CRA) final yr, and the company is named Plaid Test. This had profound implications for its money stream underwriting targets. When you’re a CRA you may present not simply information however, most significantly, insights from that information that lenders can use for underwriting. In case you are not a CRA, you can not present such insights.

This is a crucial level as a result of most lenders don’t need to cope with money stream information itself, as it’s notoriously advanced and convoluted. The worth is in offering insights into that information.

So, Plaid will now present lenders with insights from as much as 24 months of consumer-permissioned checking account information. It should additionally present Revenue Insights, which verifies a shopper’s potential to pay. However what is probably most fascinating in immediately’s announcement is Plaid’s expanded partnership with Prism Knowledge, which is able to present a singular money stream danger rating.

Prism Knowledge was spun out of bank card fintech Petal final yr and has been powering credit score merchandise since 2018. They’ve additionally developed the CashScore, a metric for creditworthiness not in contrast to a credit score rating, however primarily based purely on money stream information. Plaid shall be utilizing this rating as a part of Client Report.

How money stream underwriting is getting used immediately

Plaid has been operating beta exams of Client Report with nearly a dozen lenders throughout private loans, BNPL and proptech, together with large names like Oportun and H&R Block.

Jonathan Gurwitz, the Credit score Lead at Plaid, mentioned how lenders will use Client Report. The 2 major use circumstances are for a second search for debtors who’ve been initially declined for credit score and for growing acceptance charges by offering a greater rate of interest to these debtors who’ve already been accepted.

“That’s not a small inhabitants, a lender’s set of marginal declines,” mentioned Gurwitz. “Even in sure conditions, marginal approvals, the place you are feeling such as you don’t have a aggressive charge to supply that buyer, giving them the power to hyperlink their account and enhance their provide. That’s a fairly broad inhabitants general, and I feel there might be actual affect right here.”

After I tried to get Gurwitz to share what sort of development within the borrower pool lenders can count on, he was hesitant to present onerous numbers.

“I hesitate right here, as a result of it’s so diversified, however I feel, general, you already know, an estimated 5 to fifteen% development in originations with out including danger…there’s not too many initiatives you are able to do in like, you already know, the beautiful developed credit score area the place you will get that sort of elevate.”

Lenders are utilizing Client Report along with pulling a standard credit score report back to broaden their buyer base in addition to offering higher pricing for these clients which have been marginally accepted.

This can be a win-win-win. It’s a win for the borrower, who has now been accepted or acquired a greater rate of interest. It’s a win for the lender, who now has a paying buyer. And it’s a win for Plaid, which generates income from the usage of its information.

Lenders implement the Plaid person expertise for connecting financial institution accounts, which most individuals are acquainted with now. So, it’s a mild elevate for the borrower with a big reward.

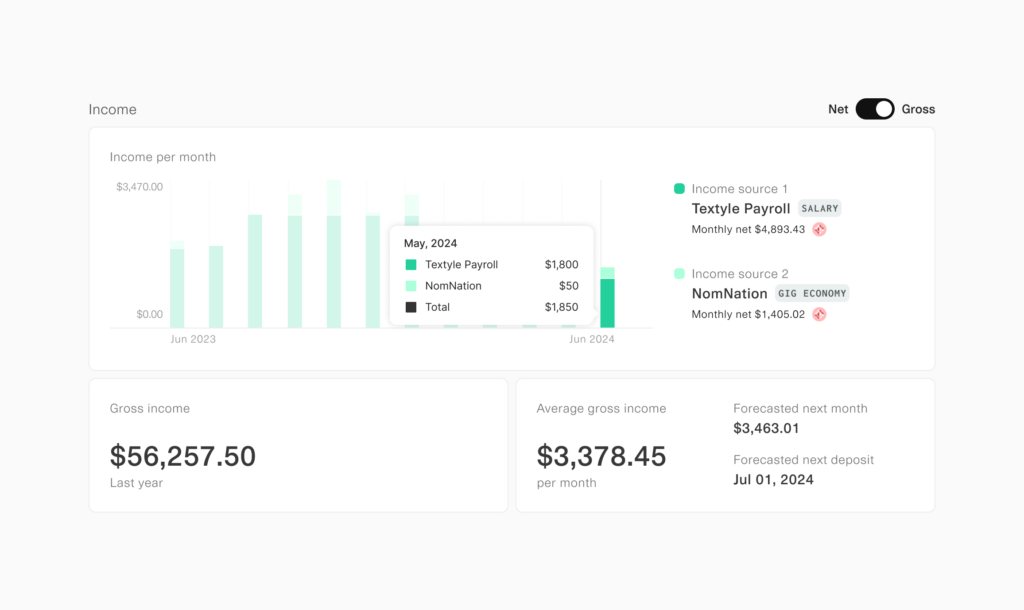

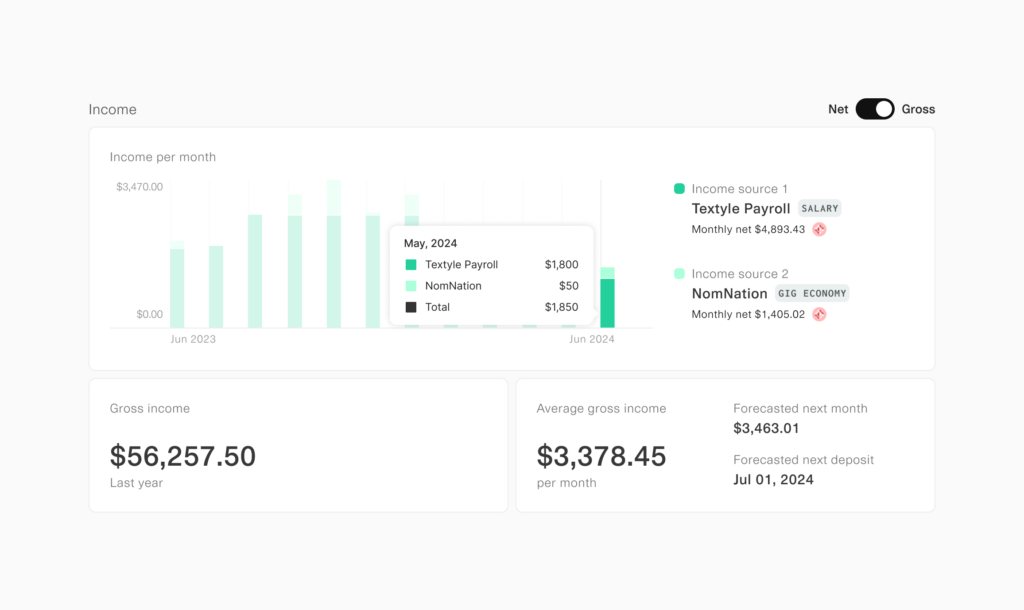

We don’t need to gloss over the Revenue Insights instrument as a result of that could be a key a part of the equation right here and one which units money stream underwriting aside from conventional credit score reviews. Usually, the credit score facet of a shopper’s checking account is sophisticated. Many individuals earn extra than simply W2 earnings as of late. There’s usually cash from gig work, facet hustles and Venmo or PayPal funds flowing out and in.

“It’s not trivial to go from the financial institution transaction information, to really having the ability to develop a robust estimate round somebody’s gross earnings,” mentioned Gurwitz.

Plaid consists of over a dozen categorized earnings streams to supply forecasted web and gross earnings in addition to a projected subsequent paycheck date. This makes debt-to-income calculations much more correct.

Trying forward

The machine studying fashions on the coronary heart of Client Report will proceed to enhance and Plaid can be taking a look at constructing new money stream attributes to assist lenders higher predict short- and long-term credit score danger.

The Plaid community is exclusive in that it encompasses 500 million linked accounts. So, the corporate is at the moment analyzing account connection exercise throughout the Plaid community as a predictor of danger. That is in its infancy, however there’s a treasure trove of data there, clearly solely used with the shopper’s permission, which may additional improve the effectiveness of Client Report.

There might come a day, within the not-too-distant future, when Plaid will take a look at all of a shopper’s linked accounts, together with brokerage and cash market accounts, and use all this real-time info to make an underwriting choice.

No matter the place that is going, the advances Plaid is saying immediately are going to have a dramatic affect on the way forward for lending on this nation. It may nicely be the kickstart wanted to carry money stream underwriting into the mainstream.