KEY

TAKEAWAYS

- To reap the benefits of Dwelling Depot’s inventory value decline, attempt implementing the put vertical unfold

- The put vertical unfold can decrease your threat when you capitalize on the draw back transfer in HD

- By going out to the August expiration, you may open a put vertical for a comparatively low value

America’s largest residence enchancment retailer, Dwelling Depot, Inc. (HD), has benefited from a protracted interval of investor curiosity and traded at a premium valuation for a number of years. Nonetheless, the latest surroundings of slowing client spending and better rates of interest has lastly caught up with HD; the dangers are to the draw back, under $300.

After rallying towards its all-time highs simply shy of $400, HD has pulled again under its key $350 and $335 help ranges and is vulnerable to persevering with decrease. HD’s relative efficiency lately reached a brand new 52-week low. This means additional draw back dangers, with targets on the subsequent help decrease, just under $300.

FIGURE 1. DAILY CHART OF HOME DEPOT (HD). The value of HD inventory has damaged under a key help degree and will see additional draw back.Chart supply: StockCharts.com. For academic functions.

Buying and selling at 21x ahead earnings, HD remains to be buying and selling at a premium, on condition that analysts are solely anticipating Earnings-Per-Share (EPS) and Income to develop at low single-digit ranges, whereas internet margins sit under 10%. The truth is that with comparatively skinny margins and client spending additional slowing down, HD could have a more durable time commanding the identical sort of premium valuation relative to the market.

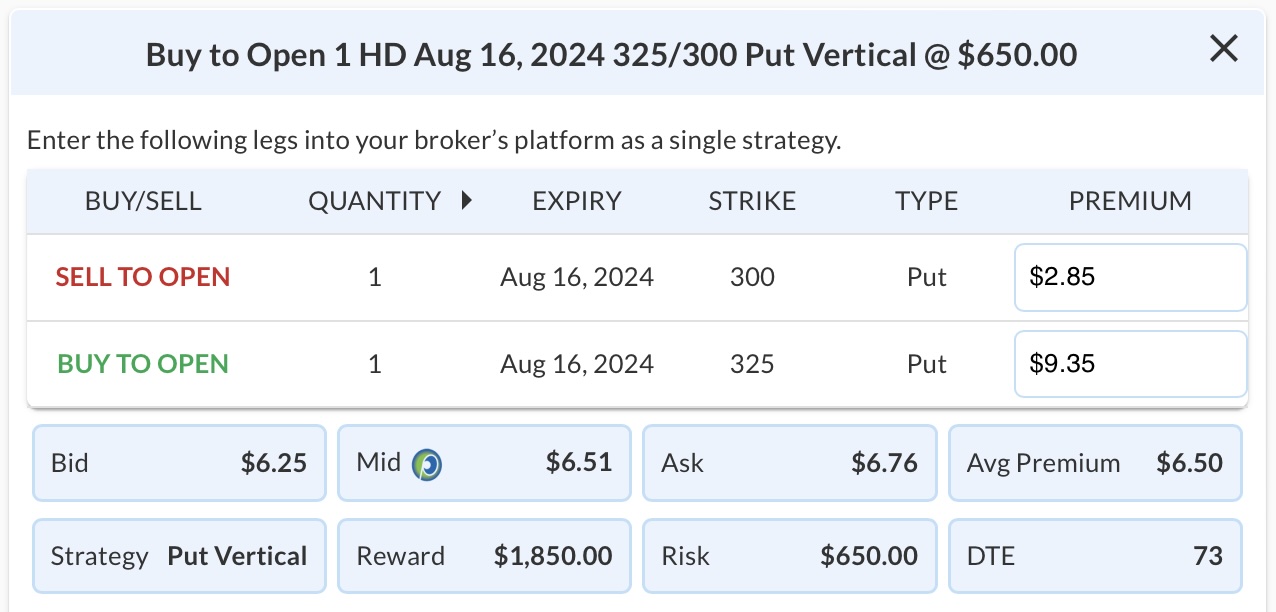

Choices are cheap now, so shopping for draw back publicity is affordable, and may be achieved by going out to August and shopping for the $325/300 Put Vertical @ 6.50 debit. This entails shopping for the next strike put and promoting a decrease strike one (see under).

- Shopping for the Aug $325 Places @ $9.35 Debit

- Promoting the Aug $300 Places @ $2.85 Credit score

FIGURE 2. EXAMPLE OF A PUT VERTICAL SPREAD OPTIONS TRADE FOR HD.

This is able to threat a complete of $650 ($935 – $285) per contract if HD is above $325 at expiration, whereas probably making almost thrice that of $1,850 per contract if HD is under $300 at expiration.

Tony Zhang is the Chief Strategist at OptionsPlay.com, the place he has assembled an agile workforce of builders, designers, and quants to create the OptionsPlay product suite for buying and selling and evaluation. He has additionally developed and managed lots of the agency’s partnerships extending from the Choices Business Council, Nasdaq, Montreal Change, Merrill, Constancy, Schwab, and Raymond James. As a confirmed thought chief and contributor on CNBC’s Choices Motion present, Tony shares concepts on utilizing choices to leverage achieve whereas lowering threat.

Be taught Extra