Onchain Highlights

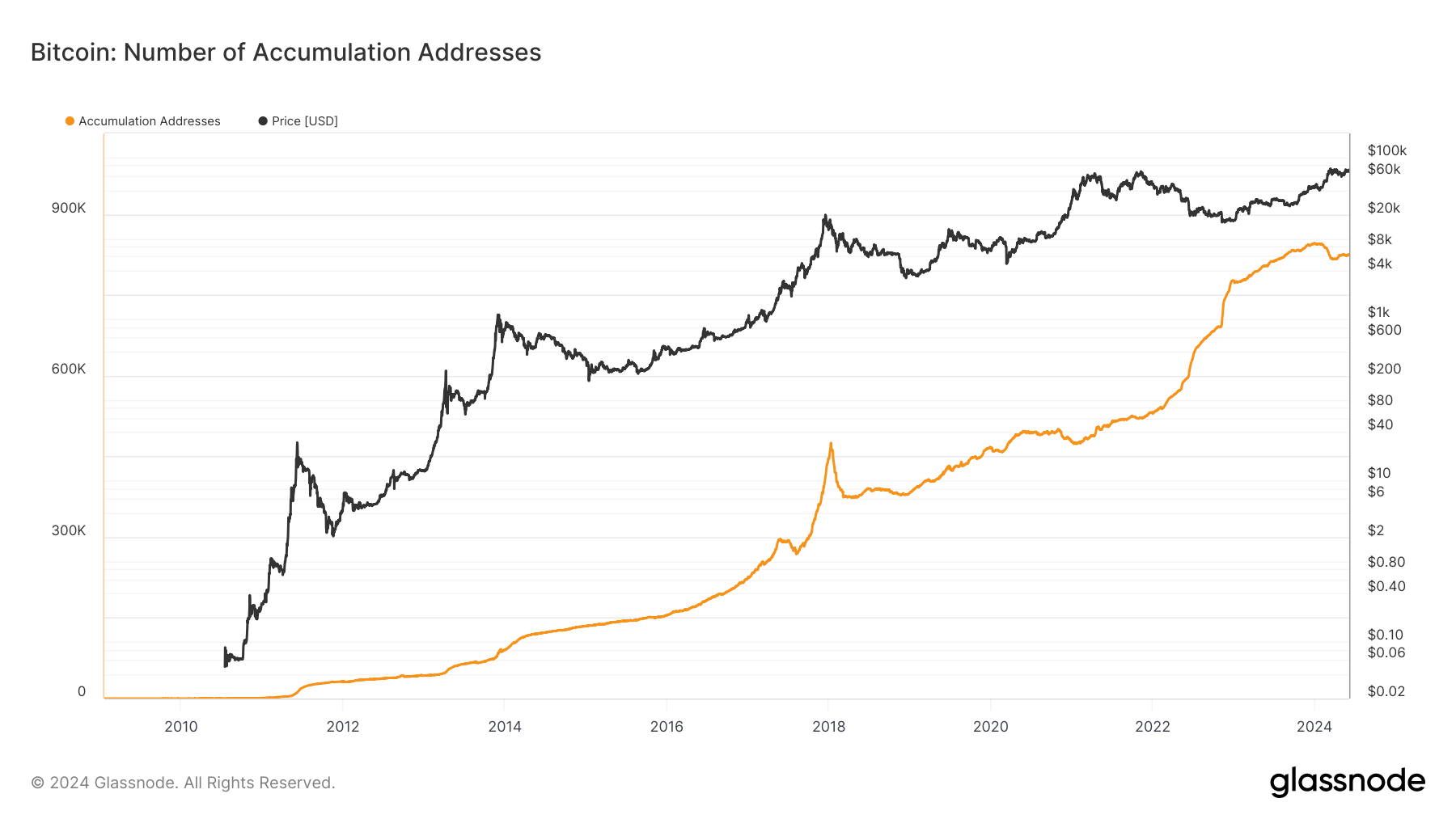

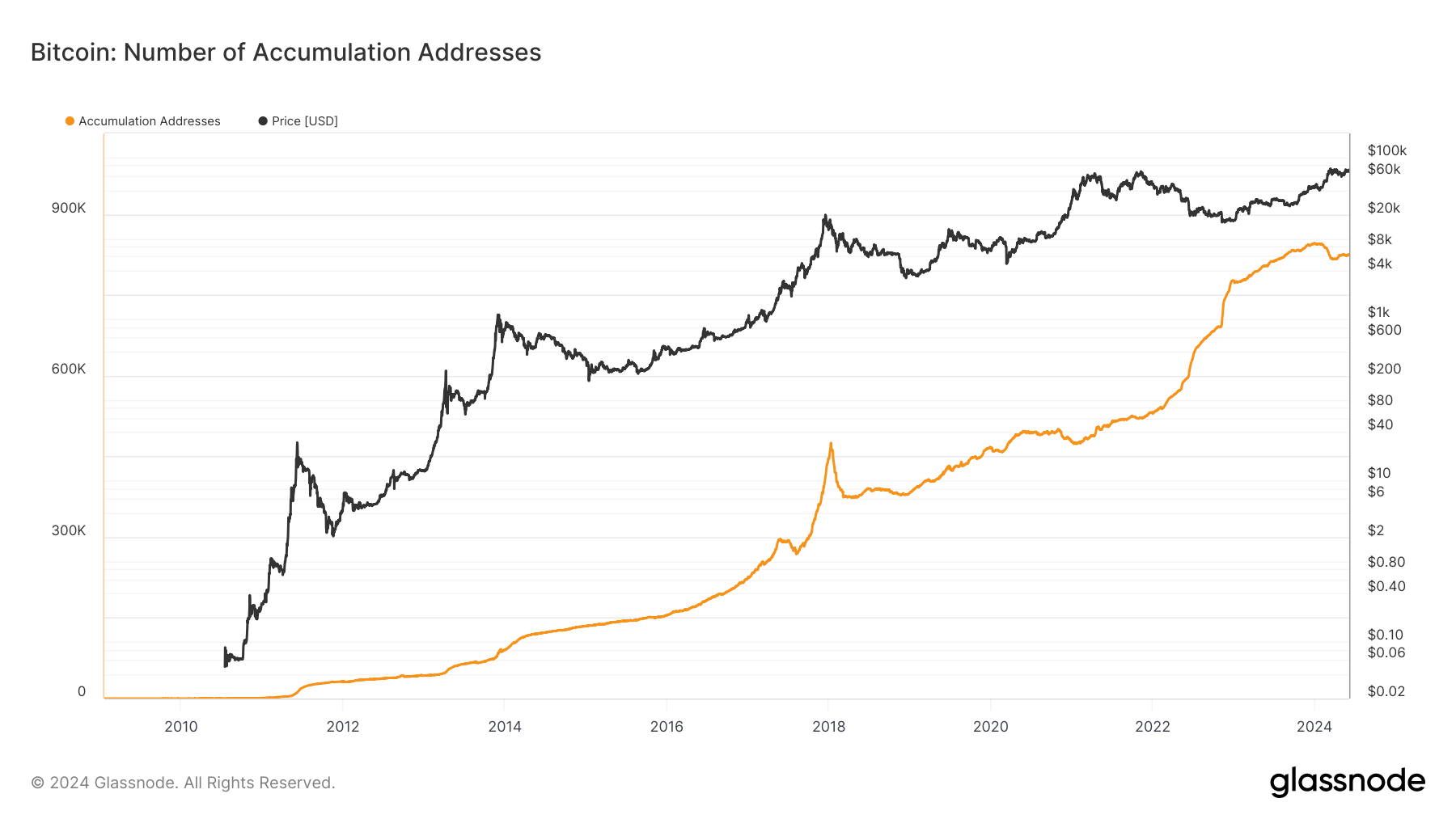

DEFINITION: The variety of distinctive accumulation addresses. Accumulation addresses are outlined as addresses which have not less than two incoming non-dust transfers and have by no means spent funds. Trade addresses and addresses acquired from coinbase transactions (miner addresses) are discarded. To account for misplaced cash, addresses that had been lively greater than seven years in the past had been additionally omitted.

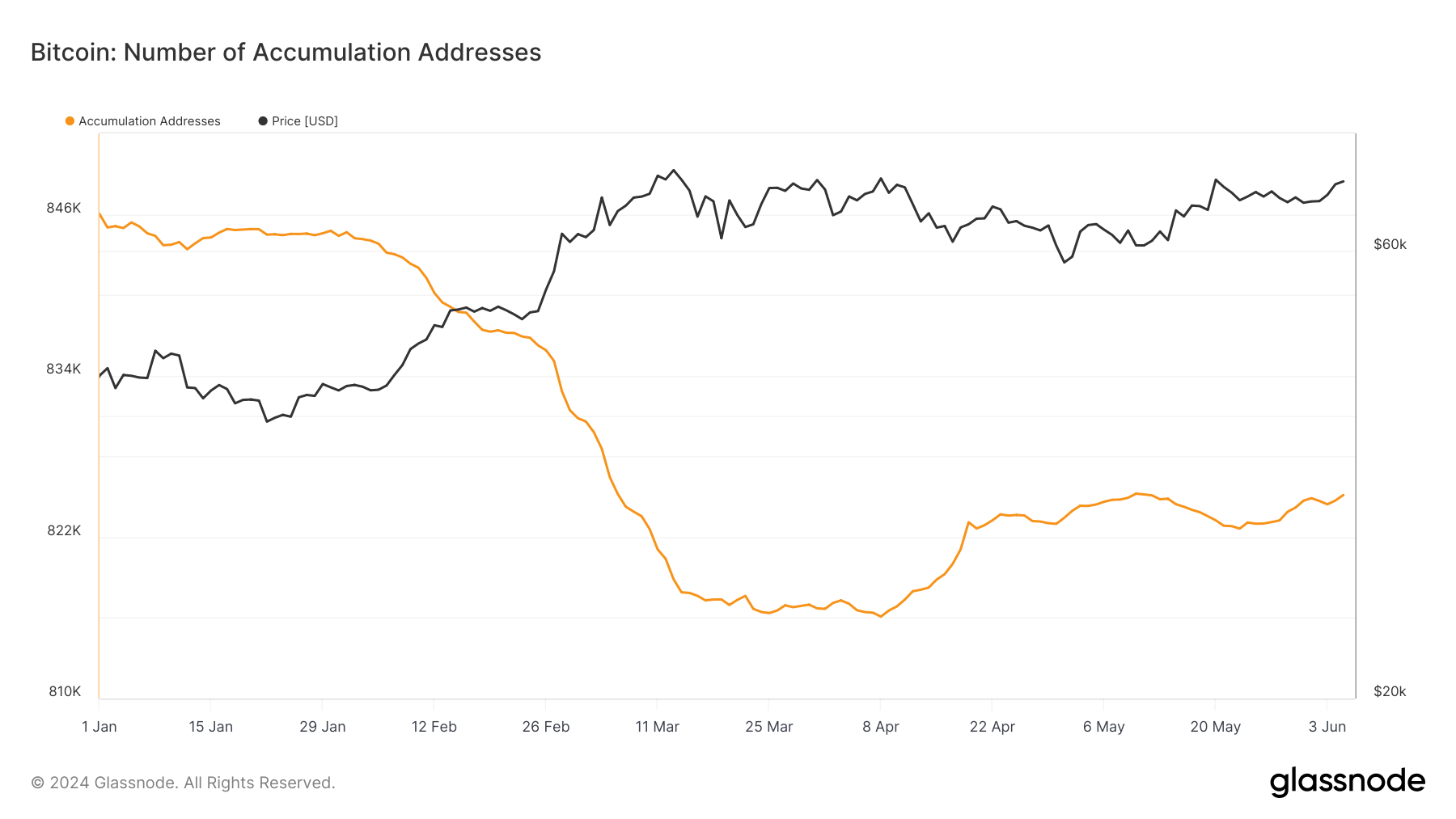

Current knowledge from Glassnode signifies notable actions in Bitcoin accumulation addresses. The variety of these addresses declined earlier this yr, and a resurgence began in late April. This enhance aligns with broader market optimism and Bitcoin’s worth stabilization round $60,000. Based on CryptoSlate, long-term holders have added practically 70,000 BTC for the reason that cycle’s backside, reversing a earlier divestment pattern.

Moreover, the Bitcoin halving spurred substantial accumulation. Over 115,000 BTC had been accrued in April alone, reflecting sturdy market confidence. This conduct is additional evidenced by a surge in investor exercise, with important inflows into Bitcoin accumulation addresses reaching document ranges in April.

These patterns recommend a bullish outlook amongst long-term holders and different key market contributors, highlighting a collective confidence in Bitcoin’s future prospects. The interaction between these accumulation traits and market occasions just like the halving can be essential in shaping Bitcoin’s trajectory within the coming months.