In a thread on X, Miles Deutscher, a famend determine within the crypto evaluation sector, has dissected what he views as a important flaw within the present altcoin market. Addressing his intensive following, Deutscher elaborated on the influence of the fast enhance within the variety of new crypto tokens, a difficulty he believes to be on the core of the altcoins’ underperformance on this cycle.

The Proliferation Of Crypto

Since April 2024, the crypto panorama has witnessed the introduction of over 1 million new crypto tokens, with a notable half of those being memecoins created totally on the Solana community. In accordance with Deutscher, the convenience of deploying these tokens on-chain contributes to an inflated token depend however highlights a deeper challenge of market saturation and dilution.

Deutscher elaborates, “We now have 5.7 occasions the quantity of crypto tokens than we did throughout peak bull in 2021. It is a main motive why crypto has been struggling this 12 months, regardless of Bitcoin hitting new all-time highs.” He likens the extreme issuance of recent tokens to inflation, the place “the extra tokens that launch, the extra cumulative provide strain in the marketplace.”

Associated Studying

The analyst additionally sheds gentle on the dynamics of enterprise capital (VC) investments within the crypto house, noting the most important quarter for VC funding peaked at $12 billion in Q1 2022, simply because the market started to flip bearish. Deutscher criticizes the timing and technique of VCs, suggesting that whereas their capital injection is important for venture growth, it typically results in market imbalances.

“VCs, like retail buyers, are opportunists. Their funding timing typically goals to maximise returns moderately than help sustainable venture progress, contributing to cyclical peaks and troughs out there,” Deutscher explains. He continues to debate the following market results, the place initiatives delay launches in unfavorable circumstances, solely to flood the market when sentiment turns, worsening the dilution.

The fixed introduction of recent tokens not solely strains the market’s liquidity but additionally impacts investor confidence, particularly amongst retail buyers. Deutscher emphasizes, “The skew in the direction of non-public markets is among the largest and most damaging points in crypto, particularly in comparison with different markets like equities and actual property.”

Associated Studying

This setting creates a barrier to entry for brand spanking new liquidity and leaves retail buyers feeling sidelined, a sentiment exacerbated by high-profile failures like LUNA and FTX. Deutscher argues, “If retail buyers really feel like they will’t win, they received’t play the sport, which is why memes have dominated this 12 months—it’s the one meta the place retail seems like they’ve a preventing likelihood.”

Wanting ahead, Deutscher proposes a number of methods to mitigate these points. Exchanges might implement higher token distribution requirements and prioritize bigger neighborhood allocations. Moreover, adjusting the share of tokens unlocked at launch might assist handle promote strain extra successfully.

“Even when the insiders don’t implement change, the market ultimately will,” Deutscher asserts. He means that exchanges ought to undertake rigorous requirements for itemizing new initiatives and be equally stringent about delisting people who fail to satisfy ongoing standards, thus preserving market integrity and liquidity.

In his closing remarks, Miles Deutscher hopes his insights will foster higher understanding and immediate a reevaluation of present practices. “Dispersion isn’t the one downside, nevertheless it actually is a significant one—and one thing that must be mentioned extra overtly to foster a more healthy crypto ecosystem.”

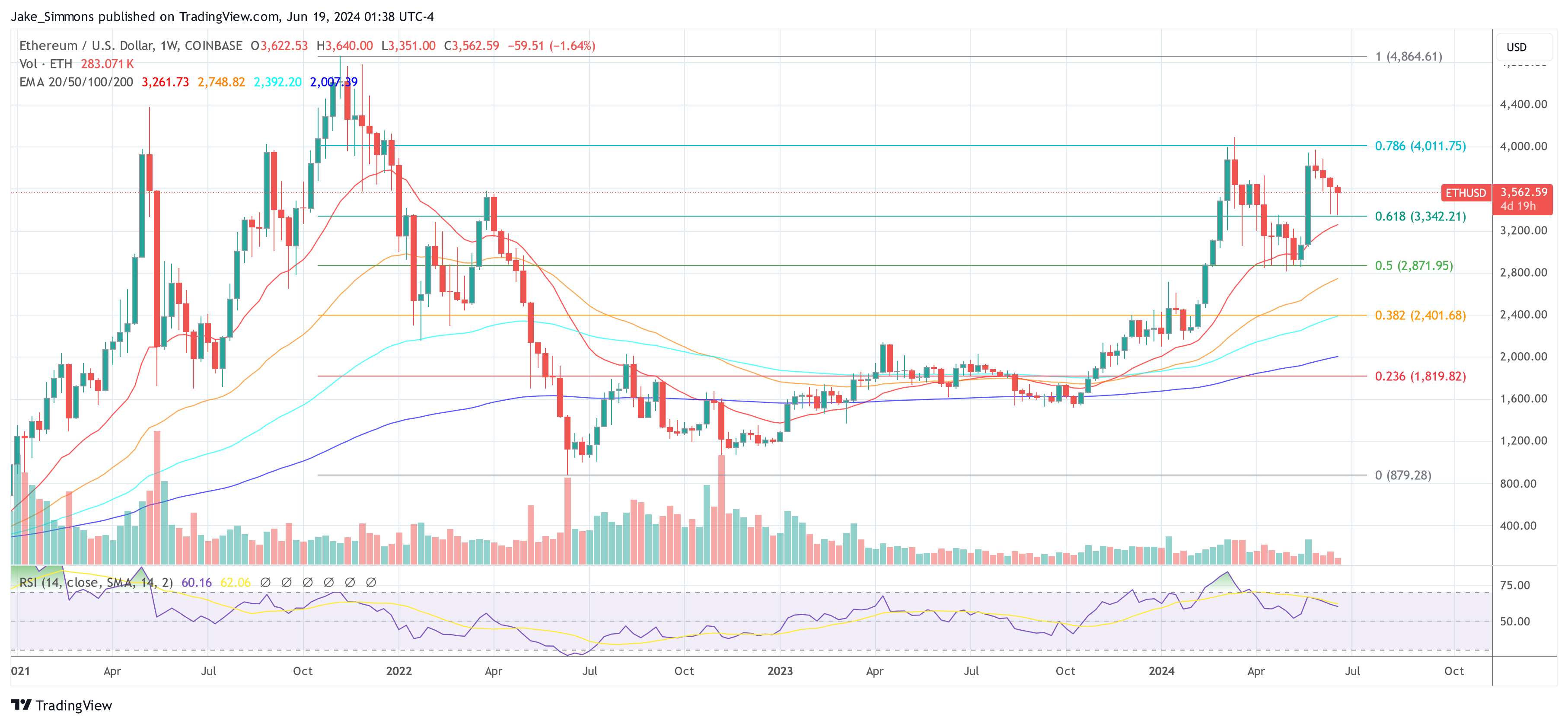

At press time, Ethereum (ETH) traded at $3,562.

Featured picture from Shutterstock, chart from TradingView.com