What does it take to go public? Has it modified over the past 15 years?

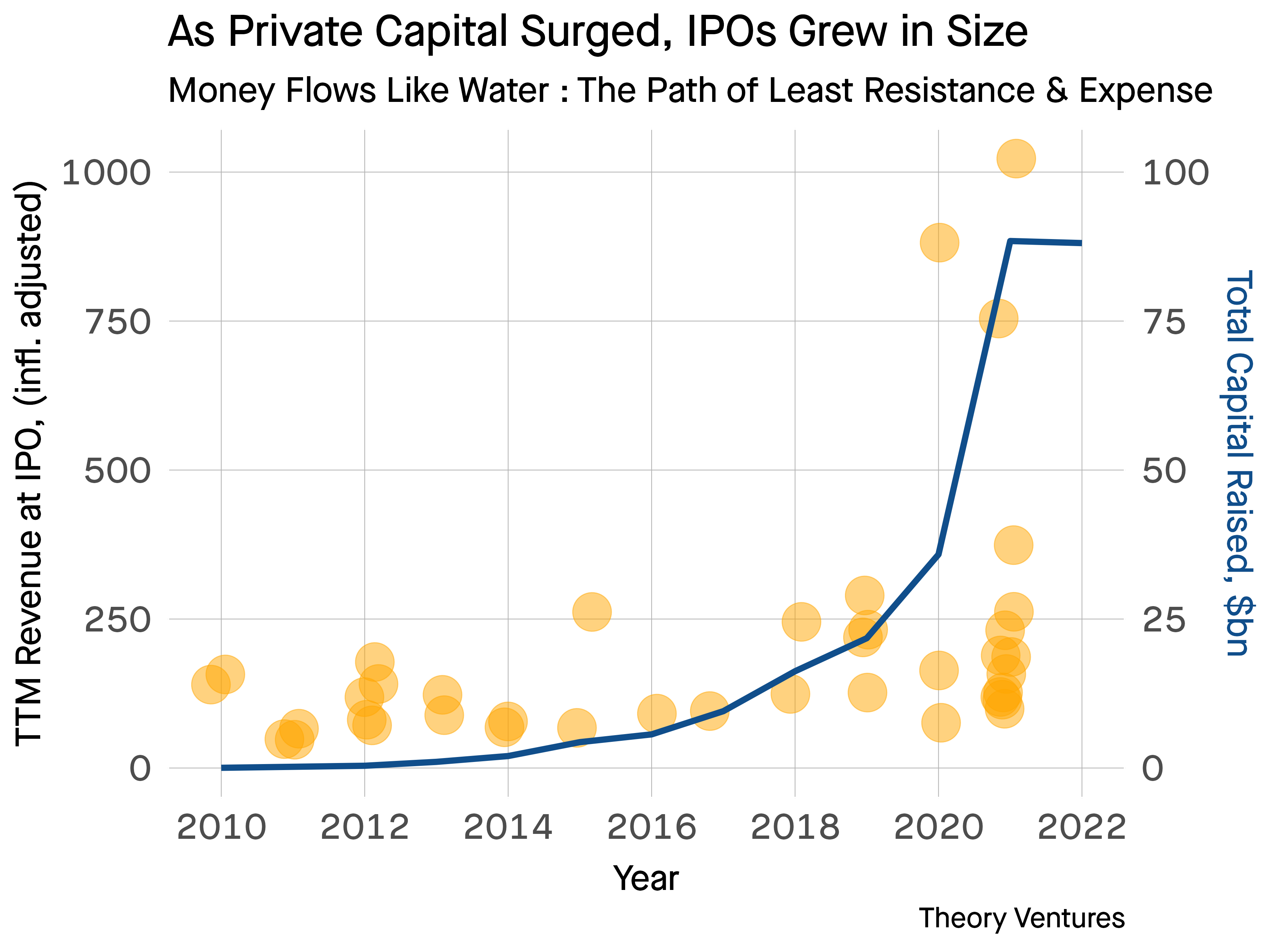

We gathered information on the US venture-backed software program corporations that went public between 2010 & at present. We corrected the trailing 12 months’ income on the time of IPO for inflation & plotted the info.

Earlier than 2018, just one firm IPOed with greater than $200m in income. Actually, the median income at IPO at $90m. Immediately, the median income at IPO is $189m (corrected for inflation), greater than double.

This ratio is roughly true throughout the board for twenty fifth & seventy fifth percentile-sized corporations as effectively.

If we divide the info set into two eras : earlier than 2018 & 2018 onwards, we see a transparent shift within the common income at IPO & the distinction is statistically vital with a p worth of 0.0063.

Earlier than 2018, 11 corporations went public with lower than $100m in trailing income. Afterwards, solely 2.

Why such a distinction? IPOs are extraordinarily costly.

An organization with about $100m in income can pay between $9-26m to go public.1

| Price Class | Typical Quantity |

|---|---|

| Underwriting Charges | 12 |

| Authorized Charges | 2.5 |

| Accounting Charges | 1 |

| Different charges | 1 |

| Complete | 16.5 |

For a corporation producing $100m a yr, this implies an IPO price 16% of their income to lift a spherical of capital : doubtless the costliest capital increase of the corporate’s life.

For a later-stage firm, the prices of a personal financing would possibly might contact $1m within the higher reaches, however is more likely to be measured within the tons of of hundreds of {dollars}.

As personal {dollars} entered the late stage market, why wouldn’t a startup increase personal {dollars} as an alternative of public?

That’s exactly the sample the info illustrates. Non-public market capital values corporations at greater costs (from greater multiples) & is cheaper to lift.

Whereas there are nonetheless many corporations sub-$200m in income who go public, the late-stage personal markets allow those that would wait to realize a lot greater scale.

As well as, this information doesn’t account for the various massive corporations who’ve but to IPO however very doubtless will : Databricks, Stripe, Canva, Rippling, OpenAI, and so forth., which is able to additional underscore the development.

1 PwC estimates price based mostly on historic information from 2019-2022