In a brand new video titled “If I Had To 10X My Cash, I’d Solely Maintain These 4 Altcoins!” aimed toward shedding mild on potential bull market leaders, famend crypto analyst Miles Deutscher dissected the crypto panorama to pinpoint 4 altcoins that he believes might considerably outperform the market. His insights got here in response to a question from his Discord channel about potential 5x to 10x features throughout the present bull market.

Deutscher believes that success within the crypto markets doesn’t essentially come from holding an enormous array of cash however moderately from rigorously deciding on a couple of which have sturdy potential narratives. He articulated this throughout his presentation, stating, “You don’t must personal 30, 40, 50, 60 altcoins to be able to get your required returns. Actually, if you choose the suitable cash and choose the suitable narratives, you would probably succeed on this market with three, 4, or 5 altcoins.”

He additionally offered strategic insights into the everyday market behaviors throughout the summer season, a interval he describes as a daily seasonal downturn throughout the crypto business. He used historic knowledge to assist his declare, emphasizing that even throughout bullish years, cryptocurrencies have suffered throughout the summer season months.

Deutscher reassured his viewers by saying, “Even in probably the most bullish years for crypto, like 2021, majors had been wanting actually dangerous throughout summer season months […] so why would you now begin to panic?”

Deutscher’s High 4 Altcoin Picks

Deutscher selected cash primarily based on their potential for important returns and their strategic place throughout the market:

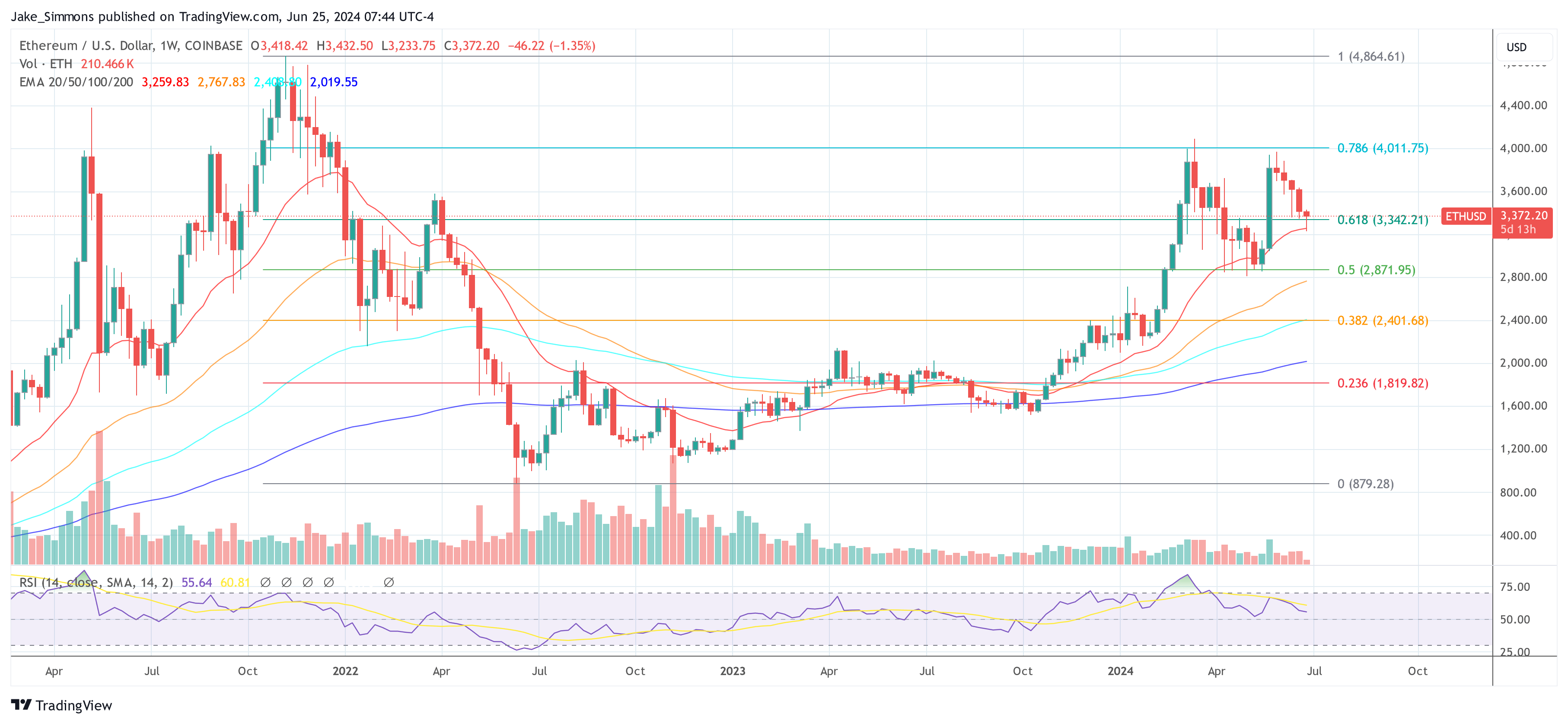

#1 Ethereum: ETH holds the premier place in Miles Deutscher’s choice resulting from its established function because the main good contract platform within the crypto sphere. Ethereum’s upcoming catalysts, notably the anticipated approval of US spot Ethereum ETFs, are seen as important potential worth drivers.

Deutscher underscores its significance by stating, “Ethereum sits at a $428 billion absolutely diluted valuation versus Bitcoin which sits at $1.2 trillion. I believe Ethereum is at an affordable market cap now.”

Associated Studying

He doesn’t predict a 10x return from Ethereum on this cycle, however he values its potential for regular progress, making it a cornerstone in a well-diversified crypto portfolio. Deutscher additional helps his selection by noting the technical features: “Ethereum has been in a powerful uptrend all the way in which since $1,500,” indicating its resilience and bullish developments.

#2 Pepe: PEPE, a meme coin with a powerful cultural footprint, is Deutscher’s second choose. He believes Pepe might carry out exceptionally properly in a positive market setting, pushed by its sturdy mindshare and place as a number one meme coin alongside giants like Dogecoin and Shiba Inu. Deutscher explains, “Pepe shouldn’t be solely the strongest proxy to commerce Ethereum’s risk-on proxy that’s, but it surely’s additionally one of many meme cash available in the market with the strongest thoughts share behind DOGE and SHIB.”

#3 Solana: SOL is chosen for its technological prowess and its important adoption amongst builders and customers within the crypto neighborhood. Deutscher views Solana as a potent mixture of innovation and market potential, saying, “Solana has been the house of meme cash, it’s been the house of degeneracy. It’s made strides when it comes to its expertise adoption, a lot of devs constructing on Solana.”

He acknowledges the excessive valuation of Solana however suggests it provides a favorable risk-reward stability, predicting that “SOL might probably go to $1,000 in a extremely loopy market.” Solana’s potential to scale and its sturdy neighborhood engagement positions it as a strong candidate for substantial mid-term features.

Associated Studying

#4 WIF: Dogwifhat enhances Solana in Deutscher’s portfolio, serving because the meme coin counterpart to Solana’s technological base. WIF, in line with Deutscher, balances the conservatism of extra established cash like Ethereum and Solana with a better threat and probably larger return profile.

He believes WIF is a key participant within the meme coin sector and a strategic choose for these seeking to capitalize on risky market segments. He remarks on its efficiency and strategic positioning, “WIF has been a significant sell-off; it’s truly buying and selling beneath a significant vary low […] However in the event you imagine in WIF like I do as a cycle lengthy meme coin wager and a Solana play, you would simply common within the decrease it goes.”

Crypto Funding Technique And Sensible Recommendation

Deutscher’s overarching technique blends conservative, foundational investments with higher-risk, probably high-reward alternatives. He advocates for a portfolio development that includes a strategic division between core holdings (80%-90%) and speculative bets (10%-20%). This strategy, he argues, permits buyers to capitalize on the upside whereas managing threat successfully.

Reflecting on the significance of market timing and portfolio positioning, Deutscher suggested his viewers, “It’s about accumulating on main dips […] and it doesn’t actually matter what occurs within the interim.” He emphasizes long-term features over short-term fluctuations, advising buyers to remain the course by way of market ups and downs.

At press time, ETH traded at $3,372.

Featured picture from iStock, chart from TradingView.com