Fast Take

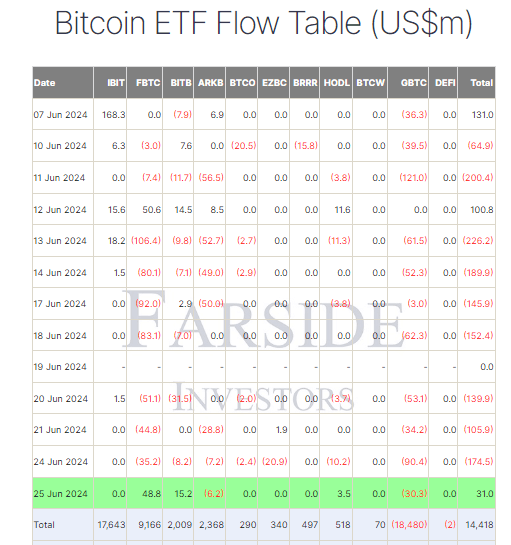

Farside information exhibits that on June 25, Bitcoin (BTC) exchange-traded funds (ETFs) skilled the primary internet influx since June 12, with $31.0 million coming into the market.

Constancy’s FBTC led the cost with a $48.8 million influx, elevating its complete internet influx to $9.2 billion. Bitwise’s BITB additionally noticed a notable influx, attracting $15.2 million and bringing its complete internet influx to $2.0 billion. In distinction, Grayscale’s GBTC struggled with outflows, shedding $30.3 million and pushing its complete outflow to $18.5 billion. In keeping with Farside information, the full internet inflows to BTC ETFs now stand at $14.4 billion.

Curiously, BlackRock’s IBIT ETF recorded no internet inflows or outflows, but its buying and selling quantity surged to $1.1 billion, in keeping with Coinglass information. For comparability, GBTC solely managed a quantity of $341 million, putting IBIT at quantity 18 general in buying and selling quantity amongst all US ETFs. This raises hypothesis about IBIT’s potential to turn out to be a key institutional foundation commerce Bitcoin ETF, given its strong buying and selling exercise regardless of the absence of internet inflows or outflows.

The publish BlackRock’s IBIT buying and selling quantity surges to $1.1 billion regardless of no inflows appeared first on CryptoSlate.