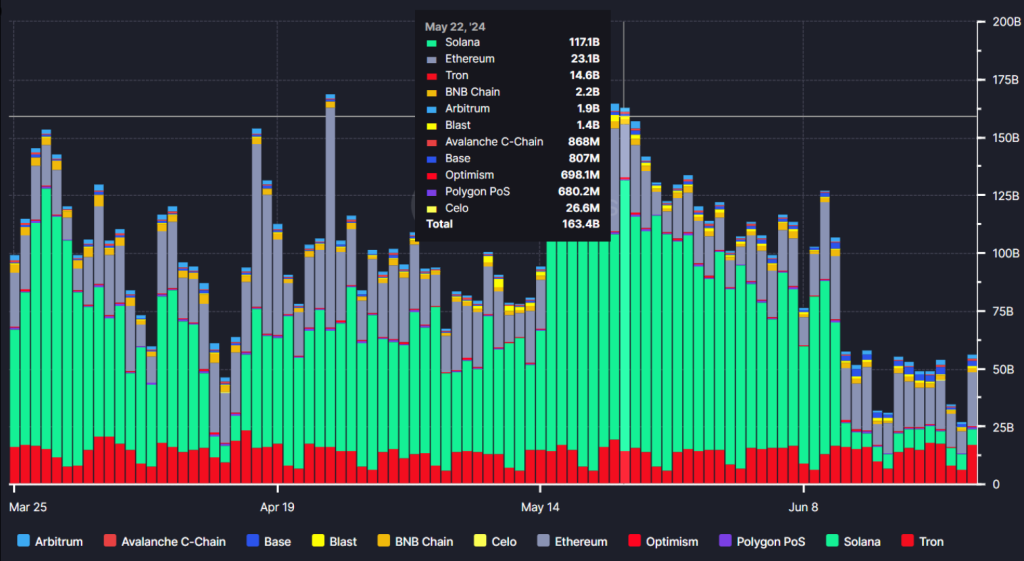

Solana has been thrown right into a tailspin after a stunning revelation: its each day stablecoin quantity could have been considerably inflated. Reviews point out a staggering drop – from a dizzying $75-100 billion to a mere $7 billion in a 24-hour interval.

This dramatic shift has unsettled the crypto neighborhood, elevating severe questions in regards to the legitimacy of Solana’s previous efficiency and its future as a DeFi powerhouse.

Associated Studying

Wash Away The Hype: Inflated Figures Or Fabricated Actuality?

Market sentinels are pointing fingers at wash buying and selling, a manipulative apply the place traders basically purchase and promote crypto forwards and backwards to one another, creating an phantasm of excessive exercise. This tactic inflates buying and selling volumes, probably deceptive traders in regards to the true degree of adoption and liquidity on the platform.

Wonderful how Solana went from $75-100 BILLION DAILY stablecoin quantity to $7 BILLION each day in 1 day!!

May it’s as a result of the info was completely faux??? Like how I’ve been speaking about all these months??

And by the best way even at $7 Billion 90% of the amount continues to be faux https://t.co/CnKWGAbjsM pic.twitter.com/ScfCgv5UhS

— Wazz (@WazzCrypto) June 25, 2024

The discrepancy is simply too massive to disregard. Whereas some wash buying and selling would possibly happen on any change, a official DeFi ecosystem shouldn’t be so closely reliant on it. This raises severe considerations in regards to the natural development of Solana’s stablecoin market.

The finger of suspicion falls significantly on USDC, a number one stablecoin pegged to the US greenback. Specialists estimate that even with the revised $7 billion quantity determine, a staggering 90% might nonetheless be inflated. This throws a wrench into Solana’s narrative as a DeFi chief, probably shaking investor confidence.

Investor Jitters And The Highway To Redemption

The sudden knowledge plunge has unnerved traders who made choices primarily based on the beforehand reported figures. This might result in a sell-off, inflicting short-term volatility within the Solana market. Moreover, the revelation comes at a delicate time – simply forward of the extremely anticipated Ethereum ETF deadline, which some imagine might have boosted Solana’s DeFi exercise additional.

This can be a main blow to Solana’s credibility. Traders want to have the ability to belief the info they’re basing their choices on. Regaining that belief would require a swift and clear response from Solana’s growth staff.

SOL market cap presently at $63 billion. Chart: TradingView.com

Past The Hype: Does Solana Nonetheless Have DeFi Potential?

Whereas the info debacle undoubtedly casts a shadow on Solana’s latest efficiency, it doesn’t negate the platform’s sturdy technological basis. Solana boasts one of many quickest and most scalable blockchains in existence, making it a technically sound possibility for DeFi functions.

Associated Studying

The approaching weeks might be crucial for Solana. How the platform addresses the info controversy and implements reforms to make sure transparency will decide whether or not it might probably climate this storm and reclaim its place as a viable DeFi contender.

Featured picture from YouTube, chart from TradingView