The Hammer

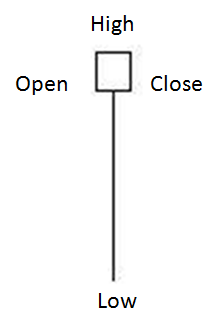

The hammer worth motion sample is a bullish sign that signifies a better chance of the market transferring greater than decrease and is used primarily in up-trending markets. Right here is an instance of what a hammer candle appears like:

A hammer exhibits sellers pushing the market to a brand new low. Nevertheless, the sellers aren’t robust sufficient to remain on the low and select to bail on their positions. This causes the market to rally again up, main consumers to additionally step into the market. The open and shut worth ranges ought to each be within the higher half of the candle. Historically, the shut will be beneath the open however it’s a stronger sign if the shut is above the opening worth degree.

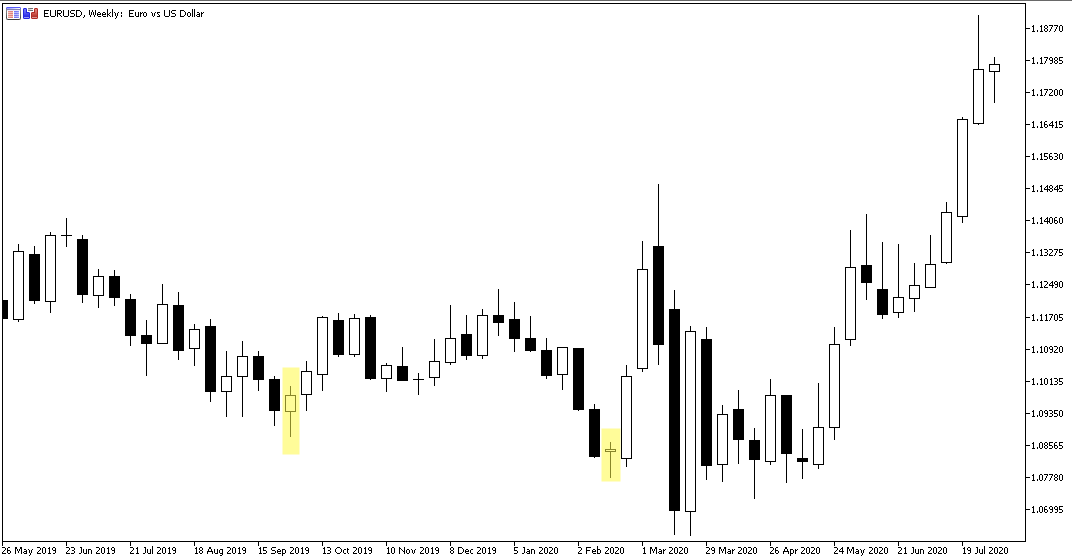

Within the above worth motion foreign exchange chart of EUR/USD, there are two examples of a hammer sample highlighted within the gold packing containers. Via the evaluation of the open, shut, excessive and low worth ranges the sample suggests a transfer greater is probably going. In these highlighted examples, worth did transfer greater after the candles fashioned. In fact, this won’t all the time be the case and there are even examples of this in the identical chart. Nevertheless, how may you’ve traded these highlighted indicators?

THE ENTRY: A doable worth degree to enter a commerce, may very well be when the subsequent candle lastly manages to interrupt the excessive of the hammer candle. The excessive of the second highlighted hammer candle above – which fashioned on the week of 16 February 2020 – is 1.0863. Due to this fact, an entry worth may very well be 1.0864.

THE STOP-LOSS: A doable cease loss degree may very well be on the low of the hammer candle. If the market triggers the entry worth however no different consumers step in, it is a warning signal the market could must go decrease for any consumers to be discovered. Due to this fact, you wouldn’t need the cease loss to be too near your entry. With the low of the hammer candle at 1.0777, a doable cease loss may very well be 1.0776.

THE TARGET: There are a number of methods to exit a commerce in revenue equivalent to exiting on the shut of a candle if the commerce is in revenue, focusing on ranges of assist or resistance or utilizing trailing cease losses. On this occasion focusing on the earlier swing excessive degree would end in a goal worth of 1.1095.

THE TRADE: With an entry worth of 1.0864 and cease lack of 1.0776 the whole threat on the commerce is 88 pips. Buying and selling at 0.1 lot would imply that if this commerce triggered the entry worth, then hit the cease loss, the general loss could be $88. On this occasion, the market traded greater to the goal worth leading to an approximate commerce revenue of $231.

Be taught extra about worth motion buying and selling and different buying and selling associated subjects by subscribing to our channel.