In case you are utilizing technical evaluation to make buying and selling selections you could be utilizing Multi Timeframe idea

I’ll share my expertise on Mutli Timeframe

Why individuals use multitimeframe?

First we have to know that multi timeframes are divided in two elements. Mother or father and Little one. Mother or father is at all times extra correct than youngster. e.g. D1 and H4

Its additionally doable to divide them in three elements resembling grand guardian, guardian and youngster e.g. W1, D1 and H4

The principle objective to categorize timeframes is to look at motion and discover entry.

Lets take instance of Mother or father and Little one

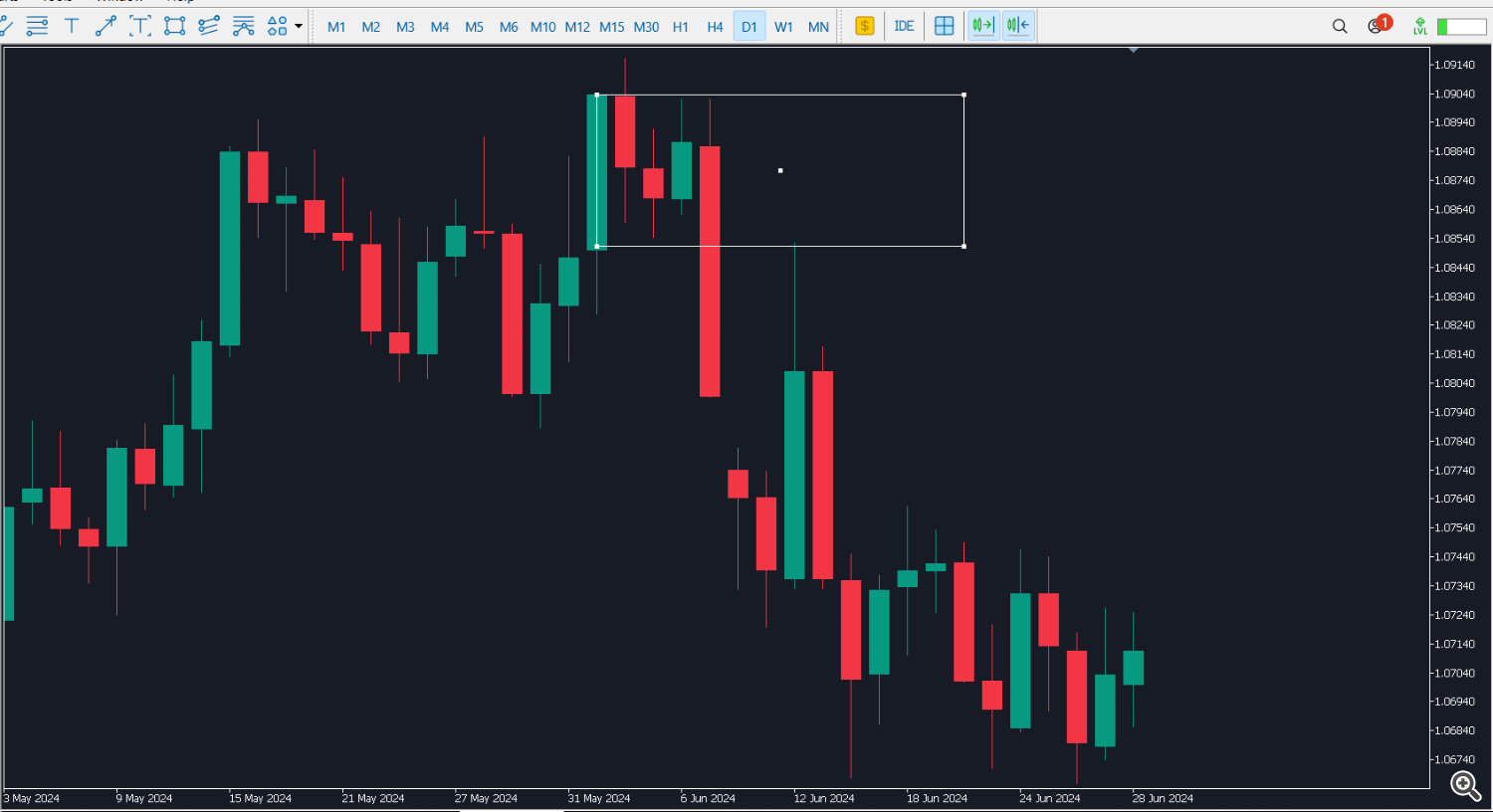

D1 = Mother or father in EurUSD A bearish Harami sample was discovered

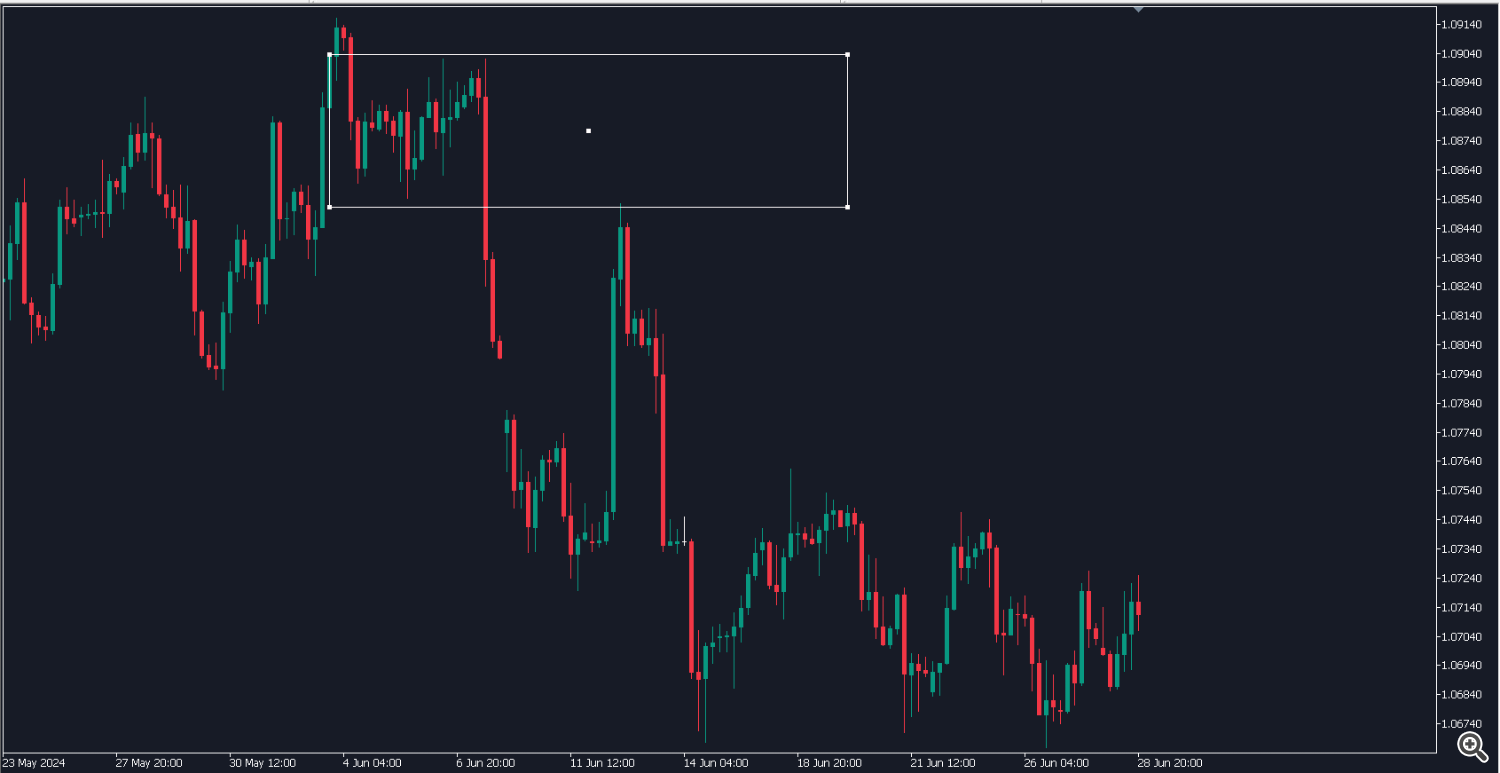

Now dealer discovered an occasion in chart, now they search for entries to promote in decrease timeframe which is H4 = Little one Chart

They change to H4 and after a closing under D1 Harami sample decrease physique they search for entry in the identical space. As quickly as value comes again there may be one other Bearish Engulfing, the second bearish engulfing is fashioned in H4 chart, dealer rushed to promote. Had they been watching solely D1 chart it was not possible to substantiate a sign to promote or could be too dangerous.

That is the end result

Now that if you’re watching a single timeframe there are uncommon methods which works with excessive accuracy in single timeframe, so its should to look at minimal 2 or 3 timeframe to wonderful tune your methods. Behind this logic there’s a cause. There are dozens of timeframe accessible in MT5, however hottest one are W1 D1 H4 H1 M30 M15 M5

which is broadly adopted by merchants however some premium buying and selling apps don’t present this for Free resembling they lock M2 M4 and different timeframes and solely present this in paid model, as a result of they’ve one thing higher data. For intraday skilled dealer could use customized timeframe and even seconds timeframe to seek out finest buying and selling methods.

Individuals may create customized timeframe which you will have not heard resembling 2 minutes and 35 seconds timeframe, the explanation for creating such timeframe is barely becuase their technique should be performing higher on that.

All of it relies on analysis. I consider 3 6 9 minutes timeframe could also be good. These concepts simply comes from calculations that are based mostly on some logic.

For instance in India market operates for 375 minutes. If we maintain dividing it by 2, 0.73 seconds timeframe could also be finest timeframe for intraday as an alternative of 1minute timeframe

If we divide 375 by 3, we get 75, 15 and three so watching 3 and 15m timeframe could have some logical which means, we additionally get 0.6 means 36 seconds of timeframe could have some clues wherein dealer could discover it attention-grabbing to check their methods

You might remark down your finest timeframe combos you discover helpful in your day buying and selling.