After consolidating within the week earlier than this one, the markets resumed their upmove and have ended the current week on a robust word. The markets additionally navigated weekly derivatives expiry; it did present some indicators of fatigue and impending consolidation on the final buying and selling day after rising for 4 buying and selling classes in a row. The buying and selling vary obtained a bit wider; the Nifty oscillated in an 824-point vary over the previous 5 days. The volatility additionally surged a bit; India Vix inched greater by 4.72% to 13.80. After trending by way of the week, the headline index closed with a web weekly achieve of 509.50 factors (+2.17%). The month has been even stronger; June ended with Nifty gaining 1479.90 factors (+6.57%) on a month-to-month word.

From a technical perspective, the markets are exhibiting preliminary indicators of an impending consolidation from greater ranges. Regardless of the trending transfer by way of the week, Nifty has created robust resistance within the 24000—24200 zone as evidenced by the derivatives information. All by way of the week, the index has seen robust Name OI addition within the strikes falling on this vary. On the month-to-month charts, a candle with an extended decrease shadow has emerged which holds the potential of briefly stalling the present upmove. The Nifty now stands mildly overbought on weekly and month-to-month charts. Going by the technical construction, even when the markets mark incremental highs, they’re now closely liable to some measured corrective strikes from the present or greater ranges.

It’s also vital to notice that the markets have once more run too arduous and forward of themselves. The closest MA, i.e., 20-week MA is at the moment positioned at 22594 which is over 1400 factors beneath the present shut. The 50-week MA is positioned at 21194 which is over 2800 factors beneath the present shut. Which means even when there’s the slightest imply reversion happening, we might even see the markets coming off considerably from the present ranges. If it does that, even then, it would maintain its main uptrend intact. Monday is prone to see a muted begin to the week; the degrees of 24200 and 24350 are prone to act as rapid resistance ranges. The helps are prone to are available decrease at 23900 and 23750 ranges.

The weekly RSI stands at 72.38; it now stays mildly overbought. The RSI has marked a brand new 14-period excessive; nonetheless, it stays impartial and doesn’t present any divergence in opposition to the worth. The weekly MACD is bullish and it stays above its sign line.

The sample evaluation of the weekly chart exhibits that the costs have closed above the higher Bollinger band. That is usually considered bullish even when there’s a short-term retracement contained in the band. Nevertheless, trying on the over-extended construction, there are greater probabilities of the worth pulling themselves again contained in the band once more.

Total, it’s strongly beneficial that even when we see the markets trying to inch greater, one should give attention to guarding income at greater ranges relatively than giving a blind chase to the upmove. It will be vital to rotate the shares and sectors successfully in order that one stays invested in comparatively stronger shares. The pockets like IT and FMCG are additionally seen bettering their relative momentum and are anticipated to do properly. By and enormous, whereas conserving the leveraged exposures at modest ranges, it is suggested to method the markets with a cautious method over the approaching week.

Sector Evaluation for the approaching week

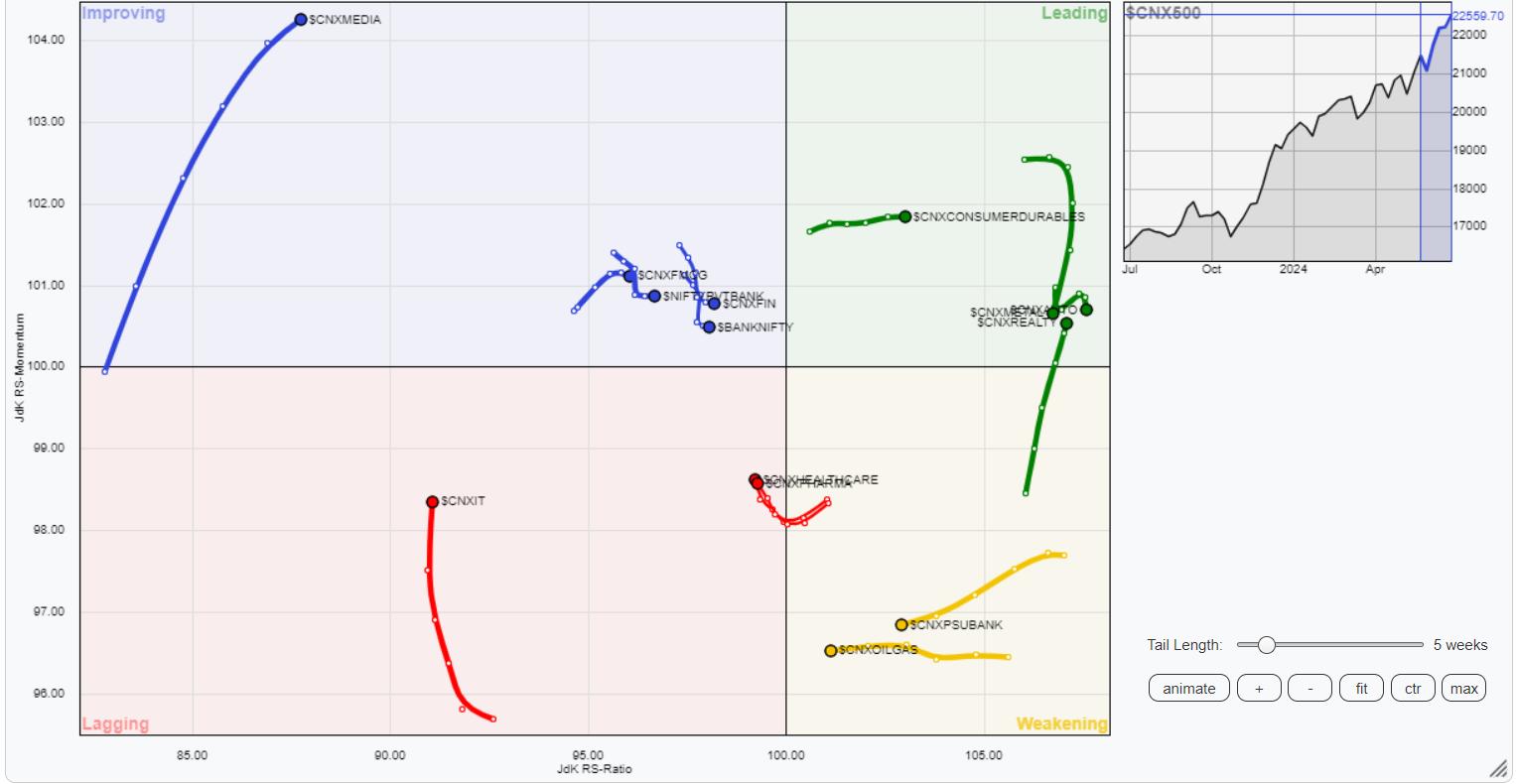

In our take a look at Relative Rotation Graphs®, we in contrast varied sectors in opposition to CNX500 (NIFTY 500 Index), which represents over 95% of the free float market cap of all of the shares listed.

Relative Rotation Graphs (RRG) present that the Nifty Consumption, Auto, Midcap 100, and Steel indices are positioned contained in the main quadrant. These teams are anticipated to comparatively outperform the broader markets. Nevertheless, the Auto, Consumption, and Steel indices are additionally seen paring their relative momentum in opposition to the broader market. The Realty Index can be firmly positioned contained in the main quadrant.

The Nifty Commodities, Power, PSU Financial institution, Infrastructure, and PSE indices are positioned contained in the weakening quadrant. Particular person inventory performances could also be seen from these teams however collectively, they could be slowing down on their relative efficiency.

The Providers Sector Index is contained in the lagging quadrant. Moreover this, the IT and Pharma Indices are additionally contained in the lagging quadrant however they’re seen bettering their relative momentum in opposition to the broader Nifty 500 index.

Banknifty, Nifty Media, Monetary Providers, and FMCG indices are positioned contained in the bettering quadrant.

Vital Observe: RRG™ charts present the relative power and momentum of a gaggle of shares. Within the above Chart, they present relative efficiency in opposition to NIFTY500 Index (Broader Markets) and shouldn’t be used immediately as purchase or promote alerts.

Milan Vaishnav, CMT, MSTA

Consulting Technical Analyst

www.EquityResearch.asia | www.ChartWizard.ae

Milan Vaishnav, CMT, MSTA is a capital market skilled with expertise spanning near 20 years. His space of experience consists of consulting in Portfolio/Funds Administration and Advisory Providers. Milan is the founding father of ChartWizard FZE (UAE) and Gemstone Fairness Analysis & Advisory Providers. As a Consulting Technical Analysis Analyst and along with his expertise within the Indian Capital Markets of over 15 years, he has been delivering premium India-focused Impartial Technical Analysis to the Shoppers. He presently contributes every day to ET Markets and The Financial Instances of India. He additionally authors one of many India’s most correct “Day by day / Weekly Market Outlook” — A Day by day / Weekly Publication, at the moment in its 18th 12 months of publication.