Obtain Demo:

Abiroid_Scanner_GMMA_Trend_Demo_v2.2.zip- 2.2

Notice: Demo solely works for 3 pairs.

Essential Hyperlinks:

Obtainable for buy right here:

https://www.mql5.com/en/market/product/38747

Get the free GMMA Arrows Indicator which works on a single Image/Timeframe right here:

https://www.mql5.com/en/market/product/42908

You’ll be able to learn extra about GMMA (Guppy System of Buying and selling) right here:

https://abiroid.com/indicators/guppy-arrows-indicator

Learn Frequent Scanner Settings described right here:

https://www.mql5.com/en/blogs/publish/747456

About Scanner Technique:

How GMMA Strains are calculated:

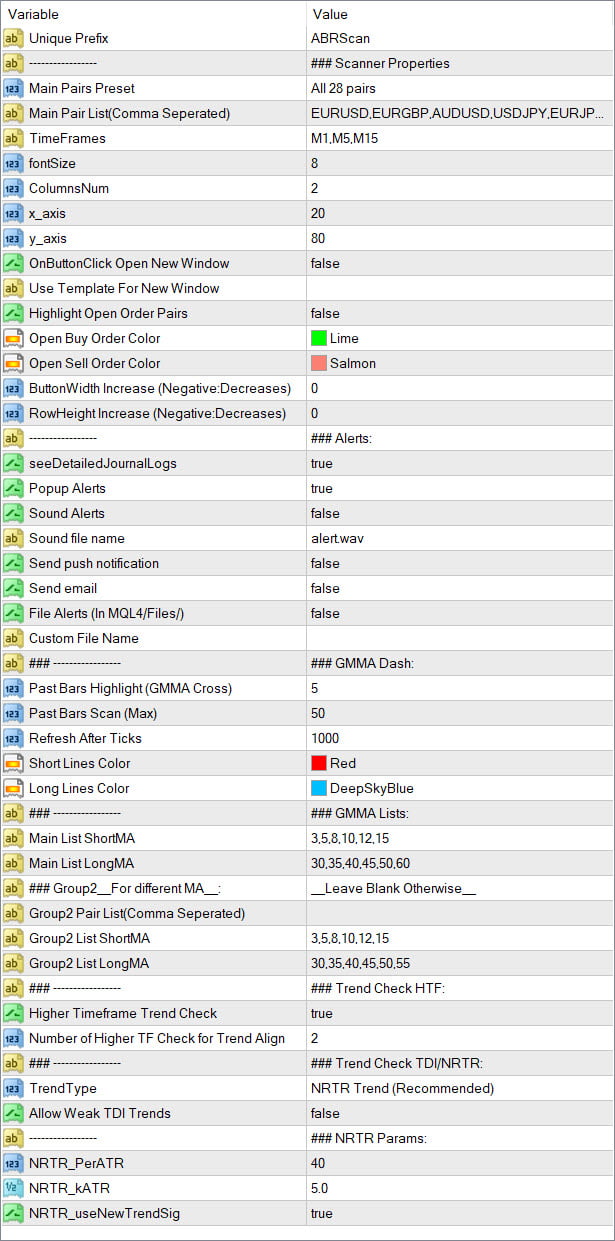

Most important Listing ShortMA is used to calculated Quick MA traces by default and Most important Listing LongMA is used for Lengthy MA traces.

However for some pairs, you may want completely different MA intervals. So you should utilize Group2 Pair Listing for including comma separated checklist of these pairs.

And specify the comma separated Quick and Lengthy MA lists for Group2.

The Checks:

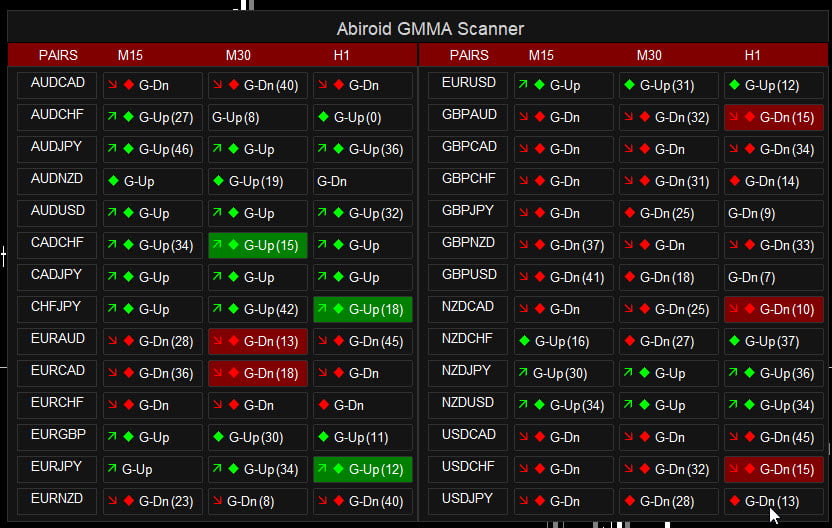

1- Present TF GMMA Cross and Pattern (Obligatory Examine.. G-Up/G-Down)

Examine for GMMA Cross. When brief GMMA traces cross lengthy GMMA traces upwards, the pattern is Bullish proven by G-Up.

When brief GMMA traces cross lengthy GMMA traces downwards, the pattern is Bearish proven by G-Dn (G-Down).

The quantity in brackets are what number of bars again the cross occurred.

Previous Bars Scan (Max): Variety of complete previous bars to scan for a cross

Previous Bars Scan (Spotlight): Default: 5. So, if variety of bars is 5 or much less and all circumstances meet (2 or 3 optionally available if true), spotlight that block (Pink for Bearish and Inexperienced for Bullish).

2- HTF GMMA Pattern Examine (Non-compulsory.. slanting arrow)

If Greater Timeframe Pattern Examine is true and “Variety of HTF Examine Pattern Align” is 2. Then examine 2 HTF for GMMA Pattern alignment.

3- TDI or NRTR Pattern Examine (Non-compulsory.. diamond)

From Pattern drop-down choose:

- NRTR: Use this NRTR indicator to detect if pattern is Up/Down:

- TDI: Use this TDI indicator to detect Pattern Up/Down. TDI is a bit heavy and CPU intensive. So in case you are utilizing all 28-pairs, then I might advocate not utilizing it. As it’d give reminiscence points and also you may get Array Out of Vary errors.

Indicator Settings:

NRTR Params:

Modify kATR worth to make NRTR SR Strains nearer or additional aside.

If NRTR Thick Pink Line is above value, it means pattern is downwards. If blue NRTR Thick line is beneath value, it means pattern is Upwards.

TDI:

If utilizing TDI, you possibly can specify Enable Weak TDI Developments true/false. If false, it can solely use the robust TDI Developments. If true, it can additionally use the weak developments.

Finest buying and selling sort:

Default settings are the perfect for M15+ and better timeframes. And they’re good for long run pattern based mostly buying and selling. GMMA will not be good for brief time period scalping. If you’re in search of scalping instruments, strive one thing like reversal based mostly buying and selling.