KEY

TAKEAWAYS

- Worth sectors have been persistently underperforming the benchmarks for the reason that April market low

- Expertise has outperformed the S&P 500 in addition to different progress sectors in 2024

- Defensive sectors like Utilities and Client Staples could also be crucial to observe, as they will display investor uncertainty

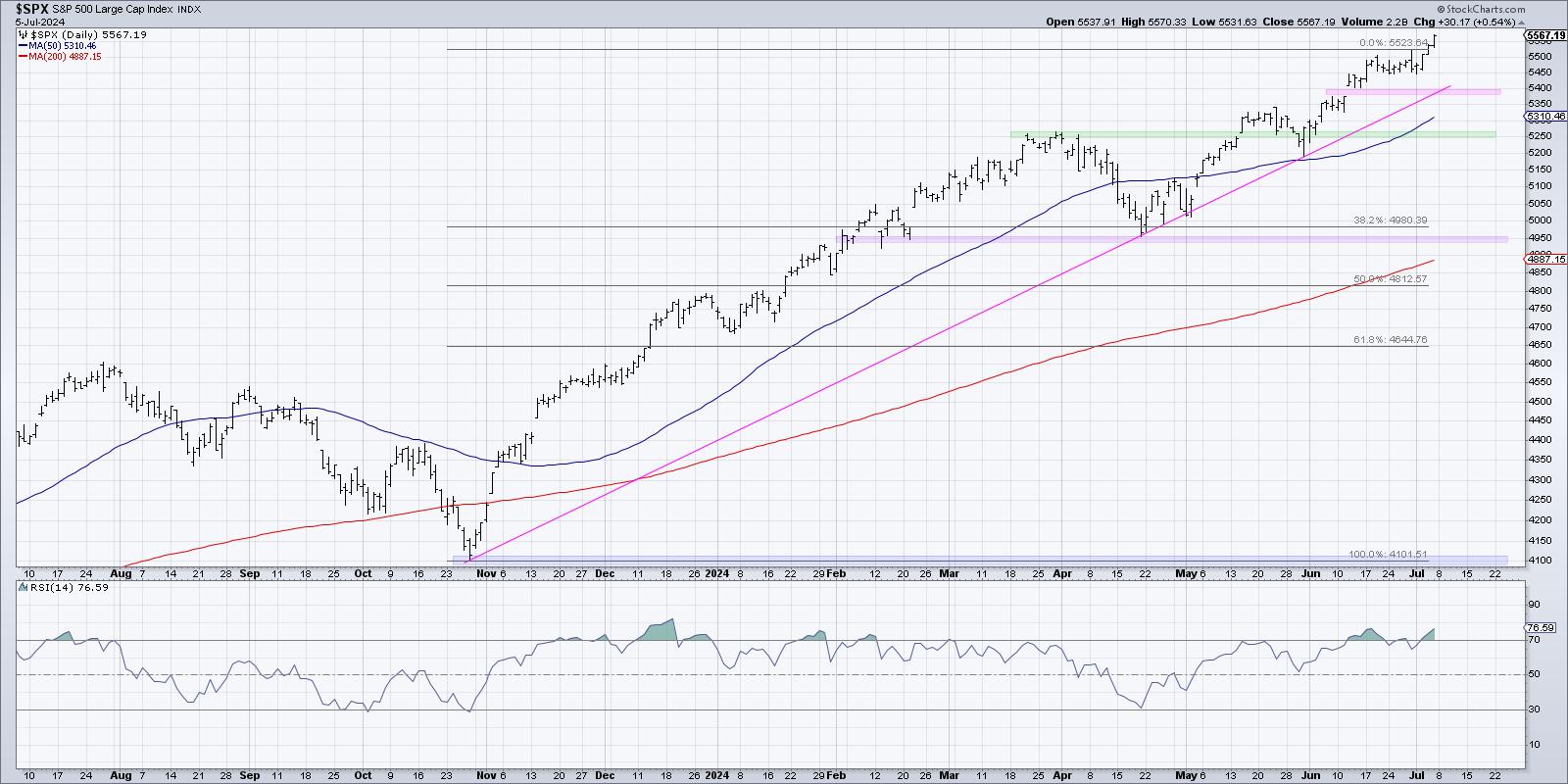

A radical evaluation of seasonal developments for the S&P 500 during the last 12 years offers two key takeaways: there’s often a significant market high in the summertime, and there’s typically a significant market low within the fall. So, on high of merely analyzing the chart of the S&P 500, what else can we do to anticipate and validate a possible market high?

I’d counsel that sector rotation could possibly be key right here, as a result of the present uptrend is being pushed by a really small variety of sectors (truly only one, to be fully sincere). Any adjustment to that configuration would represent a “change of character” for this market, and almost definitely coincide with the summer time market high many predict.

Whereas the each day chart of the S&P 500 seems pretty constant in 2024, other than a two-week drop in early April, we now have to do not forget that this market had a really completely different complexion earlier than and after that market low. Earlier than the April pullback, this was a broad advance, with most sectors thriving because the “every part rally” propelled the fairness benchmarks greater. In Could and June, and now into July, this has been extra of a slender rally, with a small variety of mega-cap progress shares thriving whereas most shares have struggled.

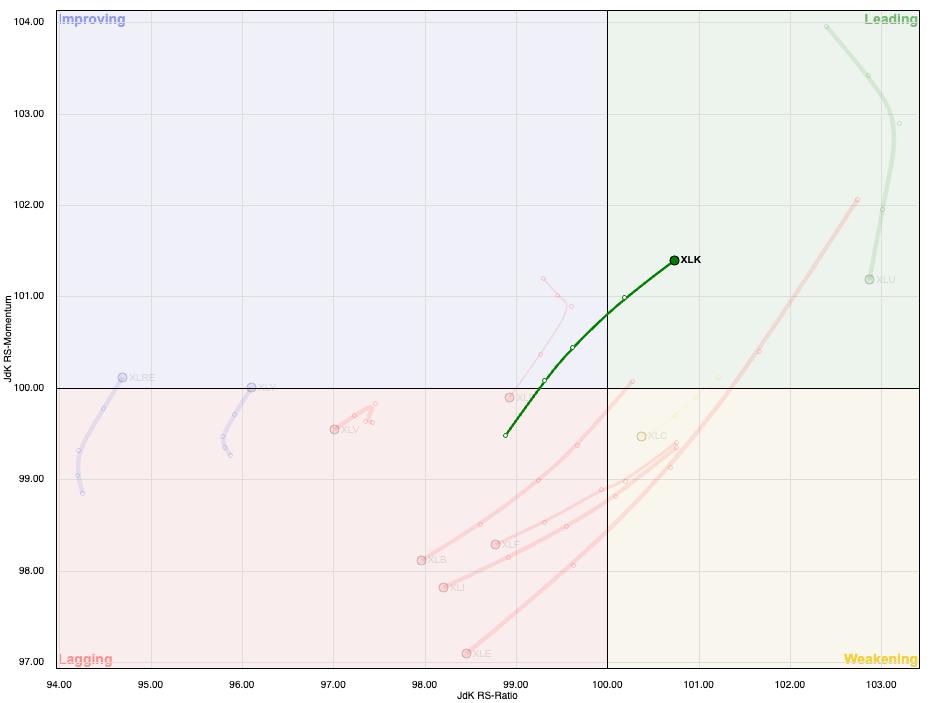

I really like the simplicity of the RRG graph in visualizing the rotation of the 11 S&P 500 sectors. The weekly RRG exhibits that it is clearly been “the expertise present” for weeks, because the XLK is the one sector within the Main quadrant and transferring up and to the precise. Now, let’s take a deeper take a look at the relative efficiency of the S&P 500 sectors in three buckets: progress management, worth management, and defensive sectors.

Defensive sector efficiency is without doubt one of the seven gadgets on my Market Prime Guidelines. Need to see the opposite six, and get assist navigating a possible summer time market high? Take a look at our Market Misbehavior premium membership and use code STOCKCHARTS for 20% off your first 12 months!

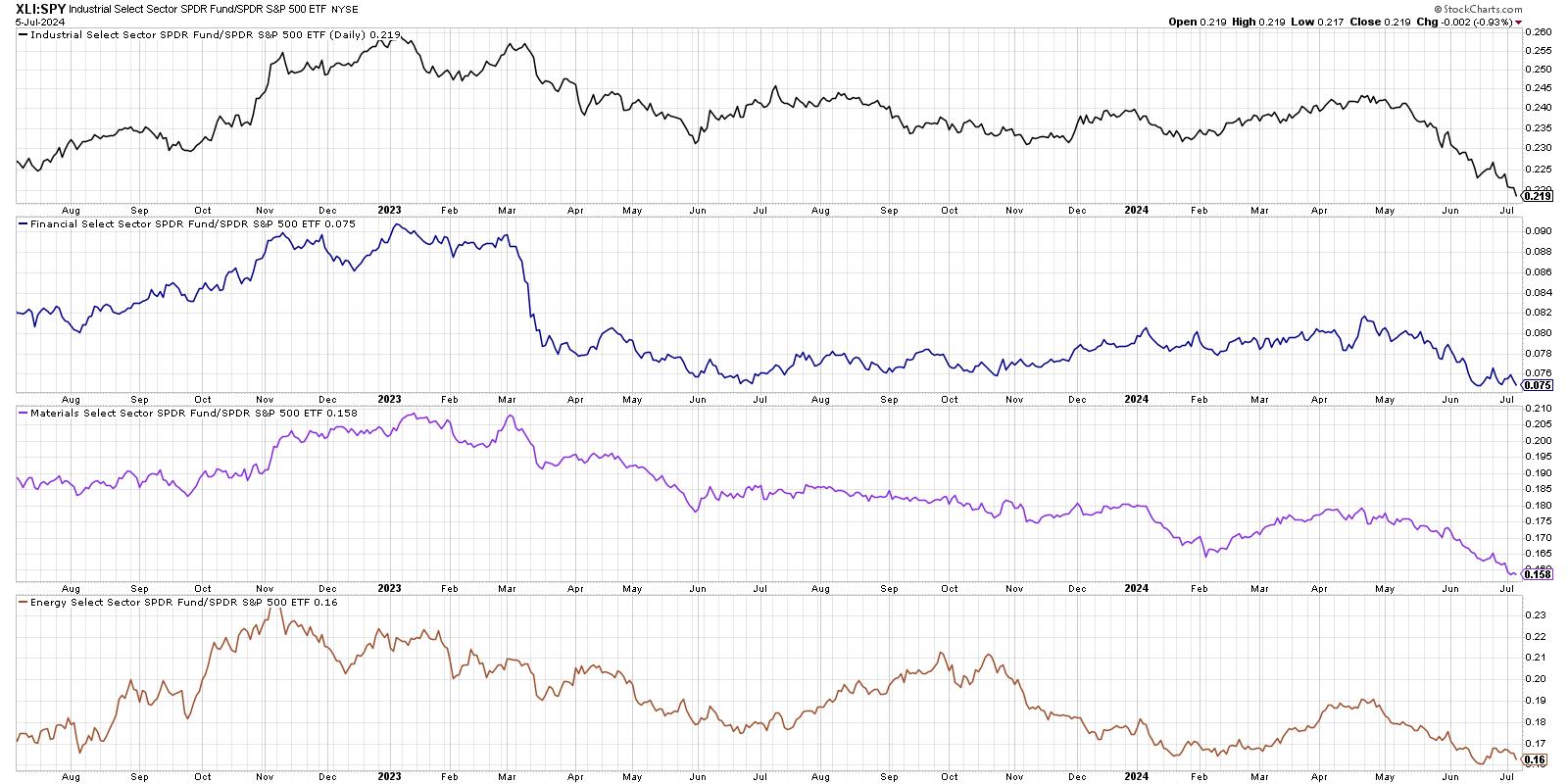

Worth Sectors Thrived in Q1, Struggled in Q2

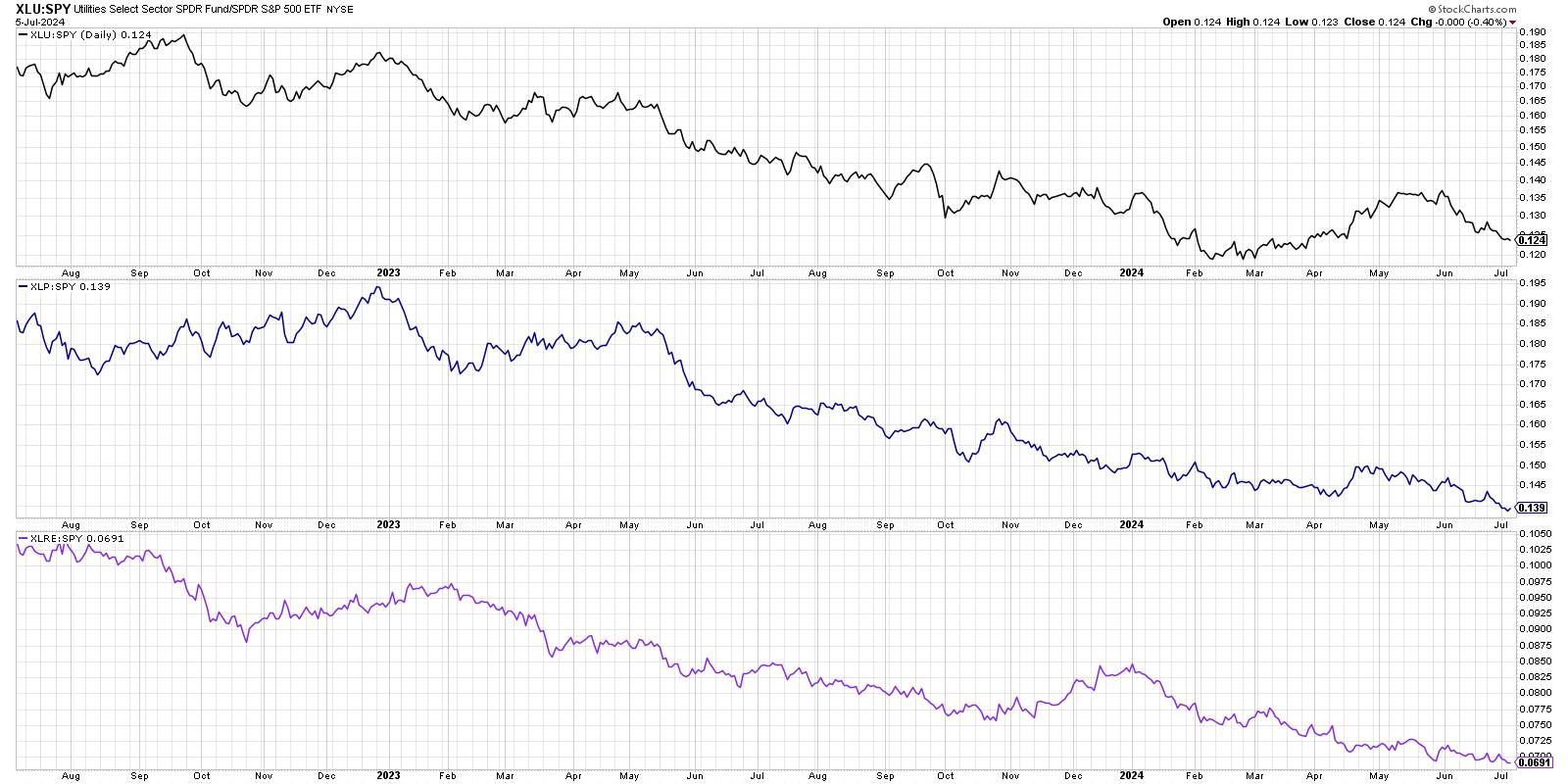

On this collection of charts, every line represents a easy ratio of the efficiency of 1 sector versus the S&P 500 index. If the road goes up, which means the sector has been outperforming. If the road is trending decrease, which means the sector underperformed throughout that interval.

We are able to see right here that the Industrial, Monetary, Supplies, and Power sectors have all underperformed the SPX for the reason that April market low. Whereas these sectors all had been outperforming in Q1, all 4 of them are at or close to new relative lows as we enter Q3. Whereas the S&P 500 and Nasdaq have been pushing greater, these sectors haven’t been part of that success story!

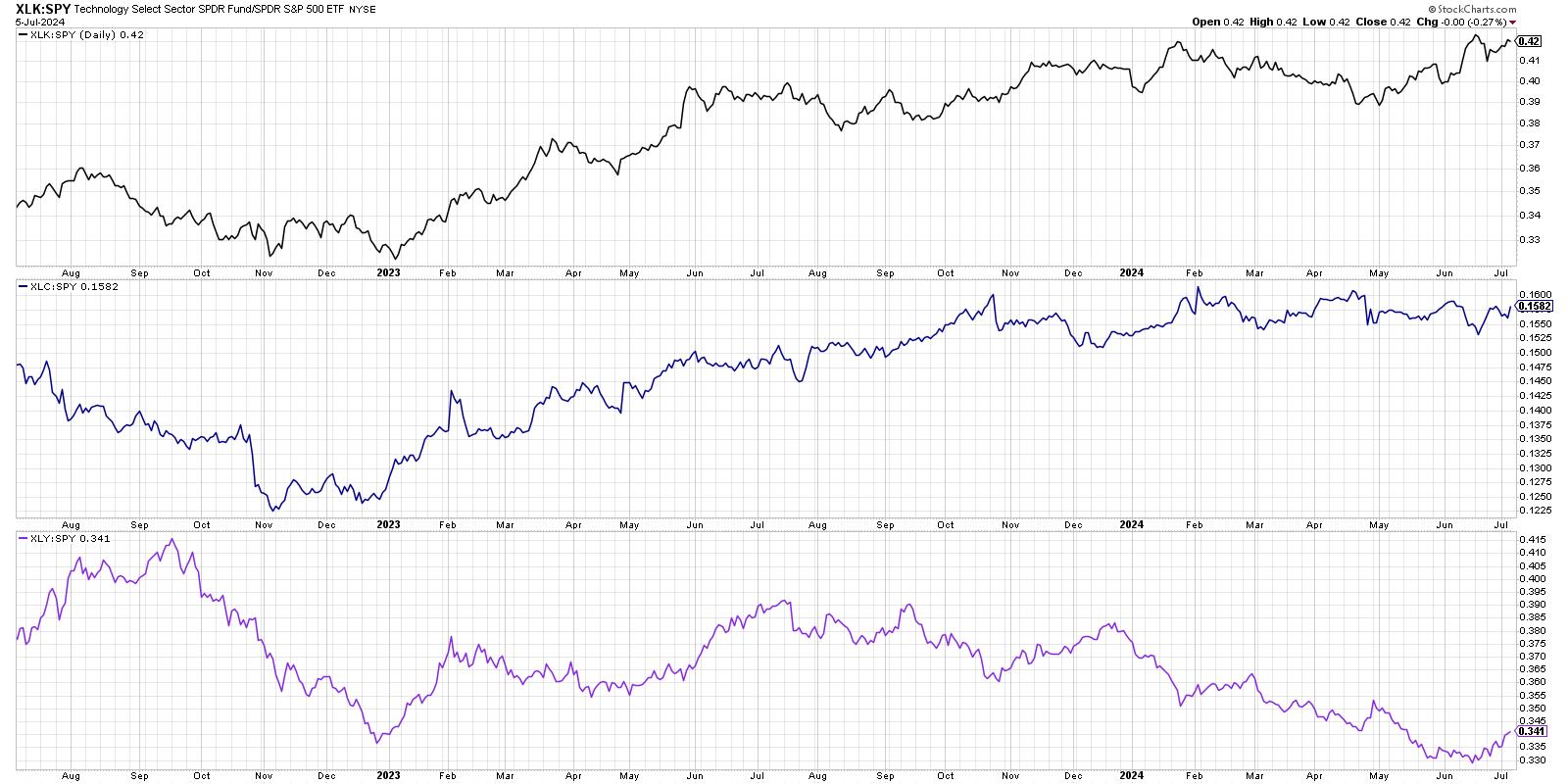

Expertise is the Solely Sector with Sturdy Relative Power

From mid-April to early July, solely one of many S&P 500 sectors has truly managed to outperform the benchmark in a significant means, that being Expertise. Whereas the Client Discretionary sector has popped greater in latest weeks pushed by AMZN and TSLA, and Communication Companies has mainly carried out in step with the S&P 500, Expertise has had the strongest run of relative efficiency.

Given the dominance of the AI commerce in 2024, it is no shock how Expertise is obvious outlier when it comes to relative efficiency. And if there’s one factor I’ve discovered from a profession as a technical analyst, it is to stay with successful trades so long as they preserve successful!

Defensive Sectors Could Be the Most Essential to Watch

In order that leaves us with three defensive sectors which do not have a tendency to draw flows except buyers are afraid to personal the rest. And all three have underperformed during the last 12 months, reinforcing the bullish sentiment nonetheless evident within the inventory market.

Utilities shares had a quick rally in April and Could, throughout a interval when most of their earnings calls had been centered on energy wants for synthetic intelligence. Nevertheless it did not take lengthy for that short-term part to finish, and Utilities as soon as once more lagged behind the main fairness benchmarks.

This chart is one which I characteristic on my Market Prime Guidelines, as a result of enchancment within the relative energy of defensive sectors means that institutional buyers try to cover out throughout a interval of market uncertainty. And whereas these three sectors have often outperformed throughout a bull market part, their relative traces often solely flip greater throughout a bear market setting.

For now, the sector relative charts inform the story of a slender market advance pushed by Expertise. I’d argue that this identical set of charts can inform you a lot of what it is advisable know to navigate a possible management rotation and even a probable market high in the summertime months of 2024!

RR#6,

Dave

P.S. Able to improve your funding course of? Take a look at my free behavioral investing course!

David Keller, CMT

Chief Market Strategist

StockCharts.com

Disclaimer: This weblog is for academic functions solely and shouldn’t be construed as monetary recommendation. The concepts and methods ought to by no means be used with out first assessing your individual private and monetary state of affairs, or with out consulting a monetary skilled.

The creator doesn’t have a place in talked about securities on the time of publication. Any opinions expressed herein are solely these of the creator and don’t in any means characterize the views or opinions of another particular person or entity.

David Keller, CMT is Chief Market Strategist at StockCharts.com, the place he helps buyers decrease behavioral biases via technical evaluation. He’s a frequent host on StockCharts TV, and he relates mindfulness strategies to investor choice making in his weblog, The Conscious Investor.

David can be President and Chief Strategist at Sierra Alpha Analysis LLC, a boutique funding analysis agency centered on managing threat via market consciousness. He combines the strengths of technical evaluation, behavioral finance, and knowledge visualization to determine funding alternatives and enrich relationships between advisors and purchasers.

Study Extra