Bitcoin flash crashed on July 4 and 5, extending losses from all-time highs to about 30%. Although there was a aid bounce over the weekend, forcing the world’s Most worthy coin up by practically 11%, BTC stays inside a bearish formation.

Bitcoin Correction Not Over: Will Bears Break $50,000?

One analyst who took to X confirmed this evaluation, including that the optimism during the last 48 hours could possibly be quashed within the coming periods. With BTC not out of the woods, at the least from technical formation, the analyst predicted not solely will the coin sink beneath final week’s lows, however it should probably break the psychological $50,000 mark.

Pointing to historic value motion, the coin stated Bitcoin may drop to as little as $48,000 within the coming days, roughly 40% from its all-time excessive.

When this occurs, and following the worth motion seen in 2017, when the coin additionally crashed by 40% after native peaks, the coin will resume the uptrend.

Even so, trying on the analyst’s evaluation, the swing excessive and low anchoring of the Fibonacci retracement software is subjective. For now, if September 2023 to March 2024 vary acts as swing and lows, a 40% drop from native highs locations Bitcoin $10,000 decrease at round $37,000.

Cracks are starting to kind on the weekly chart. After final week’s losses, the coin firmly closed beneath the 20-period transferring common, putting sellers in management. Affirmation of final week’s losses may set the ball rolling, sparking extra losses within the brief time period, pushing the world’s Most worthy coin to $50,000 and even $40,000.

How Excessive Will BTC Leap After The Correction?

Nonetheless, after the cool-off and the depth doesn’t matter, one other analyst predicts the coin will bounce off strongly. If BTC finds help at across the $47,000 to $50,000 degree, the chance of it floating to at the least $102,000 is excessive.

That is the primary degree of the Fibonacci extension. At its excessive, the coin may soar to as excessive as $242,000 within the periods to come back.

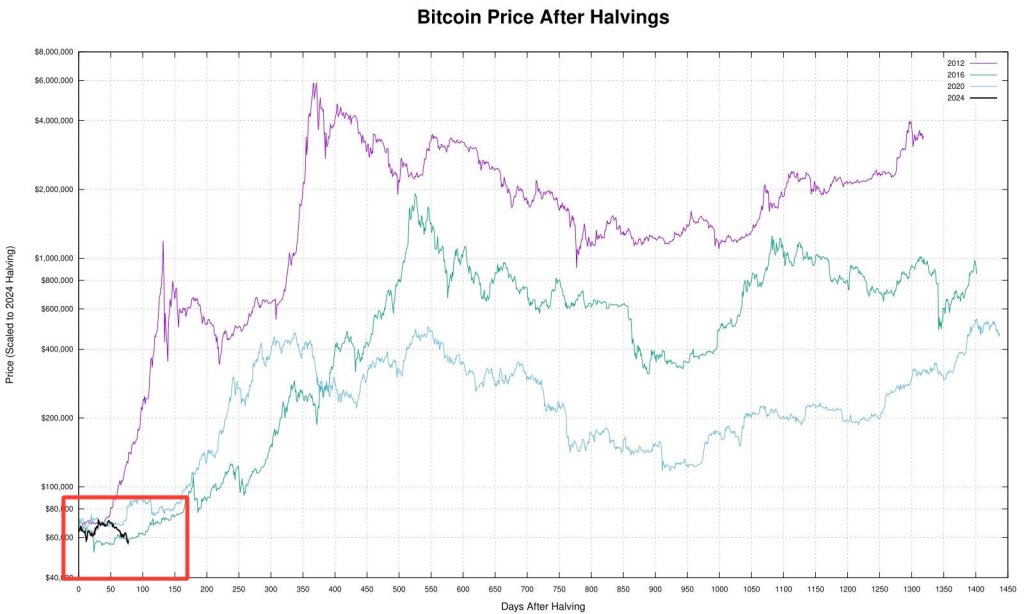

The arrogance that BTC will bounce again after the present sell-off, sparked most by Mt. Gox liquidation fears and the fixed dump by the German authorities, relies on historical past. After the Halving, Bitcoin costs are likely to get well steadily.

If something, one analyst stated holders shouldn’t panic promote inside the first 79 days after the Halving occasion. Marking the start of the fifth epoch, the community diminished its miner rewards on April 20, roughly three months in the past.

Function picture from DALLE, chart from TradingView