Whereas the Bitcoin value hasn’t reclaimed the essential $60,000 stage to reenter the earlier 4-month buying and selling vary, Ikigai Asset Administration Chief Funding Officer (CIO) Travis Kling thinks that the present bearish section isn’t greater than a “boogeyman.” By way of X, Kling listed eight causes to be bullish on Bitcoin. He said: “NFA. I’m unsuitable typically. The present “bearish” backdrop appears simpler to look via and purchase than a lot of the boogeymen we’ve had in these markets over the past 6 years.”

#1 Fast Bitcoin Liquidations By Germany

Travis Kling observes that Germany has considerably decreased its Bitcoin holdings, from 50,000 BTC to 22,000 BTC in latest weeks. In accordance with him, “Germany is speedrunning their #Bitcoin dump.” He predicts the promoting will quickly stop, suggesting, “By the point they get right down to ~5k, the market will look via it.” Kling implies that the market affect of Germany’s Bitcoin liquidations is non permanent and nearing its finish.

#2 Mt. Gox’s Overestimated Market Influence

Kling addressed the potential market results of the Mt. Gox repayments, characterizing the concern of large sell-offs as extra speculative than based mostly on the collectors’ possible actions. He said, “Gox appears extra FUD than precise mass promoting (only a guess however feels that manner).”

Associated Studying

He believes the collectors, a lot of whom are refined traders, are more likely to promote their holdings methodically, e.g. through TWAPs, thus lowering the affect in the marketplace. Relating to the retail traders, Kling requested a rhetorical query, “You’ve held on for decade when you can have offered ages in the past. You’re simply going to aggressively dump now, three months after the halving?”

#3 US Authorities’s Bitcoin Technique

Relating to the US authorities’s Bitcoin gross sales, Kling emphasised the measured method taken up to now. He said, “However they’ve been fairly measured with promoting up to now, so I assume they’ll proceed to be fairly measured.” Whereas he admits that the US authorities promoting is the “hardest to get your head round by way of tempo/technique, and their stack is big,” he claims that the promoting is unlikely to disrupt market stability.

#4 Retail Funding Increase Via ETFs

Kling highlighted a surge in retail funding in Bitcoin, notably via ETFs, following latest value dips. He remarked, “You will have boomers slurping the dipperino within the BTC ETFs Fri and Mon.” This pattern signifies sturdy retail investor curiosity in capitalizing on decrease costs, suggesting a bullish sentiment amongst this investor section.

#5 Ethereum ETF Anticipation

With the anticipation of US spot Ethereum ETFs, Kling famous that the value of ETH stays solely barely beneath its stage previous to the emergence of ETF rumors, indicating minimal speculative hype has been priced in. This commentary means that the market might react positively to the launches.

#6 Curiosity Price Cuts Are Close to

Kling additionally mentioned the potential for upcoming Federal Reserve fee cuts, noting the market has priced in a big chance of such an occasion in September. He said, “If inflation/labor information is mild this month, Powell will possible inform the market that Sept is a reside assembly on the 7/31 FOMC. Nickileaks has already teased this.”

Associated Studying

The fund supervisor is referring to Wall Avenue Journal’s Nick Timiraos who’s also referred to as “mouthpiece of the Fed”. Just a few days in the past, Timiraos wrote through X that the June jobs report will make the July Fed assembly “extra fascinating” as a result of. “For the primary time all 12 months—an actual debate over whether or not to chop on the *subsequent* assembly (in September),” he remarked.

#7 The Potential Trump Pump

Kling speculated on the political panorama’s affect on Bitcoin, notably beneath a possible Trump presidency. Kling posed a rhetorical query, “What else would you moderately personal than crypto going right into a Trump presidency?” close to the most recent pro-Bitcoin and crypto feedback by the main presidential candidate within the polls.

#8 Bitcoin And Nasdaq Re-Coupling

Kling identified the disparity between NASDAQ’s continuous new all-time highs and Bitcoin’s relative underperformance. He famous, “NASDAQ retains making new ATH after new ATH. Crypto has utterly decoupled to the draw back.” He means that Bitcoin is undervalued relative to the main market index and shortly begins a catch-up rallye. “You can argue BTC is lagging QQQ by 40% YTD,” Kling concluded.

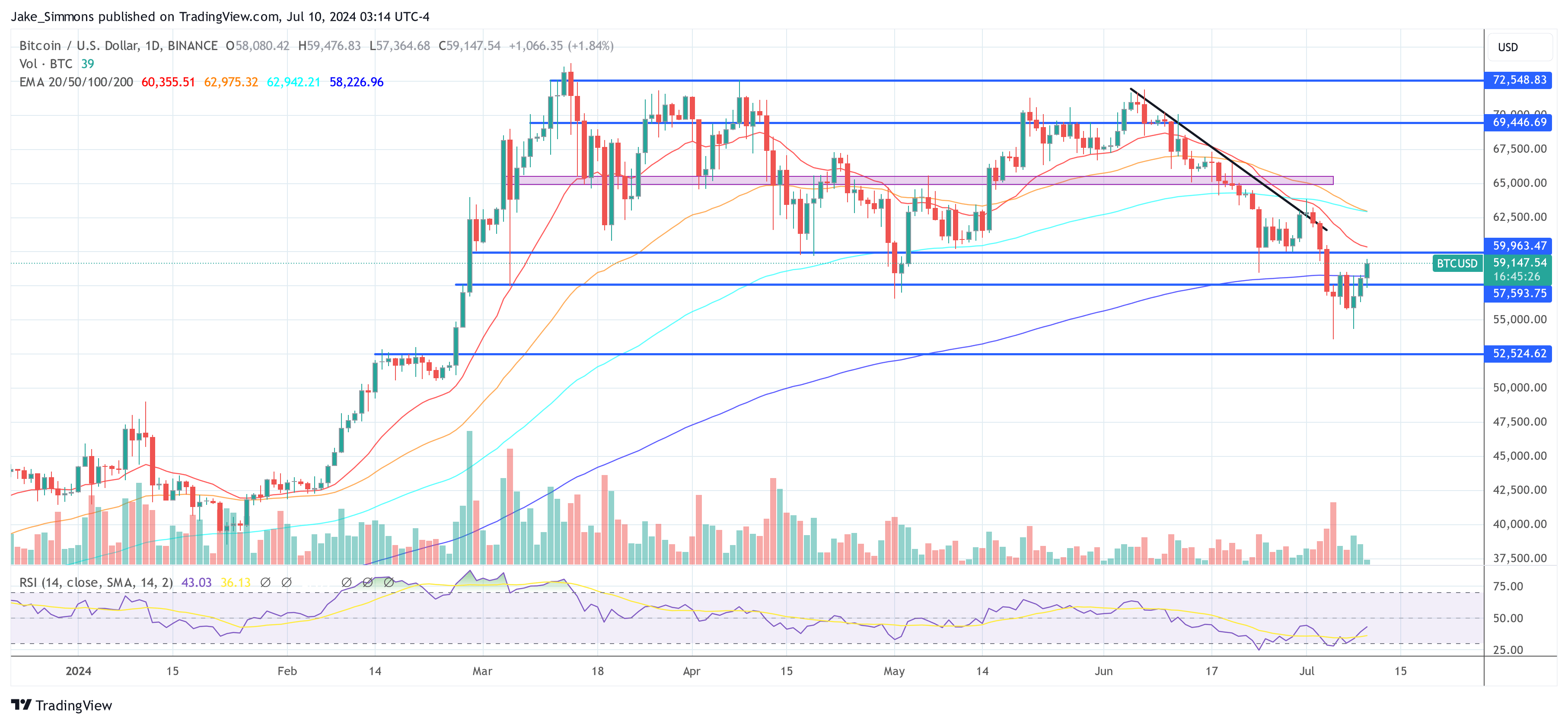

At press time, BTC traded at $59,147.

Featured picture created with DALL·E, chart from TradingView.com