In a brand new put up on X, Miles Deutscher, a famous crypto analyst with over half one million followers, has proclaimed the present market situation as “one of the vital bullish setups” he has seen in his six-year profession within the crypto business. Deutscher outlined ten pivotal catalysts that he believes are primed to drive the cryptocurrency markets greater within the close to time period.

“There was loads of discuss not too long ago about headwinds (Germans promoting, Gox, macro and so forth.). However the actuality is, there’s A LOT to sit up for,” Deutscher emphasised.

10 Causes To Be Extremely Bullish On Crypto

#1 German Authorities BTC Gross sales: Deutscher notes that the German authorities has exhausted its BTC reserves to promote, which removes a major promoting strain in the marketplace. “One of the best factor about overhang is that when promoting is priced into the market, there’s a flooring on draw back and headroom for value to maneuver greater. We nonetheless have Gox, however there’s now mild on the finish of the tunnel,” he defined.

#2 Bitcoin ETF Inflows: Based on Deutscher, the sturdy inflows into Bitcoin ETFs are underappreciated. Over the previous month, these ETFs have seen inflows exceeding $1 billion, signaling sustained investor curiosity.

“I believe many individuals are underestimating the magnitude of the long-term impression of the ETFs on BTC. It gives a powerful passive bid for the market, and urge for food for the ETF isn’t going away (we’ve had +$1b this previous month),” Deutscher added.

Associated Studying

#3 US Presidential Election: The crypto analyst identified betting markets like Polymarket, the place Trump is favored to win. A Trump presidency is seen as a optimistic catalyst for crypto, given his administration’s perceived assist for the business.

#4 Trump Advocacy at BTC 2024 Convention: Deutscher additionally highlighted Trump’s scheduled look on the BTC 2024 convention, the place he’s anticipated to advocate for Bitcoin and cryptocurrencies extra broadly. Rumors have it that Trump might make one other main announcement. Bitcoin Journal CEO David Bailey has floated the thought of creating BTC a strategic reserve asset for the US.

#5 FTX Repayments: The reimbursement of $16 billion to collectors by FTX is a much less mentioned however essential issue. “Many of those recipients will doubtless re-enter the market, resulting in a recent bid,” Deutscher predicts, suggesting a possible improve in shopping for exercise within the crypto markets.

#6 International Liquidity Cycle: Deutscher additionally talked about the correlation between international liquidity and crypto costs. “It’s loopy how correlated crypto (particularly BTC) is to international liquidity. Apparently, we’ve been intently following a 65-month cycle. This may counsel a late 2025 peak,” Deutscher predicted.

Associated Studying

#7 Spot ETH ETFs: The imminent launch of Spot ETH ETFs is one other main catalyst. This marks the primary time an altcoin has acquired such an funding car, probably increasing Ethereum’s market publicity and investor base dramatically.

#8 Goldman Sachs Tokenization Tasks: Goldman Sachs’ involvement in three tokenization tasks lends vital credibility to the crypto house. This institutional endorsement is predicted to profit a wide selection of altcoins and associated real-world asset (RWA) functions.

#9 Anticipated Charge Cuts: Based on the CME FedWatch instrument, the market is presently factoring within the probability of three fee cuts till the tip of the yr, with a 90% likelihood of a 25 foundation level discount in September. This might serve a large tailwind.

#10 Ahead-Trying Markets: Lastly, Deutscher emphasised the reflexive nature of crypto markets, the place optimistic sentiment itself can set off substantial rallies. “Over the approaching months, you’re prone to see the market value in these tailwinds. As crypto is very reflexive, a optimistic bid off the again of elevated sentiment can, in and of itself, result in a significant rally,” Deutscher concluded.

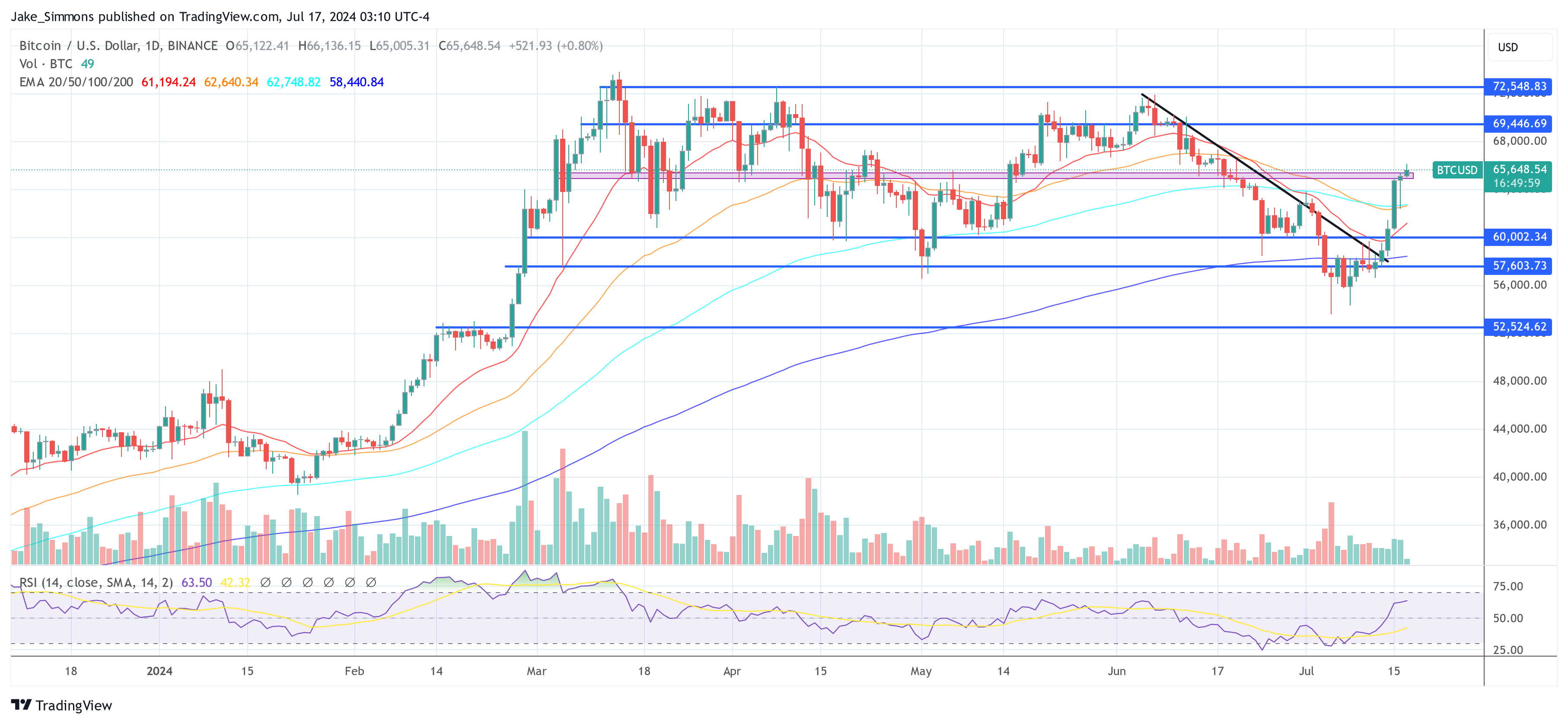

At press time, BTC traded at $65,648.

Featured picture created with DALL·E, chart from TradingView.com