Fast Take

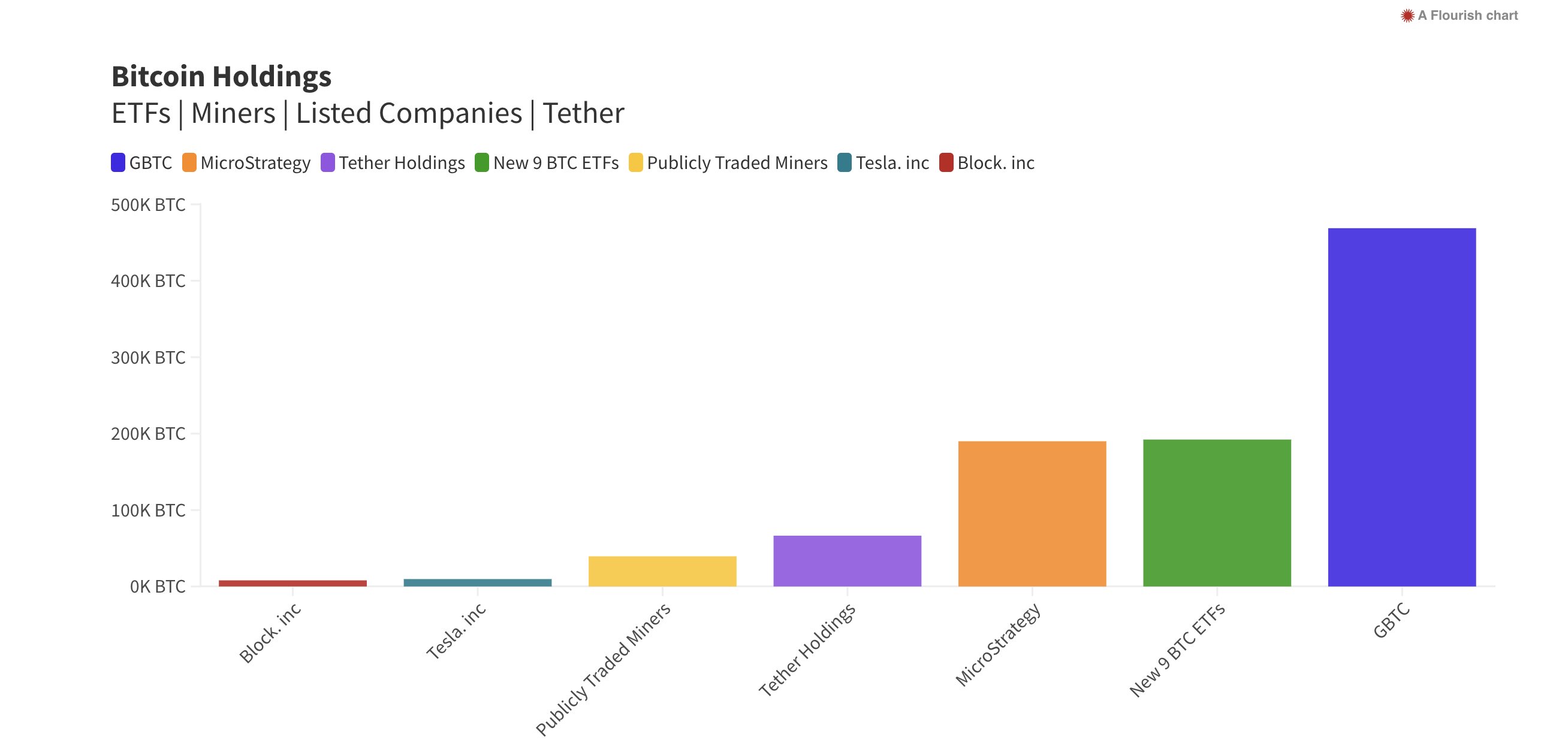

The speedy progress and success of Bitcoin ETFs, particularly the group termed the ‘New child 9,’ excluding GBTC, is reshaping the dynamics of Bitcoin holdings. In only one month since their inception, based on Bitcoin web site Apollo, these ETFs have outpaced MicroStrategy by buying 192,000 Bitcoins in comparison with MicroStrategy’s 190,000 in its company treasury. This outstanding progress signifies a shift in Bitcoin possession from particular person entities to ETFs.

Knowledge from Applo reveals that the brand new problem for the ‘New child 9’ is GBTC, holding 469,000 Bitcoins. Moreover, BlackRock’s IBIT, with 78,000 Bitcoins, signifies potential competitors for MicroStrategy within the upcoming months. These traits underscore the sturdy efficiency of Bitcoin ETFs.

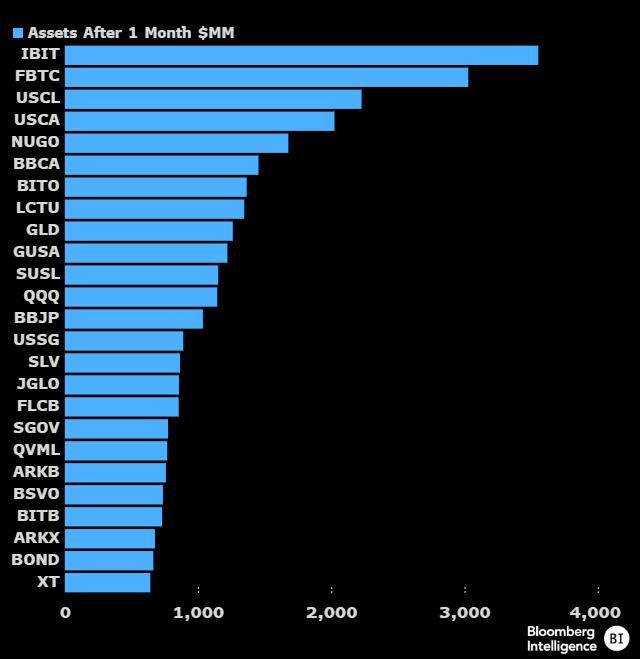

As well as, Bloomberg Analyst Eric Blachunas highlighted the spectacular standing of those ETFs, with IBIT and FBTC main the ETF pack with property of round $3 billion every inside a month of their launch. This locations them on the high of the league of the highest 25 ETFs by property, amongst 5,535 launches in 30 years. ARKB and BITB additionally made the checklist, Balchunas goes on additional to say.

The put up Bitcoin ETF newcomers surpass Microstrategy in BTC holdings appeared first on CryptoSlate.