Ethereum ETFs (exchange-traded funds) started buying and selling on Tuesday, producing important quantity throughout the first 2 hours of buying and selling. Curiously, the Ethereum ETFs ranked among the many high 1% concerning ETF quantity.

Associated Studying

Ethereum ETFs Surpass Conventional Launch Volumes

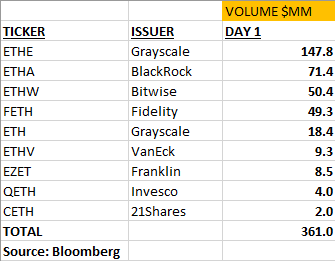

In accordance to Bloomberg ETF professional Eric Balchunas, the ETH ETFs traded $361 million within the first 90 minutes on launch day, surpassing the everyday quantity seen on the launch of conventional ETFs. Blachunas stated:

Right here’s the place we at after 90 minutes. $361m complete. As a bunch that quantity would rank them about fifteenth general in ETF quantity (about what $TLT and $EEM commerce), which is High 1%. However once more in comparison with a traditional ETF launch, which hardly ever see greater than $1m on Day One, all of them have cleared that quantity after which some.

Matthew Sigel, head of digital asset analysis at asset supervisor VanEck, highlighted the importance of those figures within the first hours of buying and selling, noting that Ethereum ETFs noticed greater than 50% of buying and selling quantity in comparison with Bitcoin’s $610 million on day one, indicating sturdy investor curiosity in Ethereum.

Nonetheless, how these numbers will fare on the shut stays to be seen. Bitcoin ETFs noticed $4.6 billion in quantity on their first day of buying and selling in January, which can point out the long run efficiency of those newly permitted index funds for the second-largest cryptocurrency available on the market.

ETH’s Worth Targets Soar

Crypto analyst Physician Revenue shared a report highlighting a probably large parabolic transfer for Ethereum’s value this 12 months within the wake of the anticipated inflows within the new Ethereum ETF market.

Whereas some anticipate a correction because of the “promote the information” phenomenon, Physician Revenue argues that the market has already factored within the ETF launch however has but to think about the numerous inflows of USD that may flood into the Ethereum ETFs.

With Ethereum’s market cap being thrice smaller than Bitcoin’s, Physician Revenue believes that each greenback invested in ETH is predicted to have thrice the worth impression in comparison with Bitcoin, positioning Ethereum favorably for substantial value positive factors.

Moreover, the analyst contends that whereas Ethereum’s Grayscale ETH Fund promote strain is similar to the Bitcoin ETF launch, the impression is predicted to be much less extreme.

Associated Studying

Trying forward, Physician Revenue has set anticipated value targets for Ethereum within the coming months, together with a possible goal between $4,500 and $5,500 by Q3 2024, indicating regular however modest development.

Transferring into This autumn 2024 and Q1 2025, the worth vary is predicted to increase from $5,500 to $8,000. Nonetheless, it’s in Q2 2025 that Ethereum is predicted to considerably bounce, with value targets starting from $8,000 to $14,000.

On the time of writing, ETH is buying and selling at $3,444, exhibiting sideways motion with no important change from yesterday’s value, regardless of the hype surrounding the launch of the ETF market.

Featured picture from DALL-E, chart from TradingView.com