Fast Take

On Aug. 5, Bitcoin (BTC) suffered a big 7% drawdown. The digital asset hit a neighborhood backside at $49,000 earlier than rallying to roughly $54,000 as soon as the US markets opened.

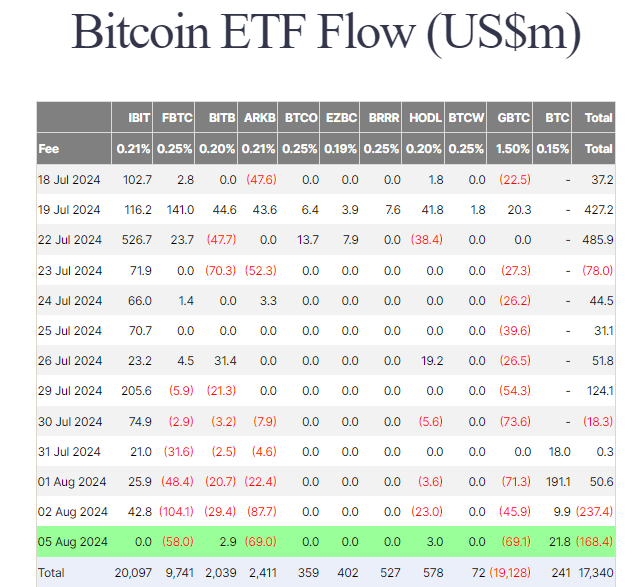

Information from Farside highlights substantial outflows from Bitcoin ETFs on today, totaling $168.4 million. Main the outflows had been Grayscale’s GBTC with $69.1 million, ARK’s ARKB with $69.0 million, and Constancy’s FBTC with $58.0 million. Notably, FBTC has now confronted outflows for six consecutive buying and selling days. In distinction, Grayscale’s mini ETF BTC noticed inflows of $21.8 million, whereas Bitwise’s BITB and Knowledge Tree’s BTCW had smaller inflows of roughly $3.0 million every. BlackRock’s IBIT ETF reported no inflows or outflows, sustaining a singular document of just one outflow day since its inception. The entire inflows for Bitcoin ETFs now stand at $17.3 billion.

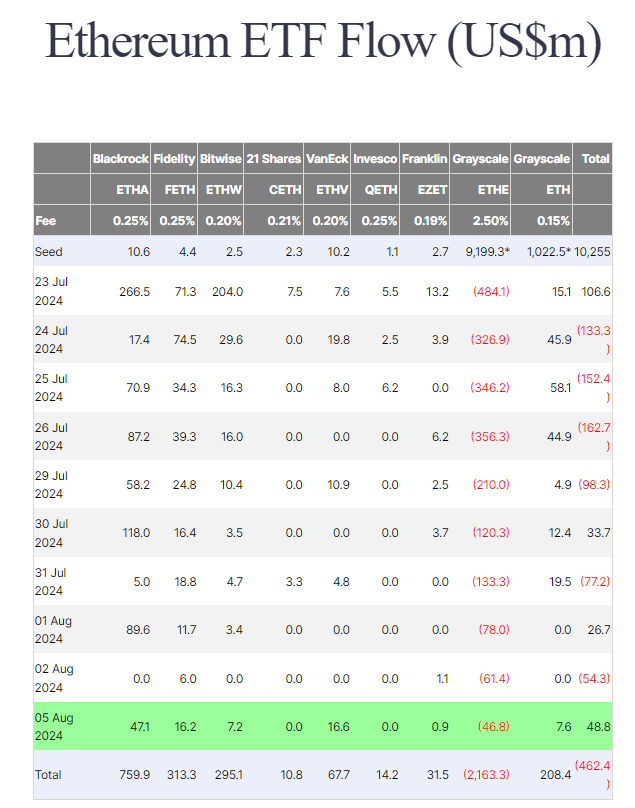

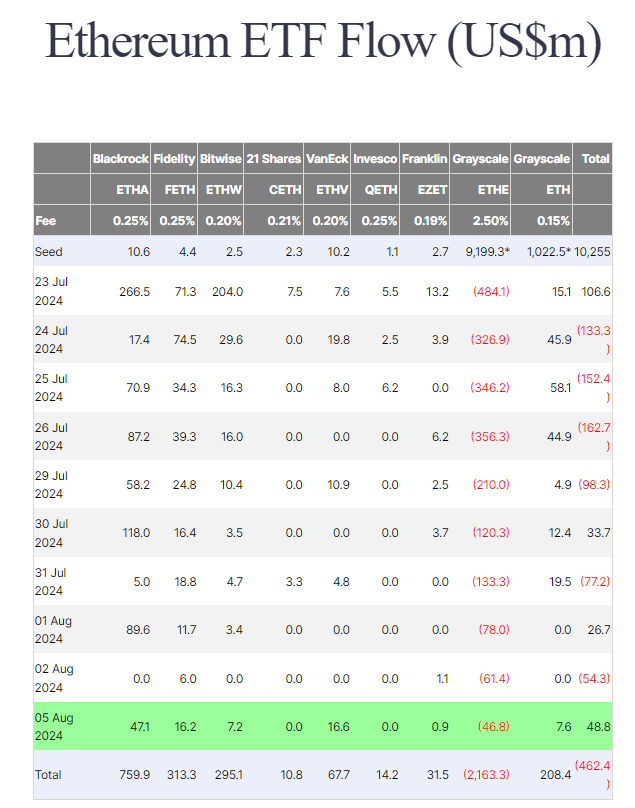

Ethereum (ETH) ETFs introduced a special image, with an influx of $48.8 million on Aug. 5. Six out of 9 ETF issuers reported inflows. Nonetheless, Grayscale’s ETHE continued to see outflows, albeit lowered to $46.8 million. The entire outflows for ETH ETFs have now reached $462.4 million, in accordance with Farside information.