Fast Take

Matthew Sigel, head of digital belongings analysis at VanEck, famous the institutional possession in Bitcoin ETFs, reflecting the rising curiosity in these monetary devices. A breakdown of institutional possession percentages in Bitcoin ETFs exhibits that Knowledge Tree (BTCW) leads with 92%, adopted by Coinshares Valkyrie Bitcoin Fund ETF (BRRR) at 90%, Bitwise (BITB) at 50%, BlackRock (IBIT) at 47%, Constancy (FBTC) at 37%, Invesco Galaxy Bitcoin ETF (BTCO) at 28%, and VanEck Bitcoin Belief (HODL) at 15%. Notably, VanEck’s personal seed funding considerably contributes to HODL’s possession.

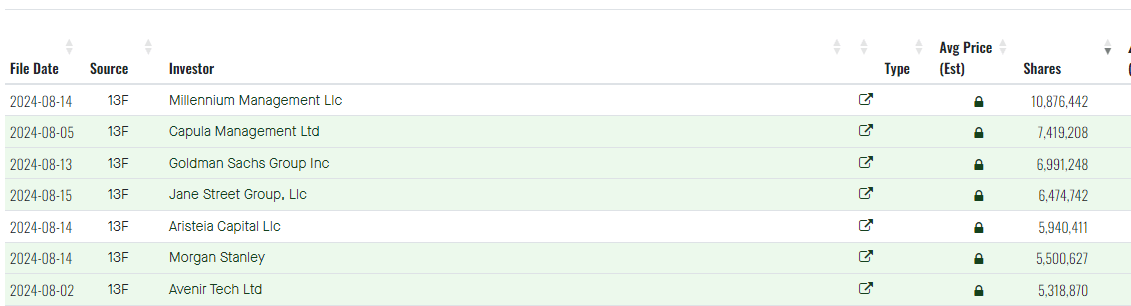

As revealed in latest 13-F filings, institutional possession contains stakes in publicly traded miners, MicroStrategy, and Bitcoin ETFs. Nonetheless, it’s necessary to think about the motives behind these investments. Whereas some establishments, like Wisconsin’s Pension Fund, seemingly undertake a buy-and-hold technique, others, reminiscent of Goldman Sachs and Morgan Stanley, is perhaps buying and selling on Bitcoin’s volatility, treating these ETFs as new monetary devices.

In line with Fintel, 5 of the seven largest positions in IBIT have been filed in the latest spherical of 13-F filings.

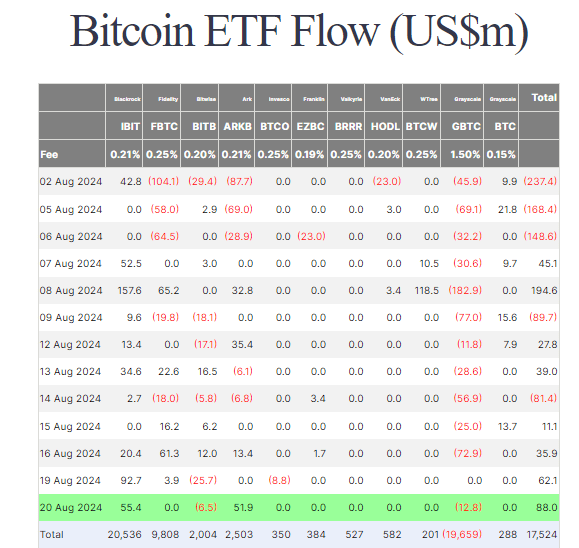

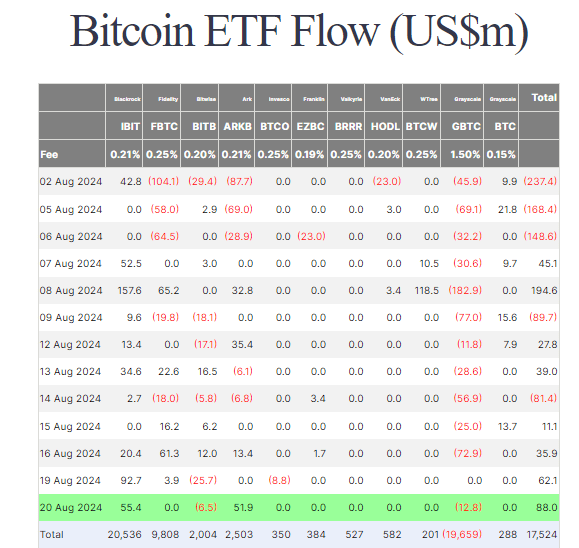

Regardless of Bitcoin’s worth struggles, Bitcoin ETFs proceed to draw inflows. On Aug. 20, IBIT acquired an extra $55.4 million, whereas ARK’s ARKB noticed a $51.9 million influx, bringing the overall each day influx to $88.0 million. Total, complete inflows into Bitcoin ETFs now stand at $17.5 billion, based on Farside information.