With the rise of AI, web3 has turn into a quieter a part of the enterprise ecosystem. I used to be curious in regards to the present state of affairs.

The launch of the Bitcoin ETF has amassed roughly $58b. In the meantime, the Ethereum ETFs has about $500m, two orders of magnitude smaller.

The some main Web3 tokens have achieved fairly properly in 2024 ; others have underperformed the Nasdaq (+19% YTD).

| Token / Index | YTD Efficiency, % |

|---|---|

| BTC | 37 |

| SOL | 36 |

| QQQ | 19 |

| DOGE | 11 |

| ETH | 9 |

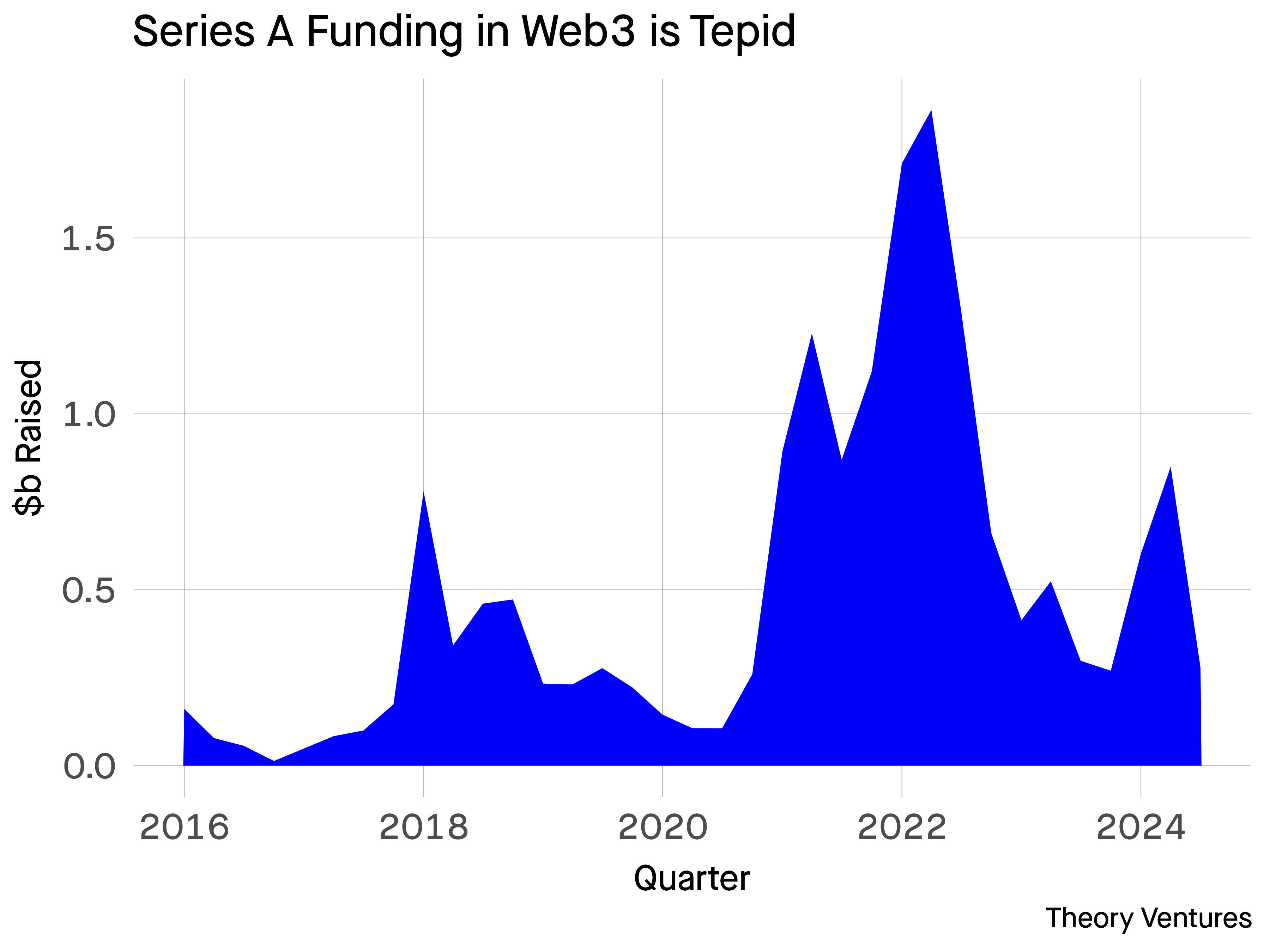

Sequence A valuations have elevated by 2022 and since have seen a a lot larger variance, with each meaningfully larger & decrease costs than the development line.

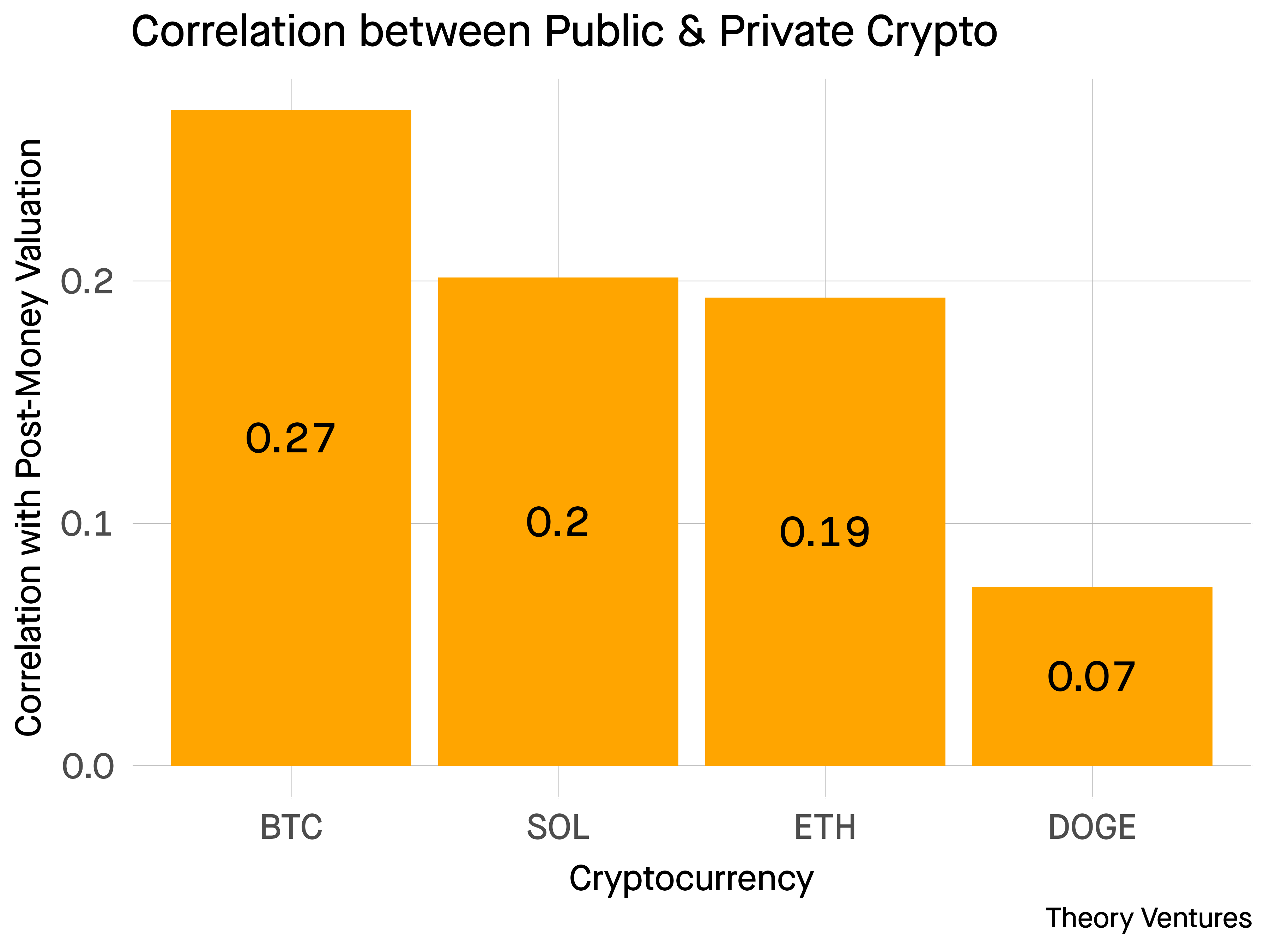

12 months-to-date, the correlation of the general public & personal web3 markets has been weak, round 0.2, which implies they transfer independently of one another. That is most true for DOGE coin, a meme coin, & much less true for Bitcoin.

With Bitcoin particularly, the correlation ought to start to dissociate as a result of many of the fund flows can be public market traders. Solana & Ethereum, with their good contract platforms ought to have the next correlation, since exercise there may be extra carefully tied to personal market startups constructing new software program.

The Sequence A financing market is risky pushed by bigger transactions & at a gradual tempo of about $500m per quarter.

One of many main questions for web3 exists within the US the place the regulatory regime isn’t clear.

Total, web3 continues to see exercise however many of the curiosity exists within the public markets because the market awaits next-generation of infrastructure & purposes & regulatory readability.