Fast Take

Bitcoin has been experiencing a protracted interval of consolidation since reaching its all-time excessive of over $70,000 in March. This downward chop section has drawn comparisons to the value motion of round $9,000 in 2019.

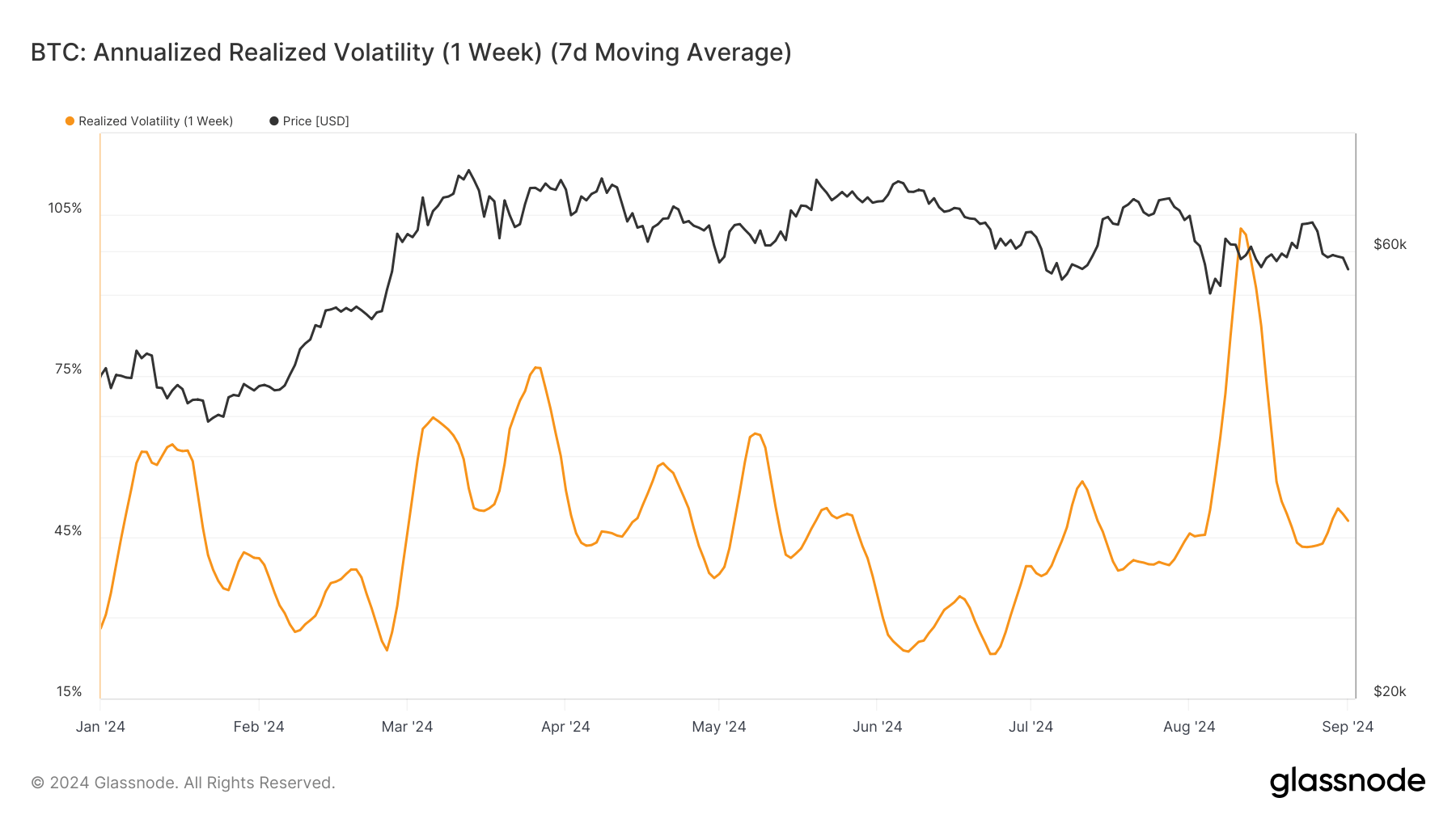

Analyst Checkmate has famous that these value swings have gotten “bigger and extra sustained,” suggesting that the present “value vary is changing into more and more unstable.” This instability signifies {that a} vital upward or downward transfer may very well be imminent.

The intraday value actions present larger deviations from the imply, which may very well be attributed to merchants attempting to catch any value breakouts from this extended vary.

As Bitcoin approaches key ranges, reminiscent of $60,000, merchants have a tendency to extend leverage, anticipating a breakout. Nonetheless, these breakouts have didn’t materialize not too long ago, contributing to an increase in realized volatility.

ByBit has elevated its reputation for spot and derivatives buying and selling, with funding charges and open curiosity fluctuating quickly in response to cost modifications. This volatility is partly pushed by merchants making an attempt to time the market with lengthy and quick positions. Moreover, uncertainty surrounding the upcoming US election provides one other layer of unpredictability to Bitcoin’s future efficiency.

The submit Merchants’ leveraged bets on Bitcoin’s $60,000 stage drive market volatility appeared first on CryptoSlate.