Bitcoin has confronted vital value fluctuations marked by a notable crash on August 5 that noticed its worth dip to $49,000. This was adopted by a rebound to roughly $65,000, solely to expertise one other decline to round $52,000 final Friday.

Regardless of these challenges, the most important cryptocurrency by market capitalization is present process essential help retests, harking back to the patterns noticed in September 2023 earlier than it soared to an all-time excessive of $73,700 in March.

Bitcoin Could Hit New All-Time Highs

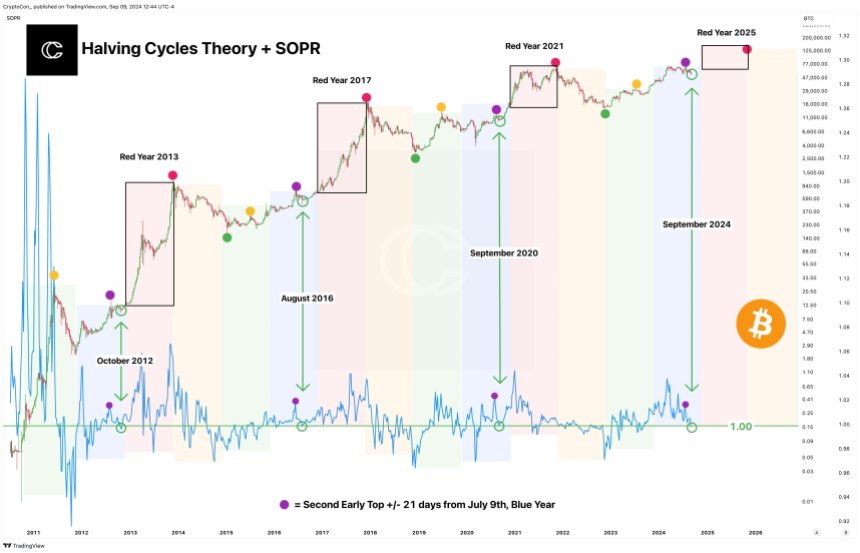

Crypto analyst Crypto Con highlighted this pattern in a social media put up, emphasizing Bitcoin’s spent output revenue ratio (SOPR). In accordance with Con, earlier peaks have correlated with the 1.0 worth line on the SOPR chart, the place the cryptocurrency usually finds a backside earlier than getting into a bull market section.

This cyclical conduct has been constant round particular months—October, August, and September—drawing parallels to the recession predictions which have emerged lately, very like in September 2023 and on the cycle backside in November 2022 following crypto trade FTX’s implosion.

The present indicators counsel that Bitcoin could also be on the verge of a big value uptick, probably surpassing its earlier all-time highs. This bullish sentiment is bolstered by historic information that present Bitcoin’s propensity to interrupt by means of previous peaks, as seen within the chart above.

Is September A ‘Pretend-Breakdown Month’?

In a extra granular evaluation of short-term value motion, fellow analyst Rekt Capital identified that Bitcoin’s weekly shut above $53,250 is essential for sustaining the help degree inside the bargain-buying vary of $52,000 to $55,000.

This vary kinds beneath a downward-trending channel noticed by the analyst at $56,500 on Bitcoin’s weekly chart. Rekt emphasised that reclaiming $55,881 as help could be important for Bitcoin to construct momentum and try a restoration inside the channel.

Moreover, Rekt raised an attention-grabbing speculation about September probably being a “fake-breakdown month.” Historic information point out that September usually sees a mean month-to-month return of -5%, whereas October averages 22.90%.

This sample means that any help that the Bitcoin value seems to have misplaced through the previous month could possibly be swiftly reclaimed, particularly because the cryptocurrency at the moment trades round $56,600. Ought to October comply with its historic pattern, a 22.90% enhance would place Bitcoin beneath its all-time excessive at roughly $68,780.

On the time of writing, the most important cryptocurrency available on the market information a 4% enhance within the 24-hour timeframe, leading to its value regaining the $56,600 mark. Nevertheless, during the last 30 days, BTC has recorded losses of over 7%.

Featured picture from DALL-E, chart from TradingView.com