Though Bitcoin (BTC) on-chain well being stays web constructive, from a value perspective two essential assist ranges should be maintained for a continued bullish uptrend, notes ARK Spend money on its newest month-to-month report.

Bitcoin’s Wholesome On-Chain Metrics, What Does It Imply?

In its report, ARK Make investments posits that Bitcoin requires some upside if its market construction is to be maintained. The report notes that in August 2024, BTC’s value slid by 8.7% to $58,972. The main digital asset was additionally unable to beat its 200-day transferring common, making two key assist areas at $52,000 and $46,000 important for its bullish momentum.

The report states that regardless of the momentary headwinds confronted by Bitcoin, its on-chain well being stays ‘web constructive.’ Primarily, the Bitcoin community is web bullish throughout totally different on-chain metrics reminiscent of community safety, community utilization, and holder conduct.

Bitcoin’s long-term holder provide, or BTC held for greater than 155 days by holders, is up 3.3% month-over-month (MoM) and down a marginal 0.23% year-over-year (YoY). As well as, Bitcoin’s locked provide has elevated in each MoM and YoY phrases by 0.58% and 1.82%, respectively.

Associated Studying

Bitcoin’s transaction quantity has tumbled by 24.5% MoM and a pair of.3% YoY, a bearish on-chain indicator. Nevertheless, Bitcoin’s bullish on-chain metrics overshadow the one bearish indicator, permitting its on-chain well being to stay web constructive.

One other key efficiency indicator strengthening ARK Make investments’s bullish stance on Bitcoin is its short-to-long liquidation dominance. Primarily, this metric measures short-term liquidations relative to long-term liquidations over the past 90 days, and located that it’s at its lowest since Q2 2023.

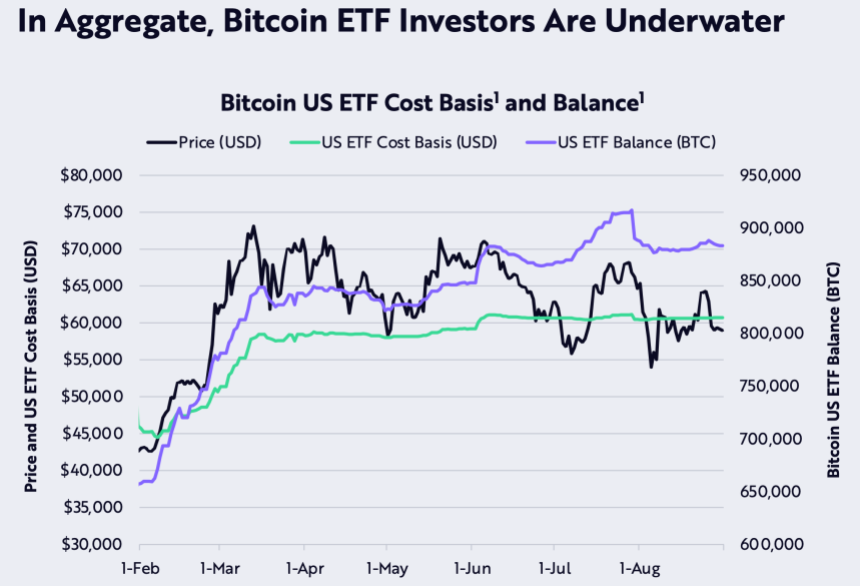

Bitcoin ETF Buyers Underwater At Giant

The report highlights that on the finish of August 2024, the estimated value foundation of US spot exchange-traded-fund (ETF) members was larger than BTC’s value, hinting that the common ETF investor could also be at a loss. The upper estimated value foundation of US spot ETF members in comparison with its value could be confirmed from the chart under.

The US Securities and Change Fee (SEC) accepted spot Bitcoin ETF earlier this yr, which made it simpler for institutional and retail traders to achieve publicity to the world’s largest cryptocurrency by a compliant funding product.

Associated Studying

Bitcoin ETFs are witnessing unprecedented curiosity from institutional traders. Particularly, Wall Avenue titans reminiscent of Goldman Sachs and Morgan Stanley have poured hundreds of thousands of {dollars} into Bitcoin ETFs. Conversely, Ethereum ETFs haven’t but piqued institutional curiosity at comparable ranges.

At press time, Bitcoin trades at $57,836, up a minimal 0.2% up to now 24 hours. BTC’s complete market cap stands at $1.14 trillion.

Featured picture from Unsplash, Charts from ARK Make investments and Tradingview.com